Abstract

Decentralized finance is financial services offered on a public blockchain over the internet. This paper reviews the decentralized finance (DeFi) research and development around the world. The findings of the literature review are that decentralized finance offers many benefits such as broadening financial inclusion; encouraging permission-less innovation; eliminating the need for intermediaries; ensuring the immutability of transactions; censorship resistance and making cross-border transactions cheaper. The associated risks include execution risk in smart contracts, legal liability risk, data theft risk, interconnectedness risk, external data risk, and greater propensity for illicit activity using DeFi applications. The review of existing DeFi research show that there are few studies on DeFi, and a large number of DeFi research studies are non-empirical studies. Most studies hold a positive view about DeFi. They emphasize the benefits of DeFi in great depth but the challenges of DeFi were not analysed in great depth, and there are no critical studies on DeFi. Observations on DeFi developments from around the world show that there is growing interest in decentralized finance in Europe, US, Asia and Oceania. There are concerns that regulating decentralized finance can impede growth in decentralized finance markets in Asia. There are also concerns that banning crypto assets can hinder the growth of decentralized finance in African countries where regulators do not fully permit blockchain-enabled cryptocurrencies. Several policy issues associated with DeFi are discussed. Areas for further research are provided to advance the literature on decentralized finance.

Similar content being viewed by others

1 Introduction

The purpose of this paper is to review the existing research and developments on decentralized finance. The paper summarizes the existing research and developments in decentralized finance to help academics and policymakers assess the viability, strength, weaknesses and implementation challenges of decentralized finance so that they can make informed judgement on whether or not decentralized finance is a worthy innovation to endorse while growing the literature. This review also aims to identify fruitful areas for future academic research on decentralized finance.

The recent boom in decentralized finance arose from disruptive transformations in digital finance. Digital finance is a segment of finance that offer financial services to users over the internet through digital devices and platforms [37]. Decentralized finance goes a step further by offering digital financial services on a public database known as blockchain over the internet. A blockchain is a database that records information that cannot be changed once recorded [15, 45]. It is often described as a digital ledger of duplicate transactions that are spread across many computer networks [2, 40]. Decentralized finance operates on blockchain technology, and the advantages of blockchain technology to users is that it eliminates delays and failure of intermediaries, it reduces the cost of transactions, and reduces credit risk when used in lending [6, 44, 19]. An example of products formed out of blockchain technology include Bitcoin, Ethereum, Litecoin, Cardano, Polkadot, Bitcoin Cash, Stellar and Chainlink.

Decentralized finance is enabled by blockchain technology, and there has been a general tendency by practitioners and researchers to over-emphasize the benefits of decentralized finance without paying adequate attention to the associated risks and challenges. This can raise skepticism about the net value (that is, the risk-adjusted benefit) of decentralized finance. Furthermore, because technology is imperfect, users of blockchain products are expected to understand the benefits and risks of blockchain technology and use their judgment to minimize their individual exposure to potential downside risks. These expectations, whether or not users take them seriously, may create an expectation gap which then becomes a subject for academic research and policy debate in the decentralized finance literature.

To address the expectation issue, there needs to be a complete and holistic understanding of the decentralized finance concept and the decentralized finance ecosystem. Such knowledge or understanding can provide researchers with useful information which they can use to identify good gaps in the literature. It can also offer policymakers insights that can improve their policy formulation and decision making for decentralized finance. Therefore, a central question for academics and policymakers is (i) what is decentralized finance? (2) what are the risks, opportunities and benefits of decentralized finance? (3) what is the state of decentralized finance at the global level and what are the notable developments so far? (4) what can we learn from existing research in decentralized finance? (5) what are the issues that policymakers and regulators would face when implementing DeFi (6) what areas should future research explore to extend the DeFi literature? Are there good gaps to fill in the literature?

This review paper is structured around these 6 broad questions. The findings show that existing academic research in decentralized finance is very scant, much of the research studies are less rigorous and they do not provide significant analysis that can help in forecasting activities in decentralized finance markets; for this reason, the existing academic research on decentralized finance is currently of limited value to policymakers and regulators. Also, the existing literature on decentralized finance provides little evidence on questions of interest to regulators who are thinking about regulating decentralized finance. These deficiencies in the literature open up opportunities for future research into decentralized finance. Some areas for future research were offered in the review.

The rest of the paper is structured as follows. Section 2 provides a conceptual background on decentralized finance. It defines decentralized finance and highlights the benefits, opportunities and risks of decentralized finance. Section 3 presents some global statistics about decentralized finance. Section 4 presents the methodology. Section 5 reviews the existing research in decentralized finance. Section 6 discuss the developments in decentralized finance around the world. Section 7 explores some of the policy issues associated with decentralized finance. Section 8 identifies some areas for future research. Section 9 concludes the paper.

2 Conceptual framework

This section presents a conceptual background about decentralized finance. It defines decentralized finance and highlights the benefits, opportunities and risks of decentralized finance. It also highlights specific DeFi market products and tools.

2.1 DeFi definition

Decentralized finance is a broad term for all financial products and services built on top of open-source public blockchains. Several definitions of decentralized finance, or DeFi, have emerged in the literature. In simple terms, decentralized finance is any financial infrastructure that uses blockchain technology to offer financial services without involving intermediaries [9, 33] defines decentralized finance as the transformation of traditional financial products into products that operate without an intermediary through smart contracts on a blockchain. [39] defines decentralized finance as an ecosystem of financial applications that are developed and enabled using blockchain and distributed ledger technology. Maia and Vieira dos Santos (2021) define decentralized finance as an ecosystem of decentralized applications that provide financial services built on top of peer-to-peer and trustless networks.

The first, second and third definitions explicitly include both blockchain and distributed ledger technologies while the fourth definition emphasizes “peer-to-peer and trustless networks”. Building on these definitions, [21] emphasize that decentralized finance is a peer-to-peer financial system that uses distributed ledger-based smart contracts to ensure its integrity and security. Also, Schar (2021) points out that decentralized finance uses smart contracts to create protocols that replicate existing financial services in a more open, interoperable, and transparent way [42, 38] defines decentralized finance as financial services that are built on public blockchains based on open protocols and removes intermediaries from the financial intermediation process.

