Abstract

This chapter defines the building blocks of Web3 to explore its implications for sustainable democracy. It explains the crash of the Terra ecosystem and compares it with the implosion of FTX, both to underscore the dark side of networks built on blockchain technology and to illuminate how all cryptocurrencies (crypto), as well as all investors, are not created equal. The chapter weighs the costs and benefits of crypto and decentralized finance (DeFi) at the present moment and explores emergent regulation. It argues that cryptocurrencies and DeFi will only serve democracy if governments and international organizations establish the right incentive structure for innovators and safeguards for investors in this space.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

1 Introduction

The sensational release in late 2022 of ChatGPT and its subsequent iteration GPT-4 shifted the world’s attention from Web3 to generative AI. Yet the new tools made possible by generative pretrained transformers will be developed in a world of Web3 possibilities. If technology is to serve humanity rather than privileged plutocrats, a basic understanding of the promise of Web3 innovations is imperative. The challenges stem from the technological complexity of recent developments, Digital Humanism values the rights and lived experiences of all human beings, not just the technologically proficient. The future of democracy and freedom in the years ahead depends on a digitally competent public.

This chapter starts by considering the worldview of the sovereign individual, one that sheds considerable light on one instantiation of Web3 development. It then explores the reasons for the crash of the crypto market in May 2022, considering the regulatory reaction to those developments for the future of blockchain technologies and related decentralized applications (dApps). The penultimate section considers the ownership ecosystem for Bitcoin, the sole cryptocurrency that has yet to be hacked on-chain. The chapter concludes with an assessment of the democracy-enhancing features of Web3, which stand in opposition to the autocratic aspects that crypto and DeFi have highlighted to date.

2 The Sovereign Individual

AI could theoretically make it possible to centrally control an entire economy. It is no coincidence that AI is the favorite technology of the Communist Party of China. Strong cryptography, at the other pole, holds out the prospect of a decentralized and individualized world. If AI is communist, crypto is libertarian.

—Peter Thiel

Preface to The Sovereign Individual, January 2020

Is Peter Thiel right? Are crypto and other blockchain technologies a boon to the free world? The simple answer to this question is both yes and no—yes in that encryption is a comparative advantage for free societies and it allows for innovation that is decentralized, at least in theory, and no in that what has transpired to date has been anything but focused on human flourishing. The claim that decentralized finance will serve ordinary humans by cutting out the middleman, thereby bolstering democratic values, has not yet panned out in practice.

To be fair, Peter Thiel might even agree with my short answer. He concludes his preface to the latest edition of The Sovereign Individual by predicting an outcome somewhere between centralized control and decentralized effervescence:

The future may lie somewhere between these two extreme poles. But we know the actions we take today will determine the overall outcome. Reading The Sovereign Individual in 2020 is a way to think carefully about the future that your own actions will help to create. It is an opportunity not to be wasted. (Thiel, p. 9)

I chose to open this chapter with claims delineated in The Sovereign Individual, because they provide a window on the minds of both Elon Musk and Peter Thiel. If you want to understand why they are obsessed with New Zealand, crypto, and space travel, this is a good place to start.

Who is the sovereign individual of the information age?

The new Sovereign Individual will operate like the gods of myth in the same physical environment as the ordinary, subject citizen, but in a separate realm politically … the Sovereign Individual will redesign governments and reconfigure economies in the new millennium. The full implications of this change are all but unimaginable. (Thiel, p. 20)

As the pandemic and the move to remote work made clear, most wealth can be earned and spent anywhere. Investors move money with a key stroke across national boundaries. Remote workers and remote-first organizations without headquarters challenge existing taxation regimes. According to The Sovereign Individual, this means that “governments that attempt to charge too much as the price of domicile will merely drive away their best customers” (Thiel, p. 21). The nation-state, as a nexus of power, will be eclipsed by sovereign individuals. With this worldview, space is the place where you can create your own rules and personalized tax shelters. The most likely beneficiaries of an increasingly complex adaptive global system will not be the nation-state, or the EU, but sovereign individuals. They will hold the keys to power and governance.

