Abstract

Discount is the difference between the face value of a bond and its present value. We propose an arbitrage-free dynamic framework for discount models, which provides an alternative to the Heath–Jarrow–Morton framework for forward rates. We derive general consistency conditions for factor models, and discuss affine term structure models in particular. There are several open problems, and we outline possible directions for further research.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Discount

Let \(P(t,T)\) denote the time-\(t\) price of a zero-coupon bond with maturity \(T\), or in short, a \(T\)-bond. Define the corresponding discount

The discount \(H(t,T)\) is the difference between the face value of the bond and its present value. It is the interest earned on investing in a \(T\)-bond at \(t\) and holding it to maturity \(T\). As such, it quantifies the time value of money. It also equals the time-\(t\) price of a long position in a floating rate note paying overnight short rates \(r_{t}=- \partial _{T} P(t,T)|_{T=t}\) minus a short position in a \(T\)-bond. We call this long/short portfolio the \(T\)-discount. The infinitesimal net cash flow generated by the \(T\)-discount is \(r_{t}\,dt\) at any \(t\le T\) and 0 after \(T\). The payments of the principals of the floating rate note and the zero-coupon bond at \(T\) offset each other. A \(T\)-discount is therefore identical to the floating leg of an overnight indexed swap with maturity \(T\).

The gains process, say \(G(t,T)\), from holding a \(T\)-discount over \([0,t]\), where the cash flows are continuously invested in the money market account that earns interest at the short rate, is given by the sum

2 Discount framework

In analogy to the Heath–Jarrow–Morton (HJM) approach [8] for modelling the forward rates \(f(t,T)=-\partial _{T} \log P(t,T)\), we now formulate an arbitrage-free dynamic framework for discount models. We start with a filtered probability space \((\Omega ,{\mathcal {F}},({\mathcal {F}}_{t})_{t\ge 0},{\mathbb{Q}})\) satisfying the usual conditions and carrying an \(n\)-dimensional standard Brownian motion \(W\). For simplicity of exposition, we skip technical details and assume throughout that all stochastic processes are adapted, and regular enough such that the differential and integral operations are well defined. For more background and technical details, also on arbitrage pricing, we refer to Björk [1, Chap. 19] and Filipović [4, Chap. 4].

We recall that ℚ is a risk-neutral or (local) martingale measure for the bond market if all discounted \(T\)-bond price processes \(({\mathrm{e}}^{-\int _{0}^{t} r_{s}\, ds} P(t,T))_{0 \le t \le T}\) are (local) ℚ-martingales. In view of (1.1), this holds if and only if all discounted \(T\)-discount gains processes \(({\mathrm{e}}^{-\int _{0}^{t} r_{s}\, ds} G(t,T))_{0 \le t \le T}\) are (local) ℚ-martingales. It is well known that the bond market is arbitrage-free if and (essentially) only if ℚ is a local martingale measure; see e.g. [1, Chap. 11] or [4, Sect. 4.3.4].

We represent the \(T\)-discount price at any \(t\le T\) in terms of its maturity derivative,

where the discount derivative \(h(t,T)\) is assumed to follow an Itô process with dynamics of the form

for some drift and volatility processes \((\alpha (t,T))\) and \((\sigma (t,T))\), respectively. We then specify the \(T\)-bond price by

The \(T\)-bond specification (2.2) is the linearised counterpart to the familiar relation \(P(t,T)={\mathrm{e}}^{-\int _{t}^{T} f(t,s) \,ds}\). Differentiating in \(T\), the relationship between the discount derivative and the forward rate is obtained as

In particular,

equals the short rate.

The challenge of our linear approach is that \(T\)-bond prices should be positive, \(P(t,T)>0\), which is equivalent to requiring that

Positivity of bond prices follows in particular if we can show that ℚ is a martingale measure for the bond market specified by (2.1) and (2.2). We now derive necessary and sufficient conditions for this to hold. We thus let \(h(t,T)\) be given by (2.1) and define the \(T\)-bond prices by (2.2) and the short rates by (2.3). Here is our first result, which shows that the drift \(\alpha (t,T)\) is fully determined by the requirement that ℚ is a local martingale measure.

