Abstract

There is a considerable volume of literature concerned with point forecasting which aims to assess whether producing aggregate forecasts as the sum of the components’ forecasts is better than alternative direct methods, whereas aggregate density forecasting from disaggregate components is still a relatively unexplored field. This paper develops an implementation of the bottom-up approach that is capable of producing well-performing and competitive density forecasts. This is achieved by accounting explicitly for the interaction between components, using Bayesian VARs to estimate the whole multivariate process and produce the aggregate forecasts. An empirical application using CPI and GDP data shows that the method can be used to produce aggregate density forecasts capable of accounting for the events resulting from the crisis. This suggests that it might be particularly useful for forecasting in turbulent times and therefore prove a valuable addition to the forecaster’s toolkit.

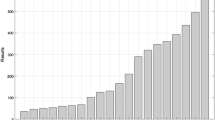

Source: OECD statistics database

Similar content being viewed by others

Notes

Examples of these comparisons are Espasa et al. (2002), Benalal et al. (2004), Hubrich (2005) and Giannone et al. (2014) for inflation in the Euro area; Marcellino et al. (2003), Hahn and Skudelny (2008), Burriel (2012) and Esteves (2013) for European GDP growth; and Zellner and Tobias (2000), Perevalov and Maier (2010) and Drechsel and Scheufele (2013) for GDP growth in specific industrialized countries.

Actual weights is used to refer to the weights that are actually used to produce the corresponding aggregate by the institution that publishes it.

They use univariate autoregressive models to forecast the components.

For forecasts beyond one period, predictive simulation is required.

The transformation involves taking the inverse normal cumulative density function transformation of the PITs making it equivalent to a test for uniformity.

Scores will suffer both for over-dispersed distributions, because probability mass is too high for infrequent values, and for under-dispersed distributions, because too many observations carry a low probability.

It is worth noting that the exercise does not replicate real-time forecasting, given that data revisions are not accounted for.

For the UK the production data on the OECD database starts in 1995. The first four years of the sample are obtained by splicing backwards the historical reference tables available from the Office for National Statistics. No inconsistencies arise from the seasonal adjustment given that the aggregates are adjusted indirectly; that is, as the sum of the seasonally adjusted components.

Four lags are used for all models.

K&K also choose \(\lambda \) and \(\kappa \) empirically over a grid. In this particular exercise, the results are not significantly different from those obtained from setting both parameters to 0.99.

Specifically, \(\gamma =e^{i}\) selecting i from \(\{-7, -6, \ldots , -1\}\).

That is that the null hypothesis of no calibration failure cannot be rejected at the 5% significance level. The tests are conducted on an individual basis which imply a Bonferroni-corrected (joint) p value of 1.25%.

For each series, the homoskedastic models are presented in the top panel and the heteroskedastic models and DMS in the bottom. The aggregate AR is included in both to serve as a reference point.

The figures for the fixed-parameter models have been dropped for clarity and because the main findings are present in their time-varying counterparts.

As Raftery et al. (2010) point out, using forgetting factors is comparable, but not equivalent, to using rolling windows. The dampening in the former is exponential, while in the latter it does not have to be. In fact, the usual practice is to give equal nonzero weights to the information within the window and zero to the rest.

References

Aiolfi M, Timmermann A (2006) Persistence of forecasting performance and conditional combination strategies. J Econom 135:31–53

Amisano G, Giacomini R (2007) Comparing density forecasts via weighted likelihood ratio tests. J Bus Econ Stat 25:177–190

Anderson TW, Darling DA (1952) Asymptotic theory of certain ”goodness of fit” criteria based on stochastic processes. Ann Math Stat 23(2):193–212

Bache I, Mitchell J, Ravazzolo F, Vahey S (2010) Macro-modelling with many models. In: Cobham D, Eitrheim Ø, Gerlach S, Qvigstad J (eds) Twenty Years of Inflation Targeting: Lessons Learned and Future Prospects. Cambridge University Press, Cambridge, pp 398–418

