Abstract

We study the balanced growth paths and their stability features of a monetary two-sector endogenous growth model with physical capital and human capital accumulation. The demand of money is motivated on the ground of a fractional cash-in-advance constraint on consumption expenditures and on those in the investment in physical capital. We consider, in sequence, two monetary rules implemented by the Central Bank. First, we assume that the latter pegs the money growth rate and then the nominal interest rate according to a Taylor feedback rule. When the Central Bank pegs the money growth rate, there emerges a unique balanced growth path which turns out to be indeterminate for a low amplitude of the liquidity constraint and/or for a low enough intertemporal elasticity of substitution in consumption even under the hypothesis that the cash-in-advance constraint applies uniquely on consumption expenditures. On the other hand, when the monetary policy is implemented according to a Taylor feedback rule, an unintended liquidity trap equilibrium may coexist with multiple interior Taylor equilibria. If, on the one hand, the liquidity trap equilibrium is bound to be locally determinate; on the other hand, the Taylor interior equilibrium may become locally indeterminate provided the cash-in-advance constraint applies also on the investment in physical capital good and under a physical capital intensive human capital good. A global analysis is performed in which we show that the Taylor equilibrium and the liquidity trap one are connected through a heteroclinic orbit.

Similar content being viewed by others

Notes

A particular two-sector model is that analyzed by Hori et al. (2018) where labor employment shifts from one sector to another and in which each sector is characterized by different levels of productivity.

In the sequel of the paper, we will provide the expression for the real interest rate.

\( F_{K}^{j}(K^{j},H^{j})\) and \(F_{H}^{j}(K^{j},H^{j})\) denote, respectively, the derivatives \(\partial F^{j}(K^{j},H^{j})/\partial K^{j}\) and \(\partial F^{j}(K^{j},H^{j})/\partial H^{j}\).

\(\sigma =1\) corresponds to the logarithm case.

Notice that Hahn and Solow (1995) propose a fractional CIA constraint applying uniquely on consumption purchases.

Notice that this is always true when \(k^T>k^N\) and for a wide range of parameter values when \(k^T<k^N\).

As we have already seen, this occurs for a quite large range for the technological parameters.

The rest of the proof is based upon arguments similar to the ones introduced in Bond et al. (1996) in Lemma 1 and Proposition 1.

One can also prove this by considering that under Assumption 1, Lemma 1 and a physical capital intensive consumable capital good (resp. human capital intensive consumable capital good), the left-hand side of (A-I) is a monotone increasing (resp. decreasing) function in p from \(-\,\delta ^{N}\) to \(+\,\infty \) (resp. \( +\,\infty \) to \(-\,\delta ^{N}\)), while the right-hand side of (A-I) is a monotone decreasing (resp. increasing) function moving from \(+\,\infty \) to \(-\,\delta ^{T}\) (resp. \(-\,\delta ^{T}\) to \(+\,\infty \)). By Assumption 4, it follows that there exists a unique p solution of (A-I) of (36).

Actually the two eigenvalues lie in he source region of the TD-plane analyzed in Grandmont et al. (1998).

Of course, this is true in the case in which there exists a unique stable eigenvalue among the previous three.

Of course it is indifferent to fix first \(i^{*}\) and then to determine endogenously \(\pi ^{*}\) or to proceed in the inverse way. For sake of simplicity in notation, we assume that the Central Bank fixes the target of the interest rate so that the deflation target is immediately drawn by the Fisher equation.

References

Barro, R.: Government spending in a simple model of endogenous growth. J. Polit. Econ. 98, 103–125 (1990)

Baxter, M.: Are consumer durables important for business cycles? Rev. Econ. Stat. 78, 147–155 (1996)

Benhabib, J., Schmitt-Grohé, S., Uribe, M.: The perils of Taylor rules. J. Econ. Theory 96, 40–69 (2001)

Bich, P., Drugeon, J.P., Morhaim, L.: On temporal aggregators and dynamic programming. Econ. Theory 66, 787–817 (2018). https://doi.org/10.1007/s00199-017-1045-0

