Abstract

This paper studies the firm size distribution arising from an endogenous growth model of quality ladders with expanding variety. The probability distribution function of a given cohort is a Poisson distribution that converges asymptotically to a normal of log size. However, due to firm entry propelled by horizontal R&D, the total distribution—i.e., when the entire population of firms is considered—is a mixture of overlapping Poisson distributions which is systematically right skewed and exhibits a fatter upper tail than the normal distribution of log size. Our theoretical results qualitatively match the empirical evidence found both for the cohort and the total distribution, and which has been presented as a challenge for theory to explain. Moreover, by obtaining a total distribution with a gradually increasing average over a long time span, the model is able to address complementary empirical evidence that points to a total distribution subtly evolving over time.

Similar content being viewed by others

Notes

Along a somewhat different line, the endogenous growth R&D models by Aghion et al. (2001) and Laincz (2009) allow for the derivation of a non-degenerate cross-section distribution of market structures, i.e., a distribution of firm sizes as measured by market shares within each industry, taken across all industries.

As their own explanation, Cabral and Mata (2003) consider the “small-firms selection” argument based on a theoretical model where financing constraints are especially relevant for small young firms. However, according to the recent empirical results by Angelini and Generale (2008), financial constraints are not the main determinant of FSD evolution, especially in financially developed economies. In a very recent paper, Gallegati and Palestrini (2010) build a statistical model without entry that explicitly addresses Cabral and Mata’s findings with respect to the FSD of a cohort of firms. Gallegati and Palestrini give an alternative explanation based on a “sample selection bias” argument, according to which a cohort of surviving firms may have a positive average rate of growth, which breaks the assumptions needed to “escape” the lognormal result (in particular, the assumptions needed in order to have an asymptotic Pareto FSD).

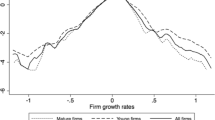

Although Cabral and Mata (2003) and Cabral (2007) analyse the evidence on FSD with size measured as employment per firm, a number of recent papers address the sensitivity of the FSD to different measures of size (employment, sales, capital and value added). Empirical results for sales per firm are obtained by Axtell (2001) and Gaffeo et al. (2003) (with respect to the tails weight), Bottazzi et al. (2007) (skewness) and Huynh et al. (2010) (evolution of cohort FSD). The evidence is qualitatively similar to that obtained when employment is the measure of firm size.

In fact, differently from the standard expanding-variety literature, we allow for entry as well as exit also along the horizontal direction. However, the structure of the model and, in particular, the assumption of an R&D lab-equipment specification, imply that positive (net) entry prevails along the BGP.

See de Wit (2005) for an extensive literature review of statistical models of firm dynamics.

In contrast, Thompson (2001) predicts that firm size, measured as sales per firm, is stationary along the BGP.

The focus on normalised firm size—i.e., firm size divided by its average—in order to analyse the shape of the steady-state FSD when size is non-stationary has been conducted by, e.g., Rossi-Hansberg and Wright (2007).

As we will see below, the uncertainty in R&D at the industry level creates jumpiness in microeconomic outcomes. However, as the probabilities of successful R&D across industries are independent and there is a continuum of industries, this jumpiness is not transmitted to macroeconomic variables.

In equilibrium, only the top quality of each ω is produced and used; thus, X(j, ω, t) = X(ω, t). Henceforth, we only use all arguments (j, ω, t) if they are useful for expositional convenience.

We assume that innovations are drastic, i.e., 1/α < λ, such that existing monopolies do not need to limit price and can instead charge the unconstrained monopoly price.

We assume that entrants are risk-neutral and, thus, only care about the expected value of the firm.

As noted by Poschke (2009), one possible explanation is that potential entrants cannot copy incumbents perfectly due to tacitness of knowledge embodied in these firms. However, the entry mechanism can be interpreted in other ways besides imitation. For instance, one can consider incumbents’ productivity as an indicator of knowledge in the economy. If entrants can draw on that, either as a spillover or because it is embodied in the production facilities they acquire upon entry, then they benefit from incumbents’ productivity.