2.2 Decentralized finance (DeFi) markets and tools

A DeFi market is a market where financial products that are offered using decentralized applications are traded. In DeFi markets, all transactions are transparent including the terms, conditions and obligations of the financial service provider, the customer or the client. A number of elements are necessary for a well-functioning DeFi market, namely, smart contracts, DeFi software protocols, decentralized applications (dApps), decentralized finance platforms, decentralized exchanges (DEXs) and decentralized finance lending platforms [14]. Smart contracts are computer programs run on a blockchain that controls digital assets and automate agreement terms between buyers and sellers, or lenders and borrowers [14]. Decentralized finance software protocols on blockchains are standards and rules written to govern specific tasks or activities on the blockchain. It enables buyers, sellers, lenders, and borrowers to interact peer to peer with one another [14]. Decentralized applications (dApps) are applications that offer simple consumer-focused services. They can be used for crypto asset trading, lending, borrowing, savings, payments, derivatives trading and to mitigate risk. A decentralized finance platform is a consumer-facing financial interface that require blockchain technology and crypto stakers to operate [14]. Decentralized exchanges (DEXs) are exchanges that allow the trading of digital assets without any centralized controller. DEXs aim to replace the market-making and custody features of exchanges with a powerful algorithm that adjust prices and execute trades based on available liquidity [14]. Decentralized finance lending platforms are platforms that allow holders of cryptocurrencies to lend a large amount of funds instantly and anonymously to borrowers, provided that they can provide enough collateral to deposit in a smart contract and settle the loan within an agreed timeframe [14].

There are diverse products, platforms and tools in DeFi markets. Examples of decentralized financial products include crypto-backed loans, interest-paying crypto savings accounts, smart contracts, staking, and stablecoins (e.g. Tether “USDT”, USD Coin “USDC”, Binance USD “(BUSD)”, Gemini USD “(GUSD)”. Some prominent DeFi products for lending include Aave, BlockFi, Compound, Ledn, Nexo, Nuo, mStable and Maker. The prominent DeFi liquidity management products include Yearn and Curve. The top DeFi exchanges include Binance, dYdX, 1inch, and Bancor. Some prominent DeFi wallet include Portis, Coinbase, Authereum and Ardent. Some DeFi asset management products and platforms include Balancer, DeFi Saver, InstaDapp, Zerion and Zapper. DeFi insurance platforms include Nexus Mutual, Opyn, and Opium Finance.

2.3 Benefits of decentralized finance

Decentralized finance has several benefits. Decentralized finance can broaden financial inclusion; encourage permission-less innovation; eliminate the need for intermediaries; ensure the immutability of transactions; resist censorship; ensure the rules are the same for all participants; ensure transactions can be audited by anyone with internet access; make cross-border transactions cheaper; promote trustless financial intermediation; and, encourage worldwide participation [36, 30, 11, 48].

Regarding financial inclusion, decentralized finance can promote financial inclusion by providing access to credit. It allows anyone to obtain a loan. This can benefit small businesses and individuals without a credit history as it does not utilize credit scoring and also does not require fulfilling know-your-customer requirements [41]. The major benefit of decentralized finance is that a decentralized financial system offers a cheaper alternative to the current traditional financial system. A decentralized finance system is considered to be cheaper because (i) everything is built on the blockchain, (ii) there are no charges for banking or intermediary services, and (iii) everything is peer-to-peer driven [41].

2.4 Opportunities of decentralized finance

Decentralized finance offers many opportunities. The first opportunity which decentralized finance brings is increased efficiency. Decentralized finance can increase efficiency in financial transactions. Decentralized finance can increase efficiency by replacing trust requirements with smart contracts. Two parties willing to exchange digital assets in the form of tokens do not need a third-party or financial intermediary to exchange digital assets in a decentralized finance environment. Instead, the transfer of digital assets can be executed bilaterally using tokens. Other efficiency advantages include: the increase in the speed of transactions using token transfers, reduced transaction costs, and decreasing demand for third-party audits [42].

The second opportunity which decentralized finance brings is increased transparency. Decentralized finance can significantly increase transparency. All financial transactions on decentralized finance applications will be transparent. This means they are publicly observable and the smart contract codes can be analyzed on the blockchain [42]. Such transparency can be useful for research and policy purposes. Researchers can collect a large number of useful historical data on the blockchain and use the collected data to conduct important research to evaluate the usefulness of decentralized finance in society and to improve the use of decentralized finance applications (dApps) in the financial sector. Also, the transparent nature of decentralized finance will make it easier for policymakers and financial regulators to monitor decentralized finance protocols remotely in order to understand the implication of decentralized finance for financial system stability.

The third opportunity which decentralized finance brings is that the decentralized finance protocols will be accessible to anyone. This can create an open and accessible financial system for everyone. Both poor and rich will be able to use decentralized finance protocols to execute transactions. It can eliminate income discrimination between the poor and rich which is predominant in the traditional financial system. Moreover, even if regulation demands access restrictions, e.g. strong security token, such restrictions can be implemented in the token contracts without compromising the decentralization properties of the decentralized finance infrastructure [42]. The fourth opportunity which decentralized finance brings is the ease to compose contracts in a decentralized finance environment. The blockchain used in a decentralized finance infrastructure has shared settlement layers that allows decentralized finance protocols and applications to interact with each other. Any two or more pieces can be combined, removed, or modified to create something entirely new. This ease of composability allows for an endless range of possibilities and financial engineering [42].

2.5 Risks of decentralized finance

Decentralized finance comes with a number of risks. Firstly, there is the execution risk in smart contracts. This may arise from coding errors when forming smart financial contracts. Coding errors can create vulnerabilities that allow an attacker to make the code unusable or create vulnerabilities that allow an attacker to steal the funds embedded in a smart financial contract. The implication is that the decentralized finance protocol is only as secure as the codes underlying the smart contracts [42]. Secondly, there is high risk of legal liability in decentralized finance smart contracts. This is because the average user of technology who cannot read a smart contract code or evaluate its security can be misled into signing a compromised smart contract, thereby exposing the user to risk and unforeseen legal liability [42].

Thirdly, there is risk of data theft. Many decentralized finance protocols and applications use admin keys to upgrade the smart contract and to perform emergency shutdowns. If the key-holders do not create or store their keys securely, malicious third parties can steal the keys and compromise the smart contract [42]. There is also the risk of interconnectedness or dependency risk. This arises because decentralized finance protocols allow various smart contracts and decentralized blockchain applications to interact with each other to offer new services based on a combination of existing ones. These interactions introduce significant dependencies such that if there is an issue with one smart contract, it may have wide reaching consequences for multiple decentralized finance applications across the entire decentralized finance ecosystem [42].