Bond, E.W., Wang, P., Yip, C.K.: A general two-sector model of endogenous growth with human and physical capital: balanced growth and transitional dynamics. J. Econ. Theory 68, 149–173 (1996)

Benhabib, J., Nishimura, K.: Competitive equilibrium cycles. J. Econ. Theory 35, 284–306 (1985)

Bosi, S., Magris, F.: Indeterminacy and endogenous fluctuations with arbitrary small liquidity constraint. Res. Econ. 57, 39–51 (2003)

Bosi, S., Magris, F., Venditti, A.: Multiple equilibria in a cash-in-advance two-sector economy. Int. J. Econ. Theory 1, 131–149 (2005a)

Bosi, S., Cazzavillan, G., Magris, F.: Plausibility of indeterminacy and complex dynamics. Annales d’Economie et de Statistique 78, 103–115 (2005b)

Brito, P., Venditti, A.: Local and global indeterminacy in two-sector models of endogenous growth. J. Math. Econ. 46, 893–911 (2010)

Clarida, R., Gali, J., Gertler, M.: Monetary policy in practice: some international evidence. Eur. Econ. Rev. 42, 1033–1067 (1998)

Drugeon, J.P.: On the emergence of competitive equilibrium growth cycles. Econ. Theory 52, 397–427 (2013). https://doi.org/10.1007/s00199-011-0631-9

Drugeon, J.P., Ha-Huy, T., Nguyen, T.D.H.: On maximin dynamic programming and the rate of discount. Econ. Theory (2018). https://doi.org/10.1007/s00199-018-1166-0

Grandmont, J.-M.: Nonlinear difference equations, bifurcations and chaos: an introduction. Res. Econ. 62, 122–177 (2008)

Grandmont, J.-M., Pintus, P., de Vilder, R.: Capital-labor substitution and competitive nonlinear endogenous business cycles. J. Econ. Theory 80, 14–59 (1998)

Gruber, J.: A tax-based estimate of the elasticity of intertemporal substitution. Q. J. Finance 3, 1–20 (2013)

Hahn, F., Solow, R.: A Critical Essay on Modern Macroeconomic Theory. Basil Blackwell, Oxford (1995)

Hori, T., Mizutani, N., Uchino, T.: Endogenous structural change, aggregate balanced growth, and optimality. Econ. Theory 65, 125–153 (2018). https://doi.org/10.1007/s00199-016-1012-1

Huang, K.X.D., Meng, Q., Xue, J.: Money growth targeting and indeterminacy in small open economies. Econ. Theory 66, 1–37 (2018). https://doi.org/10.1007/s00199-018-1132-x

Jones, R.W.: The structure of simple general equilibrium models. J. Polit. Econ. 73, 557–572 (1965)

Kuznetsov, Y.: Elements of Applied Bifurcation Theory. Applied Mathematical Sciences, vol. 112. Springer, Berlin (1965)

Le Riche, A., Magris, F., Parent, A.: Liquidity trap and stability of Taylor rules. Math. Soc. Sci. 88, 16–27 (2017)

Le Van, C., Pham, N.S.: Intertemporal equilibrium with financial asset and physical capital. Econ. Theory 62, 155–199 (2017). https://doi.org/10.1007/s00199-015-0881-z

Leeper, E.M.: Equilibria under ’Active’ and ’Passive’ monetary and fiscal policies. J. Monet. Econ. 27, 129–147 (1991)

Lucas, R.E.: Interest rates and currency prices in a two-country world. J. Monet. Econ. 10, 335–359 (1982)

Lucas, R.E., Stokey, N.L.: Optimal fiscal and monetary policy in an economy without capital. J. Monet. Econ. 12, 55–93 (1983)

Menuet, M., Minea, A., Villieu, P.: Deficit, monetization, and economic growth: a case for multiplicity and indeterminacy. Econ. Theory 65, 819–853 (2018). https://doi.org/10.1007/s00199-017-1040-5

Mino, K.: Long-run effects of monetary expansion in a two-sector model of endogenous growth. J. Macroecon. 19, 635–655 (1997)

