Abstract

In the US, the impact of authorised biologics on biosimilars is post-regulated by the competition authorities, while in Europe, pharmaceutical regulatory authorities consider competition impacts in addition to post-regulation by the competition authorities. In Japan, it is pre-regulated by the Ministry of Health, Labour and Welfare (MHLW) and the Central Social Insurance Medical Council (CSIMC), which consider competition at the point of drug price listing. Should the MHLW and CSIMC consider competition in drug pricing, it would be necessary to formulate systems to utilise the expertise of a competition expert, namely the Japan Fair Trade Commission (JFTC). When calculating the drug price of authorised biologics, reducing the cost of drugs should be prioritised over protecting the incentives for the development of biosimilars. Patient choice and the quality of healthcare should be emphasised more, taking advantage of the characteristic that the MHLW and CSIMC, who are drug experts, consider competition.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

0.7 or 0.5: that is the question.

1 Issue: Report of the Japan Biosimilar Association

On 16 May 2017, the Japan Biosimilar Association submitted a report titled ‘The Impact of Authorised Biologics (provisional name) on the Development and Promotion of Biosimilars (Report)’ to the Director of the Economic Affairs Division, Health Policy Bureau, MHLW.Footnote 1

It reports as follows: ‘Authorised biologics significantly impact the R&D and penetration of biosimilars and may ultimately hinder further development of the whole industry of biological medicinal products’. It continues that ‘If authorised biologics, considered identical to originator medicinal products, are authorised while biosimilars have not yet progressed their wide understanding and penetration, such authorisation will have a serious impact on the penetration of biosimilars, which may lead to a loss of growth opportunities not only for biosimilars but also for the entire biologics industry, which may lead to stagnation of innovation. As a result, these impacts will negatively affect the public because of dependence on foreign countries for the stable supply of biological medicinal products, persistently high prices of medicines, and lack of progress as a whole in improving patient access to treatments with biological medicinal products’.

A biological medicinal product is a drug whose active ingredient is derived from proteins such as growth hormone, insulin, and antibodies.Footnote 2 In the field of biological medicinal products, generic biological medicinal products are called biosimilars, in contrast with originator biological medicinal products. While generic biological medicinal products are not identical to the originator biological medicinal product, they have been confirmed with clinical trials, etc. to have equivalent/homogeneous quality, safety, and effectiveness.Footnote 3

On the other hand, while authorised generics (AGs) are not clearly defined, the term generally refers to generics that share not only active ingredients, but also APIs, additives, and manufacturing methods, etc. with the originator medicinal products. These are called ‘authorised biologics’ in biological medicinal products.Footnote 4 The name ‘authorised generics’ means they are marketed by the subsidiaries of originator companies or by generic industry companies under the authorisation of the originator companies.Footnote 5 AGs are characterised by the fact that, for physicians and patients, they have more similarities to originator medicinal products than generics, and AG companies may be able to sell AGs earlier than generics.Footnote 6 To secure market share, even if a generic competitor enters the market after the patent rights to the originator medicinal product expires, originator companies can take early advantage in the generic drug market by launching AGs before the patent right expires.

As they will be sold before the patent right expires, AGs will be launched if they are judged to be generally advantageous, even when they may cause the cannibalisation of originator medicinal products. Under the current Japanese drug price regulation system, generics are defined by the fact that their already listed products (originator medicinal products) sharing the APIs have finished the re-examination period, and they are marketed by different companies from their originator medicinal products. Since the definition of generics does not consider contractual relationships with the originator companies and differences in APIs, additives, and manufacturing methods, etc., AGs are treated as equivalent to generics in the drug pricing system.Footnote 7

Is the concern of the Japan Biosimilar Association reasonable? How should we consider the impact of authorised biologics on biosimilars from the perspective of competition policy and health policy? The same issues have already been discussed in the US and Europe on AGs of small molecule products and authorised biologics, and some of their competition authorities or pharmaceutical regulatory authorities have expressed their views. This article first surveys the US and European situations, and then the Japanese situation to identify implications for Japan.

In addition to the difference in the names used to describe authorised biologics between countries, each country also has no consistent naming convention, causing confusion. Both the Central Social Insurance Medical Council (CSIMC)Footnote 8 and European CommissionFootnote 9 stated the necessity of having a consistent name. In this article, ‘authorised biologics’ is used in principle for the US and Europe as well as Japan, and if different names are given in citations, it will be noted as such.

2 The US

Wong and Norey [12]; Authorized Generic Drugs: Short-Term Effects and Long-Term Impact, FEDERAL TRADE COMMISSION (Aug. 2011) (‘FTC 2011’), available at https://www.ftc.gov/sites/default/files/documents/reports/authorized-generic-drugs-short-term-effects-and-long-term-impact-report-federal-trade-commission/authorized-generic-drugs-short-term-effects-and-long-term-impact-report-federal-trade-commission.pdf.

Under the Hatch–Waxman AmendmentsFootnote 10 in the US, the first generic filing for paragraph IV of the Abbreviated New Drug Application (the ‘first-filer’) was granted 180-day exclusivity after launching its product. During this period, because of the absence of competition with other generic companies, both the generic drug price and the first-filer’s revenues were significantly higher than they would have been when there were additional generic competitors. In contrast, competition from AGs during the 180-day exclusivity period has the potential to reduce both generic drug prices and generic firm revenues. The courts have ruled that the 180-day exclusivity does not preclude an originator company (brand-name company) from entering with its own generic.Footnote 11 Therefore, originator companies frequently launch AGs to compete with first-filers.

Thus, AGs have been the subject of controversy. Originator companies that offer AGs contend that they are pro-competitive, namely that they make valuable products available to consumers at lower prices than those of originator medicinal products and provide competition that leads to lower generic prices. In contrast, some in the generic drug industry contend that AGs harm competition by drawing revenues away from first-filers during the 180-day exclusivity period and discourage generic firms from challenging the patents of originator companies, thereby undermining competition in the long run and the goals of the Hatch–Waxman Amendments.

Under these circumstances, Congress requested studies on the competitive effects of AGs. Senators Leahy, Grassley, and Rockefeller commented that if the generic industry were to be less incentivised to produce generic drugs to compete with originator drugs, possibly, fewer generic drugs would come to the market and the prices for certain drugs would remain high for consumers. In addition, Representative Waxman, a legislative sponsor of the Hatch–Waxman Amendments, stated that in response to the tactics used by the pharmaceutical industry to delay generic competition, Congress closed loopholes in the Hatch–Waxman Amendments in 2003. However, he did not believe it was a coincidence that originator companies began to exploit the practice of AGs after the closing of those loopholes.