Another risk is that many decentralized finance applications rely on external data. When a smart contract depends on data that are not available on the blockchain, the data will be provided by external data sources. Consequently, blockchain applications will be exposed to data quality and data availability issues when the applications are heavily dependent on external data sources [29, 42]. Finally, there is high propensity for illicit activity when using decentralized finance applications. The decentralized nature of decentralized finance systems makes it attractive for illicit activities. Actors with dishonest intentions can use decentralized finance applications to launder money and to fund criminal activities [42].

3 Global DeFi statistics

3.1 Countries that are top DeFi adopters

Table 1 reports the top 20 global DeFi adoption index (2021) published by Chainalysis.Footnote 1 The index show that the United States, Vietnam, Thailand, China and the United Kingdom were the top 5 adopters of DeFi protocols in 2021. Interestingly, the countries in the top 20 ranking are either high-income countries, countries with already-developed cryptocurrency markets, or countries with strong professional and institutional markets. This suggests that the decentralization of finance is easier to achieve in developed countries, high-income countries and in countries with strong professional and institutional markets.

3.2 Total users of DeFi protocols

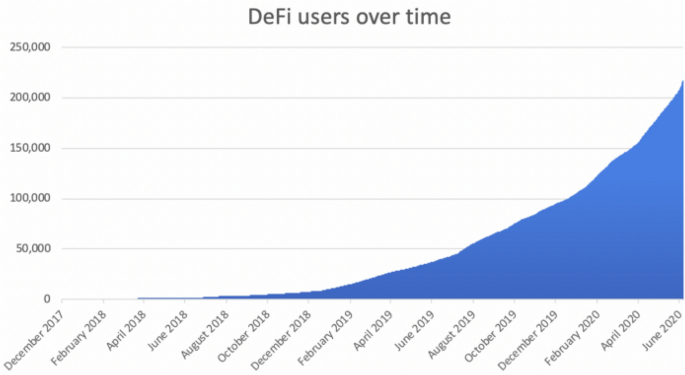

Not only have the number of DeFi assets and protocols increased in recent years, the number of users of DeFi protocols have also increased. The increase is due to the growing interest to own or trade blockchain-enabled cryptocurrencies. The total number of users of DeFi protocols increased from 3000 to over 210,000 according to Dune Analytics (Fig. 1). This statistic represents a 6900 per cent increase in the total users of DeFi protocols from 2018 to 2021. The high percentage shows that there is increasing interest in DeFi in the world.

3.3 Total value locked in DeFi

The total value locked (TVL) represents the total value of all cryptocurrency that is locked, or stored, in a DeFi application (dApp) or smart contract. The total value lockedFootnote 2 in DeFi rose from $119 million to over $83 billion, which represents an increase by over 60,000 per cent from 2017 to 2021 according to DeFi Pulse. This shows that the market for DeFi is growing rapidly. Ether (ETH) and Bitcoin (BTC) also witnessed a sharp increase in their respective total value locked as shown in Table 2.

Source: DeFi Pulse (https://defipulse.com)Footnote 3

3.4 Global interest in DeFi through online search

Internet search for DeFi-related information increased significantly in 2021. The analysis by region, reported in Fig. 2, shows that large volumes of web traffic data for information about decentralized finance protocols originated from North America and Western Europe. Meanwhile, Africa and the Middle East regions had the lowest volume of web traffic data for DeFi protocols.

4 Methodology

Discourse analysis was used to review articles for this study. Google Scholar search engine was used to identify the relevant articles in the decentralized finance literature. Google Scholar was used because it is the world’s most recognized web search engine that indexes the full text or metadata of scholarly literature across an array of publishing formats and discipline. Research into decentralized finance began in 2020. The keyword “decentralized finance” was inserted into Google Scholar search engine and the search period is from 2020 to 2022. After obtaining the search results, the results were collated. During the collation process, all policy articles, conference articles, white papers, consultative articles and academic papers that were found in the Google Scholar search results were included while all non-English articles or books were excluded. After sorting, the results showed that only 22 articles bear the keyword “decentralized finance” in their title at the time of writing this paper. Of the 22 articles, 72% of the articles (16 articles, precisely) are academic papers which are either published in a journal, published in a non-journal outlet or unpublished as working papers. The articles found in the Google Scholar search results are shown in Table 3. The very few number of studies found in the search results confirm that decentralized finance is still a recent concept in the literature, and there are very few research studies in the decentralized finance literature.

5 Review of existing decentralized finance research

This section presents a review of the 22 studies found in the search results. The studies include [34, 7, 29, 41, 50], Maia and Vieira dos Santos (2021), [26, 9, 11, 42, 47, 49, 25, 28], etc. The review is documented in Table 4. It was found that most of the studies used discourse analysis to explore the concept of DeFi, how it works, the benefits and challenges. Secondly, none of the studies used primary or secondary data to conduct any rigorous empirical analysis. Thirdly, there are no theoretical studies on decentralized finance. Furthermore, most studies hold a positive view about DeFi. They emphasize the benefits of DeFi in great depth while highlighting some challenges of DeFi sparingly, possibly because the authors are either DeFi optimists or they do not want to be seen as DeFi pessimists. Also, none of the studies explicitly criticized the DeFi movement which suggest a lack of critical research studies in the DeFi literature. Although few studies suggest some areas of regulatory concerns (e.g., [34], such studies did not suggest specific changes that policymakers need make to address specific challenges of DeFi. For this reason, such studies offer limited value to policymakers and regulators. Finally, there are no research papers that analyzed DeFi in a single country context. Overall, these observations show that research in DeFi is very recent and there is need for more research in DeFi.

The DeFi research studies identified in Table 4 have a number of challenges. The major challenge is that most of the existing DeFi research studies are analytical and discursive in nature, and they are based on case study, use case, abstract modeling or conceptual analysis that have limited application in real-world settings. The reason for this is because the DeFi idea is still developing and has not reached maturity. The implication is that policymakers and practitioners need to exercise caution when accepting DeFi propositions that are based on research ideation and conceptualization that are still evolving. Another major challenge of DeFi is the lack of empirical DeFi data that is publicly available and accessible. The lack of publicly available DeFi empirical data makes it difficult for researchers to obtain DeFi data which they can use to test the relationship between DeFi progress and changes in financial market structure and changes in the economy. Lack of DeFi data makes it difficult to conduct research that offer insight into whether DeFi makes an important contribution to the economy and society.