Mino, K., Nishimura, K., Shimomura, K., Wang, P.: Equilibrium dynamics in discrete-time endogenous growth models with social constant returns. Econ. Theory 34, 1–23 (2008). https://doi.org/10.1007/s00199-007-0211-1

Mulligan, C.: Capital interest and aggregate intertemporal substitution. NBER Working Paper 9373 (2002)

Romer, P.M.: Increasing returns and long-run growth. J. Polit. Econ. 94, 1002–1037 (1986)

Schmitt-Grohé, S., Uribe, M.: Price-level determinacy and monetary policy under a balanced-budget requirement. J. Monet. Econ. 45, 211–246 (2000)

Sorger, G.: Cycles and chaos in the one-sector growth model with elastic labor supply. Econ. Theory 65, 55–77 (2018). https://doi.org/10.1007/s00199-016-1005-0

Svensson, L.E.O.: Money and asset prices in a cash-in-advance economy. J. Polit. Econ. 5, 919–944 (1985)

Takahashi, H.: Optimal balanced growth in a general multi-sector endogenous growth model with constant returns. Econ. Theory 37, 31–49 (2008). https://doi.org/10.1007/s00199-007-0287-7

Takahashi, H., Mashiyama, K., Sakagami, R.: Does the capital intensity matter? Evidence from the postwar Japanese economy and other OECD countries. Macroecon. Dyn. 16, 103–116 (2012)

Vissing-Jorgensen, A., Attanasio, O.: Stock-market participation, intertemporal substitution and risk aversion. Am. Econ. Rev. Pap. Proc. 93, 383–391 (2003)

Woodford, M.: Interest Rate and Prices: Foundation of a Theory of Monetary Policy. Princeton University Press, Princeton (2003)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We would like to warmly thank three anonymous referees for their precious comments and suggestions. We would like to also thank S. Bosi, L. Clain-Chamosset-Yvrard, Z. Fu, J.-M. Grandmont, K. Benhima, K. Nishimura, C. Nourry, X. Raurich, T. Seegmuller, A. Venditti, R. Vivès, L. Zhang and participants at the conferences at “Financial and Real Interdependencies: Volatility, Inequalities and Economic Policies,” GREQAM, Marseille, France, November 2016, at “Theories and Methods in Macroeconomies”, Católica Lisbon School of Business & Economics, Lisbon, Portugal, March 2017, at “Research Seminar of Sichuan University”, Sichuan University, Chengdu, China, March 2017, at “Research Seminar of Barcelona University”, Barcelona University, Barcelona, Spain, May 2017, at “Asian Meeting of Econometric Society,” Hong Kong University, Hong Kong, June 2017, at “China Meeting of Econometric Society,” Wuhan University, Wuhan, China, June 2017 at “17th SAET Conference on Current Trends in Economics,” Faro, Portugal, June 2017, at “Real and Financial Interdependencies: New Approaches with Dynamic General Equilibrium Models,” Paris, France, July 2017. This research is supported by the National Natural Science Foundation of China Project Numbers 71742004 and 71673194. Of course any errors are our own.

Appendix

Appendix

1.1 Proof of Lemma 1

The Stolper-Samuelson effect (\(d \omega _{t} /dp_{t}\) and \(dr_{t}/dp_{t}\)) is obtained by analyzing the factor-price frontier. Under Assumption 1, the production functions are homogeneous of degree one, and letting \(F_{K}^{j}(K^{j}_{t},H^{j}_{t})\) and \( F_{H}^{j}(K^{j}_{t},H^{j}_{t})\) denote, respectively, the derivatives \( \partial F^{j}(K^{j}_{t},H^{j}_{t})/\partial K^{j}_{t}\) and \(\partial F^{j}(K^{j}_{t},H^{j}_{t})/\partial H^{j}_{t}\), one finds that

