Abstract

We propose a modeling approach based on a set of small-scale factor models linked together in a cluster with linkages derived from Granger causality tests. GDP forecasts are produced using a disaggregated approach across production, expenditure and income accounts. The method combines the advantages of large structural macroeconomic models and small factor models, making our cluster of dynamic factor models (CDFM) useful for large-scale model-consistent forecasting. The CDFM has a simple structure, and its forecasts outperform those of a variety of competing models and professional forecasters. In addition, the CDFM allows forecasters to use their own judgment to produce conditional forecasts.

Similar content being viewed by others

Data availability

The data used in this study are available from the authors upon request.

Notes

While Cobb (2020) does account for the dependency among the SNA variables, this is confined to the components of the production account only.

The structure of the production account depicted in Table 1 has a very basic form. However, it could easily be extended to take into account country specific production characteristics. In case of a typical raw-material goods producing country, one could decompose the value added in manufacturing into further sub-categories; the same applies to the value added in the service sector. The flexible structure of the CDFM allows for extensions along various dimensions in this context.

We checked our final results for these omitted linkages, and we find that neither of these omissions has the potential to improve the forecast accuracy of the CDFM.

The above procedure enables several options. For example, the RMSE considered is based on the average of the RMSEs of the first three quarters. A horizon different from this would naturally lead to a different set of selected variables and a different temporal displacement. Moreover, the set of variables from which the algorithm selects includes only timely available (monthly) indicators. Adding indicators with a larger release lag would also result in a different set of selected variables. With this in mind, we evaluated the sensitivity of each behavioral model with respect to the variables selected by the algorithm. It was found that while the behavioral models’ forecast accuracy (RMSE) changes slightly, the results of the Diebold–Mariano test remained unchanged.

As described in Boivin and Ng (2006) and Banbura and Rünstler (2011), the inclusion of additional variables, despite possible high correlation with the target variable, does not necessarily improve the forecast. When an additional variable is correlated with a subset of variables already in the model, the factors have a bias toward this subset of variables. As a consequence, the resulting factors explain a large fraction of the variation in each variable of this subgroup, but less of the variance in the target variable, rendering worse the overall model fit for the target variable and hence also its forecast.

The error term serves one further, more subtle, aspect: as highlighted in Proietti et al. (2021). The weighted sum of the yearly growth rates does not add up to GDP growth and can only be seen as an approximation to the contribution of the ith component to aggregate growth.

This refers specifically to changes in inventory investment and acquisitions less disposals of valuables.

Average revisions are computed as the standard deviation across each quarter; this is possible since for each quarter, various estimates are available (flash estimate, first, second, ..., official figures; in our case for some quarters we have up to fifteen distinct figures for the quarterly growth rates). The blue band shows the (smoothed) average revisions and the change thereof over time. The extent of the data revisions depends, among other things, on the level of the growth rates. Although revisions are on average zero, their standard deviation is large compared to the mean of the GDP growth rate.

We compute the GDP growth contribution of inventory investment and the statistical discrepancy using the final data vintage. We then calculate the standard deviation of the growth contributions. The value thereof is depicted by the blue dashed line in Fig. 2. The standard deviation is shown in positive and negative territory in order to establish an interval.

In contrast to Camacho and Pérez-Quirós (2011) and others, we ignore data revisions of the variables of the SNA. This arises primarily because we do not have historical data records for the majority of the variables in the SNA; and for the remaining variables, the time span of historical data records is too short to plausibly conduct an evaluation of forecast accuracy taking into account data revisions.

Motivated by the findings in Dias et al. (2015), we analyzed the forecast accuracy of the CDFM for the periods before and after the Great Recession. We find only small differences in the quantitative accuracy measures between the two periods. However, due to the short length of the respective time series for the forecast evaluation, these results should be interpreted with caution. Still, we also interpret this result in favor of our assumption for the time invariant variances in Eqs. (4) and (6).