Proposition 2.1

Measure ℚ is a local martingale measure if and only if we have the discount drift condition

Proof

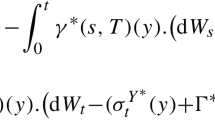

The implied \(T\)-bond price dynamics is

On the other hand, the discounted \(T\)-price process \(({\mathrm{e}}^{-\int _{0}^{t} r_{s}\, ds} P(t,T))\) is a local ℚ-martingale if and only if the drift of \(P(t,T)\) equals \(P(t,T) r_{t}\,dt\). Matching this with the drift in (2.6) gives \(\int _{t}^{T} \alpha (t,s)\,ds = H(t,T)r_{t}\). Differentiating in \(T\), we obtain (2.5), which proves the result. □

Given the drift condition (2.5) and using the existence of a local martingale measure as synonymous for the absence of arbitrage, we can paraphrase that the generic dynamics (2.1) for an arbitrage-free discount derivative model is of the form

for an initial discount derivative curve \(h_{0}\). Note that in contrast to the HJM drift condition on the forward rates, see e.g. [4, Theorem 6.1], the derivative drift condition (2.5) does not depend on the volatility \(\sigma (t,T)\).

We next show that for a given volatility structure \(\sigma (t,T)\), the system of stochastic differential equations (2.7) uniquely determines \(h(t,T)\).

Lemma 2.2

For a given volatility process \(\sigma (t,T)\), \(0\le t\le T<\infty \), and initial discount derivative curve \(h_{0}\), there exists at most one solution \(h(t,T)\), \(0\le t\le T<\infty \), to (2.7).

Proof

Let \(h\) and \(\tilde{h}\) be solutions to (2.7). Then their discounted difference

satisfies

Integrating gives, for \(T=t\),

We claim that \(q(t,t)=0\) for all \(t\ge 0\), and by (2.8) thus \(\tilde{h} = h\). Indeed, by contradiction, assume that there exist \(0\le t_{0}< t_{1}\) such that \(q(s,s)=0\) for all \(s\le t_{0}\), and \(|q(t_{1},t_{1})|>0\). We let \(\beta (s)\) be a positive process such that \(|h(s,t)|\le \beta (s)\) for all \(t_{0}\le s\le t\le t_{1}\). Then \(|q(t,t)| \le \int _{t_{0}}^{t} \beta (s) |q(s,s)| \,ds\) for all \(t\in [t_{0},t_{1}]\), and Gronwall’s inequality implies that \(q(t,t)=0\) for all \(t\in [t_{0},t_{1}]\). This contradicts the assumption, whence the claim is proved. □

The problem remains that we still have no guarantee that bond prices in (2.2) are positive. Our main result is the following theorem, which provides sufficient conditions such that the discount framework (2.7) defines an arbitrage-free price system for \(T\)-bonds. It thus represents an alternative to the HJM framework of forward rates.

Theorem 2.3

Let \(h(t,T)\), \(0\le t\le T<\infty \), be any solution to (2.7) such that \(r_{t} = h(t,t)\) is well defined and

Then ℚ is a martingale measure and the implied \(T\)-bond prices in (2.2) satisfy

and are thus positive, that is, (2.4) holds, in particular.

Proof

Let \(h(t,T), 0\le t\le T<\infty \), be a solution to (2.7). Denote \(r_{t} = h(t,t)\) and set

Then \((M(t,T))\) has zero drift and dynamics

and thus is a ℚ-martingale by the assumption (2.9). We obtain

Integrating over \(T\) gives

as desired. □

The following remarks provide further details and discussion on the above discount framework.

Remark 2.4

The identities (2.10) and (2.11) are of independent interest, and show the economic meaning of \(h(t,T)\) and \(H(t,T)\) as present values of future cash flows \(r_{T}\) and \(r_{u}\) for \(u\in [t,T]\), respectively.

Remark 2.5

The expression (2.6) shows that the induced volatility \(v(t,T)\) of the \(T\)-bond returns is given by \(P(t,T)v(t,T)=-\int _{t}^{T} \sigma (t,s)\,ds\).