Using (11), it follows that (67) is now

The above expressions can be rewritten in matrix form as

Differentiating (69) gives

It follows from the Envelope theorem that \(Z_{0}\) in (70) is equal to zero. Letting \(y^{j}_{t}=\frac{Y^{j}_{t} }{H_{t}}\), \(h^{j}_{t}=\frac{H^{j}_{t}}{H_{t}}\) and \(k^{j}_{t}=\frac{K^{j}_{t}}{H^{j}_{t}}\) (with \(j\in \left\{ T, N\right\} \)) we get that \(dr_{t}/dp_{t}\) and \( d\omega _{t}/dp_{t}\) are obtained by arranging (70):

Let us now consider the Rybczynski effect. From the full-employment conditions obtained by the stocks constraint, we obtain \(K^{T}_{t}+K^{N}_{t}=K_{t}\) and \(H^{T}_{t}+H^{N}_{t}=H_{t}.\) Letting \(k_{t}=\frac{K_{t}}{H_{t}}\), and by dividing the two last expressions by \(H_{t}\), we then obtain that the factor market clearing equations write

Differentiating (72) gives

It follows from the Envelope theorem that \(Z_{1}\) in (73) is equal to zero. Finally, by arranging (73) in terms of \( dy^{T}_{t}/dk_{t}\) and \(dy^{N}_{t}/dk_{t}\) we derive

We will now show that \(sign (d \omega _{t}/dp_{t})=sign (d w_{t}/dp_{t})\). Consider the producers’ first-order conditions (11) expressed in intensive form

Equations (75) can be combined in order to obtain the following equation:

By totally differentiating Eq. (76) we get:

Consider now the definitions of the factor rental rates: \(r(p_t)=f^{T^{ \prime }}(k^{T}(p_t))\) and \(w(p_t)=f^{N}(k_{t}^{N}(p_t))-k_{t}^{N}(p_t)f^{N^{ \prime }}(k_{t}^{N}(p_t))\). Totally differentiating them yields to:

where \(k^{T^{\prime }}(p_t)\) and \(k_{t}^{N^{\prime }}(p_t)\) are given by Eq. (77). This proves that \(sign (d\omega /dp) =sign (dw/dp)\).

1.2 Proof of Proposition 1

System (36) is four dimensional in p, k, c and \(\pi \). In the following, we show that there exists a unique and positive four-t-uple \((p, k, c, \pi )\) satisfying (36).Footnote 9 Let us first consider (A-I) in (36) and define \(A(p)=w(p)-\delta ^{N}-r(p)+\delta ^{T}\) as in Eq. (37). By differentiating it and using Eq. (78), one can show that it is a monotone function of p. Namely, A(p) is decreasing (resp. increasing) if the consumable good is physical capital intensive (resp. human capital intensive). This proves the uniqueness of the solution. Assumption 4 guarantees the existence.Footnote 10

By replacing p by its particular positive value in (A-II), (A-III) and (A-IV), we will next show that there exist unique and positive \(\pi (p)\), k(p) and c(p) satisfying, respectively, (A-II), (A-III) and (A-IV) in (36).

We show now that there exists a unique and positive k(p) consistent with balanced growth. Under diversification it holds that \(k(p)\in \Big \{\min { \left\{ k^{N}(p),k^{T}(p)\right\} },\max {\left\{ k^{N}(p),k^{T}(p)\right\} } \Big \}\). k(p) is feasible if and only if \(0<g(p)+\delta ^{N}-1<y^{N}(p)\). Since \(y^{N}(p)>w(p)\), condition \(w(p)+1-\delta ^{N}>g(p)\) is sufficient to ensure the existence of a unique and positive solution k(p). By using Eq. (35), it is possible to rewrite this inequality as \(\beta < 1/g^{1-\sigma }\). It is easy to verify that this is satisfied if \(\sigma \ge 1\). Assumption 3 ensures that this inequality is satisfied for all values of \(\sigma \). Hence, there will exists a unique and positive k(p) defined by (38) consistent with balanced growth.

Finally, we prove that there exists a unique positive c(p) consistent with the BGP. Constant returns to scale in both sectors imply that \( y^{T}+py^{N}=pw(p)+r(p)k(p)\). Using this expression together with (A-III) in (36), we obtain (39), which is positive in view of the above arguments.