In 2006, at the request of members of Congress, the Federal Trade Commission (FTC) began its own study to examine the short- and long-term competitive effects of AGs. In 2009, the FTC issued an Interim ReportFootnote 12 that focused on the short-term effects of AGs and presented an analysis suggesting that consumers benefit and the healthcare system saves money when an AG enters the market because of the greater discounting that accompanies the added competition provided by the AG. In 2011, the FTC issued its Final Report,Footnote 13 concluding that the consumer benefitted from the introduction of AGs in the market, including paying lower prices from additional competition, and that patent challenges by generics have actually increased in the relevant period. The FTC Final Report is evaluated to have concluded that AGs are pro-competitive.Footnote 14

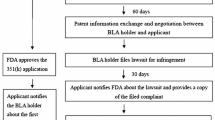

While this debate may have worked on the assumption that AGs would be small molecule drugs, with the passing of the Biologics Price Competition and Innovation Act (BPCIA) in 2009,Footnote 15 and a recent increase in biosimilar activity in the US, the same debate has started to enter the fledgling biosimilar space, leading commentators to ask how authorised biologicsFootnote 16 might affect biosimilars. The FTC has not yet expressed its opinion on authorised biologics. The differences between small molecule products and biological medicinal products mean that the debate about AGs in small molecule products cannot be directly applied to authorised biologics. That is, small molecule generic products are created to be therapeutically equivalent to their originator counterparts. As such, originator small molecule products may be substituted at the pharmacy counter for their generic counterparts without the need to involve the prescriber.

On the other hand, because of their nature and method of manufacture, truly identical copies of biologic products by others are considered impossible. Biosimilars are highly similar to and have no clinically meaningful differences from an existing reference product (i.e. originator drug) approved by the Food and Drug Administration (FDA). However, biosimilars cannot be substituted at the pharmacy counter for originator drugs without the prescriber’s involvement. Furthermore, prescribing physicians may also be reluctant to switch patients who are stable on the reference product to a new therapy. Because the market penetration for biosimilars has not been as quick as for small molecule generics, there may be little market incentive for originator companies to join the biosimilar market in the form of an authorised biologic. If a biosimilar is expected to produce the same clinical result as the reference product in any given patient, it will be approved as interchangeable by the FDA. Since this interchangeable designation brings with it the ability to substitute the biologic for an interchangeable product at the pharmacy counter without the prescriber’s involvement, authorised biologics will likely be realised after the FDA approves interchangeables.Footnote 17

3 Europe

supra note 9.

On 7 November 2019, the Pharmaceutical Committee of the Directorate-General for Health and Food Safety (DG SANTE) at the European Commission presented the following regarding duplicate marketing authorisations for biological medicinal products.Footnote 18

Article 82(1) of the Regulation of Community procedures for the authorisation and supervision of medicinal products for human and veterinary use and establishing a European Medicines Agency (Regulation (EC) 726/2004)Footnote 19 limits cases where the applicant or who obtained approval for one medicinal product to obtain multiple approvals, that is, cases of duplicate marketing authorisations for the same medicinal product. The first subparagraph of Article 82(1) provides that only one marketing authorisation may be granted to one applicant for a specific medicinal product. The 2nd subparagraph of Article 82(1) provides that the Commission shall authorise the same applicant to submit more than one application to the Agency for that medicinal product when there are objective verifiable reasons relating to public health regarding the availability of medicinal products to healthcare professionals and/or patients, or for co-marketing reasons. The Commission assesses whether the conditions of Article 82(1) are met on a case-by-case basis to determine whether to agree to the submission of a further application for the same medicinal product. According to Annex I.1 of the 2011 CommissionFootnote 20 note on the Handling of Duplicate Marketing Authorisation Applications,Footnote 21 the first introduction of a generic product by the holder of the reference medicinal product (the originator medicinal product) can also improve the availability of a medicinal product. This is because the first entry of a generic into the market impacts availability, as it usually increases accessibility. While the 2011 Commission note did not include specific considerations regarding biological products and/or biosimilars, the granting of duplicate marketing authorisations as generics in the case of biological medicinal products has raised concerns from the generic industry about the likely impact on the biosimilar market. They considered that this would affect choice and competition, undermine the EU concept of biosimilars, and ultimately may limit the range of options available to patients.

The Commission launched a targeted consultation directed at stakeholders to seek their views on the issue of granting duplicate marketing authorisations for a first generic of biological medicinal products; specifically, on the impact that such authorisations would have on the availability of biosimilars to healthcare professionals and patients. One possible consideration was that such authorisations could have anticompetitive effects and undermine other treatment options available to patients.

A view in favour of stricter scrutiny for authorised biologics was submitted by Member State Competent Authorities, the generics industry, a patients organisation and a healthcare professionals organisation. That is, contrary to the position with small molecule products, only originator companies can produce authorised biologicsFootnote 22 for manufacturing and technological reasons. This difference is the reason authorised biologics and their biosimilar counterparts may have a de facto uneven position in the national market. As a result, differences between Member State health systems can influence market access for certain competing products, which in time may result in a negative effect on the availability of medicinal products to patients and healthcare professionals. Contrary to the position of authorised biologics, biosimilars have to invest time and money in clinical studies, which also impacts their market entry. The vast majority of EU Member States do not allow pharmacy substitution for biosimilars, whereas substitution is in principle automatically allowed for authorised biologics, resulting in a privileged position of authorised biologics compared to biosimilars from the viewpoint of pharmacy substitution. Allowing authorised biologics can reportedly affect physicians’ decision-making in treatment monitoring because of misconceptions regarding the inferior therapeutic properties of biosimilars compared to authorised biologics. While authorised biologics will almost certainly be marketed at a much lower price than their reference products, biosimilars are also subject to a price decrease. The resulting situation would allow originator companies to undercut the price of biosimilars while allowing the reference originator medicinal product to maintain a high price. In tendering procedures, authorised biologics can be used as a tool to influence pricing dynamics to drastically reduce the market value for biosimilars, or the originator company would essentially be competing against itself with two of its own medicinal products. Even though the introduction of authorised biologics in the market can initially have a positive effect on availability, in the long term, they may have a negative effect on the availability of biosimilars. A stakeholder expressed the view that duplicate authorisation should lose its validity once it is proven that biosimilar alternatives exist at a sufficient quantity to adequately meet demand and that the Commission should go even further, questioning whether authorised biologics should be allowed.

A view against stricter scrutiny of authorised biologics was submitted by originator companies. That is, the first introduction of authorised biologics will increase availability for patients and healthcare professionals. Furthermore, authorised biologics can be granted with a full label without carving out any indications, which may increase availability and accessibility for a larger section of the patient population. Authorised biologics should not be treated differently from the AGs of small molecule products and should be subject to the same authorisation criteria. The Commission proposes the following change in Annex I: ‘Requests for duplicate marketing authorisations need to be properly substantiated and based on sound evidence’. However, the standard applied under this wording is quite high, and the wording is unclear. Since the current logic has been established for years and was issued at a time when biological medicinal products were well known and available on the market, any change to such practice needs to be properly justified.