Remark 2.6

The equivalent physical measure \({\mathbb{P}}\approx {\mathbb{Q}}\) is related to ℚ by the market price of risk \(\theta \) such that the Radon–Nikodým derivative satisfies

for any time horizon \(T>0\). This yields the ℙ-Brownian motion \(dW^{{\mathbb{P}}}_{t} = dW_{t} -\theta _{t} \,dt\). Hence the dynamics under ℙ of \(h(t,T)\) is

Remark 2.7

The proofs of Lemma 2.2 and Theorem 2.3 rely on technical properties, e.g. that \(T\mapsto h(t,T)\) is locally bounded in \(T\ge t\) a.s., or that the order of integration and expectation can be changed. Such properties can be asserted by imposing sufficient technical assumptions.

Remark 2.8

Existence of a solution for the system (2.7) of SDEs is an open problem. Existence could be an issue in view of the quadratic drift (2.5), which may cause explosion in finite time. Example 2.9 and Sect. 3.3 below give non-exploding specifications. A natural approach for a systematic study is to state (2.7) as a stochastic partial differential equation for the discount derivative curve \(\psi _{t}(x):=h(t,t+x)\) in an appropriate function space ℋ. Such an SPDE is of the form

for some appropriate volatility operator \(B:{\mathcal {H}}\to {\mathcal {H}}^{n}\) such that \(\sigma (t,t+\cdot )=B(\psi _{t})\). An example of an appropriate function space is the weighted Sobolev space \({\mathcal {H}}_{w}\) consisting of weakly differentiable functions \(\psi :[0,\infty )\to {\mathbb{R}}\) with

and \(\psi (\infty )=0\), for some increasing and continuously differentiable weight function \(w\) such that \(\int _{0}^{\infty }w^{-1/3}(x)\,dx<\infty \). An example could be \(w(x)={\mathrm{e}}^{\alpha x}\) for some \(\alpha >0\). This is similar to the space \(H_{w}\) introduced in Filipović [3, Chap. 5]. It can be shown as in [3, Equation (5.7)] that the \(L^{1}\)-norm of any \(\psi \in {\mathcal {H}}_{w}\) is bounded by \(\int _{0}^{\infty }|\psi (x)|\,dx\le C_{w} \|\psi \|_{w}\) for some finite constant \(C_{w}\). It can further be shown as in [3, Theorem 5.1.1] that the differential operator \(\partial _{x}\) generates a strongly continuous semigroup on \({\mathcal {H}}_{w}\). Hence one can study existence and uniqueness of (local) mild and weak solutions to (2.12) in the spirit of Da Prato and Zabczyk [2, Chap. 7]. In fact, uniqueness follows as soon as the volatility operator \(B(\psi _{t})\) is Lipschitz-continuous in \(\psi _{t}\); see [3, Corollary 2.4.1]. This is a direct improvement of Lemma 2.2, since there we assumed that the volatility process \((\sigma (t,T))\) is given as exogenous and does not depend on \(\psi _{t}\). Similarly, global existence would follow if one could show that any local weak solution of (2.12) with \(\|\psi _{0}\|_{w}< C_{w}^{-1}\) remains bounded in the sense that \(\|\psi _{t}\|_{w}< C_{w}^{-1}\) for all \(t\ge 0\). Combined with the above \(L^{1}\)-bound, this would imply that \(h(t,s)=\psi _{t}(s-t)\) satisfies (2.4), so that the induced bond prices (2.2) are positive.

For the special deterministic case where \(B\equiv 0\), the unique local solution to (2.12) is given by

This solution does not explode in finite time if and only if the initial curve satisfies (2.4), that is, \(\int _{0}^{t} \psi _{0}(s)\,ds<1\) for all finite \(t\). In this case, it follows easily that also \(\psi _{t}\) satisfies (2.4), as \(\int _{0}^{T-t} \psi _{t}(x)\,dx = (\int _{0}^{T} \psi _{0}(s)\,ds - \int _{0}^{t} \psi _{0}(s)\,ds)(1 - \int _{0}^{t} \psi _{0}(s)\,ds)^{-1} < 1\) for all finite \(T\ge t\).

The following example illustrates that the discount framework (2.7) admits global solutions.