Rather than reporting the whole distribution of the responses for each variable as in Bańbura et al. (2015), we only show the point estimates. This is due to the fact that we do not use a Bayesian approach in the CDFM for inference. Putting the CDFM into a Bayesian framework not only allows for an easy computation of error bands for the difference of the conditional and unconditional forecasts, but also to take the forecast uncertainty of downstream models into account for the forecast uncertainty of GDP.

This is mainly due to the fact that the Austrian economy has a higher foreign trade intensity with EU countries, accounting for around 75% of Austrian exports, than with the US.

This suggests that the structure of the CDFM can be considered as a restricted large-scale factor model, in which the restrictions pertain to zero-restrictions on specific factor loadings.

We use the term goods for both goods and services.

References

Aastveit K, Trovik T (2012) Nowcasting Norwegian GDP: the role of asset prices in a small open economy. Empir Econ 42(1):95–119

Angelini E, Camba-Mendez G, Giannone D, Reichlin L, Rünstler G (2011) Short-term forecasts of euro area GDP growth. Econom J 14(1):25–44

Arnoštová K, Havrlant D, Luboš R, Peter T (2011) Short-term forecasting of Czech quarterly GDP using monthly indicators. Czech J Econ Finance 61(6):566–583

Bai J, Ng S (2002) Determining the number of factors in approximate factor models. Econometrica 70(1):191–221

Bai J, Wang P (2016) Econometric analysis of large factor models. Annu Rev Econ 8(1):53–80

Bai J, Ghysels E, Wright JH (2013) State space models and midas regressions. Econom Rev 32(7):779–813

Banbura M, Rünstler G (2011) A look into the factor model black box: publication lags and the role of hard and soft data in forecasting GDP. Int J Forecast 27(2):333–346

Bańbura M, Giannone D, Lenza M (2015) Conditional forecasts and scenario analysis with vector autoregressions for large cross-sections. Int J Forecast 31(3):739–756

Barhoumi K, Rünstler G, Cristadoro R, Den Reijer A, Jakaitiene A, Jelonek P, Rua A, Ruth K, Benk S, Van Nieuwenhuyze C (2008) ‘Short-term forecasting of GDP using large monthly datasets: a pseudo real-time forecast evaluation exercise.’ Working papers 215, Banque de France, July

Bell Robert M, McCaffrey D (2002) Bias reduction in standard errors for linear regression with multi-stage samples. Surv Methodol 28:169–181

Belloni A, Chernozhukov V, Kato K (2014) Uniform post-selection inference for least absolute deviation regression and other Z-estimation problems. Biometrika 102(1):77–94

Boivin J, Ng S (2006) Are more data always better for factor analysis? J Econom 132(1):169–194

Bårdsen G, den Reijer A, Jonasson P, Nymoen R (2012) MOSES: model for studying the economy of Sweden. Econ Model 29(6):2566–2582

Brayton F, Levin A, Lyon R, Williams JC (1997) The evolution of macro models at the Federal Reserve Board. Carn-Roch Conf Ser Public Policy 47:43–81

Camacho M, Pérez-Quirós G (2010) Introducing the euro-sting: short-term indicator of euro area growth. J Appl Econom 25(4):663–694

Camacho M, Pérez-Quirós G (2011) Spain-sting: Spain short-term indicator of growth. Manchester School 79(s1):594–616

Camacho M, García-Serrador A (2014) The Euro-Sting revisited: the usefulness of financial indicators to obtain Euro Area GDP forecasts. J Forecast 33(3):186–197

Clark T (2004) Can out-of-sample forecast comparisons help prevent overfitting? J Forecast 23(2):115–139

Clements M, Hendry D (1998) Forecasting economic time series. Cambridge University Press, Cambridge

Cobb Marcus PA (2020) Aggregate density forecasting from disaggregate components using Bayesian VARs. Empir Econ 58(1):287–312

Coroneo L, Iacone F (2020) Comparing predictive accuracy in small samples using fixed-smoothing asymptotics. J Appl Econom 35(4):391–409