The feedback received from Member State Competent Authorities showed that they had no experience regarding the actual effect of duplicate authorisations for authorised biologics. In addition, although in principle, the first introduction of an authorised generic (small molecules or biologics) improves availability and reduces prices, the originator companies do not have an interest in keeping prices permanently low. Thus, an authorised biologic could be used as a vehicle to deter competing biosimilars from entering or staying on the market. Therefore, the introduction of an authorised biologic to the market can have negative effects on long-term availability.

The European Commission concluded that most arguments are made on a theoretical basis, as there is still not enough experience to draw practical conclusions on the issue. The Commission is also considering amending Annex I.1 of the 2011 Commission note along the following lines, collecting the opinions of Member States. That is, duplicate marketing authorisation is an exceptional process, and for duplicates (small molecules or biologics) requested for public health reasons, the applicant should provide specific evidence to allow the Commission to verify a positive effect on availability. The first entry of a generic into the market is not automatically considered to increase the availability.

On 5 March, 2021, the European Commission published an updated version of the 2011 Commission note on the handling of duplicate marketing authorisation applications for medicinal products.Footnote 23 The updated note states experience shows that there is no automatic link between the introduction of a duplicate marketing authorisation by the holder of the original medicinal product (be it a chemical or a biological medicinal product) and increased availability. Taking into account that duplicate marketing authorisation can only be granted exceptionally, the applicant should provide the Commission with specific evidence that demonstrates that duplicate marketing authorisation is likely to increase availability, which should be assessed on a case-by-case basis.

4 Japan

Regarding the AGs of small molecule products, the following remarks and proposals were given at the meeting of the Japan Society of Generic Medicines in November 2014. ‘Introducing AGs as safe because they are the same as the originator medicinal product will give rise to the implication that generics to date are not safe’. The only advantage of AGs is that they can be sold several months earlier than other generics. It is better to lower drug price of the originator medicinal products than to allow AGs.Footnote 24

Regarding authorised biologics, on 16 May 2017, the Japan Biosimilar Association submitted a report to the Director of Economic Affairs Division, Health Policy Bureau, MHLW, stating that authorised biologics may threaten the development and penetration of biological medicinal products. It was reported that this submission responded to the situation of Kyowa Hakko Kirin. The company considered commercialising the authorised biologics of Nesp, aiming to minimise the damage caused by the expiration of its patent in 2019 protecting its mainstay therapeutic agent for renal failure Nesp (generic name: Darbepoetin Alfa). It established a new company, Kyowa Kirin Frontier, to manage Nesp’s authorised biologics businessFootnote 25 of Nesp on 18 January 2017.Footnote 26 Footnote 27

After the authorised biologic of Nesp was approved, the Drug Price Special Committee of the CSIMC on 27 March 2019Footnote 28 discussed whether to calculate the drug price of an authorised biologic to be 0.5 times the price of the originator medicinal product, as is the norm with generic products, or 0.7 times the price, as with biosimilars. The tentative agreement was 0.7. The committee members expressed the following opinions: ‘Considering the aim to move away from the model where originator companies rely on their long-listed products, I am very concerned that the originator companies try to remain in the market through their subsidiaries’.

Furthermore, ‘Providing drugs with firmer efficacy and safety at low prices would be the most desirable for patients, and it is an important issue from the perspective of saving medical expenses. Thus, for AGs positioned similar to a biosame,Footnote 29 we should urgently deepen discussions on the drug price system to reduce the prices targeting the next revision, maintaining an appropriate competitive environment between companies, not preventing the development of biosimilars, authorised biologics, etc.’.

It was also stated that ‘The authorised biologics are exactly the same product except for its packaging and are manufactured by a wholly-owned subsidiary. I would like to ask again: Why are the effectiveness and efficacy different even though they are the same products? … I feel uncomfortable that the wholly owned subsidiary may be the same company. I know that there is a rule, but I feel extremely uncomfortable that the same company launches drugs in this way to affect biosimilars, while understanding it as a company strategy’.

Furthermore, ‘Authorised biologics will probably not be launched unless biosimilars are developed and apply for authorisation. I understand that originator companies can launch authorised biologics within the existing rule responding to the development of biosimilars, under the mechanism that their development funds, etc., can be recovered through evaluation of their new drugs. However, I feel that such a strategy is not sophisticated competition. In that sense, I agree with the Drug Supervisor about how to decide the drug price of authorised biologics in order to be in time for the drug price listing this June. However, this issue cannot be fully solved only with a price of 0.7. In cases where authorised biologics are launched, we should also consider how to deal with the drug price of substantially the same originator medicinal products’.

Finally, ‘As for 0.7, you are right, and there is a problem whether it is appropriate to multiply by 7 (sic) like with biosimilars, although authorised biologics are authorised without clinical trials and with no development cost. However, more than 0.7 would cause various harmful effects, and less than 0.7 would also raise problems’.

In response, Kenichi Tamiya, the Drug Supervisor of the Medical Economics Division, Health Insurance Bureau, MHLW, stated, ‘We are concerned that if pricing authorised biologics stagnates biosimilar development, this may cause a very negative impact from the perspective of reducing drug costs and promoting the R&D of biological medicinal products, including biosimilars. Sufficient attention is required to maintain an appropriate competitive environment’. He reiterated the need to ‘maintain an appropriate competitive environment’ and expressed concern that ‘pricing authorised biologics could hinder biosimilar development’.Footnote 30

The discussions continued at the Drug Price Special Committee of the CSIMC on 23 October 2019.Footnote 31 Tamiya, the Drug Supervisor, presented three ideas for a calculation rule for authorised biologics: (1) to multiply the drug price of the originator medicinal product by 0.5, as with a new generic; (2) to multiply the drug price of the originator medicinal product by 0.7, as with biosimilars; and (3) to have the same drug price as a succession item.

Committee members expressed the following opinions regarding these ideas: The originator company suggesting sales of authorised biologics to restrain the development and sales of biosimilars may not violate a rule, but it does bring a significant problem from the viewpoint of maintaining an appropriate competitive environment.

It was also stated that, ‘The most important thing is to set prices encouraging the development of biosimilars and to create an appropriate competitive environment. From this perspective, the drug price should be set. For example, biosimilars may be 0.7 times the drug price of originator medicinal products because of higher manufacturing costs, including R&D, than generics. In addition, we should maintain the motivation to develop biosimilars, which requires clinical trials and an appropriate competitive environment. Therefore, one option is to raise the drug price of authorised biologics, which do not require clinical trials, to a little higher than 0.7, which is different from the biosimilars’ 0.7. Then, regarding the drug price of originator medicinal products when their authorised biologics apply for authorisation, the relevant originator medicinal product should be priced at the same level as the authorised biologic at that time. However, considering sales competitiveness, it may be unavoidable to have a certain price difference’.

