Abstract

We investigate the social desirability of free entry under co-opetition where firms compete in a homogeneous product market while sharing common property resources that affect industry-wide demand. Our findings indicate that free entry leads to socially excessive or insufficient market entry, depending on the commitment of investment in common property resources. In the non-commitment case, where quantities and investment are simultaneously chosen, there is a possibility of insufficient entry. However, in the pre-commitment case, where investment is chosen at a prior stage, free entry leads to excess entry and a reduction in common property resources. Interestingly, in this case, the excess entry results of Mankiw and Whinston (RAND J Econ 17:48–58, 1986) hold even without entry costs or economies of scale. These results have important policy implications for entry regulation.

Similar content being viewed by others

Notes

A mobile phone company’s investment to expand its service areas has a positive external effect on the profits of rival mobile phone carriers because the investment increases the availability of calls between different mobile carriers. The investment also benefits consumers and increases their willingness to pay for phone services.

Baniak et al. (2014) study the effect of stricter producer liability in a model where oligopolistic firms are bounded by a common industry reputation for product safety.

Other examples of co-opetition include development of open-source software and rent-seeking or lobbying for permission to sell products to certain groups (e.g., lobbying for the relaxation of regulations on the sale of tobacco or alcohol to under-age people, of specific medicines to a mass of people, and of financial products to inexperienced consumers).

Berry and Waldfogel (1999) empirically examine the problem of excess entry in U.S. commercial radio broadcasting and estimate the welfare loss because of excess entry.

Wang et al. (2015) show that free entry results in excessive entry even under the case of R&D with perfect spillovers. However, they do not show that such excess entry properties also hold for the case of no economies of scale (or no entry costs).

The sequential co-opetition model in our study has a similar structure as the case of research joint venture competition (NJ case) in Kamien et al. (1992) where the firms independently choose R&D with maximal sharing of information. Moreover, the sequential co-opetition game with industry cooperation considered in Appendix 2 is analogous to the cartelization case (CJ case) in Kamien et al. (1992). Their study does not consider the welfare evaluation of free entry. See also Suzumura (1992) for R&D competition and cooperation with spillovers.

Matsumura and Okamura (2006a, b) show that the equilibrium number of firms can be either excessive or insufficient in a spatial price discrimination model. Mukherjee and Mukherjee (2008) and Mukherjee (2012) show theoretically that free entry can result in socially insufficient entry in the presence of technology licensing or market leaders. Furthermore, when entry is ex ante uncertain (Creane 2007), or when consumers care about social status (Woo 2013), the excess entry result does not always hold.

Using a dataset of the German manufacturing sector, Czarnitzki et al. (2014) also show empirically that an endogenous entry threat reduces R&D intensity for the average firm, whereas it increases that for an incumbent leader firm. See also Etro (2007). Moreover, incorporating international trade into the model of Etro (2006, 2011) investigates the optimal export promoting policies such as R&D subsidies.

We ignore the integer constraint of the number of firms, n. For the effect of the integer constraint on the excess entry property, see Galera and Garcia-del-Barrio (2011).

In detail, we have shown that

$$\begin{aligned} \overline{W}'(\bar{n}_f)=-\frac{(a-c)^2 \left[ 2\left( \bar{n}_{f}^2-6 \right) \left( \bar{n}_{f} +1 \right) bg+ \left( \bar{n}_{f}+ 1 \right) ^3 b^2 g^2 +8 \right] ng}{ \varTheta ^3}<0. \end{aligned}$$For welfare evaluation of entry regulation, Kim (1997) considers the strategic behavior of firms and the government and shows that entry regulation to prevent excess entry induces the incumbent to behave strategically against the government. Therefore, the final outcome is socially suboptimal compared with that in the case without government intervention. Considering the relevance of the integer constraint on the number of firms, Matsumura (2000) and Galera and Garcia-del-Barrio (2011) show that the excess-entry theorem may not hold true under the presence of increasing marginal production costs.