By replacing the steady state value p in (35), we then obtain a unique growth factor g, which is larger than one under Assumption 3. The BGP solutions satisfy the transversality conditions defined in (18). This is guaranteed by Assumption 3.

1.3 Proof of Propositions 2

In order to study the local stability of the stationary solution, we must analyze the four characteristic roots defined by (45). Let us first consider \(\lambda _{1}^{\gamma }=J_{11}^{\gamma }\) which is given by:

From Lemma 1, we know that if \(k^{T}>k^{N}\) then \(dw/dp>0\) and \(dr/dp<0\), meanwhile if \(k^{T}<k^{N}\) then \(dw/dp<0\) and \(dr/dp>0\). When \(k^{T}>k^{N}\), one has \(0<\lambda _{1}^{\gamma }<1\) . When \(k^{T}<k^{N}\), the modulus of \(\lambda _{1}^{\gamma }\) can be either larger or lower than one.

Let now consider the two characteristic roots \(\lambda _{3\pm }^{\gamma }\). In order to check for their stability, we study the trace and the determinant of the \( 2\times 2\) subsystem corresponding to the \(2\times 2\) sub-Jacobian matrix of Jacobian (43) defined by

The corresponding characteristic polynomial is given by \((\lambda ^{\gamma })^2-(1+J^{\gamma }_{33}) \lambda ^{\gamma }+(J^{\gamma }_{33}-J^{\gamma }_{23} J^{\gamma }_{32}) =0\) where \(T(J_{2}^{\gamma })=1+J_{33}^{\gamma }\) and \(D(J_{2}^{\gamma })=J_{33}^{\gamma }-J_{23}^{\gamma }J_{32}^{\gamma }\) are the trace and the determinant of the matrix \(J_{2}^{\gamma }\), respectively. In the case \(k^T > k^N\), one has that \(D>T-1\), \(D>-T-1\) and \(D>1\). It follows that both eigenvalues are unstable.Footnote 11 In the case \(k^T < k^N\), one has \(D<1\), \(D<T-1\), meanwhile the location of the point (T, D) with respect to the line \(D=-T-1\) is ambiguous. All this information allows us to claim that either one eigenvalue is stable, the other being unstable or both eigenvalues are unstable.

On the basis of these considerations we have that the occurrence of indeterminacy is completely linked to the stability of the remaining root \(\lambda _{2}^{\gamma }\). If it is stable, indeed, the system will be locally indeterminate and otherwise locally determinate.Footnote 12

To this end, let us now consider \(\lambda _{2}^{\gamma }=J_{44}^{\gamma }\) which is given by:

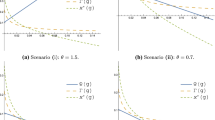

To analyze \(\lambda _{2}^{\gamma }\), we observe that this characteristic root is parametrized by \(\psi _{1} \in (0,1)\) and then we can study its behavior according to the admissible range for \(\psi _{1} \). Is it immediate to verify the following three properties

It follows that the characteristic root is a monotone decreasing function of \(\psi _{1} \) moving from 0 to \(1/(1-\sigma )\). The only remaining task is to verify if \(\lambda _{2}^{\gamma }\) crosses 1 or/and \(-\,1\). By setting \( \lambda _{2}^{\gamma }=1\), it is immediate to verify that such a result is not possible. Setting \(\lambda _{2}^{\gamma }=-\,1\) gives:

This value \(\tilde{\psi }_{1} \) must fall within the admissible values for \(\psi _{1} \in (0,1)\). It is immediate to verify that when \(\sigma <2\) we get \(\tilde{\psi }_{1}\in [0,1]\). Then, when \(\psi _{1} <\tilde{\psi }_{1} \) we get \(\mid \lambda _{2}^{\gamma }\mid <1\), meanwhile when \(\psi _{1} >\tilde{\psi }_{1} \) we get \( \mid \lambda _{2}^{\gamma }\mid >1\). Moreover, when \(\sigma \ge 2\), then \( \mid \lambda _{2}^{\gamma }\mid <1\) for all \(\psi _{1} ,\) since \(\lambda _{2}^{\gamma }\) is a monotone decreasing function of \(\psi _{1} \) going from 0 to \( 1/(1-\sigma )\).