If we consider the capital market equilibrium represented in the space (N, r + I), a graph can be drawn with, e.g., the number of varieties, N, on the horizontal axis (conditional on Q) and the effective rate of return, r + I, on the vertical axis. Then, Eq. 16 defines a horizontal line, while Eq. 21 is always downward-sloping in N (for a given Q), hence crossing Eq. 16 from above whatever the value of the positive constants ζ, ϕ, m and L.

Also, considering a(t) = η(t) · N(t) and Eq. 22, we re-write the transversality condition as

$$ \underset{t\rightarrow\infty}{\textrm{lim}}e^{-\rho t}C(t)^{-\theta}\zeta\cdot L\cdot Q(t)=\underset{t\rightarrow\infty}{\textrm{lim}}e^{-\rho t}\left(\frac{C(t)}{Q(t)}\right)^{-\theta}\zeta\cdot L\cdot\left(\hat{Q}e^{gt}\right)^{1-\theta}=0$$(28)where \(Q=\hat{Q}e^{gt}\) and \(\hat{Q}\) denotes detrended Q. Thus, the transversality condition implies ρ > (1 − θ)g; i.e., r > g, since \(g=\left(r-\rho\right)/\theta\). This condition also guarantees that attainable utility is bounded, i.e., the integral (Eq. 1) converges to infinity.

Bearing in mind that simultaneous vertical and horizontal R&D is a stable equilibrium in the capital market (see Section 2.3), we assume throughout the simulation exercise that the number of firms, N, at time t satisfies the inter-R&D arbitrage condition (22) given the level of technological knowledge, Q, also at t, for t ≥ 0. That is, we assume that Eq. 22 holds for the first cohort, when N = N 0 (and Q = Q 0); subsequently, as new cohorts enter the market, the assumption that N grows in tandem with Q at the constant rate g N = g Q /(1 + β) (see Eqs. 24 and 26) ensures that condition (22) continues to hold along the BGP. Thus, whatever the number of cohorts considered in each step of the simulation exercise, the corresponding N is implied by Q such that a BGP equilibrium with simultaneous vertical and horizontal R&D always holds as determined by Eq. 22.

Observe that, for all t, \(1+m(\bar{q}_{t}-1)\approx m\bar{q}_{t}\) for \(\bar{q}_{t}\) large enough, where m ∈ (0, 1) denotes the degree of imperfect imitation by horizontal entrants (see Section 2.3). However, since \(1+m(\bar{q}_{t}-1)>1\) provided \(\bar{q}_{t}\geq1\), we can compute \(\ln\left(1+m(\bar{q}_{t}-1)\right)\) as a positive number for any arbitrarily small (non-negative) value of m and \(\bar{q}_{t}\). This is not the case for \(\ln\left(m\bar{q}_{t}\right)\), because \(m\bar{q}_{t}\) may take values below unity.

The data concerns 23 European countries in the period 1995–2005 and is available from the Eurostat on-line database (link at http://epp.eurostat.ec.europa.eu).

We consider the Fisher skewness coefficient of a distribution F, which is given by \(\mu_{3}/\mu_{2}^{3},\) where μ s denotes the s-th central moment of F. As regards the tail weight, we consider modified versions of the tail-weight coefficient defined in Hoaglin et al. (1983). Thus, the right-tail weight is given by \(\left(\frac{F^{-1}(0.99)-F^{-1}(0.5)}{F^{-1}(0.75)-F^{-1}(0.5)}\right)\left(\frac{\Phi^{-1}(0.99)-\Phi^{-1}(0.5)}{\Phi^{-1}(0.75)-\Phi^{-1}(0.5)}\right)^{-1}\) and the left-tail weight is given by \(\left(\frac{F^{-1}(0.5)-F^{-1}(0.01)}{F^{-1}(0.5)-F^{-1}(0.25)}\right)\left(\frac{\Phi^{-1}(0.5)-\Phi^{-1}(0.01)}{\Phi^{-1}(0.5)-\Phi^{-1}(0.25)}\right)^{-1},\) where F − 1 and Φ − 1 denote the inverse cdf of F and of the standard Normal, Φ, respectively.