Dias F, Pinheiro M, Rua A (2015) Forecasting Portuguese GDP with factor models: pre- and post-crisis evidence. Econ Model 44:266–272

Diebold Francis X (1998) The past, present, and future of macroeconomic forecasting. J Econ Perspect 12(2):175–192

Diebold Francis X, Mariano Roberto S (1995) Comparing predictive accuracy. J Bus Econ Stat 13(3):253–263

Doz C, Giannone D, Reichlin L (2011) A two-step estimator for large approximate dynamic factor models based on Kalman filtering. J Econom 164(1):188–205

Durbin J, Siem Jan K (2001) Time series analysis by state space methods. Oxford University Press, Oxford

Eitrheim Ø, Husebø Tore A, Nymoen R (1999) Equilibrium-correction vs. differencing in macroeconometric forecasting. Econ Model 16(4):515–544

Esteves PS (2013) Direct vs bottom-up approach when forecasting GDP: reconciling literature results with institutional practice. Econ Model 33:416–420

Eurostat (2013) Handbook on quarterly national accounts. Publications Office of the European Union, Luxembourg

Forni M, Lippi M (2001) The generalized dynamic factor model: representation theory. Econom Theor 17(6):1113–1141

Forni M, Hallin M, Lippi M, Reichlin L (2000) The generalized dynamic-factor model: identification and estimation. Rev Econ Stat 82(4):540–554

Foroni C, Marcellino M (2014) A comparison of mixed frequency approaches for nowcasting Euro area macroeconomic aggregates. Int J Forecast 30(3):554–568

Friesenbichler Klaus S, Glocker C (2019) Tradability and productivity growth differentials across EU Member States. Struct Chang Econ Dyn 50:1–13

Ghysels E, Santa-Clara P, Valkanov R (2006) Predicting volatility: getting the most out of return data sampled at different frequencies. J Econ 131(1):59–95

Giacomini R, White H (2006) Tests of conditional predictive ability. Econometrica 74(6):1545–1578

Giacomini R, Rossi B (2010) Forecast comparisons in unstable environments. J Appl Econom 25(4):595–620

Giannone D, Reichlin L, Small D (2008) Nowcasting: the real-time informational content of macroeconomic data. J Monet Econ 55(4):665–676

Glocker C, Kaniovski S (2014) A financial market stress indicator for Austria. Empir J Eur Econ 41(3):481–504

Glocker C, Wegmüller P (2020) Business cycle dating and forecasting with real-time Swiss GDP data. Empi Econ 58(1):73–105

Glocker C, Hölzl W (2021) A direct measure of subjective business uncertainty. German Econ Rev (forthcoming)

Granger C, Jeon Y (2004) Forecasting performance of information criteria with many macro series. J Appl Stat 31(10):1227–1240

Hamilton James D (1994) Time series analysis. Princeton University Press, Princeton

Hammersland R, Træ Cathrine B (2014) The financial accelerator and the real economy: a small macroeconometric model for Norway with financial frictions. Econ Model 36:517–537

Harvey D, Leybourne S, Newbold P (1997) Testing the equality of prediction mean squared errors. Int J Forecast 13(2):281–291

Hecq A, Margaritella L, Smeekes S (2019) ‘Granger causality testing in high-dimensional VARs: a post-double-selection procedure.’ Papers 1902.10991

Heilemann U, Findeis H (2012) Empirical determination of aggregate demand and supply curves: the example of the RWI business cycle model. Econ Model 29(2):158–165

Heinisch K, Scheufele R (2018) Bottom-up or direct? Forecasting German GDP in a data-rich environment. Empir Econ 54(2):705–745

Hmamouche Y (2020) NlinTS: an R package for causality detection in time series. R J 12(1):21–31

Jiang Y, Guo Y, Zhang Y (2017) Forecasting China’s GDP growth using dynamic factors and mixed-frequency data. Econ Model 66:132–138

Kapetanios G, Labhard V, Price S (2008) Forecast combination and the Bank of England’s suite of statistical forecasting models. Econ Model 25(4):772–792