1.4 Proof of Proposition 3

We first show that \(i^{*}\) represents a steady state for our dynamic system. As a matter of fact, for a given \(i^{*}>0\) chosen arbitrarily by the Central Bank, equation \((B-I)\) in system (51) determines the stationary value of p which is obtained simply by solving the following equation:Footnote 13

It is clear that Assumption 6 ensures the existence of a unique stationary p associated to a particular \(i^{*}\) . Once this value has been found, equation \((B-IV)\) in system (51) allows to find the unique \(\pi ^{*}\) consistent with the Fisher equation. Finally, equations \((B-II)\) and \((B-III)\) of system (51) determine the unique stationary values of k and c as a function of \(i^{*}\) and of the corresponding p and \(\pi ^{*}\). However, by a direct inspection of the equations included in (51), it is possible to prove that there may exist other steady state values of the nominal interest rate and therefore for all the other variables. To see that, let us observe that at the steady state the two following equations must be satisfied:

The two equations in (82) define a relation linking the steady state value of the nominal interest rate i to the stationary relative price p. In fact, by solving them for i, one obtains the relationship linking the stationary nominal interest rate with the gross real interest rate and the policy targets:

By replacing the above expression of i into equation \((B-I)\) of (51), one obtains the steady state values for the relative price p are the solutions of the following equation:

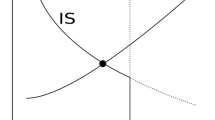

Notice that, in view of Assumptions 5 and 6, \(i^{*}\) and the corresponding p and \(\pi ^{*} \) represent a particular solution. To check for other solutions, let us first assume that \(\varepsilon _{i}<1\). It follows that, if \(r^{\prime }(p)>0 \) and thus \(w^{\prime }(p)<0\), then the LHS of Eq. (84) is non-monotone in p while the RHS is increasing in p. In the opposite case, when \(r^{\prime }(p)<0\) and \(w^{\prime }(p)>0\), the LHS of Eq. (84) is non-monotone and the RHS is decreasing in p. Hence, in both cases, there is the possibility of multiple steady states, even arbitrarily close each other. The same result holds when \(\varepsilon _{i}>1\). In fact, in such a case the LHS of Eq. (84) is a non-monotone function of p, while the RHS can be increasing or decreasing in p depending on which sector is more physical capital intensive. As a conclusion, in any case, they may emerge multiple steady state values of the relative price p whatever the relative capital intensity is and whatever the degree of aggressiveness of the Taylor rule is.

The existence of a liquidity trap equilibrium can be also easily demonstrated. For \(i=0\) we know, in view of equation \((B-I)\) in (51), that \(1-\delta ^{N}+w(p)=1-\delta ^{T}+r(p)\). Let \( \bar{p}\) the solution of this equation. Equation \((B-IV)\) in (51) obtained for \(i=0\) determines the corresponding inflation factor \(\pi =1-\delta ^{N}+w(\bar{p})\). By definition, at the liquidity trap equilibrium it must be \(\left( 1+i^{*}\right) \left( \pi /\pi ^{*}\right) ^{-\varepsilon _{i}}<1\). Since at the Taylor equilibrium the relative price, the interest rate and the deflation factor are, respectively, \(p,i^{*},\pi ^{*}=\left( 1+i^{*}\right) ^{-1}\left( 1-\delta ^{N}+w(p)\right) \), this means that a liquidity trap equilibrium emerges if and only if \(\left( 1+i^{*}\right) ^{1-\varepsilon _{i}}\left\{ \left( 1-\delta ^{N}+w(\bar{p})\right) /\left[ \left( 1-\delta ^{N}+w(p)\right) \right] \right\} ^{-\varepsilon _{i}}<1\) where one has \(p\ne \bar{p}\).