Finally, ‘It is very difficult to rate the biosameFootnote 32 to promote the development and launch of biosimilars, but a higher drug price than that of biosimilars would cause various problems, and the lower price would also cause problems. Therefore, for the time being, adopting the same price is painful but inevitable’.

On 22 November 2019, the Drug Price Special Committee of the CSIMCFootnote 33 agreed that the drug price of authorised biologics would be 0.7 times that of their originator medicinal products, like biosimilars.

The history of the authorised biologic of Nesp is as follows: On 5 August 2019, Kyowa Kirin Frontier launched an authorised biologic of Nesp, the first authorised biologic in Japan. However, contrary to the prediction that the authorised biologic of Nesp would overwhelm the market, the demand for Nesp’s biosimilars (Nesp BS) expanded. The supply of all three biosimilar companies, Kissei Pharmaceutical Co., Ltd., Mylan EPD, and Sanwa Kagaku Kenkyusho Co., Ltd., could not keep up with the strong demand. A nephrologist remarked, ‘Based on my feeling at the site, the BS, having a lower delivery price than the authorised biologic, appears to be penetrated due partly to reduction in the unit price of dialysis’.

Reportedly, with a reduction in the bundled payment of medical expenses in dialysis, the adoption of BS is accelerating, which seems related to the delivery price difference between BS and authorised biologics.Footnote 34

The JFTC has not issued any opinions on the AGs of small molecule products and biological medicinal products.

5 Implications for Japan

5.1 Differences Between the US, Europe, and Japan

As outlined above, the US, Europe, and Japan differ in terms of authorised biologics. Although the US issued a competition authority’s view on the AGs of small molecule products, no view on authorised biologics has been issued and examples of authorised biologics are few. Europe issued views on the AGs of small molecule products and authorised biologics by the pharmaceutical regulatory authorities, which consider competition when examining duplicate marketing authorisation applications. However, there are few examples of authorised biologics. Japan already has an example of authorised biologics, in which the CSIMC discussed and approved the drug price. However, in Japan, the JFTC has not expressed its view on the AGs of small molecule products or authorised biologics.

These differences may reflect the differences between the US, Europe, and Japan in terms of the timing and authorities of considering competition with respect to AGs, that is, the presence or absence of post-regulation by competition authorities and consideration of competition by pharmaceutical regulatory authorities.

Post-regulation by competition authorities is implementable in the US and Europe,Footnote 35 while in Japan, such post-regulation is less likely. This is mainly derived from the different ways of drug pricing. That is, in the USFootnote 36 and many European countries, drug prices are in principle determined by drug manufacturers, which enables the competition authorities to apply post-regulation regarding the impact of authorised biologics on biosimilars. In Japan, drug pricingFootnote 37 is conducted by the MHLW and CSIMCFootnote 38 under the national health insurance system, with the application of the government’s drug price standards (official prices at the retail stage). It is unlikely that the JFTC will point out that the drug price decided by the MHLW and CSIMC violates the Antimonopoly Act.Footnote 39 Although it may detect cartels of delivery prices, it is difficult to assume that the JFTC implements post-regulation.

Regarding the consideration of competition by the pharmaceutical regulatory authorities, neither the US FDAFootnote 40 Footnote 41 nor Japan’s MHLWFootnote 42 have approval authority from a competition standpoint. However, in Europe, the European CommissionFootnote 43 considers competition for duplicate marketing authorisation applications.Footnote 44In Japan, the MHLW and CSIMC consider competition at drug price listingFootnote 45after approval but before launch. This is clearly reflected in the repeated emphasis on ‘maintaining an appropriate competitive environment’ by Drug Supervisor Tamiya at the CSIMC.

5.2 Utilising the JFTC’s Expertise in Drug Pricing

5.2.1 Pre-simulation

Fundamentally, in drug pricing, the MHLW and CSIMC consider efficacy, safety, etc.,Footnote 46 and it is questionable whether they can consider competition.Footnote 47 If they do, the current practice needs to be improved.

That is, as long as the MHLW and CSIMC have less expertise in competition than the JFTC, it is advisable to formulate the systems to utilise the expertiseFootnote 48 of the JFTC, a competition expert, including its economic analysis. In fact, the JFTC enforces not only post-regulation conduct by detecting Antimonopoly Act violations, but also pre-evaluates regulations, targeting the establishment or alteration/abolition of regulations.Footnote 49 Applying the JFTC’s expertise to the current regulatory practices and operations and utilising it in drug pricing by the MHLW and CSIMC will make it easier to achieve ‘maintaining an appropriate competitive environment’. In assessing a drug price for authorised biologics and preventing biosimilar companies from giving up biosimilar development because they cannot recover their invested capital owing to the launch of the authorised biologics,Footnote 50 they could run simulations using a model to derive the relationship between the drug price, wholesale price, delivery price, and market share of authorised biologics and biosimilars, and predict how the profits of biosimilar manufacturers will change depending on the drug price setting. The cost of biosimilar manufacturers is predicted based on development costs, including clinical trials and manufacturing costs. Based on these results, the break-even point for biosimilar manufacturers can be determined. Through the above simulation, it will be possible to some extent to find a turning point at which drug price biosimilar companies are unlikely to recover their invested capital.Footnote 51 Drug Supervisor Tamiya’s proposal and committee members’ remarks at the CSIMC reached the 0.7 times drug price for authorised biologics and biosimilars after deliberating various factors.Footnote 52 This leaves the rest to a ‘competition under price-cap regulation’Footnote 53 Footnote 54 and can be evaluated as a ‘painful but inevitable decision’.Footnote 55 However, the JFTC’s expertise including economic analysis would allow more objective rather than intuitive evaluations and decisions.

The JFTC’s expertise can be used by applying the current system,Footnote 56 but establishing new systems is also worth considering, such as an opinion request system and opinion statement system (Article 79 of the Antimonopoly Act, Article 180(2) of the Patent ActFootnote 57) to provide an opportunity for the JFTC to express opinions on drug pricing. Similarly, systems of judicial research officials (Article 57 of the Court ActFootnote 58) and technical advisers (Article 92(2) of the Code of Civil ProcedureFootnote 59) could be instituted to enable them to hear expertise on competition from JFTC officials, academics and practitioners with deep knowledge of the Antimonopoly Act and obtain the expertise involved in the drug pricing discussion. Moreover, the findings of the US and European competition authorities may lead to an optimal solution, although the systems are largely different from the Japanese one.