It is also important to consider the case in which firms choose their output before choosing investment. Such a reversed sequence may be of some relevance, particularly if one considers Cournot as the case of choice of capacity, which in some cases may be more difficult to change than some forms of investment in a common resource. We can easily show that the subgame-perfect equilibrium of this game is the same as that of simultaneous co-opetition game studied in Sect. 3, as long as the demand function stays linear. This is because the first-order condition of investment choice in the last stage yields \(z_i=q_i/g\), which is independent of \(q_j\). Therefore, the case of reversed sequence is essentially equivalent to the case of simultaneous co-opetition, implying that Proppsition 1 also applies to the case.

For example, we have \(d\bar{Q}/dn<0\) when \(\epsilon =1\), \(c=10\), \(a=2\), \(g=4\) and \(n=12\).

References

Baniak A, Grajzl P, Guse AJ (2014) producer liability and competition policy when firms are bound by a common industry reputation. B.E. J Econ Anal Policy 14:1645–1676

Berry ST, Waldfogel J (1999) Free entry and social inefficiency in radio broadcasting. RAND J Econ 30:397–420

Brandenburger AM, Nalebuff BJ (1996) Co-opetition. Harvard Business School Press, Boston, MA

Creane A (2007) Note on uncertainty and socially excessive entry. Int J Econ Theory 3:329–334

Czarnitzki D, Etro F, Kraft K (2014) Endogenous market structures and innovation by leaders: an empirical test. Economica 81:117–139

Dixit AK, Stiglitz JE (1977) Monopolistic competition and optimum product diversity. Am Econ Rev 67:297–308

Etro F (2006) Aggressive leaders. RAND J Econ 37:146–154

Etro F (2007) Competition, innovation, and antitrust. A theory of market leaders and its policy implications. Springer, Berlin, New York

Etro F (2011) Endogenous market structures and strategic trade policy. Int Econ Rev 52:63–84

Galera R, Garcia-del-Barrio P (2011) Excessive entry and the integer constraint with many firms: a note. J Econ 103:271–287

Ghosh A, Morita H (2007) Free entry and social efficiency under vertical oligopoly. RAND J Econ 38:541–554

Ghosh A, Saha S (2007) Excess entry in the absence of scale economies. Econ Theory 30:575–586

Gu Y, Wenzel T (2009) A note on the excess entry theorem in spatial models with elastic demand. Int J Ind Org 27:567–571

Haruna S, Goel RK (2011) R&D, free entry, and social inefficiency. Econ Innov New Technol 20:89–101

Kamien MI, Muller E, Zang I (1992) Research joint ventures and R&D cartels. Am Econ Rev 82:1293–1306

Kim J (1997) Inefficiency of subgame optimal entry regulation. RAND J Econ 28:25–36

Konishi H, Okuno-Fujiwara M, Suzumura K (1990) Oligopolistic competition and economic welfare. J Public Econ 42:67–88

Kühn K, Vives X (1999) Excess entry, vertical integration, and welfare. RAND J Econ 30:575–603

Mankiw NG, Whinston MD (1986) Free entry and social inefficiency. RAND J Econ 17:48–58

Matsumura T (2000) Entry regulation and social welfare with an integer problem. J Econ 71:47–58

Matsumura T, Okamura M (2006a) Equilibrium number of firms and economic welfare in a spatial price discrimination model. Econ Lett 90:396–401

Matsumura T, Okamura M (2006b) A note on the excess entry theorem in spatial markets. Int J Ind Org 24:1071–1076

Mukherjee A (2012) Social efficiency of entry with market leaders. J Econ Manag Strategy 21:431–444

Mukherjee A, Mukherjee S (2008) Excess-entry theorem: the implications of licensing. Manch Sch 76:675–689