These challenges will affect the scope of future DeFi research. It can make the DeFi literature susceptible to lots of idea formation with little scientific testing of ideas. This can reduce the relevance of DeFi research outputs in policy analysis and decision-making. There is need to make DeFi data available so that more research outputs can be generated to enrich the DeFi literature and to inform policy.

6 Decentralized finance developments around the world

This section reviews the decentralized finance developments around the world using available authored speeches, media articles, opinion articles, conference papers, consultative papers, policy reports and academic papers obtained from the article search. The articles must have “decentralized finance” in its title to be eligible for review in this section.

6.1 Africa region

Proponents of decentralized finance in Africa, such as [23], argue that decentralized finance can facilitate better access to financial services and accelerate financial inclusion in African countries. [23] further argue that smart contracts and decentralized blockchain can create whole industries in Africa with products developed to tackle various needs in many African countries. It can also facilitate smart contracts in many activities that are still done manually in African countries such as in employment contracts, tenancy agreements, payments, online retail, freelance agreements and cross-border transactions.

[23] points out some challenges to decentralized finance adoption in Africa. The challenges include the distinct knowledge gap problem, regulatory bottlenecks and non-existent blockchain technology or infrastructure in Africa. Firstly, the knowledge gap problem is significant in Africa since Africa is often considered to be home to the world’s largest number of illiterate people. Consequently, it will take a long time to sensitize citizens about decentralized finance as many people in African countries are unaware of digital finance and decentralized systems and how they work. Secondly, there may be regulatory bottlenecks to creating a decentralized financial system in African countries. Financial regulators in African countries may be reluctant to accept the underlying blockchain technology that is used to decentralize finance especially when they do not understand blockchain technology. In Africa, financial regulators rarely approve or allow what they don’t understand. Examples of such regulatory bottlenecks can be found in African countries like Nigeria, Morocco, Algeria, Libya, Egypt, Zambia, Zimbabwe, and Namibia. Thirdly, the blockchain technology and infrastructure that enables a decentralized financial system is non-existent in most African countries. For this reason, policymakers in African countries may adopt a diminished version of decentralized finance – one that does not use blockchain technology to facilitate finance. The case of Kenya is an example. [46] reviewed the decentralized financial services project that was developed in Kenya. They found that the decentralized financial system adopted in Kenya only focused on developing and testing simple tools to strengthen the operation, management and governance in community-based financial organizations (CBFOs). This means that policymakers in Kenya view a decentralized financial system as a system where financial institutions are brought closer to unbanked people rather than as a system that uses peer-to-peer networks without involving any financial intermediary.

The discordant regulatory approach towards blockchain-enabled financial services is also a problem in African countries. In Nigeria, for instance, [16] point out that decentralized finance is difficult to adopt in Nigeria under the current regulatory framework. The reason for this is because of the conflicting approach from regulators in the financial sector regarding cryptocurrency and its potential impact on access to decentralized finance products. Specifically, the bank regulator, the Central Bank of Nigeria, prohibited banks and other financial institutions from dealing in cryptocurrency or providing banking and payment services to cryptocurrency exchanges and dealers. In contrast, the Nigerian Securities and Exchange Commission (NSEC) in the same year issued a statement that it would permit cryptocurrency to exist only as crypto assets, thereby regulating cryptocurrency just like every other investment asset. The conflicting approach by the two regulators-the Central Bank and the SEC– towards blockchain-enabled cryptocurrency products can discourage investors from investing their funds in a decentralized finance project originating from Nigeria.

6.2 Oceania region

Australia is one of many countries that are enthusiastic adopters of new technology. [18] showed that several Australian decentralized finance projects have emerged in 2020 such as Rocket Pool, Ren and mStable. Rocket Pool is a decentralized Eth2 staking service that enables users to run their own validator on the blockchain. Ren is a decentralized way to create tokenized Bitcoin and other coins that can be used in decentralized finance. mStable allows users to swap US dollar stablecoins with zero slippage and earn high yields. [10] point out that the blockchain underlying decentralized finance innovations in Australia are being supported by favorable regulations. Also, Australian lawmakers have considered whether it is best to treat assets created for decentralized finance as assets eligible for treatment under the existing Basel Framework (with some modifications) if they bear low risks, or to subject such assets to new prudential treatments [1]). In New Zealand, decentralized finance is being promoted by an interest group that advocates for the adoption of blockchain technology in New Zealand. In 2020, the decentralized finance space in New Zealand had NZ$1.5 billion in funds locked in financial applications enabled by public blockchains while over NZ$150 billion in funds have been poured into DeFi applications in 2021 [30].

6.3 Asia region

Asia has a high rate of digital literacy, mobile internet connectivity and a digital savvy generation of consumers, which creates an opportunity for the adoption of decentralized finance. In India, decentralized finance is emerging as a crypto innovation. Currently, India is ranked “sixth” in terms of decentralized finance adoption according to the 2021 Global DeFi Adoption Index (Table 1). Proponents of DeFi in India argue that decentralized finance will extend decentralized financial services to millions of unbanked Indian adults and will provide low-cost alternatives for borrowing and lending to Indian citizens [8]. But there are fears that a government ban on all blockchain-enabled cryptocurrencies would frustrate private sector efforts to grow the decentralized finance sector in India [5].

In China, decentralized finance is growing very fast. The Central Bank (or the PBOC) has already adopted blockchain technology to create a digital yuan or central bank digital currency (CBDC). The major concern about DeFi in China is that the size of decentralized financial services can become so large that it reduces the Chinese government’s ability to eliminate fraud and tax evasion that are committed through smart contracts and other crypto assets. When this reaches a tipping point, the government may clamp down on decentralized finance activities. In Singapore, decentralized finance is expanding very fast. Currently, there is no regulation of decentralized finance in Singapore. The Monetary Authority of Singapore (MAS) has not banned or restricted blockchain-enabled crypto activities. The lack of regulation of decentralized finance in Singapore makes decentralized finance very risky for unsophisticated customers and investors who do not have money they are willing to lose when investing or trading in DeFi-related crypto tokens on a crypto exchange in Singapore.