Example 2.9

A simple toy model specification is \(h(t,T)=\phi (T-t) r_{t}\) for some deterministic function \(\phi \) with \(\phi (0)=1\), and where the short rate \(r_{t}\) follows an Itô process of the form \(dr_{t} = \mu _{t}\,dt + \nu _{t}\,dW_{t}\). The induced dynamics of \(h(t,T)\) is

The drift condition (2.5) now reads as the consistency condition

which does not depend on the volatility process \((\nu _{t})\), whereas the volatility in (2.7) is simply induced as \(\sigma (t,T)= \phi (T-t)\nu _{t}\). This property holds more generally in affine discount term structure models; see Remark 3.1 below.

For \(T=t\), as \(\phi (0)=1\), we obtain the short rate drift \(\mu _{t} = (r_{t}+\phi '(0))r_{t} \) and volatility \(\nu _{t}=\sigma (t,t)\). Assume that \(\phi '(0)=-\theta \) is negative for some parameter \(\theta >0\), and assume that \(\sigma (t,t)\to 0\) fast enough as \(r_{t}\to 0\) and \(r_{t}\to \theta \), respectively. Then the risk-neutral dynamics

is well behaved with values in \([0,\theta ]\), for any initial value \(r_{0}\in [0,\theta ]\). This short rate dynamics is reminiscent of the linear–rational framework; see Filipovic et al. [7, Sect. IV.E].

Plugging \(\mu _{t}=-(\theta -r_{t})r_{t}\) back into (2.13), we obtain

which is equivalent to \(\phi (s)={\mathrm{e}}^{-\theta s}\). This results in a term structure of \(T\)-discounts of the form

and thus a term structure of \(T\)-bonds of the form

As a technical note, we have from the above that \(r_{t}\) takes values in \([0,\theta ]\), which implies that the discount curve \(T\mapsto P(t,T)\) is decreasing and \(P(t,T)>0\) for all finite maturities \(T>t\).

3 Discount factor models

We now elaborate on discount factor models, extending Example 2.9. We first derive the consistency conditions for a general factor model. We then study in more detail the affine discount factor models.

3.1 General factor models

We study consistent discount factor models of the form

for some function \(\phi :[0,\infty )\times {\mathcal {Z}}\to {\mathbb{R}}\), where \({\mathcal {Z}}\subseteq {\mathbb{R}}^{d}\) is some state space with non-empty interior, and the factor \((Z_{t})\) is some \({\mathcal {Z}}\)-valued diffusion process with dynamics

for a drift function \(\mu :{\mathcal {Z}}\to {\mathbb{R}}^{d}\) and volatility function \(\nu :{\mathcal {Z}}\to {\mathbb{R}}^{d\times n}\). We denote the corresponding diffusion function by \(c(\,\cdot \,)=\nu (\,\cdot \,)^{\top }\nu (\,\cdot \,)\). The induced dynamics of \(h(t,T)\) is

Matching the drift term with the arbitrage-free dynamics (2.7) pointwise gives the consistency equation

whereas the induced volatility is

3.2 Affine discount term structure models

We now assume an affine term structure

for some functions \(\phi _{j}:[0,\infty )\to {\mathbb{R}}\), \(j=0,1,\dots ,d\). Plugging in the affine term structure (3.3) in the consistency equation (3.1) gives

where we denote

Remark 3.1

We note that the consistency condition (3.4) does not depend on the diffusion matrix \(c(z)\) of the factor process \((Z_{t})\). This is in contrast to the nonlinear case as seen in (3.1), where \(c(z)\) shows up. In other words, an affine discount term structure leaves the underlying volatility unspanned. This is in contrast to affine models of the forward rates, see Filipović et al. [6], and reminiscent of the linear–rational framework, see Filipović et al. [7, Sect. I]. In fact, it follows directly from (3.3) that \(T\)-bond prices become affine expressions in \(Z_{t}\). We derive the explicit expressions in (3.17) below.