Donald Trump is a sovereign individual, as is his booster, Peter Thiel, but so are Jeff Bezos and Mark Zuckerberg.

Viewed from the vantage point, cyberspace is the ultimate offshore jurisdiction, making the market for crypto a virtual reality, detached from geographical space. Transactions take place, but in what country should they be regulated? Who has jurisdiction? This is the brave new world of Web3, which will present unique new challenges for governance.

Web3 can mean different things to different people. When I use the term, I refer to the network of decentralized databases and the connections between them (blockchains). Web1 was a read/write only world, that of the worldwide web and blogs. Web2 is the interactive version of the Internet we know today. It is the world of social media, of search, and of e-commerce. Web2 is the world of big tech and central authority, a world in which top-down censorship is possible. Indeed, the ultimate manifestation of this reality was the de-platforming of a freely elected US president by the major technology platforms after MAGA (Make America Great Again) extremists stormed the US Capitol in January 2021.

In contrast, in the ideal-type Web3 world, each of us becomes a sovereign individual, cutting out banks and all middlemen, answering only to ourselves and to our own unique needs and preferences. Technology allegedly makes possible a variant of decentralized authority that does not require trust to provide order. Or at least that is the claim.

3 Welcome to the Web3 World

For Mark Zuckerberg, in contrast, Web3 is the metaverse, the virtual 3D planet that blockchain technologies and scientific breakthroughs in both artificial intelligence and chip design will make possible.

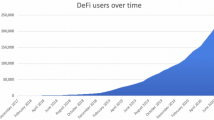

Whether metaverse or sovereign individual, decentralized finance is the engine of opportunity for the Web3 ecosystem. Decentralized finance, also known as DeFi, uses cryptocurrency and blockchain technology to manage financial transactions. It aims to democratize finance, at least in theory, by replacing legacy, centralized institutions, such as banks, with peer-to-peer relationships. With DeFi, in theory, I can conduct all my financial transactions, from everyday banking, loans, and mortgages to complicated contractual relationships and asset trading without the assistance of banks or brokerages.Footnote 1 In practice, I still need a bank as an intermediary to cash out or buy crypto, even with a self-custody wallet.

What is a blockchain? A blockchain is a shared digital database or ledger that makes Web3 possible. It stores transactions in immutable, chronological sequences of cryptographically linked blocks secured by consensus mechanisms, such as proof of work (Bitcoin and Ethereum in its first incarnation) or proof of stake (most other cryptocurrencies). Blockchains can ensure data integrity and trust in a peer-to-peer network without central authority because of their radical transparency. One can literally read the blockchain to follow the money when transactions take place between self-custody wallets.

Cryptocurrencies are made possible by blockchains. All cryptocurrencies are digital phenomena. Transactions in a particular cryptocurrency are verified and records maintained by a decentralized system using cryptography. Any sovereign individual can set up their own cryptocurrency. The key question is whether a particular cryptocurrency ecosystem has valuable applications associated with it that can be monetized or whether it is a store of value for the long run, like gold.

Bitcoin is the first decentralized cryptocurrency, introduced in 2009 by Satoshi Nakamoto, a pseudonym for either an individual or a group whose identity remains secret to this day. It operates on a peer-to-peer network and relies on a proof of work consensus mechanism to keep the blockchain secure and transparent, so that users can add new transactions to it. The proof-of-work consensus algorithm uses complex problems for miners to solve using high-powered computers. The problems are solved using trial and error. The first miner to complete the puzzle or cryptographic equation gets the authority to add new blocks to the blockchain for transactions. When the block is authenticated by a miner, the digital currency is then added to the blockchain. The miner also receives compensation with coins. Proof of work is energy-intensive but the least hackable. While numerous crypto exchanges trading Bitcoin have been hacked, there has never been a Bitcoin blockchain hack.Footnote 2

Bitcoin is distinctive due to its pioneering status but also because of its limited and fixed supply of 21 million coins. Since new Bitcoin cannot be created after those 21 million coins have been mined, it has a unique potential as a digital store of value, referred to by some as digital gold. With Bitcoin and a self-custody wallet, you have assets that no one can seize, since your valuables reside in cyberspace, not physical space (unless someone successfully tortures you to reveal your unique key.)