A similar result follows if, instead of considering that a given cohort of entrants introduces new varieties with the quality level concentrated at a given point of mass (given by m times the average quality level of extant varieties), we assume that the quality level of those new varieties follows a non-degenerate distribution, provided this distribution has a smaller variance than the distribution of the quality level of the extant varieties.

At a given instant of time, due to the co-existence of different cohorts, not all firms have had the same time to grow, while the population of firms itself continuously grows. Such behaviour of firm entry and growth resembles the well-known Yule process, whose limiting distribution exhibits a heavy upper tail and was used by Simon (1955) as a model for various skewed empirical distributions, including the city size distribution (see de Wit 2005).

In the empirical literature, the goodness of fit of the data to a power law (strict Pareto) \(F(x)=1-\left(a/x\right)^{p},x\geq a,p>0\), is usually determined by means of the OLS regression \(\textrm{ln}(1-F(x))=b-p\,\textrm{ln}x\), \(b=p\,\textrm{ln}a\), where x stands for firm size and F is the corresponding empirical cdf. In our case, we fit the line \(\textrm{ln}(1-F(x))=b-p\,\textrm{ln}x\), where x ≡ q, to the log-log plot of the theoretical tail of the cdf generated by Eq. 31 with support changed from z to q.

We study the effect of subsidies by considering that the government budget is always balanced and that changes in subsidies are exactly matched by changes of opposite sign in nondistortionary taxes (e.g., lump-sum taxes on consumption).

Given that q ≡ e z, the change of support from z to q brings about an increase in the variance that exceeds the increase in the average of the FSD (indeed, as shown in Table 3, γ z < 1 while γ q > 1). Since \(V(z)=E(z^{2})-\left(E(z)\right)^{2}\) and \(V(q)=E(e^{2z})-\left(E(e^{z})\right)^{2}\), this behaviour must be due to the fact that the effect of the change of support on the second moment of the distribution dominates the effect on (the quadratic of) the first moment. If this dominance is strong enough, then a shift in a given parameter with respect to the baseline that affects the coefficient of variation may imply that \(\gamma_{z}/\gamma_{z}^{base}<1\) and \(\gamma_{q}/\gamma_{q}^{base}>1\), where γ base denotes the coefficient of variation corresponding to the baseline scenario. This is the case as regards the change in ζ analysed in Table 3.

Using Rivera-Batiz and Romer (1991)’s terminology, the assumption that the homogeneous final good is the R&D input means that one adopts the “lab-equipment” version of R&D, instead of the “knowledge-driven” specification, in which labour is ultimately the only input.

See Thompson (2001) on the difficulty of introducing horizontal (net) exit in this class of endogenous growth models.

The numerical computation of the lower tail-weight coefficient is not possible if one cannot compute the lower quantiles, in particular, the quantiles of probability 0.01 and of probability 0.25.

The only practical consequence of having a very low level for economic growth is that a quite larger number of periods/cohorts, T, is required in order to obtain a total FSD with stabilised variance, skewness and tails weight.

References

Aghion P, Harris C, Howitt P, Vickers J (2001) Competition, imitation and growth with step-by-step innovation. Rev Econ Stud 68:467–492

Angelini P, Generale A (2008) On the evolution of firm size distributions. Am Econ Rev 98(1):426–438

Audretsch DB (1995) Innovation and industry evolution. MIT Press, Cambridge

Axtell RL (2001) Zipf distribution of U.S. firm sizes. Science 293:1818–1820

Barro R, Sala-i-Martin X (2004) Economic growth, 2nd edn. MIT Press, Cambridge

Bottazzi G, Cefis E, Dosi G, Secchi A (2007) Invariances and diversities in the patterns of industrial evolution: some evidence from italian manufacturing industries. Small Bus Econ 29:137–159