We henceforth assume that the functions

Equation (3.4) then implies that every drift function \(\mu _{i}(z)\) is a quadratic polynomial in \(z\),

for some coefficients \(b_{i}\), \(\beta _{ij}\), \(B_{i,jk}\). Plugging (3.6) into (3.4) and matching coefficients of the same order in \(z\) gives

Writing \(\bar{Z}_{t} = (1,Z_{1,t},\dots ,Z_{d,t})^{\top}\) for the extended factor process including the constant 1 and setting \(e_{0}=(1,0,\dots ,0)^{\top}\), \(\bar{\phi}(x) := (\phi _{0}(x),\dots ,\phi _{d}(x))^{\top}\) and \(\bar{\gamma}:=(\gamma _{0},\dots ,\gamma _{d})^{\top }=\bar{\phi}(0)\), we arrive at the following result.

Proposition 3.2

Assume (3.5). The factor process \((Z_{t})\) in an arbitrage-free affine discount term structure model of the form (3.3) has a quadratic drift of the form

for some coefficients \(b_{i}\), \(\beta _{ij}\) and \(\gamma _{j}\). The functions \(\phi _{i}\) in turn are given by

where \(A\) is defined as the \((d+1)\times (d+1)\) matrix on the right-hand side of (3.14) below. The \(T\)-discounts and short rates are linear in \(\bar{Z}_{t}\),

Proof

In view of (3.5), condition (3.9) is equivalent to

Hence the drift (3.6) takes the form (3.10).

Equations (3.7) and (3.8) are equivalent to the linear system of ordinary differential equations

The system (3.14) of ODEs can be written in compact form as

The solution of (3.15) is (3.11).

Note that

Hence \(\bar{\phi}(x) = - {\mathrm{e}}^{Ax}A e_{0} =-\partial _{x} {\mathrm{e}}^{Ax} e_{0}\), and the primitive functions

are given by

The expressions (3.12) and (3.13) for the \(T\)-discount \(H(t,T) = \bar{\Phi}(T-t)^{\top}\bar{Z}_{t}\) and short rates \(r_{t}\) now follow by elementary calculus. □

As announced in Remark 3.1, we conclude from (3.12) that the induced \(T\)-bond prices are linear in \(\bar{Z}_{t}\),

Differentiation using (3.16) shows that forward rates are linear–rational in \(\bar{Z}_{t}\),

3.3 Well-behaved factor processes

As noted in Remark 2.8, the existence of global factor processes may be an issue in view of their quadratic drift (3.10), which may cause explosion in finite time. We discuss here some well-behaved specifications.

More specifically, we show that there exist factor processes \((Z_{t})\) with quadratic drift of the form (3.10) and taking values in the half-open solid simplex

This can always be achieved, as we show now. To that end, we first specify a diffusion \((U_{t})\) with values in \([0,\infty )^{d}\) and then apply the diffeomorphism \(G:[0,\infty )^{d}\to {\mathcal {Z}}\) defined by

with inverse \(G^{-1}_{i} (z) = z_{i} (1-\sum _{j=1}^{d} z_{j} )^{-1}\).

The dynamics of \((U_{t})\) could be of the form

for some parameters \(\kappa _{i}\in {\mathbb{R}}\), \(\theta _{i},q_{i}\ge 0\).

Lemma 3.3

There exists a \([0,\infty )^{d}\)-valued weak solution \((U_{t})\) to (3.18). The drift of the transformed process \((Z_{t}):=(G(U_{t}))\) is quadratic in \(Z_{t}\) of the form (3.10), and assumption (2.9) holds so that Theorem 2.3applies.

Proof

The existence of a \([0,\infty )^{d}\)-valued weak solution \((U_{t})\) to (3.18) follows from Filipović and Larsson [5, Theorem 5.3 and Proposition 6.4].

Now define \(V_{t}:= 1+\sum _{j=1}^{d} U_{t,j}\) so that we obtain \(Z_{t,i}=U_{t,i}(V_{t})^{-1}\), and denote \(\theta _{V}:=\sum _{j=1}^{d} \theta _{j}\). Using Itô calculus, we get

and thus

and

Integration by parts thus gives

This shows that the drift function of \((Z_{t})\) is of the form (3.10).