Klein Lawrence R, Özmucur S (2010) The use of consumer and business surveys in forecasting. Econ Model 27(6):1453–1462

Kuck K, Schweikert K (2021) Forecasting Baden-Württemberg’s GDP growth: MIDAS regressions versus dynamic mixed-frequency factor models. J Forecast 40(5):861–882

Kuzin V, Marcellino M, Schumacher C (2013) Pooling versus model selection for nowcasting with many predictors: empirical evidence for six industrialized countries. J Appl Econom 28(3):392–411

Leeb H, Pötscher BM (2005) Model selection and inference: facts and fiction. Econom Theor 21(1):21–59

Lehmann R (2021) Forecasting exports across Europe: What are the superior survey indicators? Empir Econ 60(5):2429–2453

Liu P, Matheson T, Romeu R (2012) Real-time forecasts of economic activity for Latin American economies. Econ Model 29(4):1090–1098

Majd S, Pindyck RS (1987) Time to build, option value, and investment decisions. J Financ Econ 18(1):7–27

Marcellino M, Schumacher C (2010) Factor MIDAS for nowcasting and forecasting with ragged-edge data: a model comparison for German GDP. Oxford Bull Econ Stat 72(4):518–550

Marcellino M, Sivec V (2021) Nowcasting GDP growth in a small open economy. Natl Inst Econ Rev 256:127–161

Mariano RS, Murasawa Y (2003) A new coincident index of business cycles based on monthly and quarterly series. J Appl Econom 18(4):427–443

Modugno M, Soybilgen B, Yazgan E (2016) Nowcasting Turkish GDP and news decomposition. Int J Forecast 32(4):1369–1384

Moser G, Rumler F, Scharler J (2007) Forecasting Austrian inflation. Econ Model 24(3):470–480

Öğünç F, Akdoğan K, Başer S, Chadwick MG, Ertuğ D, Hülagü T, Kösem A, Özmen MU, Tekatlı N (2013) Short-term inflation forecasting models for Turkey and a forecast combination analysis. Econ Model 33:312–325

Pareja AA, Gómez-Loscos A, de Luis López M, Pérez-Quirós G (2020) A short-term forecasting model for the Spanish economy: GDP and its demand components. Economía 43(85):1–30

Proietti T, Giovannelli A, Ricchi O, Citton A, Tegami C, Tinti C (2021) Nowcasting GDP and its components in a data-rich environment: the merits of the indirect approach. Int J Forecast (in Press)

Qin D, Cagas Marie A, Ducanes G, He X, Liu R, Liu S, Magtibay-Ramos N, Quising P (2007) A macroeconometric model of the Chinese economy. Econ Model 24(5):814–822

Rusnák M (2016) Nowcasting Czech GDP in real time. Econ Model 54:26–39

Schumacher C, Breitung J (2008) Real-time forecasting of German GDP based on a large factor model with monthly and quarterly data. Int J Forecast 24(3):386–398

Stock James H, Watson Mark W (1991) A probability model of the coincident economic indicators. In: Lahiri Kajal, Geoffrey H (eds) Leading economic indicators: new approaches and forecasting records. Cambridge University Press, Cambridge, UK, pp 63–90

van der Ploeg F (1982) Reliability and the adjustment of sequences of large economic accounting matrices. J R Stat Soc 145(2):169–194

Wladyslaw W (2011) Long-term macroeconometric models: the case of Poland. Econ Model 28(1):741–753

Zhou C (2000) Time-to-build and investment. Rev Econ Stat 82(2):273–282

Acknowledgements

We would like to thank two anonymous reviewers for thoughtful advice and constructive comments. We also thank Massimiliano Marcellino, Ferdy Adam and his team, and participants at WIFO/Vienna and the 2nd Vienna Workshop on Economic Forecasting 2020 at IHS/Vienna for valuable comments on an earlier draft. We are greatly indebted to Astrid Czaloun for excellent research assistance. All errors are our own responsibility. Financial support by the Austrian Ministry of Finance (Bundesministerium für Finanzen—BMF) is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Alternative Granger causality tests

We check the links uncovered by the conventional Granger causality test using two alternative tests. The Granger is a bivariate test that cannot account for the possibility of a causal relationship between a pair of variables being induced by a third variable acting as a common cause. The omission of common causes can lead to spurious causality. The second issue is that the Granger test involves model selection as a first step, which invalidates the subsequent asymptotic and finite sample inference (Leeb and Pötscher 2005).