All other cryptocurrencies, often referred to as altcoins, are digital currencies created after Bitcoin. While Bitcoin focused on being a digital store of value and a means of payment, in contrast, altcoins are designed to enable a wide range of applications, such as smart contracts, decentralized finance, privacy solutions, and non-fungible tokens (NFTs). The most popular of these is Ethereum.

Ethereum first used proof of work, like Bitcoin, to keep its blockchain secure. It has recently successfully made a glitch-free transition to proof of stake, which amounts to an engineering triumph on a massive scale. As a result of this merger, Ethereum is more sustainable, energy-wise, and more versatile in terms of its potential applications, but less secure, relatively speaking. Other cryptocurrencies based on proof of work have been hacked, although this does not necessarily mean Ethereum is destined to be hacked. It depends on the ingenuity of the cryptographic mechanism.

Why does this distinction between proof of work and proof of stake matter for the world of decentralized finance?

Put simply, it is difficult to build dApps on top of the Bitcoin blockchain.Footnote 3 You can build them more easily on Ethereum and on many other cryptocurrency blockchains. What sort of dApps might be built is up to the human imagination.

As a result, the best way to think about Web3 is that it is a new technology that is just at the beginning of its development curve. Where it will go is anybody’s guess, but the money will be made by what people build on top of the blockchain, just as the money for Web2 was made through the social media platforms built upon it.

4 Why Did the Crypto Market Tank in May 2022?

As we have seen, blockchains and their related products are genuine technological innovations in search of a killer application. So why do so many smart people think crypto is a Ponzi scheme?

The simple answer is that for ordinary investors, most of the crypto ecosystem is a Ponzi scheme, albeit a technologically sophisticated one.

To illustrate this simple fact in the most objective way possible (there is a lot of fake news in the crypto world), let’s take the case of Terraform Labs, whose meltdown in May 2022 catalyzed the collapse of the crypto market culminating in the spectacular flameout of FTX and Alameda Research and the arrest of the principals in those two ventures. It’s a great case to illustrate who bears the risk of tech failure in the Wild West, free market world of decentralized finance as initially conceived.

What was Terraform Labs attempting to do?

The South Korean entrepreneur Do Kwon co-founded Terraform Labs in 2018. Terraform Labs is the company that created the Terra blockchain, which aimed to provide a more efficient and user-friendly financial infrastructure through the deployment of algorithmic stable coins. Its signature cryptocurrency was called Luna. Unaware of the potential for irony, fans and supporters of Luna called themselves lunatics.

The value of all fiat money government-issued currency—typically, that is not backed by a physical commodity like gold or silver—is and always has been a function of the degree of trust humans have in it as a store of value. Even the US dollar today is fiat money, as it is no longer backed by gold. In other words, the dollar today does not have intrinsic value, as does a gold or a silver coin. The US dollar is a favored store of value only because people trust it to remain valuable for the foreseeable future.

The interesting question Do Kwon asked was, “How can I create a cryptocurrency where technological innovation builds trust and hence value?”

Do Kwon’s innovation was the introduction of programmable money, which enabled a suite of stable coins pegged to various traditional fiat currencies, such as the US dollar and the South Korean Won. The Luna-based stable coin (TerraUSD) was pegged to the US dollar. TerraUSD was stable because it would always be worth 1 dollar. But it couldn’t be traded in for USD, like other stable coins, such as Tether. Instead, it derived its stability from algorithms within the Luna ecosystem that kept it stable—that was Do Kwon’s innovation. Faith in Do Kwon’s algorithms was to replace faith in the USD.

Do Kwon thought that such a creation would be attractive to investors, especially since investors often use stable coins to buy and sell riskier assets.