6.4 Middle East region

Interest in DeFi adoption in the Middle East began in 2019 just before the coronavirus pandemic. As of today, decentralized finance is in its early stage in Middle Eastern countries, and full adoption of the enabling blockchain technology has not been implemented in any Middle Eastern country. Recently, Bahrain is studying the legal aspects of blockchain and preparing a regulatory and legal framework for blockchain while the United Arab Emirates and Saudi Arabia are focused on researching the current and future applications of blockchain systems for government, financial and commercial service [3]. In Qatar, DeFi proponents claim that blockchain-enabled decentralized finance can improve trade finance in the country [22]. Meanwhile, in Saudi Arabia, the Saudi Arabian Monetary Authority (SAMA) has partnered with “Ripple” (an allied banking blockchain network) to help domestic banks settle payments and transactions with regional banks to make monetary transfers more efficient and cheaper on the blockchain [3].

Overall, regulators in Middle Eastern countries have been generally cautious about blockchain technology. For example, the Central Bank of Bahrain (CBB) spent a significant amount of time studying the strengths of blockchain crypto assets before developing a relevant regulatory framework. Also, it is important to point out that the high regard for cultural and Islamic norms in Middle Eastern countries can lead to the rejection of some of the current ideals of decentralized finance. Middle Eastern countries will most likely accept Sharia-compliant decentralized finance protocols that prohibits interest in its lending applications. Many of the decentralized finance protocols today are technically Sharia non-compliant, and for this reason, resistance to decentralized finance is expected in some Middle Eastern countries such as Pakistan, Iran and Afghanistan and Saudi Arabia. Among the Middle Eastern countries, only the United Arab Emirates (UAE) has created an excellent blockchain and decentralized finance environment, and a legal approach to crypto that is progressive. The UAE government has recently used a custom-built blockchain to conduct government transactions.Footnote 4 Apart from the UAE, regulators in other Middle eastern countries like Bahrain, Kuwait and Qatar are trying to keep up with the pace of decentralized finance development to regulate it, and ensure it operates within the principles of Islamic sharia.

6.5 European region

The recent interest in decentralized finance in Europe is mainly due to the need to reduce the cost of financial services. European businesses want to reduce transaction costs, and are searching for decentralized finance peer-to-peer products that remove intermediaries and their associated costs. More so, in the European banking sector, regulatory changes, low interest rates and Fintech competition are putting immense pressure on banks and are pushing banks to search for decentralized finance solutions to cut costs in some banking operations. Companies that are pioneering decentralized finance projects in Europe include (i) “Argent”–a UK-based company providing a gateway to the decentralized finance ecosystem; (ii) “Jellyswap”–a crypto-agnostic decentralized finance exchange in Bulgaria; (iii) “Nexus Mutual”–a London-based company offering decentralized insurance services; (iv) “AAVE”–a UK-based company offering decentralized lending and borrowing services; (v) “Centrifuge”–a company in Germany that specializes in converting real-world assets into digital assets for clients; and finally, (vi) “Monolith”–a UK-based company that enable users to spend their ether (ETH) and ERC-20 tokens in the real-world with a Visa debit card.

Regarding regulation, the European Commission will introduce wide ranging changes to existing financial services laws in order to capture technology changes arising from blockchain and distributed ledger technologies and digital assets. Specifically, the European commission plans to make amendments to, or expand, the Markets in Financial Instruments Directive (MiFID) to include all digital assets in order to regulate all digital assets and decentralized finance products. This development will make Europe the only region that has reached an advanced stage in regulating decentralized financial products and services.

6.6 North and South America

In North America, Canada and the United States are leaders in decentralized finance innovations. In Canada, proponents of decentralized finance argue that decentralized finance products can provide credit and liquidity in cross-jurisdictional markets where it has been difficult to do so in the past [17]. This means that decentralized finance users in Canada will be able to extend credit and liquidity through cryptocurrencies to users in several countries. In 2022, the only known decentralized finance platform originating from Canada is “Prophecy DeFi”-which is a publicly traded investment issuer focusing on the emerging DeFi sector in Canada. With regard to DeFi regulation, there are no discussions about regulating decentralized finance in Canada due to the few number of DeFi platform or products in Canada [17]. However, the Canadian government has adjusted its regulatory frameworks to guard against money laundering and other terrorism financing risks involving digital assets (Clements 2019).

In the United States of America, there is wide-spread interest in cryptocurrency, and this interest is driving decentralized finance adoption in the United States. While the United States government lags behind many countries in legally recognizing and adopting DeFi-enabled cryptocurrencies, private sector agents in the United States are leading the way in decentralized finance adoption. Most of the decentralized finance adoption in the US is driven mainly by cryptocurrency, miners, traders and investors who are searching for new sources of income via blockchain. According to Chainalysis, the United states is ranked number one followed by Vietnam, Thailand, China, and the United Kingdom in terms of on-chain DeFi value received, and on-chain number of DeFi deposits.

Although there is no single regulator responsible for regulating financial activity in the US decentralized finance sector, government agencies are closely monitoring the growth of DeFi to understand its potential impact on banks, consumers and investors, as well as its implications for financial crimes. For instance, the US SEC is constantly pressuring crypto businesses to register with the SEC. The aim is to ensure that the activities and income of crypto businesses are taxed appropriately until when a more robust regulatory framework for digital assets is fully developed and implemented. Recently, the US SEC announced on August 7th 2021 that it had fined a decentralized finance platform “Blockchain Credit Partners” and its executives for selling unregistered securities of more than $30 million and for misleading investors. This action became the first ever enforcement action taken against a decentralized finance (DeFi) platform in the World. The action of the US SEC has ethical implications which is that the freedom to innovate in the US financial sector is not a license to violate existing financial laws and regulations in the USFootnote 5

Moving to South America, Brazil is leading the way in the adoption of decentralized finance in South America. A survey by ConsenSys show that Brazil has the largest number of DeFi portfolio users in Latin America. The growth in decentralized finance in Brazil is driven by a shift from seeing cryptocurrency as real money towards seeing cryptocurrency as an alternative asset class which can help individuals achieve specific investment objectives. Meanwhile, other South American countries, such as Argentina and Venezuela, have experienced repeated episodes of economic instability due to a sharp rise in inflation, which makes the fiat currency almost worthless. The growing economic hardship faced by Argentines and Venezuelans due to high inflation has led citizens to shift away from fiat money towards investing and saving their money in cryptocurrency assets and blockchain money alternatives to preserve their personal wealth and as a means to hedge against economic instability.