The generalization by Hecq et al. (2019) rectifies the deficiency of a bivariate causality test. This multivariate test is based on a high-dimensional VAR that includes the entire dataset used to estimate the CDFM. The estimation procedure uses a sparsity-seeking regularization that uncovers the key dynamic interactions among the variables while discarding the rest. Model selection and testing follow the Belloni et al. (2014) post-double-selection approach that partially mitigates the problem associated with the validity of post-model-selection estimators. The LM test then accounts for multiple joint cause for each pair of variables of interest. We use test statistic with a final sample correction that has been shown to improve the size of the test.

The conventional Granger causality test and its multivariate generalization involve a VAR and thus assume a linear relationship between the variables. Our second alternative is based on a highly nonlinear view adaptive recurrent neural network (VA-RNN) model, which is a multilayer feed-forward neural network (Hmamouche 2020). The nonlinear test is bivariate. The test statistic being equivalent to that of the conventional Granger test in that it relates the residual sum of squares of errors of the restricted and the unrestricted models and follows an F-distribution under the null hypothesis of no causality.

Table 8 summarizes the test results for the final selection of links. The underlying models have been tested using quarterly data up to lag two, as suggested by the BIC criterion. Due to a sequential structure of the cluster, we are only interested in unidirectional causality relationships, by which past realizations of the variable listed in the first column improves forecasts of the corresponding variable in the second column, but not the other way around. We call unidirectional causality weak (W) if the test is significant at the 10% level, and strong (S) if it is significant at the 5% level. Note that the multivariate test tends to uncover fewer causal links that the two bivariate tests, which is expected due to the existence of multiple common causes in large dataset of highly interdependent time series. All the links except those between the exports of services and the value added of the service sector, and between construction investment and the value added in the construction sector have been validated by at least one of the three tests. These two links have been retained because their inclusion has significantly improved the forecasting performance of the respective value-added models when entered contemporaneously. Contemporaneous links could not be validated by causality tests that seek an intertemporal relationship between a pair of variables.

Appendix B: An alternative view on the production account: tradable and nontradable goods (TNT)

The approach proposed in Sect. 2 for modeling production is frequently used by international organizations, central banks and economic research institutes. It follows the sectoral composition of the National Accounts, but does not reflect the macroeconomic theory, which usually groups the sectors in producers of tradable goods (T) and nontradable goods (NT).Footnote 19 While the TNT classification is clear for some sectors, it can be ambiguous for others. Moreover, structural change might turn a previously tradable sector into a nontradable one, and vice versa. We follow the approach to the sectoral classification in Friesenbichler and Glocker (2019), determine the nominal value added for tradable goods and nontradable goods and calculate the corresponding deflators, which allows us to determine the real value added of these two categories.

The next step involves specification of separate behavioral models for tradable goods and nontradable goods, and an aggregator model for the GDP. The aggregator model features an error term, as the tradable and nontradable goods do not sum up to GDP, the difference being product taxes and subsidies. Another reason for including an error term is that we again consider a log-linearized representation of a weighted sum, in which the weights of the components can change over time. These changes in the weights are addressed by an autoregressive error term, as shown in Eq. (5).

Table 3 provides the normalized values of the RMSE for a GDP forecast based on the TNT approach. The forecasting accuracy of the TNT approach is similar to that of the standard production-side GDP approach considered in Sect. 3. Although the normalized RMSE of GDP is slightly smaller than in the conventional three-sector approach (manufacturing, construction, services), this difference is not statistically significant. The forecasts of the value added of tradable goods and nontradable goods seem to be comparatively precise. The values for the normalized RMSE for these two components are smaller than those for the sectors in the conventional approach for all forecasting horizons.

