Abstract

Achieving the Paris goal of limiting global warming to well below 2 °C requires radical decarbonization of our economy, including a shift to renewable energy. In the automotive sector, electromobility offers a promising option for making this transition. However, while electric vehicles (EVs) have lower emissions during their use phase, a significant part of the carbon footprint is shifted upstream in the value chain to raw material extraction and battery production. Against this background, this chapter provides an in-depth look at how the automotive industry’s transition to electromobility leads to far-reaching implications for the EV battery value chain. The chapter begins with a brief review of resource scarcity as a relevant strategic background for the circular economy. It continues with the different steps of the linear EV battery value chain. The chapter then uses a circularity perspective to discuss the technology and value chain steps for closing the loop in the EV battery life cycle. It concludes with an outlook on the challenges of circular EV battery value chains.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

6.1 Introduction

In the face of increasing global warming and extreme climatic conditions, 196 parties signed up to the Paris Agreement with the goal of limiting global warming to well below 2 °C compared with preindustrial levels, requiring net-zero emissions by 2050 (United Nations Framework Convention on Climate Change, 2022). The use of renewable energy and electromobility is essential for a transition to a carbon-free economy (Weimer et al., 2019). Current fossil-based road transport is the largest contributor to global warming within the transport sector, creating significant potential through the deployment of electric vehicles (Basia et al., 2021). Here, rechargeable lithium-ion batteries (also known as Li-ion batteries or LIBs) are currently the most favorable technological solution for the electric vehicle (EV) market (Weimer et al., 2019).

While EVs can offer several sustainability benefits, creating new and transforming existing automotive value chains to enable this transition is a formidable task. On the Road to Net Zero outlined in this book, Transforming Value Chains for Sustainability, thus marks a critical step that connects the previous chapter (Chap. 5) and the following chapter (Chap. 7). Chapter 5 introduced the general idea of the circular economy and its potential for Creating Sustainable Products. Chapter 6 now takes a deep dive into the EV battery value chains to review and discuss the complexity, potential, and challenges of what it means to strive to keep materials in a continuous cycle.

Since batteries and battery technologies are an essential part of modern electric vehicles, both the automotive value chain and the automotive battery industry must become a complex overall system in which the players’ steps are interlocked and comprehensively regulated. At present, the Li-ion battery value chain still follows the approach of the traditional linear economy (Di Persio et al., 2020). In the context of meeting climate targets, the European Commission has also expressed the need for change in the battery industry. It commits to creating a competitive and sustainable battery value chain that adheres to circular economy principles, while developing high environmental and social standards. To achieve this, the battery production and recycling chains need to minimize their environmental footprint. Requirements for the safe and sustainable production, reuse, and recycling of batteries will play an essential role (Bielewski et al., 2021).

The purpose of this chapter is to provide an in-depth look at how the automotive industry’s transition to electromobility is leading to far-reaching implications for the EV battery value chain. The chapter is divided into five sections. Section 6.2 sets the scene with a brief review of resource scarcity as a relevant strategic background for the circular economy. Section 6.3 then takes a detailed look at the different steps of the EV battery value chain, but without focusing on circularity yet. Section 6.4 presents the expert conversation between Prof. Oliver Zipse, Chairman of the Board of Management of Bayerische Motoren Werke (BMW) AG, and Prof. Dr. Kai-Ingo Voigt, Chair of Industrial Management at FAU Erlangen-Nürnberg. Section 6.5 returns to the EV battery value chain with a circularity perspective and discusses the technology and value chain steps for closing the loop in the EV battery life cycle. After giving an outlook on the challenges of circular EV battery value chains in Sect. 6.6, the chapter concludes in Sect. 6.7 with key takeaways and the link to the following chapter (Chap. 7) on Sustainability in Manufacturing.

6.2 In the Age of Resource Scarcity

The EV market is moving from a predominantly policy-driven market to one where organic customers are the most significant factor. In many countries, supply is a greater barrier to adoption than demand (BloombergNEF, 2022). Based on the market size of electric mobility of 142 GWh in 2018, the battery market for EVs is expected to increase 16-fold in size by 2030, with a compound annual growth rate of 26.3% (World Economic Forum, 2019). These developments pose significant challenges to the industry, not only by covering material demand for vehicle production but also in proceeding with the vehicles after their end-of-life (EoL).

Regarding material demand, Germany (and thus the German industry, in particular) is almost entirely dependent on imports for fossil fuels, metallic raw materials, and many industrial minerals. There are many risk factors, ranging from political instability in some producing countries to strategic trade restrictions. In addition, companies are increasingly confronted with delivery difficulties, supply bottlenecks, and the risk of delivery disruptions. Increasing demand for raw materials from the developing and emerging countries is also leading to stronger competition on the raw materials market. This applies, in particular, to raw materials that are required for new technologies in the automotive industry, electronics, or environmental technology fields. High prices, price fluctuations, and supply bottlenecks are burdening the German economy. Companies are forced to diversify their sources of supply, hedge price risks, and substitute raw materials that are becoming scarcer (DIHK, 2022).

