Abstract

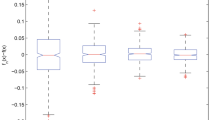

In this paper, strong consistency of tail value-at-risk (TVaR) estimator under widely orthant dependent (WOD) samples is established, and a numerical simulation is performed to verify the validity of the theoretical results. To reveal the essence of the result, theoretical discussion on complete and complete moment convergence corresponding to the Baum–Katz law, as well as the Marcinkiewicz–Zygmund type strong law of large numbers (MZSLLN) for maximal weighted sums and maximal product sums of widely orthant dependent (WOD) random variables are investigated. The results obtained in the context extend the corresponding ones for independent and some dependent random variables.

Similar content being viewed by others

References

Acerbi C, Tasche D (2002a) On the coherence of expected shortfall. J Bank Financ 26(7):1487–1503

Acerbi C, Tasche D (2002b) Expected shortfall: a natural coherent alternative to value at risk. Econ Notes 31(2):379–388

Adler A, Rosalsky A (1987) Some general strong laws for weighted sums of stochastically dominated random variables. Stoch Anal Appl 5(1):1–16

Adler A, Rosalsky A, Taylor RL (1989) Strong laws of large numbers for weighted sums of random elements in normed linear spaces. Int J Math Math Sci 12:507–529

Alex GJ, Baptista AM (2004) A comparison of VaR and CVaR constraints on portfolio selection with the mean-variance model. Manag Sci 50(9):1261–1273

Alexander S, Coleman TF, Li Y (2006) Minimizing CVaR and VaR for a portfolio of derivatives. J Bank Financ 30(2):583–605

Anh VTN, Hien NTT (2022) On complete convergence for weighted sums of coordinatewise negatively associated random variables in Hilbert spaces. Bull Korean Math Soc 59(4):879–895

Baum LE, Katz M (1965) Convergence rates in the law of large numbers. Trans Am Math Soc 120(1):108–123

Bingham N, Goldie C, Teugels J (1989) Regular variation. Cambridge University Press, Cambridge

Brahim B, Fatah B, Djabrane Y (2018) Copula conditional tail expectation for multivariate financial risks. Arab J Math Sci 24(1):82–100

Cai Z, Wang X (2008) Nonparametric estimation of conditional VaR and expected shortfall. J Econ 147(1):120–130

Cai GH, Xiang L, Zhang Q (2020) Complete convergence for weighted sums of WOD random variables sequence. Appl Math J Chin Univ 35(1):21–28

Chen SX (2008) Nonparametric estimation of expected shortfall. J Financ Econ 6(1):87–107

Chen W, Wang YB, Cheng DY (2016) An inequality of widely dependent random variables and its applications. Lith Math J 56(1):16–31

Chen YQ, White T, Yuen KC (2021) Precise large deviations of aggregate claims with arbitrary dependence between claim sizes and waiting times. Insurance 97:1–6

Chow YS (1988) On the rate of moment convergence of sample sums and extremes. Bull Inst Math 16(3):177–201

Cossette H, Mailhot M, Marceau É (2012) TVaR-based capital allocation for multivariate compound distributions with positive continuous claim amounts. Insurance 50:247–256

Cossette H, Mailhot M, Marceau É, Mesfioui M (2016) Vector-valued tail value-at-risk and capital allocation. Methodol Comput Appl Probab 18:653–674

da Silva JL (2016) Convergence in \(p\)-mean for arrays of row-wise extended negatively dependent random variables. Acta Math Hungar 150(2):346–362

Frey R, McNeil AJ (2002) VaR and expected shortfall in portfolios of dependent credit risks: conceptual and practical insights. J Bank Financ 26(7):1317–1334

Hsu PL, Robbins H (1947) Complete convergence and the law of large numbers. Proc Natl Acad Sci USA 33(2):25–31

Inui K, Kijima M (2005) On the significance of expected shortfall as a coherent risk measure. J Bank Financ 29(4):853–864