Subplot (d) in Fig. 3 shows the annual GDP-forecast for the year 2009 obtained using the TNT approach over a period of 2008 and 2009. The TNT-based forecasts indicate negative annual growth relatively early, somewhat overestimating the extent of the recession at the end of 2008, but nonetheless approaching the realized value quickly.

Finally, the deflators for tradable and nontradable goods allow for an alternative approach to modeling and forecasting the GDP deflator. We specify a behavioral model for each of the two deflators and link them to the GDP deflator in an aggregator model. The forecast evaluation in Table 9 shows the normalized RMSE of the deflators for tradable and nontradable goods to be comparatively small. The TNT-based forecasts of the GDP deflator are thus comparable to the baseline approach.

Appendix C: The small-scale dynamic factor model

We consider a small-dynamic factor model (small DFM), as popularized by Mariano and Murasawa (2003), Camacho and Pérez-Quirós (2010), Camacho and Pérez-Quirós (2011), Arnoštová et al. (2011), Aastveit and Trovik (2012) as a competing model. This approach comprises a small-scale and hence simple factor model applied directly to GDP growth. Following Mariano and Murasawa (2003), we combine monthly and quarterly data, expressing the quarterly data as a function of monthly data. If the sample mean of the three monthly observations in a given quarter can be approximated by the geometric mean, then the quarterly growth rates can be decomposed as weighted averages of monthly growth rates. We follow the outline put forward in Sect. 3 and utilize the approach motivated by Glocker and Wegmüller (2020) to select an appropriate set of variables. This approach explicitly takes into account the fact that additional variables do not necessarily improve the model’s forecast. The available set of variables contains around sixty variables.

The principal criterion for variable selection is out-of-sample forecasting ability, producing a set of variables geared toward economic expectations. We have already seen in Sect. 4.6 that the resulting model performs well in forecasting the 2009 economic downturn. The final specification of the small-scale factor model (SDFM) for GDP includes: (1) expectations in the construction sector, (2) expectations in the manufacturing sector, (3) expectations in the service sector, (4) Purchasing Managers Index (PMI), (6) order backlog (manufacturing sector), (7) employment (all sectors), (8) vacancies (all sectors), (9) retail sales (total) and (10) truck mileage. We add further variables only if they improve the out-of-sample forecasting performance of the model. We find that some additional variables could be included; however, they do not improve the forecast (e.g., Economic Sentiment Index (ESI) from the European Commission, ATX/Austrian Traded Index volatility, the financial market stress indicator as considered in Glocker and Kaniovski (2014), term-structure—i.e., the difference between 10-year and 2-year government bond yield, industrial production—excluding the construction sector, and retail sales). Other variables worsened the out-of-sample forecasts and were subsequently discarded from the model. The final selection proved robust to enlargements of the model in various directions. We tested our model using disaggregated versions of the variables already included in the model. For instance, we used retail sales without oil-related products instead of total retail sales. We also checked for the employment of different sectors (manufacturing sector, construction sector) instead of the aggregate measure, failing to improve the model in all cases.

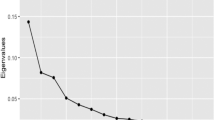

Since the variables considered address both the outlook and the current situation, we allow for a temporal displacement between GDP as the target variable and the additional variables, for which we follow Camacho and García-Serrador (2014). This setup follows Camacho and Pérez-Quirós (2010) with a dynamic factor structure involving one factor with two lags (we omit the elements concerning data revisions from the model). The number of factors is selected by using Bai and Ng (2002) information criteria (BG) modified to take into account that the parameters are estimated using maximum likelihood. The number of lags in the factor equation and for the error terms was chosen by relying on the Bayesian Information Criterion (BIC).