He was right. He hired the best and the brightest to pursue his vision. Riding high in early 2022, he inked a $40 million deal with Major League Baseball’s DC-based team, the Washington Nationals.Footnote 4 He mocked a British economist who criticized TerraUSD’s design by saying that he doesn’t “debate with poor people.”Footnote 5

In April 2022, Luna’s price rose to a peak of $116 from less than $1 in early 2021, minting a new generation of crypto millionaires. LUNA, TerraUSD (UST) and other tokens in the Terra ecosystem had a total market cap of more than $60 billion.Footnote 6 Do Kwon’s daughter was born in April, and he named her, fatefully, Luna.Footnote 7 Everything was breaking Do Kwon’s way.

And then a combination of economic factors caused Luna’s value to plummet, and Do Kwon’s algorithms, much to his own apparent surprise, failed to keep TerraUSD at $1 as promised. A death spiral for the entire Terra ecosystem then set in, as Luna plummeted to near zero, with TerraUSD becoming wildly untethered from the USD for all the world to see. TerraUSD had previously become unpegged in May 2021, but it had recovered its value in a matter of several days. At the time, Do Kwon cited this recovery as a signal of the robustness of his algorithmic concept. In May 2022, however, TerraUSD did not recover. All the decentralized applications that developers had built within that ecosystem suddenly had no value either.

All the action for crypto markets is on Twitter. When one high-profile trader, @GiganticRebirth, who also goes by GCR (an acronym for Gigantic Cassocked Rebirth), announced he was shorting Luna $10 million, it was a red flag to many other traders that something was amiss. GCR proved to be right—and made a ton of money to boot.

The Terra ecosystem crash had a domino effect on the entire cryptocurrency market, with prices suddenly plummeting, even the unhackable Bitcoin losing 16% of its value in a single week.

But what slowly became terribly and tragically clear was that the normal investors (somewhat patronizingly referred to as “normies” by high-stakes crypto traders) were the ones who took the biggest hit. Ordinary investors who had invested their life savings to cash in on what seemed like a path to instant riches were suddenly bankrupt. The creators of the Terra ecosystem, in contrast, were not impoverished. They managed to move some of their money out of harm’s way, furthering the death spiral.

After Luna’s collapse, Do Kwon conveniently moved his base of operations to Singapore before being served with a South Korean arrest warrant. The Korean Ministry of Foreign Affairs revoked his passport. In April 2023, Do Kwon was arrested boarding a flight to Dubai from Podgorica with a forged Costa Rican passport. At the time of this writing, both American and South Korean law enforcement seek his extradition. In the United States, the SEC has charged him with criminal fraud, but Do Kwon continues to insist that TerraUSD was a currency, not a security, and hence not within the SEC’s jurisdiction. He is currently imprisoned in Montenegro, awaiting resolution of where he will stand trial.Footnote 8

Things spun downward from Do Kwon’s demise, and 6 months later, the cryptocurrency exchange FTX US declared bankruptcy on November 11, 2022. FTX founder Sam Bankman-Fried (SBF) was arrested in the Bahamas on December 12, 2022, and shortly thereafter extradited to the United States, where he remains under house arrest prior to his trial. As of March 2023, SBF faced twelve counts of criminal fraud, including charges that he defrauded the Federal Elections Commission, committed wire fraud, and engaged in money laundering.Footnote 9 His closest associates have surrendered to the authorities and are cooperating with the prosecution in exchange for relative leniency.

In a world where states still control passports and their borders, there are apparently still limits to the power of the sovereign individual. SBF was found guilty on seven counts of fraud and conspiracy in early November 2023. He faces up to 110 years in prison.

5 Are Crypto and DeFi Democratic?

Do the developments I have just sketched for you bode well for democracy? It all depends on us. Crypto and decentralized finance could be democratic if the powerful wanted it to be and if we, the people, insisted upon it. In an ideal world, public education could teach every citizen to read the blockchain, and since transactions are all traceable in Web3, citizens could then collectively keep their elites honest.

Theoretically, crypto could allow for remittances from foreign-based nationals to their home countries without a series of middlemen reducing the value of money wired back home. It could allow us to execute smart contracts without having to pay out huge sums to lawyers.