Jadhav DK, Ramanathan TV, Naik-Nimbalkar UV (2013) Modified expected shortfall: a new robust coherent risk measure. J Risk 16(1)

Joag-Dev K, Proschan F (1983) Negative association of random variables with applications. Ann Stat 11:286–295

Kuczmaszewska A (2010) On complete convergence in Marcinkiewicz-Zygmund type SLLN for negatively associated random variables. Acta Math Hungar 128:116–130

Kuczmaszewska A, Yan JG (2021) On complete convergence in Marcinkiewicz-Zygmund type SLLN for random variables. Appl Math J Chin Univ 36(3):342–353

Le VD, Ta CS (2022) Complete moment convergence for \(m\)-ANA random variables and statistical applications. J Stat Comput Simul 92(2):370–394

Liu L (2009) Precise large deviations for dependent random variables with heavy tails. Stat Probab Lett 79:1290–1298

Lu DW, Song LX, Li HA (2018) Precise large deviations for sums of WUOD and \(\varphi \)-mixing random variables with dominated variation. Commun Stat Theory Methods 47(19):4791–4807

Luo ZD (2020) Nonparametric kernel estimation of CVaR under \(\alpha \)-mixing sequences. Stat Pap 61:615–643

Luo ZD, Yang SC (2013) The asymptotic properties of CVaR estimator under \(\rho \)-mixing sequences. Acta Math Sin 56(6):851–870

Nadarajah S, Zhang B, Chan S (2014) Estimation methods for expected shortfall. Quant Financ 14(2):271–291

Patton AJ, Ziegel JF, Chen R (2019) Dynamic semiparametric models for expected shortfall (and Value-at-Risk). J Econ 211(2):388–413

Pflug GC (2000) Some remarks on the value-at-risk and the conditional value-at-risk, probabilistic constrained optimization, vol 49. Springer, Boston, pp 272–281

Righi MB, Ceretta PS (2015) A comparison of expected shortfall estimation models. J Econ Bus 78:14–47

Scaillet O (2004) Nonparametric estimation and sensitivity analysis of expected shortfall. Math Financ 14(1):115–129

Scaillet O (2005) Nonparametric estimation of conditional expected shortfall. Insurance Risk Manag J 74(1):639–660

Seneta E (1976) Regularly varying function. Lecture Notes in Math., vol. 508. Springer, Berlin

Shen AT, Li X, Ning MM (2021) Strong convergence properties for weighted sums of WNOD random variables and its applications in nonparametric regression models. Stochastics 93(3):376–401

Stout WF (1974) Almost sure convergence. Academic Press, New York

Su C, Liang HY, Wang YB (2000) Hsu-Robbins type theorems for pairwise products sums of i.i.d. random rariables (I). Acta Math Sin 43(5):875–886

Syuhada K, Neswan O, Josaphat BP (2022) Estimating copula-based extension of tail value-at-risk and its application in insurance claim. Risk 10(6):113. https://doi.org/10.3390/risks10060113

Taylor JW (2008) Estimating value at risk and expected shortfall using expectiles. J Financ Econ 6(2):231–252

Trindade AA, Uryasev S, Zrazhevsky G (2007) Financial prediction with constrained tail risk. J Bank Financ 31(11):3524–3538

Wang YB, Cheng DY (2011) Basic renewal theorems for random walks with widely dependent increments. J Math Anal Appl 384(2):597–606

Wang YB, Yan JG, Cheng FY, Cai XZ (2001) On the strong stability for Jamison type weighted product sums of pairwise NQD series with different distribution. Chin Ann Math Ser A 22:701–706

Wang KY, Yang Y, Lin JG (2012) Precise large deviations for widely orthant dependent random variables with dominatedly varying tails. Front Math Chin 7(5):919–932

Wang KY, Wang YB, Gao QW (2013a) Uniform asymptotics for the finite-time ruin probability of a new dependent risk model with a constant interest rate. Methodol Comput Appl Probab 15(1):109–124