Cabral L (2007) Small firms in portugal: a selective survey of stylized facts, economic analysis, and policy implications. Port Econ J 6:65–88

Cabral L, Mata J (2003) On the evolution of the firm size distribution: facts and theory. Am Econ Rev 93(4):1075–1090

de Wit G (2005) Firm size distributions. An overview of steady-state distributions resulting from firm dynamics models. Int J Ind Organ 23:423–450

Dunne T, Roberts M, Samuelson M (1988) Patterns of entry and exit in U.S. manufacturing. Rand J Econ 19:495–515

Etro F (2008) Growth leaders. J Macroecon 30:1148–1172

Evans GW, Honkapohja SM, Romer P (1998) Growth cycles. Am Econ Rev 88:495–515

Freeman C, Soete L (1997) The economics of industrial innovation. MIT Press, Cambridge

Gabler A, Licandro O (2008) Endogenous growth through selection and imitation. Mimeo

Gaffeo E, Gallegati M, Palestrini A (2003) On the size distribution of firms: additional evidence from the G7 countries. Physica A 324:117–123

Gallegati M, Palestrini A (2010) The complex behavior of firms’ size dynamics. J Econ Behav Organ 75:69–76

Geroski P (1995) What do we know about entry? Int J Ind Organ 13:421–440

Gibrat R (1931) Les Inegalités Économiques; Applications: aux Inégalités des Richesses, à la Concentration des Entreprises, aux Populations des Villes, aux Statistiques des Familles, etc., d’une Loi Nouvelle, la Loi de L’Effet Proportionnel. Paris: Librairie du Recueil Sirey

Gil PM, Brito P, Afonso O (2010) Growth and firm dynamics with horizontal and vertical R&D. FEP Work Pap 356:1–29

Growiec J, Pammolli F, Riccaboni M, Stanley HE (2008) On the size distribution of business firms. Econ Lett 98:207–212

Hoaglin DM, Mosteller F, Tukey JW (1983) Understanding robust and exploratory data analysis. Wiley, New York

Howitt P (1999) Steady endogenous growth with population and R&D inputs growing. J Polit Econ 107(4):715–730

Huynh KP, Jacho-Chavez DT, Petrunia RJ, Voia M (2010) Evolution of firm distributions through the lens of functional principal components analysis. Mimeo

Jones CI, Williams JC (2000) Too much of a good thing? the economics of investment in R&D. J Econ Growth 5:65–85

Jovanovic B (1993) The diversification of production. Brookings Pap Econ Act Microecon 1:197–247

Klepper S (1996) Entry, exit, growth, and innovation over the product life cycle. Am Econ Rev 86(3):562–583

Klepper S, Thompson P (2006) Submarkets and the evolution of market structure. Rand J Econ 37(4):861–886

Klette J, Kortum S (2004) Innovating firms and aggregate innovation. J Polit Econ 112(5):986–1018

Laincz CA (2009) R&D subsidies in a model of growth with dynamic market structure. J Evol Econ 19:643–673

Luttmer EG (2007) Selection, growth, and the size distribution of firms. Q J Econ 122(3):1103–1144

Mansfield E (1986) The R&D tax credit and other technology policy issues. Am Econ Rev Pap Proc 76:190–194

McCloughan P (1995) Simulation of concentration development from modified gibrat growth-entry-exit processes. J Ind Econ XLIII(4):405–433

Pagano P, Schivardi F (2003) Firm size distribution and growth. Scand J Econ 105(2):255–274

Peretto P (1998) Technological change and population growth. J Econ Growth 3:283–311

Poschke M (2009) Employment protection, firm selection, and growth. J Monet Econ 56:1074–1085

Reed W (2002) On the rank-size distribution for human settlements. J Reg Sci 42(1):1–17

Reed W (2003) The pareto law of incomes: an explanation and an extension. Physica A 319:469–486