Banbura M, Giannone D, Reichlin L (2010) Large Bayesian vector auto regressions. J Appl Econom 25(1):71–92

Benalal N, Diaz del Hoyo JL, Landau B, Roma M, Skudelny F (2004) To aggregate or not to aggregate? Euro area inflation forecasting. Working paper 374, European Central Bank

Berkowitz J (2001) Testing density forecasts, with applications to risk management. J Bus Econ Stat 19(4):465–474

Bjørnland HC, Gerdrup K, Jore AS, Smith C, Thorsrud LA (2011) Weights and pools for a Norwegian density combination. North Am J Econ Fin 22(1):61–76

Burriel P (2012) A real-time disaggregated forecasting model for the Euro area GDP. Economic Bulletin 04/2012, Banco de España

Carriero A, Clark TE, Marcellino M (2015) Bayesian VARs: specification choices and forecast accuracy. J Appl Econom 30(1):46–73

Corradi V, Swanson N (2006) Predictive density evaluation. In: Elliott G, Granger C, Timmermann A (eds) Handbook of economic forecasting, vol 1. Elsevier, Amsterdam, pp 197–284

Dawid AP (1984) Statistical theory: the prequential approach. J R Stat Soc Ser A (General) 147(2):278–292

Del Negro M, Hasegawa RB, Schorfheide F (2016) Dynamic prediction pools: an investigation of financial frictions and forecasting performance. J Econom 192(2):391–405

Diebold FX, Gunther TA, Tay AS (1998) Evaluating density forecasts with applications to financial risk management. Int Econ Rev 39:863–883

Drechsel K, Scheufele R(2013) Bottom-up or direct? Forecasting German GDP in a data-rich environment. IWH discussion papers 7, Halle Institute for Economic Research

Elliott G (2017) Forecast combination when outcomes are difficult to predict. Empir Econ 53(1):7–20

Espasa A, Senra E, Albacete R (2002) Forecasting inflation in the European Monetary Union: a disaggregated approach by countries and by sectors. Eur J Fin 8(4):402–421

Esteves PS (2013) Direct vs bottom-up approach when forecasting GDP: reconciling literature results with institutional practice. Econ Model 33:416–420

Geweke J, Amisano G (2010) Comparing and evaluating Bayesian predictive distributions of asset returns. Int J Forecast 26(2):216–230

Giannone D, Lenza M, Momferatou D, Onorante L (2014) Short-term inflation projections: a Bayesian vector autoregressive approach. Int J Forecast 30(3):635–644

Gneiting T, Balabdaoui F, Raftery AE (2007) Probabilistic forecasts, calibration and sharpness. J R Stat Soc Ser B (Stat Methodol) 69(2):243–268

González-Rivera G, Sun Y (2017) Density forecast evaluation in unstable environments. Int J Forecast 33(2):416–432

Gupta R, Kabundi A (2011) Forecasting macroeconomic variables using large datasets: dynamic factor model versus large-scale BVARs. Indian Econ Rev 46(1):23–40

Hahn E, Skudelny F (2008) Early estimates of Euro area real GDP growth: a bottom up approach from the production side. Working paper series 0975, European Central Bank

Hall SG, Mitchell J (2007) Combining density forecasts. Int J Forecast 23(1):1–13

Hora S (2004) Probability judgements for continuous quantities: linear combinations and calibration. Manag Sci 50:597–604

Hubrich K (2005) Forecasting Euro area inflation: does aggregating forecasts by HICP component improve forecast accuracy? Int J Forecast 21(1):119–136

Hubrich K, Skudelny F (2017) Forecast combination for euro area inflation: a cure in times of crisis? J Forecast 36(5):515–540

Jore AS, Mitchell J, Vahey SP (2010) Combining forecast densities from VARs with uncertain instabilities. J Appl Econome 25(4):621–634

Koop G, Korobilis D (2012) Large time-varying parameter VARs. Working paper series 11-12, The Rimini Centre for Economic Analysis