Wang XJ, Hu TC, Volodin A, Hu SH (2013b) Complete convergence for weighted sums and arrays of rowwise extended negatively dependent random variables. Commun Stat Theory Methods 42:2391–2401

Wang XJ, Xu C, Hu TC, Volodin A, Hu SH (2014a) On complete convergence for widely orthant dependent random variables and its applications in nonparametric regression models. TEST 23:607–629

Wang XJ, Deng X, Zheng LL, Hu SH (2014b) Complete convergence for arrays of rowwise negatively superadditive dependent random variables and its applications. Stat J Theory Appl Stat 48(4):834–850

Wu Y, Wang XJ (2021) Strong laws for weighted sums of \(m\)-extended negatively dependent random variables and its applications. J Math Anal Appl 494(2):124566. https://doi.org/10.1016/j.jmaa.2020.124566

Wu Y, Wang XJ, Shen AT (2020) Strong convergence properties for weighted sums ofm-asymptotic negatively associated random variables andstatistical applications. Stat Pap. https://doi.org/10.1007/s00362-020-01179-z

Xing GD, Yang SC, Li YM (2014) Strong consistency of conditional value-at-risk estimate for \(\varphi \)-mixing samples. Commun Stat Theory Methods 43:5105–5113

Xu X, Yan JG (2021) Complete moment convergence for randomly weighted sums of END sequences and its applications. Commun Stat Theory Methods 50(12):2877–2899

Yamai Y, Yoshiba T (2002a) On the validity of value-at-risk: comparative analyses with expected shortfall. Monet Econ Stud 20(1):977–1015

Yamai Y, Yoshiba T (2002b) Comparative analyses of expected shortfall and value-at-risk: their estimation error, decomposition, and optimization. Monet Econ Stud 20(1):87–121

Yamai Y, Yoshiba T (2005) Value-at-risk versus expected shortfall: a practical perspective. J Bank Financ 29:977–1015

Yan JG (2017) Strong stability of a type of Jamison weighted sums for END random variables. J Korean Math Soc 54(3):897–907

Yan JG (2018a) Almost sure convergence for weighted sums of WNOD random variables and its applications to non parametric regression models. Commun Stat Theory Methods 47(16):3893–3909

Yan JG (2018b) Complete convergence and complete moment convergence for maximal weighted sums of extended negatively dependent random variables. Acta Math Sin Eng Ser 34(10):1501–1516

Yan JG (2019) Complete convergence in Marcinkiewicz-Zygmund type SLLN for END random variables and its applications. Commun Stat Theory Methods 48(20):5074–5098

Zhang WH, Cheng DY, Wang YB (2016) On the strong convergence of weighted sums of widely dependent random variables. Commun Stat Theory Methods 45(21):6447–6460

Zhou JY, Yan JG, Cheng DY (2022a) Complete convergence for maximum of weighted sums of WNOD random variables and its application. Commun Stat Theory Methods. https://doi.org/10.1080/03610926.2022.2059681

Zhou JY, Yan JG, Du F (2022b) Complete and complete \(f\)-Moment convergence for arrays of rowwise END random variables and some applications. Sankhyā A. https://doi.org/10.1007/s13171-022-00289-0

Zhou JY, Yan JG, Yan TJ (2022c) Complete moment convergence for randomly weighted sums of arrays of rowwise \(m_n\)-extended negatively dependent random variables and its applications. Jpn J Ind Appl Math. https://doi.org/10.1007/s13160-022-00522-1

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zhou, J., Yan, J. & Cheng, D. Strong consistency of tail value-at-risk estimator and corresponding general results under widely orthant dependent samples. Stat Papers (2024). https://doi.org/10.1007/s00362-023-01525-x

Received:

Revised:

Published:

DOI: https://doi.org/10.1007/s00362-023-01525-x

Keywords

- Strong consistency

- Tail value-at-risk

- Widely orthant dependent random variables

- Product sums

- Complete convergence

- Complete moment convergence