5.2.2 Post-verification

In addition, any drug price decided through a pre-simulation should be post-verified. While the current legislation arranges post-verification by annual drug price surveys,Footnote 60 in this case, it is essential to verify the outcome of the sales of authorised biologics and biosimilars after setting the drug price of authorised biologics as 0.7 times the originator price. In the Nesp case, contrary to the prediction that authorised biologics of Nesp would overwhelm the market, Nesp BS expanded its demand, which could not be covered by the supply. This partially results from the success of the Japan Biosimilar Association’s lobbying activities,Footnote 61 but undoubtedly relies largely on the fact that the delivery price of Nesp BS was less expensive than that of Nesp AG, with the reduction of bundled dialysis medical expenses. Based on this, close attention should be paid to the sales of authorised biologics and biosimilars under fee-for-service medical expenses if the delivery price of authorised biologics is reduced to the same level as biosimilars. What should be done if in these cases authorised biologics are adopted more than biosimilars,Footnote 62 even though both drug prices are 0.7 times the originator price? It should be evaluated whether ‘an appropriate competitive environment’ is maintained under which biosimilars just lose the competition and should not receive further relief, or if ‘an appropriate competitive environment’ is lost, based on which the drug price of authorised biologics should be changed.Footnote 63

In addition, in conducting post-verification of whether ‘maintaining an appropriate competitive environment’ has been achieved, operational and institutional design should be built to utilise the expertise of the JFTC, which is a competition expert. The evaluation of ‘maintaining an appropriate competitive environment’ in the market of biological medicinal products is close to the evaluation in post-regulation routinely conducted by the JFTC; that is, an evaluation of the substantial restriction of competition or inhibition of fair competition in a certain trading field to determine whether or not it corresponds to a private monopolisation, an unreasonable restraint of trade, or unfair trade practices. Based on the above, the JFTC’s expertise can be used more directly.

5.3 Emphasis on Patient Choice and Quality of Healthcare in Drug Pricing

When considering competition in the drug pricing of authorised biologics, not only incentives to develop biosimilars but also patient access, quality of healthcare, therapeutic decisions by physicians, and patient choice, etc. must be considered.

The discussions at the CSIMC seemed to overemphasise the incentives to develop biosimilars, i.e., the protection of biosimilar companies. Fundamentally, the protection of incentives to develop biosimilars ultimately aims to reduce drug costs. When authorised biologics are priced at 0.5 times the originator price, such pricing might lower the total drug cost compared to setting it at 0.7 times, which has been apparently never examined.Footnote 64 This attitude would unavoidably provoke criticism that the national policy of promoting biosimilars has been overemphasised ahead of the ultimate goal of reducing drug costs.

From the viewpoint of patient choice and quality of healthcare, patients desire to obtain good quality medicines at a low price,Footnote 65 and for that purpose, authorised biologics priced 0.5 times the originator price seems more beneficial for patients.Footnote 66 However, the physician committee members gave no opinions to support this viewpoint. Taking advantage of the characteristic that the MHLW and CSIMC, the drug experts, consider competition and perform assessments in Japan, it may be necessary to examine the impact of authorised biologics with further emphasis on the factors of patient choice and healthcare quality.

Notes

- 1.

Bio kozokuhin no kaihatsu sokushin ni taisuru bio AG (kashou) ga ataeru eikyou ni tsuite [The Impact of Authorised Biologics (provisional name) on the Development and Promotion of Biosimilars (Report)], The Japan Biosimilar Association (16 May 2017).

- 2.

Bio iyakuhin to biosimilar (bio kozokuhin) ni kansuru Q&A [Q & A on biological medicinal products and biosimilars], The Japan Pharmaceutical Manufacturers Association, available at http://www.jpma.or.jp/medicine/bio/pdf/bio_03.pdf, last visited 7 February 2021.

- 3.

Yaku-1 Jiki yakkaseido kaiaku ni mukete (4) [Yaku-1 The next Reform of the Drug Price System No.4] The Drug Price Special Committee, CSIMC, MHLW at 41 (23 October 2019), available at https://www.mhlw.go.jp/content/12404000/000559485.pdf.

- 4.

Id. at 46.

- 5.

Id.

- 6.

Id.

- 7.

Id.

- 8.

At the Drug Price Special Committee of the CSIMC on 27 March 2019, the Chairman Hiroshi Nakamura stated the following: ‘Today, I am very concerned that biosimilars are so-called follow-on biologics, and biosames are so-called generic biological medicinal products. Since documents include both follow-on biologics and generic biological medicinal products with a different “generic” position, it may cause confusion. I believe that each committee member had a very appropriate discussion about biosames and biosimilars today, but in future, to avoid confusion, we should discuss their name not only at this CSIMC but also at other places’. Chuou shakai hoken iryo kyougikai yakka senmonbukai dai 151 kai gijiroku [No. 151 meeting minutes of The Drug Price Special Committee of the CSIMC], (27 March 2019), available at https://www.mhlw.go.jp/stf/shingi2/0000203254_00007.html, last visited 7 February 2021.

- 9.

Duplicate marketing authorisations for biological medicinal products, European Commission Health and Food Safety Directorate-General Pharmaceutical Committee (Nov. 7, 2019) available at https://ec.europa.eu/health/sites/health/files/files/committee/pharm780_duplicates_en.pdf. Here, it is stated that terms such as ‘autobiologicals’, ‘biosimilars’, ‘biogenerics’, ‘autobiosimilars’, ‘autogeneric’, ‘bioidentical’, ‘biosimilar generics’, etc. are used, which causes confusion.

- 10.

Drug Price Competition and Patent Term Restoration Act of 1984, Pub. L. No. 98–417, 98 Stat. 1585 (1984).

- 11.

Teva Pharm. Indus. Ltd. v. Crawford, 410 F.3d 51, 54 (D.C. Cir. 2005).

- 12.

Authorized Generic: An Interim Report, FEDERAL TRADE COMMISSION (June 2009) (‘FTC 2009’) available at https://www.ftc.gov/sites/default/files/documents/reports/authorized-generics-interim-report-federal-trade-commission/p062105authorizedgenericsreport.pdf.

- 13.

FEDERAL TRADE COMMISSION, supra note 10.

- 14.

- 15.

Biologics Price Competition and Innovation Act of 2009, Pub. L. 111–148, 124 Stat. 119, 804 (2010).

- 16.

The name ‘authorised biologics’ or ‘branded biosimilars’ is used.

- 17.

McGowan [7] predicts that interchangeables will not be launched until 2023.

- 18.

The European Commission has not adopted the document.

- 19.

OJ L 136, 30.4.2004, p. 30.

- 20.