Okuno-Fujiwara M, Suzumura K (1993) Symmetric Cournot oligopoly and economic welfare: a synthesis. Econ Theory 3:43–59

Perry MK (1984) Scale economies, imperfect competition, and public policy. J Ind Econ 32:313–330

Puppim de Oliveira JA (2003) Governmental responses to tourism development: three Brazilian case studies. Tour Manag 24:97–110

Salop SC (1979) Monopolistic competition with outside goods. Bell J Econ 10:141–156

Spence AM (1976) Product selection, fixed costs, and monopolistic competition. Rev Econ Stud 43:217–235

Suzumura K (1992) Cooperative and noncooperative R&D in an oligopoly with spillovers. Am Econ Rev 82:1307–1320

Suzumura K, Kiyono K (1987) Entry barriers and economic welfare. Rev Econ Stud 54:157–167

Varian HR (1995) Entry and cost reduction. Jpn World Econ 7:399–410

Von Weizsacker CC (1980) A welfare analysis of barriers to entry. Bell J Econ 11:399–420

Wang LFS, Chao AC, Lee JY (2015) R&D and social inefficiency of entry. J Ind Compet Trade 15:181–187

Woo WC (2013) Social inefficiency of free entry with status effects. J Public Econ Theory 15:229–248

Acknowledgments

This work was supported by JSPS KAKENHI Grant Number 25380343.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Constant elasticity demand

In this appendix, we consider a constant elasticity demand (CED) instead of a linear one (2), and check the robustness of our results obtained in the main body. We specify a constant elasticity demand expressed by

where a is a positive constant and \(\epsilon \) is price elasticity of demand. We further assume \(\epsilon \ge 1\) to satisfy \(P_{ZZ}\le 0\). The CED has the property of \(P_{QZ}<0\), indicating that the higher the quality of common property resources, the steeper is the slope of the inverse demand curve.

1.1 Simultaneous co-opetition

The simultaneous co-opetition game comprises two stages: in the first stage, firms make entry decisions; in the second stage, firms simultaneously decides their own investment and output.

Using (16), we obtain the symmetric equilibrium of the second stage as follows:

where \(\varLambda \equiv (\epsilon n -1)/(c \epsilon n)>0\) and \(d\varLambda /dn>0\). Then, we have the following comparative statics:

As the number of firms increases, individual output and investment decrease, whereas the total output and investment increase. Furthermore, we have

which implies that as the number of firms approaches infinity, individual output and investment converge to zero, while the total output and investment converge to positive and finite values. These properties are the same as in the linear demand case.

In the first stage, firms enter the market until their expected profits fall to zero. Therefore, the free-entry equilibrium number of firms, \(\hat{n}_f\), satisfies

Because \(\hat{\pi }(n)\) is strictly decreasing in n and \(\lim _{n\rightarrow \infty }\hat{\pi }=-K\), we confirm \(\lim _{K\rightarrow 0}\hat{n}_f=\infty \). Thus, the free-entry number of firms goes to infinity when there are no entry costs, as in the linear demand case.

The socially optimal number of firms, \(\hat{n}_{sb}\), satisfies

We also find that \(\lim _{K\rightarrow 0}\hat{n}_{sb}=\infty \), which implies that the second-best number of firms goes to infinity as K approaches zero.

Then we have

Therefore, the excess (insufficient) entry theorem applies for a larger (smaller) market size (a) and greater (smaller) production and investment costs (c and g). We cannot analytically derive the impact of \(\epsilon \) on the sign of \(\widehat{W}'(\hat{n}_f)\), but the numerical examples demonstrate that the excess entry theorem is more likely to hold for less elastic demand (i.e., smaller value of \(\epsilon \)).

In his simple Cournot model with endogenous entry, Varian (1995) demonstrates that excessive entry results hold for constant elasticity demand cases. Our result extends this by allowing firms co-opetitive investment and shows that free entry leads to either excessive or insufficient entry depending on the value of price elasticity and investment cost.