Koop G, Korobilis D (2013) Large time-varying parameter VARs. J Econom 177(2):185–198

Koop GM (2013) Forecasting with medium and large Bayesian VARs. J Appl Econom 28(2):177–203

Lütkepohl H (1987) Forecasting aggregated vector ARMA processes, vol 284. Springer, New York

Marcellino M, Stock JH, Watson MW (2003) Macroeconomic forecasting in the Euro area: country specific versus area-wide information. Eur Econ Rev 47(1):1–18

Mazur B (2015) Density forecasts based on disaggregate data: nowcasting Polish inflation. Dyn Econom Models 15:71–87

Mitchell J, Hall SG (2005) Evaluating, comparing and combining density forecasts using the KLIC with an application to the Bank of England and NIESR fancharts of inflation. Oxford Bull Econ Stat 67(s1):995–1033

Mitchell J, Wallis KF (2011) Evaluating density forecasts: forecast combinations, model mixtures, calibration and sharpness. J Appl Econom 26(6):1023–1040

Noceti P, Smith J, Hodges S (2003) An evaluation of tests of distributional forecasts. J Forecast 22(6–7):447–455

Perevalov N, Maier P (2010) On the advantages of disaggregated data: Insights from forecasting the US economy in a data-rich environment. Working papers 10-10, Bank of Canada

Proietti T, Marczak M, Mazzi G (2017) Euromind-D: a density estimate of monthly gross domestic product for the euro area. J Appl Econom 32(3):683–703

Raftery AE, Kárnỳ M, Ettler P (2010) Online prediction under model uncertainty via dynamic model averaging: application to a cold rolling mill. Technometrics 52(1):52–66

Ranjan R, Gneiting T (2010) Combining probability forecasts. J R Stat Soc Ser B (Stat Methodol) 72(1):71–91

Ravazzolo F, Vahey SP (2014) Forecast densities for economic aggregates from disaggregate ensembles. Stud Nonlinear Dyn Economet 18(4):367–381

Rossi B (2013) Advances in forecasting under instability. In: Elliott G, Timmermann A (eds) Volume 2 of handbook of economic forecasting, chapter 21. Elsevier, Amsterdam, pp 1203–1324

Rossi B, Sekhposyan T (2010) Have economic models’ forecasting performance for us output growth and inflation changed over time, and when? Int J Forecast 26(4):808–835

Rossi B, Sekhposyan T (2014) Evaluating predictive densities of us output growth and inflation in a large macroeconomic data set. Int J Forecast 30(3):662–682

Rossi B, Sekhposyan T (2019) Alternative tests for correct specification of conditional predictive densities. J Econom 208(2):638–657

Smith J, Wallis KF (2009) A simple explanation of the forecast combination puzzle. Oxford Bull Econ Stat 71(3):331–355

Steele M, Chaseling J (2006) Powers of discrete goodness-of-fit test statistics for a uniform null against a selection of alternative distributions. Commun Stat Simul Comput 35(4):1067–1075

Stock JH, Watson M (2003) Forecasting output and inflation: the role of asset prices. J Econ Lit 41(3):788–829

Timmermann A (2006) Forecast combinations. In: Elliott G, Granger C, Timmermann A (eds) Handbook of economic forecasting, vol 1. Elsevier, Amsterdam, pp 135–196

Zellner A, Tobias J (2000) A note on aggregation, disaggregation and forecasting performance. J Forecast 19(5):457–465

Acknowledgements

I would like to thank two anonymous referees and Andrea Carriero for their very insightful suggestions at different stages of this research. I would also like to thank Antonia Palacios, Linda Craddock and Oliver Cobb for their helpful comments and encouragement. The views expressed in this paper are those of the author and do not necessarily represent those of anyone at the Central Bank of Chile.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that he has no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Cobb, M.P.A. Aggregate density forecasting from disaggregate components using Bayesian VARs. Empir Econ 58, 287–312 (2020). https://doi.org/10.1007/s00181-019-01720-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-019-01720-6