Commission Directorate-General for Health and Consumers (DG SANCO, now DG SANTE).

- 21.

Handling of Duplicate Marketing Authorisation Applications, European Commission Health and Consumers Directorate-General (October 2011) available at https://ec.europa.eu/health/sites/health/files/files/latest_news/2011_09_duplicates_note_upd_01.pdf.

- 22.

The wording of ‘autobiologicals’ is used here.

- 23.

Handling of duplicate marketing authorisation applications of pharmaceutical products under Article 82(1) of Regulation (EC) No 726/2004, European Commission (5 March 2021) available at https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52021XC0305(01)&from=EN. last visited 10 May, 2021.

- 24.

The Nikkan Yakugyo (17 November 2014).

- 25.

【Kyowa Hakko Kirin】Nesp AG ga shounin shutoku—bio iyakuhin de wa hatsu [Nesp AG first authorised as a Biological Medicinal Product], Yakujinippo (21 August 2018), available at https://www.yakuji.co.jp/entry66762.html, last visited 7 February 2021.

- 26.

Biosimilar kyougikai ga kenkai—Bio AG sannyuu wa bio iyakuhin sangyou zentai no hatten wo sogai [Bio AG launch hinders growth of the Biological Medicinal Products Industry , MIX Online (17 May 2017), available at https://www.mixonline.jp/tabid55.html?artid=57513, last visited 7 February 2021.

- 27.

Bio AG, sangyo wo obiyakasu—BS kyougikai ga kenkai [Japan Biosimilar Association concerns Bio AG threatened Biological Medicinal Products Industry], Yakujinippo (23 May 2017), available at https://www.yakuji.co.jp/entry58194.html, last visited 7 February 2021.

- 28.

supra note 8.

- 29.

This means authorised biologics.

- 30.

Nesp no biosame toujou de touseki sijou wa saranaru kyousou he biosame wa 0.7 gake ni [Nesp Biosame to bring further competition in Dialysis Market—Biosame pricing at 70%] MIX Online (28 March 2019), available at https://www.mixonline.jp/tabid55.html?artid=67246, last visited 7 February 2021.

- 31.

Chuou shakai hoken iryo kyougikai yakka senmonbukai dai 158 kai gijiroku [No. 158 meeting minutes of The Drug Price Special Committee of the CSIMC], (23 October 2019), available at https://www.mhlw.go.jp/stf/shingi2/0000203254_00016.html, last visited 7 February 2021.

- 32.

This means authorised biologics.

- 33.

Chuou shakai hoken iryo kyougikai yakka senmonbukai dai 160 kai gijiroku [No. 160 meeting minutes of The Drug Price Special Committee of the CSIMC], (22 November 2019), available at https://www.mhlw.go.jp/stf/shingi2/0000203254_00018.html, last visited 7 February 2021.

- 34.

The Nikkan Yakugyo (26 November 2020).

- 35.

Alexander Roussanov (Partner of Arnold & Porter, former senior legal adviser in the Legal Department of the European Medicines Agency (EMA)) provided insight into the possible post-regulation by the European Commission's Directorate-General for Competition (DG COMP) after launch following a duplicate marketing authorisation by the European Commission.

- 36.

Kefauver [6: 16, 26] states, ‘The pharmaceutical industry is particularly susceptible to monopoly control due to its unique market structure’. In addition, ‘The usual laws of supply and demand do not apply here. Customers with a prescription can only purchase branded medicines prescribed by physicians’. He further criticises the high monopoly prices of pharmaceutical companies.

- 37.

Yakka seisaku kenkyukai [13: 138, 146] explains in detail the drug price system and its practice.

- 38.

Sato [11], based on the experience of actual engagement in revision discussions at the CSIMC, explains this in detail.

- 39.

Shiteki dokusen no kinshi oyobi kosei torihiki no kakuho ni kansuru horitsu [Antimonopoly Act] Act No. 54 of 14 April 1947, as last amended by Act No. 45 of 26 June 2019.

- 40.

Since the FDA does not have the authority to consider competition in the approval process, the act of excluding competitors using regulations, known as ‘Regulatory Gaming’, is considered to be manifested (Competition Policy Research Center of the JFTC ‘iyakuhin shijo ni okeru kyousou to kenkyu kaihatsu incentive—generic iyakuhin no sannyuu ga shijou ni ataeta eikyou no kenshou wo tsuujite—[Competition in the Pharmaceutical Market and R & D Incentives: Through Verification of the Impact of the Entry of Generic Drugs on the Market]’ 22 (2015), Dogan and Lemley [3: 708].

- 41.

The BIOSIMILARS ACTION PLAN of the FDA states—although not about the approval process itself—that the agency will focus on promoting innovation and competition in biological medicinal products and biosimilars. The FDA’s key actions for achievement include developing and implementing new tools for FDA approval to improve the efficiency of the review process and to provide more information on the FDA’s evaluation. (BIOSIMILARS ACTION PLAN Balancing Innovation and Competition, U.S. Food & Drug Administration (July 2018), available at https://www.fda.gov/media/114574/download).

- 42.

In reviewing the approval of pharmaceutical products, the Minister of Health, Labour, and Welfare considers matters related to quality, efficacy, and safety, and whether the methods to control manufacturing or the quality of the item at the manufacturing facility complies with the standards (Article 14(2) of Iyakuhin, iryokikito no hinshitsu, yukosei oyobi anzensei no kakuhoto ni kansuru horitsu [Pharmaceutical and Medical Device Act] Act No. 145 of 10 August 1960, as last amended by Act No. 63 of 4 December 2019.).

- 43.

The European Medicines Agency (EMA) adopted opinions based on scientific criteria for the evaluation of medicines, and the European Commission makes an administrative decision based on these opinions (Kenichi Hayashi Canary Wharf dayori—Oushuu iyakuhinnchou (EMA) nite-dai 1 kai 2010nen 1 gatsu [News from Canary Wharf —at the European Medicines Agency (EMA)—(1) January 2010] 27 January 2010), available at https://www.pmda.go.jp/int-activities/outline/0027.html, last visited 7 February 2021.

- 44.

According to Annex I.1 of the 2011 Commission note on the Handling of Duplicate Marketing Authorisation Applications, the first introduction of a generic product by the holder of the reference medicinal product (the originator medicinal product) can also improve the availability of a medicinal product. Furthermore, the Pharmaceutical Committee of the Directorate-General for Health and Food Safety (DG SANTE) and the European Commission on 7 November 2019 presented that the Commission launched a targeted consultation directed to stakeholders to seek their views on the impact of duplicate authorisations on the availability of biosimilars to healthcare professionals and patients. One possible consideration was that duplicate authorisations could have anticompetitive effects and undermine other treatment options available to patients. Dodds-Smith and Roussanov [2: 143] state that Article 82(1), which provides for duplicate authorisations, is seemingly based on the Commission’s belief that if more than one authorisation was granted for the same product, it would allow companies to ‘partition’ the single market, which sometimes occurred in the national authorisation system. They added that it was competition law concerns, rather than concerns relating to quality, safety, and efficacy (the assessment criteria governing the grant of marketing authorisation) that drove this policy. Alexander Roussanov (Partner of Arnold & Porter, former senior legal adviser in the Legal Department of the European Medicines Agency (EMA)) provided the insight that the European Commission considers competition at duplicate marketing authorisation.