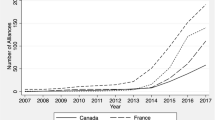

We provide the following numerical examples. In the case of \(a=2\), \(c=0.1\), \( \epsilon =2\), and \(K=0.1\), we find \(\hat{n}_f\approx 14\) and \(\hat{n}_{sb}\approx 19\) for \(g=1\), and \(\hat{n}_f\approx 10\) and \(\hat{n}_{sb}\approx 8\) for \(g=8\). Therefore, free entry leads to excess (insufficient) entry when g is large (small). In the case of \(a=2\), \(c=0.1\), \(g=3\), and \(K=0.1\), we find that \(\hat{n}_f\approx 49 < \hat{n}_{sb}\approx 74\) for \(\epsilon =3\), and \(\hat{n}_f \approx 5 > \hat{n}_{sb}\approx 4\) for \( \epsilon =1.2\). Figure 3 depicts these situations. In each panel, profits and welfare in the second-stage equilibrium are depicted. The left (right) panel depicts the case in which price elasticity of demand is high (low), and indicates that insufficient (excess) entry occurs.

1.2 Sequential co-opetition

A sequential co-opetition game comprises three stages: in the first stage, firms make entry decisions; in the second stage, firms non-cooperatively decide on their investment; in the last stage, firms compete in quantity.

Specifying the inverse demand as (16), we obtain the third-stage equilibrium:

where \(\varLambda \equiv (\epsilon n -1)/(c\epsilon n)>0\), as in the simultaneous co-opetition game. Furthermore, we obtain \(\partial \tilde{q}/\partial n<0\), \(\partial \tilde{q}/\partial z_i>0\), \(\partial \tilde{Q}/\partial n>0\), and \(\partial \tilde{Q}/\partial z_i=\partial \tilde{Q}/\partial z_j>0\).

Solving for the second-stage problem, we have

The comparative static yields the following:

We find that \(d\bar{Z}/dn<0\) also holds under constant elasticity demand, indicating that an increase in the number of firms decreases total investment. The sign of \(d\bar{Q}/dn\) is ambiguous: however, it is more likely to be negative when \(\epsilon \) is smaller, c is larger, and/or d is smaller.Footnote 14 Furthermore, we have

Therefore, we find that as the number of firms increases, the total output converges to the perfect competition outcome without investment activities and the total investment converges to zero, as in the linear demand case.

In the first stage, the number of firms is endogenously decided. The free-entry equilibrium number of firms, \(\bar{n}_f\), satisfies

On the basis of the fact that \(\bar{\pi }(n)\) is strictly decreasing in n and \(lim_{n\rightarrow \infty }\bar{\pi }=-K\), we confirm \(\lim _{K\rightarrow 0} \bar{n}_f=\infty \), which indicates that the free-entry number of firms goes to infinity when there are no entry costs. After some tedious manipulation, we find that the second-best number of firms, \(\bar{n}_{sb}\), satisfies

Then, we find that

which indicates that free entry necessarily results in excessive entry. Therefore, we find that, under constant elasticity demand, the free-entry equilibrium of the sequential co-opetition game yields excessive entry because \(\overline{W}'(\bar{n}_f)\) is always negative. Furthermore, this result holds even when there are no entry costs.

In the constant elasticity demand case, the second-best number of firms when \(K=0\) cannot be analytically derived; therefore, we provide numerical examples to show that the excess entry property holds even when \(K=0\). In the case of \(a=20\), \(c=0.1\), \(g=4\), and \(\epsilon =2\), \(\bar{n}_f\approx 31>\bar{n}_{sb}\approx 7\) holds for \(K=0.1\) and \(\bar{n}_f \approx \infty >\bar{n}_{sb}\approx 9\) holds for \(K=0\).