7 Some policy issues

Despite the positive publicity about decentralized finance by decentralized finance enthusiasts, some policymakers think differently about decentralized finance. This section highlights some of the issues that policymakers have regarding decentralized finance.

7.1 Heightened technological risk and cyber attacks

Policymakers understand that many decentralized finance protocols, such as the Ethereum public blockchain infrastructure, are not infallible. This is because increased customer adoption of decentralized finance can lead to increase in cyberattacks, bugs, and cyber security threat as well as other issues such as network congestion. Hackers can target vulnerabilities in decentralized finance applications to steal crypto loans or alter smart contracts to render them unusable.

7.2 Liquidation issues arising from network problems

Policymakers also have concerns about liquidity risks that may arise when there are network issues. Whenever there is network congestion, it can lead to high network transaction fees, failed transactions, and serious liquidation issues when decentralized finance apps stop functioning altogether.

7.3 Volatility is still an issue

Policymakers also have concerns that decentralized finance is not immune to volatility. This is because the collateral pledged in decentralized finance transactions are simply cryptocurrencies that already have a reputation for being volatile. The value of crypto-based collateral can sharply decline and cause liquidity risk problems which can trigger unexpected sell-offs, thereby making decentralized finance markets very volatile. Also, panic buying can lead to major increase in the price of decentralized finance products especially decentralized finance tokens. Policymakers want to reduce volatility in financial markets as much as possible, and they have concerns that decentralized finance will not reduce volatility despite attempts by crypto-enthusiasts to peg the value of some cryptocurrencies against a stable fiat currency like the US dollar, to make it a stablecoin.

7.4 Loss of job

Another issue that is of great concern to policymakers is that decentralized finance innovations can destroy many non-tech jobs than it creates. DeFi will require the gradual removal of traditional financial intermediaries from the financial ecosystem and promote peer-to-peer transactions. While financial intermediaries increase the cost of financial transactions, they also create jobs that ultimately benefit the economy. There is concern that a full-fledge adoption of decentralized finance will lead to massive loss of intermediary jobs which cannot be immediately replaced by DeFi alternatives. This is because jobs in the decentralized finance sector can only be filled by tech savvy people, mostly coders, programmers and networking practitioners. Also, the number of jobs created in the DeFi sector, possibly in the 10,000s, will be relatively smaller than the jobs created by traditional financial intermediaries which is often in the 100,000s and in millions. The immediate implication of removing financial intermediaries from the ecosystem in a decentralized finance world is that brokerage companies, payment agents and underwriters will no longer be needed, they will have to lay off a large number of staff, leading to high unemployment. Policymakers do not want this outcome, especially when they understand that loss of jobs in the financial sector will affect economic output due to the close link between financial stability and macroeconomic stability.

7.5 Immediate regulation of decentralized finance is not the first-best solution

The identified DeFi risks call for regulation of decentralized finance even though decentralized finance is supposed to operate without regulation by a central authority. Some policymakers believe that decentralized finance is still an immature market with relatively poor security protocols. Others believe that decentralized finance markets have a unique regulatory ambiguity and a distinct lack of liquidity. Therefore, there is no need to immediately regulate the decentralized finance market until it reaches a certain level of maturity.

There is also the argument that regulating the DeFi sector can help the decentralized finance sector attain maturity much quicker. However, regulating decentralized finance markets immediately, when the decentralized finance market is still immature, can lead to regulatory errors and frequent change in regulations. Moreover, many decentralized finance products do not fit well within the existing financial regulatory framework of many countries. For these reasons, regulators in some countries may prefer to closely monitor the development of decentralized finance markets without regulating it until the DeFi sector or market matures. Notwithstanding, policymakers in other countries may choose to be pro-active and issue some immediate guidance on DeFi activities.

8 Areas for future research

8.1 Mutual co-existence of CeFi and DeFi

Decentralized finance (DeFi) can replace the current system of centralized finance (CeFi). But a move to completely overhaul centralized finance will be resisted by policymakers who want to retain control of the financial system in order to monitor and prevent financial crimes from occurring in the financial system. Policymakers may likely accept a possible co-existence of CeFi and DeFi since it won’t significantly threaten their oversight of the financial system. Future studies should investigate how CeFi and DeFi can coexist and complement each other.

8.2 Understanding the implication of decentralized finance for financial system stability

Decentralized finance can transmit both technology and liquidity risks to the financial system when users respond to sharp decline in token prices by engaging in panic selling. Such occurrences can transmit unexpected and frequent shocks to the financial system. But such risks may be small and non-systemic since the decentralized finance sector is still a small segment of the larger financial system. Notwithstanding, there is a need to understand all the possible channels and means through which decentralized finance protocols, participants’ activities or behavior can transmit risks to the wider financial system. Future studies should develop models, and develop frameworks that show the link between decentralized finance market activity and financial stability, and also show how irrational behavior in decentralized financial markets can transmit risks to the financial system.

8.3 The need to develop a single one-size-fits-all regulatory framework to reduce pressure on regulators

New digital financial innovations in the financial ecosystem often require a different set of regulation, such as blockchain regulation, Fintech regulation, etc. The problem is that while many regulators are still in the process of understanding the innovations in the Fintech and payment sectors, they now face a disruptive boom of cryptocurrency in their countries. While they are thinking about whether to regulate cryptocurrency or leave it unregulated, they are now faced with another boom in decentralized finance. It is possible that the constant rise of new digital finance innovations can overwhelm policymakers and regulators. The pressure they face can make them ban or disallow new digital financial innovations until a time when they are able to understand and regulate emerging digital innovations in finance. This problem arises because there is no single all-embracing or one-size-fits-all regulation for digital financial innovations. Future studies should explore the possibility of developing a single digital finance regulatory framework that can guide the operation of all kinds of digital finance innovations including Fintech, blockchain, cryptocurrency, decentralized finance and future digital finance innovation, so that new digital finance innovations will not require a separate set of regulation.