- 45.

Unlisted drugs in the drug price standard are not reimbursed by insurance; therefore, drug manufacturers want the drug price listing, which enables regulations to work in a virtual environment at this stage as well.

- 46.

Notification No. 0207-1, issued by Health Insurance Bureau, Yakka santei no kijun ni tsuite [Criteria for drug pricing] (7 February 2020).

- 47.

On the other hand, if the MHLW and CSIMC never consider competition, it will not be considered in drug pricing. Because it is unlikely that the JFTC will post-regulate the drug pricing by the MHLW and CSIMC, drug pricing will take place without considering competition and problems may occur.

- 48.

See Kyousou seisaku de tsukau Keizai bunseki handbook [Economic Analysis Handbook Used in Competition Policy: CPRC Handbook Series No. 1], Competition Policy Research Centre of the JFTC (2012).

- 49.

Kisei no seisaku hyouka ni okeru kyousou joukyou heno eikyou no haaku bunseki ni kansuru kangaekata ni tsuite [Considerations on Understanding and Analyzing the Impact on Competitive Conditions in Regulatory Policy Evaluation], The General Secretariat, JFTC (31 July 2017).

- 50.

To evaluate ‘maintaining an appropriate competitive environment’, it is necessary to consider not only the situations of biosimilar companies but also those of the originator companies. That is, at how much the drug price of authorised biologics is set will the originator companies abandon the selling of authorised biologics, and maintain a balance between them. At the Drug Price Special Committee of the CSIMC on 25 September 2019, regarding AGs in general, the Drug Supervisor Tamiya stated the following, indicating the necessity of also considering the circumstances of the AG: ‘When authorised generics were launched, it was pointed out that the price of long-listed products should be lowered to the price of AGs. If a rule is set that the drug price of long-listed products is lowered to that of AGs, I have a concern whether the AGs will be licensed by the originator companies to launch, which needs consideration. In that case, licensing authorised generics and granting manufacturing and marketing approval of generic products may not occur, so we need to discuss this’. Chuou shakai hoken iryo kyougikai yakka senmonbukai dai 156 kai gijiroku [No. 156 meeting minutes of The Drug Price Special Committee of the CSIMC], (25 September 2019), available at https://www.mhlw.go.jp/stf/shingi2/0000203254_00014.html, last visited 7 February 2021.

- 51.

See Nagate [9: 13, 16–17]. It builds a simple market model for originator medicinal products and biosimilars, and analyses the source of profits of the biosimilar business. Nagate points out that if originator medicinal products have brand value, and the price of the originator medicinal products is equal to that of biosimilars, the market share of originator medicinal products may be 100%, because the originator medicinal products become dominant against biosimilars. On the other hand, even though the price of biosimilars is lower than that of originator medicinal products, the price of the originator medicinal products may remain high because there is no competition for price devaluation between the originator medicinal products and biosimilars, leaving a producer surplus for biosimilar manufacturers. This model will also be helpful in predicting the prices, market share, and producer surplus of authorised biologics that can inherit the brand value of the originator medicinal products and biosimilars. In Dubois and Lasio [4: 3685], the impact of drug price regulation on demand, margins, and costs of the originator medicinal products and generic products is estimated via an economic analysis using a model that explores the Nash equilibrium of Bertrand competition in France, where drug prices are regulated as in Japan. This estimation was made in the case where the drug price was regulated under the actual French system and in the case where the drug price was determined by the free market unlike the actual system. The cases were then compared. The estimates and comparisons clarified that the drug price of originator medicinal products is easily reduced by price constraints, which stimulates demand, and with a smaller wedge between originator medicinal products and generics, demand shifts from generics to the originator medicinal products, and drug costs will be reduced by an average of 2%, etc. In France, where as mentioned, drug prices are regulated as in Japan, a method for estimating demand, margins, and costs with a Bertrand competition model is used, which is helpful in predicting the demand, revenue, and cost of authorised biologics and biosimilars in Japan.

- 52.

Both payer and physician committee members at the Drug Price Special Committee of the CSIMC on 27 March 2019 questioned the following problem: ‘Although authorised biologics were approved without clinical trials and development costs, is it allowed to multiply it by 7 (sic) like for biosimilars?’ Here, the addition of 0.2 cannot be explained theoretically.

- 53.

Competition Policy Research Center, of the JFTC, supra note 42, at 69.

- 54.

In fact, since then, competition has emerged between the authorised biologic of Nesp and Nesp BS because of differences in delivery prices.

- 55.

First, drug prices should be derived deductively and should be calculated by policy judgment. The question of whether the drug price of authorised biologics should be multiplied by 0.7, 0.5, or 1 is based on the inductive idea of whether it should be the same as the drug price of biosimilars—i.e. 0.7—or be less or more expensive than that. Based on this idea, 0.7 times will be a standard, obsessed with that number.

- 56.

This is the said pre-evaluation system for regulations. The Coordination Division of the Economic Affairs Bureau of the JFTC coordinates with each ministry and agency to prevent the bills drafted and measures taken by each ministry and agency from limiting or hindering fair and free competition.

- 57.

Tokkyoho [Patent Act] Act No. 121 of 13 April 1959, as last amended by Act No. 3 of 17 May 2019.

- 58.

Saibanshoho [Court Act] Act No. 59 of 16 April 1947, as last amended by Act No. 44 of 26 June 2019.

- 59.

Minji Soshoho [Code of Civil Procedure] Act No. 109 of 26 June 1996, as last amended by Act No. 22 of 24 April 2020.

- 60.

For the reality of the drug price survey, see Yakka seisaku kenkyukai [13] supra note 39:138, 146.

- 61.

At the Drug Price Special Committee of the CSIMC on 27 March, 23 October, and 22 November 2019, the expert advisors on originator companies did not make particular remarks regarding authorised biologics. However, at the Drug Price Special Committee of the CSIMC on 25 September 2019, regarding AGs in general, the expert advisors on originator companies made the following remarks: ‘There were various discussions about AGs, but I think AGs promoted the replacement with generics in some aspects. Since AGs are not clearly defined in the drug price system, I desire careful discussion about changing the system from the perspective of AGs, including whether it is really appropriate’. Chuou shakai hoken iryo kyougikai yakka senmonbukai dai 156 kai gijiroku [No. 156 meeting minutes of The Drug Price Special Committee of the CSIMC], (25 September 2019), available at https://www.mhlw.go.jp/stf/shingi2/0000203254_00014.html, last visited 7 February 2021.