Appendix D: The large-scale dynamic factor model

In addition to the small-scale dynamic factor model as competing model, we also consider a large-scale dynamic factor model (large DFM). Large factor models use a small number of factors to capture the co-movement of a high-dimensional set of time-series. High dimensionality poses challenges. The first concerns the data frequency and missing observations in general. The second concerns the identification of the latent factors.

In order to allow for a decent comparison of the predictive accuracy of the CDFM to the large DFM, we use all variables of the CDFM in the large DFM. We extract the latent factors by relying on principal component analysis. This approach is easy to implement, and, given that the cross-section and time dimension are large, provides consistent estimates under quite general assumptions. It suffers, however, from one main drawback: the dataset must be balanced, that is, the start and end points have to be the same across all observable variables and all data-series must have the same frequency so that missing observations do not arise. To this purpose, we consider a quarterly frequency of the data and of the large DFM alike. We transform all monthly series into quarterly series by considering a three-months average. The sample used for the estimation starts in 2007 as missing observations prior to this year would otherwise impede the estimation. All series enter the large DFM contemporaneously; hence, in contrast to the small DFM, we do not allow for temporal displacements within the data series. We rely on Bai and Ng (2002) to determine the number of factors, and specify a finite-order VAR model to approximate the dynamics of the latent factors.

We consider the principal component methods and maximum likelihood methods to estimate the large DFM (see Bai and Wang 2016, for further details). To this purpose, we again standardize all data-series prior to the estimation. The estimation relies on a two-step procedure in which the latent factors are estimated in a first step, and the VAR model in the second step. As highlighted by Doz et al. (2011), this procedure yields consistent estimates even when the static factor model is misspecified with respect to some of its dynamic elements. We establish forecasts from the large DFM in the same form as done for the other models. This allows for an adequate comparison of the large DFM’s forecasts with those of the other models, keeping in mind, though, the different underlying frequency.

Appendix E: The mixed-data-sampling (MIDAS) regression model

We complete the set of competing models with a mixed-data-sampling (MIDAS) regression model for GDP using the set of indicators from the small-scale dynamic factor model detailed in Sect. 3. MIDAS regression was developed by Ghysels et al. (2006) as a means of predicting a single low-frequency time series (quarterly GDP growth) with multiple high-frequency indicators (monthly indicators). The key feature of MIDAS regression is the distribution of the current and past values of the high-frequency indicators that effectively yields different forecasting models for each forecast horizon. We found that a MIDAS specification with simple uniform distribution (fixed weighting scheme) produces the most accurate GDP forecasts at all frequencies. To facilitate comparison with the CDFM and the other competing models, the performance of MIDAS regression was measured using the NRMSE and MAE measures of forecast error. Forecasting quarterly GDP using MIDAS regression requires future values of monthly indicators as input. The forecasts of the monthly indicators were determined using optimally selected ARMA models, with model selection based on BIC.

There are several important conceptual differences between a MIDAS regression and a DFM used as a building block of the CDFM, or as direct competing model in Sect. 3. First, a DFM is based on a system of equations, whereas a MIDAS regression involves a single equation in reduced form. Bai et al. (2013) argue that a MIDAS model can be less efficient and more prone to specification errors than a DFM estimated using the Kalman filter. Second, because a MIDAS regression requires forecasts for the indicators as input, it must be supplemented by auxiliary models for the indicators. This makes the choice of a MIDAS regression less practical than that of a DFM for the purpose of designing a cluster of such models such as the CDFM. Finally, a DFM estimated using the Kalman filter can easily cope with ragged edges and missing observations at different frequencies, as well as changing frequencies within a time series, which poses a problem to MIDAS.

Appendix F: Additional figures and tables

See Tables 10, 11, 12, 13, 14, 15 and 16.

Rights and permissions

About this article

Cite this article

Glocker, C., Kaniovski, S. Macroeconometric forecasting using a cluster of dynamic factor models. Empir Econ 63, 43–91 (2022). https://doi.org/10.1007/s00181-021-02129-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-021-02129-w