8.4 Finding innovative ways to eliminate the risks inherent in DeFi investing

Future studies need to investigate ways to reduce or eliminate the risks inherent in DeFi investing especially the risks associated with overleveraging to increase gains. This is important because many decentralized finance services allow investors to borrow money to magnify their gains thereby increasing leverage with great risk of losses. The risk of losses is great because there is no intermediary (regulator or bank) who can send back funds to investors when funds are transferred in error, and there is no intermediary to repay investors when hackers find a vulnerability in smart contracts or other aspects of a decentralized financial service. Future studies should investigate innovative ways to eliminate the risks inherent in investing in decentralized finance.

8.5 Provision of liquidity guarantees

Future studies need to also explore the possibility of offering liquidity guarantees to decentralized finance markets to mitigate liquidity risks. But liquidity guarantees are often offered by intermediaries such as a central bank, insurance firm, a bank or other financial institutions, and since the decentralized finance business model does not recognize intermediaries, it will be difficult to provide liquidity guarantees in decentralized finance smart contracts. Future studies should identify innovative ways to introduce liquidity guarantees in decentralized finance smart contracts without involving financial intermediaries.

8.6 The decentralized finance literature needs more critical research studies

Currently, there is a lack of critical research studies in the decentralized finance literature. Much of the existing DeFi studies hold a positive view about DeFi and conclude that DeFi will transform traditional finance in exceptional ways. Being mindful that technological innovations bring its own problems to society, it is important to tamper DeFi optimism with a bit of pessimism in order to find a solution that work best for society. There is need for critical research studies that identify new risks and issues in DeFi that are detrimental to the welfare people in society so that these risks and issues can be addressed.

9 Conclusion

This study reviewed the decentralized finance research and development around the world. The review showed that decentralized finance refers to financial products and services that are offered on open-source public blockchains without involving intermediaries. The benefits of decentralized finance include: broadening financial inclusion; encouraging permission-less innovation; eliminating the need for intermediaries; ensuring the immutability of transactions; censorship resistance and making cross-border transactions cheaper. The benefits of decentralized finance are not without risks. Some of the risks include: execution risk in smart contract, legal liability risk, data theft risk, interconnectedness or dependency risk, external data risk, and a greater propensity for illicit activity using decentralized finance applications.

Despite the risks, global decentralized finance statistics show a very promising prospect for the decentralized finance sector. For instance, the number of decentralized finance users increased from about 3000 in December 2017 to over 210,000 in June 2021. Also, the total value locked in decentralized finance increased from over US$119 million in 2017 to over US$80 billion in September 2021. Observations on DeFi developments from around the world show that there is growing interest in decentralized finance in Europe, US, Asia and Oceania. There are concerns that regulating decentralized finance can impede growth in decentralized finance markets in Asia. Also, there are concerns that banning DeFi-related crypto assets can frustrate decentralized finance developments in Africa.

On the policy side, there are several issues that make policymakers skeptical or pessimistic about decentralized finance. They include the heightened technological risk, the risk of cyber-attack, liquidation issues, high volatility, loss of jobs and other regulatory issues. Some of these policy concern creates new areas for future research. Some of the areas include: investigating how centralized finance (CeFi) and decentralized finance (DeFi) can coexist together; understanding the implication of decentralized finance for financial system stability; developing a single one-size-fits-all regulatory framework for all types of digital financial innovations; finding innovative ways to eliminate the risks inherent in DeFi investing; and providing liquidity guarantees for smart contracts.

Finally, having highlighted the developments, benefits and issues associated with DeFi, it is yet to be seen whether decentralized finance will be fully accepted as an alternative to the traditional financial system on a national scale in many countries, or whether it will become another standalone “technology innovation” only for the pleasure of people who are enthusiastic about crypto-assets.

Notes

TVL in DeFi is calculated by pulling the total balance of Ether (ETH) and ERC-20 tokens held by all smart contracts and multiplying them by their price in USD.

DeFi Pulse is a site where you can find the latest analytics and rankings of DeFi protocols. Available at: https://defipulse.com/.

References

ABA (2021) Senate select committee on Australia as a technology and financial centre–issues paper. Australian Banking Association. https://www.ausbanking.org.au/wp-content/uploads/2021/07/210630-ABA-Submission-on-Australia-as-a-Technology-and-Financial-Centre-Issues-Paper.pdf. Accessed 30 Jun 2021

Adams R, Kewell B, Parry G (2018) Blockchain for good? Digital ledger technology and sustainable development goals. Handbook of sustainability and social science research. Springer, Cham, pp 127–140

AlSubaei F. (2019), December 10 Blockchain adoption in the Gulf states. The Middle East institute. https://www.mei.edu/publications/blockchain-adoption-gulf-states

Anoop VS, Goldston J. (2022) Decentralized finance to hybrid finance through blockchain: a case-study of acala and current. J Bank Financial Technol, 1–7

Arora G. (2020) RBI and the Indian crypto industry. Available at SSRN 3733291

Atlam HF, Alenezi A, Alassafi MO, Wills G (2018) Blockchain with internet of things: Benefits, challenges, and future directions. Int J Intell Syst Appl 10(6):40–48

Avgouleas E, Kiayias A. (2020) The architecture of decentralised finance platforms: a new open finance paradigm. Edinburgh School of Law Research Paper. No.16

Bhuvana R, Aithal PS (2020) RBI distributed ledger technology and blockchain-a future of decentralized India. Int J Manage Technol Social Sci (IJMTS) 5(1):227–237

Caldarelli G, Ellul J (2021) The blockchain oracle problem in decentralized finance—a multivocal approach. Appl Sci 11(16):7572

Chang V, Baudier P, Zhang H, Xu Q, Zhang J, Arami M (2020) How blockchain can impact financial services–the overview, challenges and recommendations from expert interviewees. Technol Forecast Soc Chang 158:120166

Chen Y, Bellavitis C (2020) Blockchain disruption and decentralized finance: the rise of decentralized business models. J Bus Venturing Insights 13:e00151

Clements R. (2020) Fintech in Canada. In: Claudia Sandei et al. (eds). ‘Research handbook on the law of fintech’, digital innovation and technology law lab, digital law network, University of Padova, Italy. Available at SSRN: https://ssrn.com/abstract=3500597

Cumming DJ, Dombrowski N, Drobetz W, Momtaz PP. (2022) Decentralized finance, crypto funds, and value creation in tokenized firms. crypto funds, and value creation in tokenized firms. Available at SSRN: https://ssrn.com/abstract=4102295