Appendix 2: Investment cooperation and obligation

Here, we consider two additional cases of investment: (1) investment cooperation among firms in which firms invest cooperatively in common property resources to maximize industry profits but remain rivals in Cournot competition, and (2) investment obligation in which the government requires firms to provide a specified level of investment that maximizes social welfare. In particular, we examine the social desirability of free entry in an extended sequential co-opetition game in which firms make entry decisions in the first stage, determine the level of investment required from all firms in the second stage, and compete in a Cournot fashion in the third stage. The inverse demand is linear as given by (2).

We first characterize the equilibrium of the investment cooperation case. The third stage equilibrium is the same as that derived in Sect. 4, so the Nash equilibrium output and investment per firm are given by (8). In the second stage, the level of investment (\(z=Z/n\)) is determined to maximize joint profits:

Arranging the first-order condition and using (3), we have

which implies that firms can internalize positive external effects of investment for market expansion (i.e., \(n P_Z\) in the first bracket). Therefore, the level of cooperative investment is greater than that of non-cooperative investment. Solving (17), we characterize the second-stage equilibrium as

where \(\varPsi \equiv (n+1)^2 bg-2n^2>0\) (the inequality follows from the second-order condition). Because \(\varPsi <\varTheta \), from (10), we have \(\breve{q}(n)>\bar{q}(n)\) and \(\breve{z}(n)>\bar{z}(n)\): given that the number of firms is fixed, the individual output and investment under the cooperative investment case are greater than those under the non-cooperative investment case. Then, we have the following comparative statics:

In contrast to the non-cooperative investment case analyzed in Sect. 4, an additional entry in this case increases the total investment and total output because entry does not increase the incentive to free ride on investments in common property resources. Furthermore, we have

Note that these limiting values are similar to those in the case of simultaneous co-opetition. The total investment converges to positive and finite values as the number of firms approaches infinity.

In the first stage, firms enter the market until their profits fall to zero. The free-entry number of firms is defined as \(\breve{n}_f\) such that \(\breve{\pi }(\breve{n}_f)=0\). The associated level of welfare is defined by \(\breve{W}(\breve{n}_f)\). Then, we have

where

This indicates that the greater (smaller) the value of b and/or d, the more likely free entry would be to lead to excess (insufficient) entry. In other words, even when investment has commitment value, investment cooperation may lead to insufficient entry.

We provide the following numerical examples: In the case of \(a=10,\ b=1,\ c=1,\) and \(K=2\), we find that \(\breve{n}_f\approx 7<\breve{n}_{sb}\approx 10\) for \(g=5\), which corresponds to the insufficient entry theorem. On the other hand, we find that \(\breve{n}_f\approx 6 > \breve{n}_{sb}\approx 3\) for \(g=20\), which corresponds to the excess entry theorem.

Then, we characterize the equilibrium of the investment obligation case in which the government requires firms to provide a specified level of investment that maximizes social welfare.

The third stage equilibrium is the same as the case of investment cooperation. The level of investment in the second stage is determined to maximize the social surplus:

The second-stage equilibrium is characterized as

where \(\varXi \equiv bg(n+1)^2-(n+2)n^2>0\) (the inequality follows the second-order condition).

After some mathematical manipulations, we have the following condition:

where \(\check{n}_f\) is a free-entry number of firms that satisfies \(\check{\pi }(\check{n}_f)=0\). Therefore, we find that the greater (smaller) the value of b and/or g, the more likely is free entry to be lead to excess (insufficient) entry. The level of investment in the investment obligation case is greater than that in the investment cooperation case because the government decides the level of investment by considering the positive effect on consumer surplus. This implies that free entry under investment obligation is more likely to result in insufficient entry compared to the case of investment cooperation.

Rights and permissions

About this article

Cite this article

Hattori, K., Yoshikawa, T. Free entry and social inefficiency under co-opetition. J Econ 118, 97–119 (2016). https://doi.org/10.1007/s00712-015-0469-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-015-0469-x