But elites always figure out a workaround or hack. And current signs suggest that the real world differs enormously from the theoretical ideal. For starters, if you invest your money in an exchange such as FTX or Coinbase, individual transactions are transparent and visible on-chain, but just who is making them becomes impossible to track.

The SEC, Treasury Department, and other US oversight bodies are still trying to figure out how to regulate crypto. In August 2022, Treasury and the SEC sanctioned so-called virtual currency mixers, Blender and Tornado Cash. According to the SEC:

Tornado Cash (Tornado) is a virtual currency mixer that operates on the Ethereum blockchain and indiscriminately facilitates anonymous transactions by obfuscating their origin, destination, and counterparties, with no attempt to determine their origin. Tornado receives a variety of transactions and mixes them together before transmitting them to their individual recipients. While the purported purpose is to increase privacy, mixers like Tornado are commonly used by illicit actors to launder funds, especially those stolen during significant heists.Footnote 10

The SEC reported that the largest heist was the $455 million stolen by the Lazarus Group, a North Korean-backed hacking organization with ties to terrorism and organized crime.

Regardless of where one resided or conducted business, using a virtual currency mixer such as Tornado Cash violated the law and was subject to prosecution. In other words, even though crypto is a global phenomenon, the SEC has not restricted its perceived jurisdiction to US territory alone.

At Congressional hearings in fall 2022, Senator Patrick Toomey (Republican-Pennsylvania), one of the seven Republicans who voted to impeach Donald Trump at the second impeachment trial, challenged SEC Chairman Gary Gensler to clarify which cryptocurrencies were considered securities and therefore subject to regulation by the SEC and which were not.Footnote 11 Gensler has said that Bitcoin is not a security, and some of his colleagues have said that Ethereum is not a security, but he has not indicated where and why the line is drawn as to which cryptocurrency ecosystems are considered securities. Developers therefore don’t know which ecosystems fall under the jurisdiction of the SEC and which do not, which has had a chilling effect on dApp building and innovation.

To make matters more complicated still, should the American SEC really be the entity ruling on what is ostensibly a global issue? Both the Wall Street Journal Editorial Board and the SEC Inspector General have criticized Gary Gensler’s “fast-and-furious” rulemaking.Footnote 12 As stands, it looks like US regulators may be calling the shots in this market, which may be necessary in volatile times, but it is also hegemonic rather than democratic.

In the United States, Americans seem to have learned that crypto is not a prudent investment vehicle for the Main Street investor. Polling results from March 2023 indicate that 75% of Americans “say they are not confident that current ways to invest in, trade or use cryptocurrencies are reliable and safe.”Footnote 13 The Wall Street investor, however, may have learned a different lesson. Bitcoin might be a hedge store of value against inflation for those with the means to move money around quickly. Regulation has not yet been forthcoming from Congress, although it has been proposed by Republicans.Footnote 14

In contrast, in Europe, the EU is in the process of bringing crypto-assets issuers and crypto-assets service providers under a harmonized regulatory framework that aims to support innovation and fair competition while preventing fraud.Footnote 15

The global distribution of crypto ownership has certainly changed since China banned cryptocurrencies that were not sanctioned by the Communist Party in 2017 and, by extension, Chinese cryptocurrency exchanges. China’s crackdown intensified in 2021, when China banned Bitcoin trading and mining, after which many miners moved operations to other countries. Prior to the ban, China had been a significant player in Bitcoin mining.

It is hard to determine Bitcoin ownership by country since crypto wallets are virtual and are not physically domiciled in any given territory. In the Bitcoin market, there are “whales” who hold significant amounts of Bitcoin, and while the distribution of ownership is difficult to assess, it is imminently clear that a few addresses own a large percentage of the total supply. If ownership of assets is plutocratic, decentralized finance becomes a contradiction in terms.

6 Conclusions

In the realm of theory, cryptocurrencies and decentralized finance sound like fiercely democratic forces, a weapon of the common man. DeFi, after all, claims to democratize finance.