The induced short rate process \((r_{t})\) is linear in \(Z_{t}\) as in (3.13) and thus uniformly bounded. The volatility function of \((Z_{t})\) is also uniformly bounded, and hence the induced discount derivative volatility is given by (3.2). Hence assumption (2.9) holds, which completes the proof. □

The existence result in Lemma 3.3 is only partially an answer to the question about the global existence of a solution to the SPDE (2.12) in Remark 2.8. In fact, the affine discount term structure model (3.3) generates only discount derivative curves of the form \(\psi _{t}(x) = \phi _{0}(x) + \sum _{i=1}^{d} \phi _{i}(x) Z_{t,i}\), which lie in a \(d\)-dimensional affine subspace, say \({\mathcal {A}}\), of ℋ. In view of (3.5), there exist points \(0\le x_{1}< x_{2}<\cdots <x_{d}\) such that the factor \(Z_{t}\) is an affine function of the \(d\) discount derivative values \(\psi _{t}(x_{1}),\dots ,\psi _{t}(x_{d})\). Combining this with (3.2) and (3.19), we easily see that the volatility operator \(B(\psi _{t})\) in (2.12) is a (non-Lipschitz-continuous) function of the values \(\psi _{t}(x_{1}),\dots ,\psi _{t}(x_{d})\) when restricted to \(\psi _{t}\in {\mathcal {A}}\). However, it is not clear how to extend \(B\) beyond \({\mathcal {A}}\) in such a way that a solution to (2.12) still exists outside \({\mathcal {A}}\). Moreover, uniqueness remains a problem anyway because of the lack of Lipschitz continuity at \(Z_{t,i}=0\) of the volatility of \(Z_{t}\) given in (3.19), as the following remark shows.

Remark 3.4

While pathwise uniqueness for (3.18) is proved in Filipović and Larsson [5, Theorem 4.3] in dimension \(d=1\), it remains an open problem in higher dimensions \(d>1\). We conjecture that pathwise uniqueness for (3.18) can be proved along similar arguments as used in Yamada and Watanabe [9]. However, as discussed in [5, Sect. 4], the problem is far from trivial. For instance, the results in [9] do not directly apply here as they assume that the \(i\)th element of the diagonal diffusion matrix only depends on the \(i\)th coordinate of the process.

4 Conclusion

An arbitrage-free dynamic discount model defines an arbitrage-free price system for bonds. Modelling discount derivatives thus provides a valuable alternative to modelling forward rates. Of particular interest are affine discount term structure models, for which we provide some concrete specifications.

The paper identifies various open problems outlined in Remarks 2.7, 2.8 and 3.4, which point to directions for further research. Other research directions include the implementation of discount models for pricing and hedging interest rate derivatives.

References

Björk, T.: Arbitrage Theory in Continuous Time, 4th edn. Oxford University Press, London (2020)

Da Prato, G., Zabczyk, J.: Stochastic Equations in Infinite Dimensions. Encyclopedia of Mathematics and Its Applications, vol. 44. Cambridge University Press, Cambridge (1992)

Filipović, D.: Consistency Problems for Heath–Jarrow–Morton Interest Rate Models. Lecture Notes in Mathematics, vol. 1760. Springer, Berlin (2001)

Filipović, D.: Term-Structure Models. A Graduate Course. Springer, Berlin (2009)

Filipović, D., Larsson, M.: Polynomial diffusions and applications in finance. Finance Stoch. 20, 931–972 (2016)

Filipović, D., Larsson, M., Statti, F.: Unspanned stochastic volatility in the multifactor CIR model. Math. Finance 29, 827–836 (2019)

Filipović, D., Larsson, M., Trolle, A.B.: Linear–rational term structure models. J. Finance 72, 655–704 (2017)

Heath, D., Jarrow, R., Morton, A.: Bond pricing and the term structure of interest rates: a new methodology for contingent claims valuation. Econometrica 60, 77–105 (1992)

Yamada, T., Watanabe, S.: On the uniqueness of solutions of stochastic differential equations. J. Math. Kyoto Univ. 11, 155–167 (1971)

Funding

Open access funding provided by EPFL Lausanne.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing Interests

The author declares no competing interests.

Additional information

In memory of Tomas Björk

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I thank Bent Jesper Christensen, Martin Larsson and two anonymous referees for helpful comments.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Filipović, D. Discount models. Finance Stoch 27, 933–946 (2023). https://doi.org/10.1007/s00780-023-00514-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00780-023-00514-0