De Meijer. (2021) DeFi and regulation: the European approach. Finextra B; og Article. https://www.finextra.com/blogposting/20516/defi-and-regulation-the-european-approach

Dinh TTA, Liu R, Zhang M, Chen G, Ooi BC, Wang J (2018) Untangling blockchain: a data processing view of blockchain systems. IEEE Trans Knowl Data Eng 30(7):1366–1385

Diya OO, Omoniyi O. (2021), July 14 Nigeria: The changing face of finance: decentralised finance-an emerging alternative financial infrastructure. Mondaq. Available at: https://www.mondaq.com/nigeria/fin-tech/1091106/the-changing-face-of-finance-decentralised-finance--an-emerging-alternative-financial-infrastructure

Dolny T, Iqbal A. (2021) 02 March). Canada: decentralized finance: regulation, growth, and legal enforcement. Mondaq. https://www.mondaq.com/canada/fin-tech/1041176/decentralized-finance-regulation-growth-and-legal-enforcement

Fenton A. (2020), December 20 Australia’s crypto ecosystem 2020: the spark for a DeFi explosion. Cointelegraph. https://cointelegraph.com/news/australia-s-crypto-ecosystem-2020-the-spark-for-a-defi-explosion

Garg P, Gupta B, Chauhan AK, Sivarajah U, Gupta S, Modgil S (2021) Measuring the perceived benefits of implementing blockchain technology in the banking sector. Technol Forecast Soc Chang 163:120407

Grassi L, Lanfranchi D, Faes A, Renga FM (2022) Do we still need financial intermediation? The case of decentralized finance–DeFi. Qualitative Res Acc Manage 19(3):323–347

Gudgeon L, Perez D, Harz D, Livshits B, Gervais A. (2020) The decentralized financial crisis. In 2020 crypto valley conference on blockchain technology (CVCBT) (pp. 1–15). IEEE

Ibrahim IA, Truby J. (2021) Governance in the era of blockchain technology in Qatar: a roadmap and a manual for trade finance. J Bank Regul, 1–20

Ijaoba A. (2021) How DeFi can facilitate better access to financial services in Africa. A Benjamin Dada Report. July 14th https://www.benjamindada.com/decentralized-finance-elevate-financial-services-africa/

John J. (2020) Decentralised finance: usecases & risks for mass adopfion. dGen report

Johnson KN (2020) Decentralized finance: regulating cryptocurrency exchanges. William Mary Law Rev 62:1911

Katona T (2021) Decentralized finance: the possibilities of a blockchain “money lego” system. Financial Economic Rev 20(1):74–102

Kaur D. (2021), 3 August Will Asia be home to decentralized finance? TechWire Asia

Kiong LV. (2020) DEFI handbook: a comprehensive guide to decentralized finance. Liew Voon Kiong

Kumar M, Nikhil N, Singh R. (2020) Decentralising finance using decentralised blockchain oracles. In 2020 International Conference for Emerging Technology (INCET) (pp. 1–4). IEEE

Macaskill S. (2021), june 24 Blockchain adoption in N.ew Zealand. BLOCKCHAINNZ Newsletter. https://blockchain.org.nz/2021/06/24/blockchain-adoption-in-new-zealand/

Maia GC, Vieira dos Santos, J. (2021) MiCA and DeFi (‘Proposal for a regulation on market in crypto-assets’ and’decentralised finance’). Forthcoming article in” blockchain and the law: dynamics and dogmatism, current and future

Makarov I, Schoar A. (2022) Cryptocurrencies and decentralized finance (DeFi). National Bureau of Economic Research. No. 30006

Meegan X (2020) Identifying key non-financial risks in decentralised finance on ethereum blockchain masters dissertation. MIP Milan Polytechnic University, Milan, Italy

Meegan X, Koens T. (2021) Lessons learned from decentralised finance (DeFi). ING. URL: https://new.ingwb.com/binaries/content/assets/insights/themes/distributed-ledger-technology/defi_white_paper_v2. 0. pdf

Momtaz PP. (2022) How efficient is decentralized finance (DeFi)? Available at SSRN 4063670

Ozcan R (2021) Decentralized finance financial ecosystem and strategy in the digital era. Springer, Berlin, pp 57–75

Ozili PK (2018) Impact of digital finance on financial inclusion and stability. Borsa Istanbul Rev 18(4):329–340

Ozili PK (2022) Decentralized finance and cryptocurrency activity in Africa. CSEF 109:1–13

Popescu AD (2020) Decentralized finance (defi)–the lego of finance. Social Sci Educ Res Rev 7(1):321–349

Riva GM (2020) What happens in blockchain stays in blockchain a legal solution to conflicts between digital ledgers and privacy rights. Front Blockchain 36:1–40

Salami I (2020) Decentralised finance: the case for a holistic approach to regulating the crypto industry. J Int Bank Financial Law 35(7):496–499

Schär F (2021) Decentralized finance: on blockchain-and smart contract-based financial markets. FRB of St Louis Review Federal Reserve Bank of St Louis Review 103(2):153–174

Scharfman J (2022) Decentralized finance (DeFi) compliance and operations. Cryptocurrency compliance and operations. Palgrave Macmillan, Cham, pp 171–186

Swan M (2017) Anticipating the economic benefits of blockchain. Technol Innov Manage Rev 7(10):6–13

Tseng L, Yao X, Otoum S, Aloqaily M, Jararweh Y (2020) Blockchain-based database in an IoT environment: challenges, opportunities, and analysis. Cluster Comput 23(3):2151–2165

Wambugu A, Lee N (2008) Developing decentralised financial services: project review. FSD Kenya, Nairobi, Kenya

Werner SM, Perez D, Gudgeon L, Klages-Mundt A, Harz D, Knottenbelt WJ. (2021) Sok: Decentralized finance (defi). arXiv preprint arXiv:2101.08778

Yavin O, Reardon AJ (2021) What digital banks can learn from decentralised finance. J Digit Bank 5(3):255–263

Zetzsche DA, Arner DW, Buckley RP (2020) Decentralized finance. J Financial Regul 6(2):172–203

Zmaznev E (2021) Measuring decentralised finance regulatory uncertainty (Master’s thesis). Norwegian School of Economics, Bergen, Norway

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ozili, P.K. Decentralized finance research and developments around the world. J BANK FINANC TECHNOL 6, 117–133 (2022). https://doi.org/10.1007/s42786-022-00044-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42786-022-00044-x