Rivera-Batiz L, Romer P (1991) Economic integration and endogenous growth. Q J Econ 106(2):531–555

Rossi-Hansberg E, Wright MLJ (2007) Establishment size dynamics in the aggregate economy. Am Econ Rev 97(5):1639–1666

Segerstrom P (2000) The Long-run growth effects of R&D subsidies. J Econ Growth 5:277–305

Segerstrom P (2007) Intel Economics. Int Econ Rev 48(1):247–280

Sherer F, Ross D (1990) Industrial market structure and economic performance. Houghton Mifflin, Boston

Simon HA (1955) On a class of skew distribution functions. Biometrika 42(3/4):425–440

Strulik H (2007) Too much of a good thing? The quantitative economics of R&D-driven growth revisited. Scand J Econ 109(2):369–386

Sutton J (1997) Gibrat’s legacy. J Econ Lit 35:40–59

Thompson P (2001) The microeconomics of an R&D-based model of endogenous growth. J Econ Growth 6:263–283

Acknowledgement

We would like to thank an anonymous referee for his comments and suggestions, which we found extremely helpful and constructive.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

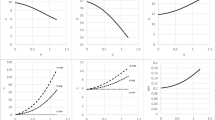

Since the properties of the FSD derived in Section 4.2.1 cannot be studied by analytical methods, we proceeded with our study by computing approximate numerical results. Then, a sensitivity analysis must be conducted in order to access the robustness of our results.

The sensitivity analysis consists of: (i) considering a sensible interval of variation for each parameter—defined in the light of both theoretical and empirical considerations—; and (ii) re-running the simulation exercise by letting a given parameter take the extreme values of that interval, while the other parameters are set to their baseline values. Recall that we have calibrated the model with the following baseline parameter values: β = 2.4, ϕ = 1, ζ = 0.7, λ = 2.5, ρ = 0.02, θ = 1.5, α = 0.4, and m = 0.4.

Table 4 of this appendix presents the extreme values for each parameter of interest considered in the sensitivity analysis. No sensitivity analysis was carried out for ϕ and L, since they have no impact on the FSD, while a set of practical criteria has commanded the selection of the extreme values for the remaining parameters.

Thus, given the lack of well-established empirical guidance, we have chosen: the lower value for β as the smallest possible value that allowed for the numerical computation of the lower tail-weight coefficient;Footnote 30 the upper values for β and λ by observing that they defined a threshold above which an increase of those parameters had a negligible impact on the endogenous variables (g, g N and I); the lower value for λ and the upper values for ρ and ζ such that the implied economic growth rate was not too low (i.e., roughly below one percent);Footnote 31 the lower value for ζ such that the implied economic growth rate was not too large (roughly above 10%). On the other hand, the extreme values for α, θ and m were chosen broadly in line with the range of values cited by the empirical literature (regarding the latter two, the interval was augmented by a tolerance error term, given the uncertainty surrounding the empirical estimates) (see Barro and Sala-i-Martin 2004, and also Geroski 1995 and McCloughan 1995).

Finally, we performed the sensitivity analysis for t = 2,000 since we wanted to be sure that even under a wide variation of a given parameter, we would still get a stabilised FSD regarding the variance, the skewness and the tail weight.

Table 5 of this appendix summarises the results. Thus, after testing for a wide range of parameter values, we conclude that the skewness and the upper-tail weight coefficients presented in the text, whose values are systematically above zero and one, respectively, are robust to changes in all parameters. That is, we always obtain a FSD that is right skewed and has a fatter upper tail than the normal of log size. In contrast, we can see that the weight of the lower tail is sensitive to changes in β , m , λ and α, such that lower-tail weight coefficient oscillates between values below and above unity.

Rights and permissions

About this article

Cite this article

Gil, P.M., Figueiredo, F. Firm size distribution under horizontal and vertical innovation. J Evol Econ 23, 129–161 (2013). https://doi.org/10.1007/s00191-011-0246-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-011-0246-0