In practice, they threaten to further centralize wealth and power in the hands of the few, for three reasons:

First, risk is currently borne by ordinary investors. Technological innovations before they reveal their real value are always risky propositions. As the crash of the crypto market showed, the risk was primarily borne by ordinary investors, as major players were able to hedge their bets and move their assets in a timely fashion. Estimates by the SEC say that Do Kwon cashed out $80 million every month before the LUNA and UST collapse.Footnote 16

Second, the spoils go to the already wealthy. The big winners in the crypto space have been investors and traders with sufficient funds and expertise to skillfully engage in high-stakes arbitrage. Anyone who had funds in FTX or Coinbase was and is prevented from moving quickly enough to benefit from rapidly changing and volatile markets, but fund managers were not similarly impeded.

Finally, the decentralized ironically winds up being centralized. Especially after the crypto crash, decentralized finance, given the nature of the major players in the space, is anything but decentralized.

The good news is that if we keep our eyes wide open as blockchain applications are further developed, we could see mind-blowing new things created beyond our wildest dreams of the present moment.Footnote 17 Just 10 years ago, for example, who would have thought we could instantaneously communicate with friends and family around the world for free? As Jaap Gordijn argues in this volume, blockchain technologies have the potential to promote fairness and equality in our digital ecosystems.

In conclusion, the main message I would like to leave you with is this: Blockchain is a technological innovation whose killer application has yet to emerge. It is something to watch—as are the moves of the Big Technology companies in this space. One thing is clear: in a world without data dignity and respect for human plurality, the strong will continue to do as they can and the weak as they must. Given existing wealth disparities, such a world will not be one that most want to live in.

Discussion Questions for Students and Their Teachers

-

1.

What are the likely similarities between Web2 and Web3? What are the likely differences? Why might they matter for global politics?

-

2.

A friend of yours asks you if cryptocurrency is a good investment. How would you advise them?

-

3.

Are crypto and DeFi democratic? If your answer is yes, what steps should be taken to cultivate further an ecosystem of equals? If your answer is no, what policies would you recommend for democratizing Web3?

-

4.

Should the market for cryptocurrency be under US oversight and jurisdiction? Should Europe accept such a state of affairs? What steps might the EU take to move toward genuine co-governance of Web3?

-

5.

What rules might encourage innovation while containing winner-take-all dynamics in the global economy? Whose rules should they be?

Learning Resources for Students

For readers interested in doing a bit of self-organized on-chain analysis, the following sources are worth consulting in June 2023 (this is a rapidly evolving landscape):

-

1.

Coin Metrics. Coinmetrics is an important source for on-chain data and analysis on various cryptocurrencies, including Bitcoin. Their regular reports and research articles provide valuable insights into the Bitcoin ecosystem: Coin Metrics

-

2.

Glassnode. Glassnode offers comprehensive on-chain data analytics for Bitcoin and other cryptocurrencies. You can find various metrics and charts related to Bitcoin wealth distribution, market behavior, and other trends: Glassnode

-

3.

Chainalysis: Chainalysis provides blockchain data and analysis. They provide valuable insights into various aspects of the cryptocurrency ecosystem including country-specific trends and ownership distribution: Chainalysis

-

4.

Cambridge Center for Alternative Finance (CCAF): CCAF regularly publishes research on the cryptocurrency industry, including mining activities and geographic distribution. Their Global Cryptoasset Benchmarking Study is particularly valuable: CCAF publications - Cambridge Centre for Alternative Finance

-

5.

Coin Dance: Coin Dance is a community-driven platform that provides Bitcoin statistics, including data on node distribution, mining, and development within the Bitcoin ecosystem. Coin Dance

-

6.

On data dignity, see There Is No A.I. | The New Yorker and Jaron Lanier, Who Owns the Future? (Lanier, 2013).

-

7.

On plurality, see GETTING-Plurality, Plurality: Technology for Collaborative Diversity and Democracy and The Collective Intelligence Project.

-

8.

On the sovereign individual, see James Dale Davidson and William Rees-Mogg, The Sovereign Individual (Touchstone, 1999/2020). Preface to the second edition by Peter Thiel.