1.5 Proof of Propositions 4 and 5

From the arguments included in “Appendix 8.3”, we know that \(k^{T}>k^{N}\) implies that \(\mid \lambda _1^T\mid \) is smaller than one and the modulus of the eigenvalues \(\lambda _{2\pm }^{T}\) is greater than one, meanwhile for \(k^{T}<k^{N}\), if \(\mid \lambda _1^T \mid >1\), then the other eigenvalues \(\lambda _{2\pm }^{T}\) are either both unstable or one stable, the other being unstable. On the other hand, if \(\mid \lambda _1^T \mid <1\), one has necessarily that the two other eigenvalues are both unstable. Eventually, the stability of the liquidity trap equilibrium is governed by the same eigenvalues and does not depend upon i.

1.6 Proof of Proposition 6

The second characteristic polynomial, given in (55), is the same as that found in the case with \(\psi _{2}=0\) and we already know that the two roots can be either both unstable or one stable, the other being unstable, according if, respectively, \(k^{T}>k^{N}\) or \(k^{T}<k^{N}\). In the first case, since the number of non-predetermined variables is two and there can exist at most two stable roots (those possibly characterizing the second polynomial \( \left( \lambda ^{T }\right) ^{2}-\lambda ^{T}(1+J_{33}^{T})+J_{33}^{T}-J_{23}^{T}J_{32}^{T}=0\)), then it follows that the steady state is bound to be locally determinate, whatever the degree of aggressiveness of the monetary policy is. Conversely, the case \(k^{T}<k^{N}\) opens the door for the occurrence of local indeterminacy under the condition that both eigenvalues of the first polynomial, \(\lambda ^{2}-J_{11}^{T}\lambda -J_{14}^{T}=0\), are stable and provided, of course, that the second polynomial possess a stable root.

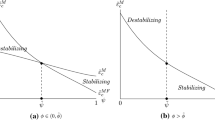

Following analogous lines as in Grandmont et al. (1998), this is true if and only if, in the \(\left( T,D\right) \) plane, the coordinates of the stationary solution lie below the line \(D=1\), on the left of the line \(D=T-1\) and on the right of the line \( D=-T-1\), that is in the interior of the triangle \({\mathscr {ABC}}\) depicted in Figures 8. The expressions of D and T are, respectively, \(D=-J_{14}^{T}\) and \(T=J_{11}^{T}\), defined in (56) and (57).

In order to carry out such an analysis it is useful to define \(\phi \equiv \frac{\varepsilon _{i}}{1-\varepsilon _{i}}\) that we let vary from 0 to \(+\,\infty \) corresponding to passive Taylor rules (namely \(\varepsilon _{i} \in (0,1)\)), and from \(-\,\infty \) and \(-\,1\), in order to describe active rules (\(\varepsilon _{i} \in (1,+\infty )\)).

First of all, notice that the trace \(J_{11}^T\) and the determinant \(-\,J_{14}^T\) are first-order polynomials with respect to \(\phi \), sharing the same denominator. This implies that when \(\phi \) is progressively increased, the trace and the determinant lie on a straight line \(\varDelta \), whose slope is given by \((\partial D/\partial \phi ) / (\partial T/\partial \phi )\), which, under Assumption 8, is positive. Indeed, one can easily verify that \(\partial D/\partial \phi < 0\) and, under Assumption 8, \( \partial T/\partial \phi \) is negative too.

Our strategy consists now in analyzing how the trace and the determinant do vary as \(\phi \) is made to increase. In the light of the previous considerations, we know that the trace and the determinant decrease along the line \(\varDelta \). A very useful piece of information consists in locating in the plane (T, D) the critical values of the trace and the determinant corresponding to \(\phi = 0\), \(\phi = \pm \infty \) and \(\phi = -1\). Straightforward computations show that, under Assumption 7, \(D(+\infty )=D(-\infty )>1\) and \(T(+\infty )=T(-\infty ) < D(+\infty )+1\), that is it lies on the left of the line \(D=T-1\), as it is depicted in Fig. 8. On the other hand, again under Assumption 7, for \(\phi = 0\), it is \(D(0)=0\) and \(T(0)<0\). Eventually, for \(\phi =-1\), the determinant is strictly positive, either larger than one for \(\psi _2 > \tilde{\psi }_2\), or lower than one for \(\psi _2 < \tilde{\psi }_2\), where \(\tilde{\psi }_2\) is such that \(D(-1)=1\). This follows immediately from the fact that D is decreasing in \(\psi _2\). At the same time, the sign of the trace for \(\phi = -1\) is ambiguous. The remaining piece of information needed to characterize the local stability of the steady state consists in determining how T(0) does vary as soon as the depreciation rate of physical capital, \(\delta ^T\), is relaxed from 0 to 1. Straightforward although tedious computations show that T(0) increases with \(\delta ^T\), although it remains always negative.