- 62.

It is unclear which drug spreads more widely under the fee-for-service system when both authorised biologics and biosimilars are priced at the same 0.7 times the drug price. The result may depend not only on differences in patient burden under the High-Cost Medical Expense Benefit System and economic incentives for medical institutions, but also on the preferences of patients and physicians in the qualitative differences between authorised biologics and biosimilars.

- 63.

While difficult to imagine in reality, theoretically, if the difference between the bundled payment and fee-for-service is pointed out as the main factor regarding whether authorised biologics are used more than biosimilars, it will be necessary to consider whether to allow flexible drug price calculation by intentionally making the drug prices of authorised biologics inconsistent between the bundled payment and the fee-for-service, even though the drug price is determined in units of biosimilars, etc., not after further subdivision (‘The criteria for drug price calculation’ (Health Insurance Bureau, supra note 48).

- 64.

The committee members’ remarks highlighted strong doubt regarding the scheme of authorised biologics, which might have hindered discussions on promoting authorised biologics.

- 65.

As the payer committee member stated at the Drug Price Special Committee of the CSIMC on 27 March 2019, ‘Providing drugs with firmer efficacy and safety at a low price would be the most desirable for patients’. Nagasaka [8: 109] also provides a general remark on the Japanese drug price system, stating, ‘From a financial viewpoint, drug compression would be welcomed to ease patients’ burden. However, from the viewpoint of patient access to the latest best medicines, low cost is not necessarily good’.

- 66.

The patient burden will be lower with the 0.5 times drug price of authorised biologics than the 0.7 times to which the High-Cost Medical Expense Benefit System is not applied. For example, insulin preparations, both insulin glargine (Lantus), an originator medicinal product, and insulin glargine BS, are not covered by High-Cost Medical Expense Benefit System. According to Nakamura [10: 41], ‘The High-Cost Medical Expense Benefit System applies to biologic medicinal products, which are expensive, and exempts patient burden from a certain amount or more. Therefore, even if originator medicinal products are switched to the biosimilars, the patient burden may not change’. In that case, the patient burden may not change for authorised biologics or biosimilars.

References

Dechert, L. L. P. (2011). The FTC finds that authorized generic drugs yield procompetitive benefits. Dechert On Points 65. https://s3.amazonaws.com/documents.lexology.com/742d89d3-2ac8-48f0-972c-cd88ebe2f526.pdf

Dodds-Smith, I., & Roussanov, A. (2020). Duplicate marketing authorisations in the EU: Evolution of the regulatory framework and practical implications. European Pharmaceutical Law Review, 4(3), 142–152.

Dogan, S. L., & Lemley, M. A. (2009). Antitrust law and regulatory gaming. Texas Law Review, 87, 685.

Dubois, P., & Lasio, L. (2018). Identifying industry margins with price constraints: Structural estimation on pharmaceuticals. American Economic Review, 108(12), 3685–3724.

Feldman, R., & Frondorf, E. (2016). Drug wars: A new generation of generic pharmaceutical delay. Harvard Journal on Legislation, 53, 500–561.

Kefauver, C. E. (1965). In a few hands: Monopoly power in America. Pantheon Books. Japanese edition: Kefauver, C. E. (1966). Shosuusha no te ni—dokusen tono tatakai no kiroku (trans: Ohara, K.). Takeuchi Shoten.

McGowan, S. (2021). The US biosimilar market: Predictions for 2021. https://pharmaphorum.com/views-and-analysis/biosimilar-market-predictions-2021/

Nagasaka, K. (2010). Nihon no iryou seido sono byouri to shohousen [Japanese medical system: Its pathology and prescription]. Toyo Keizai.

Nagate, T. (2018). Jigyou yosoku biosimilar business no micro keizaigakutekina kousatsu—Biosimilars: The new long listed products?—[Business forecast: Microeconomic consideration of biosimilar business–biosimilars: The new long listed products?]. Kokusai Iyakuhin Joho, 1098, 13–18.

Nakamura, H. (2018). Yakkaseido no kangaekata, tokucho to yakka wo torimaku kadai [Concepts and characteristics of the drug price system and problems around drug price]. In K. Oguro & T. Sugahara (Eds.), Yakka no keizaigaku [Economics of drug price] (pp. 27–47). Nikkei Publishing.

Sato, T. (2018). THE chuuikyou, sono hensen wo fumae kenkouhoken seido no ‘ima’ wo saguru [THE CSIMC, Exploring the ‘Now’ of the health insurance system based on the transition]. Yakuji Nippo.

Wong, H. K. & Norey, E. L. (2019). Will authorized biologics disrupt the market for biosimilars? Biosimilar Development. https://www.biosimilardevelopment.com/doc/will-authorized-biologics-disrupt-the-market-for-biosimilars-0001

Yakka seisaku kenkyukai (2020). Kaihoken to iyakuhin sangyo no mirai ni mukete –yakka seido 70 nen wo furikaeru [Toward the future of national health insurance and the pharmaceutical industry: Looking back on the 70 years of the drug price system]. Shakai hoken kenkyujo.

Acknowledgements

I thank Akira Negishi (emeritus professor, Kobe University), Kensuke Kubo (associate professor, Keio University Faculty of Business and Commerce), and Alexander Roussanov (Partner of Arnold & Porter, former senior legal adviser in the Legal Department of the European Medicines Agency (EMA)) for their helpful comments; Kosuke Uetake (associate professor, Yale School of Marketing) for providing helpful articles; and the Ministry of Health, Labour and Welfare and the Japan Fair Trade Commission for answering questions.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License (http://creativecommons.org/licenses/by-nc-nd/4.0/), which permits any noncommercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if you modified the licensed material. You do not have permission under this license to share adapted material derived from this chapter or parts of it.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2022 The Author(s)

About this chapter

Cite this chapter

Abe, T. (2022). Will Authorised Biologics Deter Biosimilars?—Utilising JFTC’s Expertise in Drug Pricing. In: Negishi, A., Wakui, M., Mariyama, N. (eds) Competition Law and Policy in the Japanese Pharmaceutical Sector. Kobe University Monograph Series in Social Science Research. Springer, Singapore. https://doi.org/10.1007/978-981-16-7814-1_11

Download citation

DOI: https://doi.org/10.1007/978-981-16-7814-1_11

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-16-7813-4

Online ISBN: 978-981-16-7814-1

eBook Packages: Law and CriminologyLaw and Criminology (R0)