-

9.

For windows on a brighter Web3 future, see Allen, Danielle, Eli Frankel, Woojin Lim, Divya Siddarth, Joshua Simons, and E. Glen Weyl. “Ethics of Decentralized Social Technologies: Lessons from the Web3 Wave.” Edmond & Lily Safra Center for Ethics, Harvard University, March 20, 2023, Putting Flourishing First: Applying Democratic Values to Technology - GETTING-Plurality and Decentralized Society: Finding Web3’s Soul.

Notes

- 1.

What Is DeFi? Understanding Decentralized Finance – Forbes Advisor.

- 2.

- 3.

For a noteworthy exception, see Bitcoin Ordinals (https://www.forbes.com/sites/digital-assets/2023/05/24/bitcoin-ordinals-are-the-next-big-thing-in-crypto/?sh=132702c873b0).

- 4.

Terra Signs 5-Year, $40M Sponsorship Deal With MLB Team Washington Nationals - Decrypt.

- 5.

TerraUSD founder Do Kwon mocked an economist for being 'poor' after she criticized his cryptocurrency—which is now collapsing.

- 6.

How Far We’ve Fallen: Lessons Learned in the Aftermath of the Terra (LUNA) Ecosystem Crash | Nasdaq.

- 7.

They Made Millions on Luna, Solana and Polygon: Crypto’s Boom Beyond Bitcoin - The New York Times.

- 8.

Do Kwon, Jailed Crypto CEO, Rejects SEC Fraud Allegations - WSJ; Crypto Crisis: A Timeline of Key Events – WSJ.

- 9.

- 10.

U.S. Treasury Sanctions Notorious Virtual Currency Mixer Tornado Cash.

- 11.

- 12.

Gary Gensler’s Bad Performance Review – WSJ.

- 13.

Americans view crypto investing as unreliable. They’re right.

- 14.

Crypto bill from Republicans lays out clear roles for SEC and CFTC.

- 15.

PE-CONS 54/22 KHO/cc ECOFIN and Digital finance: agreement reached on European crypto-assets regulation (MiCA).

- 16.

Terra’s Do Kwon cashed out over $80 million per month before LUNA and UST collapse.

- 17.

For windows on a brighter Web3 future, see Allen, Danielle, Eli Frankel, Woojin Lim, Divya Siddarth, Joshua Simons, and E. Glen Weyl. “Ethics of Decentralized Social Technologies: Lessons from the Web3 Wave.” Edmond & Lily Safra Center for Ethics, Harvard University, March 20, 2023, Putting Flourishing First: Applying Democratic Values to Technology—GETTING-Plurality and Decentralized Society: Finding Web3’s Soul.

References

Allen, D., et al. (2023). Ethics of decentralized technologies: Lessons from the Web3 Wave. EJ Safra Center for Ethics, Harvard University.

Davidson, J. et al. (1999). The sovereign individual, Touchstone. Preface to the second edition (2020) by Peter Thiel.

Lanier, J. (2013). Who owns the future? Simon & Schuster.

Weyl, E., et al. (2022). Decentralized society: Finding Web3’s Soul. Social Science Research Network.

Zalesne, K. et al. (2023). Putting flourishing first: Applying democratic values to technology. Research Brief, GETTING-Plurality Research Network, Harvard University.

Acknowledgments

The author would like to acknowledge the support of GPT4 in researching and formatting this paper. Jachym Kraus, Woojin Lim, and two insightful reviewers also helped me improve my first iteration pronouncement on this rapidly changing global ecosystem.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2024 The Author(s)

About this chapter

Cite this chapter

Stanger, A. (2024). Are Cryptocurrencies and Decentralized Finance Democratic?. In: Werthner, H., et al. Introduction to Digital Humanism. Springer, Cham. https://doi.org/10.1007/978-3-031-45304-5_32

Download citation

DOI: https://doi.org/10.1007/978-3-031-45304-5_32

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-45303-8

Online ISBN: 978-3-031-45304-5

eBook Packages: Computer ScienceComputer Science (R0)