All this information, as it is possible to verify by looking at Fig. 8, enables us to prove that when \(\psi _2 < \tilde{\psi }_2\), and in view of the fact that the line \(\varDelta \) is rightward shifting, there exist \(\delta _1^T\) and \(\delta _2^T\) such that for \(\delta _1^T\) the line \(\varDelta \) passes through the point \(\mathscr {B}\) of the triangle and for \(\delta _2^T>\delta _1^T\), it goes through the point whose coordinates are \((-1,0)\). The immediate consequence is that for \(\delta ^T<\delta _1^T\), the line \(\varDelta \) passes on the left of point \(\mathscr {B}\), and thus, at it is shown in Fig. 8, the steady state is locally determinate. Conversely, for \(\delta _1^T<\delta ^T<\delta _2^T\), the steady state, for active Taylor rules, becomes stable for \(\phi >\phi ^H\) up to \(\phi =\phi ^F\), which can be infinite. We immediately verify that at \(\phi ^H\) the system undergoes a Hopf bifurcation and at \(\phi ^F\) a flip bifurcation. Eventually, when \(\delta ^T\) is further increased above \(\delta _2^T\), the local dynamics is fully described by Fig. 8. Under active Taylor rules, the steady state is locally determinate for \(\phi \in (-\infty , \phi ^H)\) and becomes locally indeterminate for \(\phi \in (\phi ^H,-1)\); conversely, when the monetary rules are passive, the steady state is first locally indeterminate for \(\phi \in (0, \phi ^F)\) and it is determinate otherwise. It is immediately verifiable at \(\phi ^H\) occurs a Hopf bifurcation and at \(\phi ^F\) a flip bifurcation.

We now briefly discuss the local stability features that may arise when Assumption 8 is violated. In such a case it is easy to prove that the slope of the line \(\varDelta \) is negative. Let first observe that such an occurrence is possible only for depreciation rates of physical capital low enough. As a matter of fact, in correspondence to such low values, indeterminacy may arise according to several different ways. As it is depicted in Fig. 8, either it can arise through a Hopf bifurcation (when the Taylor rule is active) and disappear through a transcritical bifurcation (when the Taylor rule is passive), or it can arise through a flip bifurcation (both in the cases of active and passive monetary rules), and disappear through a transcritical bifurcation in the case of passive rules (Fig. 8).

The last case to be investigated corresponds to \(\psi _{2}>\tilde{\psi }_2\). Under such a configuration \(D(-1)>1\) and thus local indeterminacy is ruled out for active Taylor rules. On the other hand, for passive Taylor rules, under Assumptions 7 and 8, there still exist a \(\delta _1^{T'}\) and \(\delta _2^{T'}\) such that the same partition of the case \(\psi _{2}<\tilde{\psi }_2\) corresponding to passive Taylor rule still hold.

1.7 Proof of Proposition 7

As we show in the “Appendix 8.5”, the eigenvalues of the Jacobian matrix defined by (62) are not equal to one. This implies that the Jacobian matrix is invertible. Notice that it is not possible to have a closed-form expression of the inverse map M. However, it is possible to show that the inverse map M is solution of the following system:

Rights and permissions

About this article

Cite this article

Le Riche, A., Magris, F. & Onori, D. Monetary rules in a two-sector endogenous growth model. Econ Theory 69, 1049–1100 (2020). https://doi.org/10.1007/s00199-019-01188-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-019-01188-6