With regard to the battery market, which is particularly relevant for electromobility, the global battery market can be divided into primary and secondary batteries, with a ratio of 1 to 3. Whereas, in primary batteries, the chemical reaction is not reversible and the battery is designed only for a single use, the chemical reaction in secondary batteries is reversible. This reversible chemical process allows secondary batteries to be repeatedly charged and discharged. With a market share of almost 50% each, lead-acid and Li-ion batteries shared the global battery market for secondary batteries in 2019 (Zhao et al., 2021). The technical characteristics make Li-ion batteries particularly interesting for traction batteries in EVs. Although the basic principle is always the same, countless different Li-ion battery solutions are available, depending on the chemical composition and design.

The production of automotive Li-ion batteries uses many materials not previously required in the automotive sector. Moreover, battery use leads to six times higher mineral demand for electric vehicles than for conventional vehicles (International Energy Agency, 2018). This poses challenges for the industry regarding the continuous material supply of precious metals and rising demand (International Energy Agency, 2018). While some materials can be delivered without any problems, the so-called critical resources sometimes cause great difficulties.

Given the current trends and developments within battery chemistry, cobalt, graphite, lithium, manganese, and nickel are seen as critical battery raw materials and will be briefly presented (Bobba et al., 2020). Within the critical resources, cobalt, lithium, and graphite are assigned a further increased risk compared with nickel and manganese (Vereinigung der Bayerischen Wirtschaft, 2021).

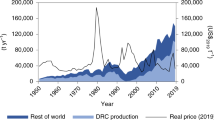

Cobalt is mainly extracted as a by-product of copper and nickel mining. The Democratic Republic of Congo remains the leading source of mined cobalt as of 2021, accounting for 70% of global cobalt production. Subsequent processing occurs mainly in China, which has over 90% of the global refining and processing capacity (U.S. Geological Survey, 2022). This strong focus on mining and processing in two countries leads to a high risk for the supply chain of cobalt (International Energy Agency, 2021). China is the leading consumer of cobalt, with a strong focus of 80% on the rechargeable battery industry. There is an increasing trend to reduce the cobalt content within the battery chemistry (U.S. Geological Survey, 2022).

The security of the global lithium supply has recently become the highest priority of technology companies. Australia, Chile, and China account for 95% of the world production. The supply of two types of resources can be distinguished: the brine-based lithium sources from Chile and China and the spodumene ore from Australia. The type of resource also differentiates the subsequent processing and refining. China dominates the market in terms of hard-rock mineral refining facilities for spodumene ore, with 45% of total refining capacity. In contrast, 32% of the refining capacity is located in Chile and 20% in Argentina, with a focus on refining lithium from brine operations (U.S. Geological Survey, 2022). In the supply area, no major issue for the battery supply chain is found in the short- and medium-term future (Huisman et al., 2020). Despite recent developments in sodium-ion batteries, no large-scale material substitutes for lithium are expected in automotive batteries any time soon (U.S. Geological Survey, 2022).

Overall, 79% of the global graphite production is ensured by China, which accounts for one-quarter of the available amorphous graphite and three-quarters of the flake graphite (U.S. Geological Survey, 2022). China also dominates the downstream processing of spherical graphite. The graphite for Li-ion battery production has high requirements in terms of flake size and carbon content (Bobba et al., 2020). China therefore occupies a dominant position, and this strongly hinders any diversification of the supply chain. In addition to natural graphite, synthetic graphite powder and secondary synthetic graphite from machining graphite shapes have come increasingly to the fore (U.S. Geological Survey, 2022).

Indonesia, the United States, the Philippines, and Russia accounted for 75% of the world’s nickel production in 2021 (U.S. Geological Survey, 2022). Li-ion batteries have high purity requirements for nickel and resort to nickel sulfate, which can be synthesized from Class 1 products with a purity of over 99.8% (International Energy Agency, 2021). Nickel already has a well-developed supply chain due to its versatile use in the past. Li-ion batteries comprise only a tiny part of the demand mix (International Energy Agency, 2018). Nevertheless, over the past 5 years, strong developments can be seen in the Asia/Pacific region (International Energy Agency, 2021). Here, Indonesia and the Philippines account for 50.7% of the global supply.

South Africa, Gabon, and Australia ensure the supply of manganese, providing 71.5% of the world production. No substitute is expected in Li-ion battery technology (U.S. Geological Survey, 2022).

In summary, in the age of resource scarcity, the supply of raw materials for electromobility, which will become increasingly important in the future, can be assumed to pose major challenges for the automotive value chain and trigger major change processes. In addition, the automotive industry is confronted with another major challenge: Even if electromobility is just picking up speed at present, researchers expect a huge annual volume of old battery returns by 2040. Concepts and techniques for the sustainable use of old Li-ion batteries are therefore just as much in demand as the value chains that are adapted and modified to meet these raw material challenges.

6.3 Value Chain Transformations

The automotive Li-ion batteries value chain spreads its process steps globally. The mining of materials, the following processing, and the batteries’ production are distributed worldwide depending on availability, expertise, and production costs. While procuring critical raw materials is mainly located in the southern hemisphere, the subsequent processing and production of the cells occur in Asia. Usually, the final assembly of the modules and the EV battery takes place at the original equipment manufacturer (OEM), concentrated in Asia, the European Union (EU), and the United States. The single steps of the linear value chain can be divided into four phases: The extraction and procurement of materials with subsequent processing describe the upstream (Phase 1). In the midstream (Phase 2), the individual cell components are manufactured and assembled into a battery cell. The downstream (Phase 3) takes place at the OEM and includes the assembly of the battery cells into modules and packs, including their battery management system and auxiliary systems. This is followed by integrating the battery system into the electric vehicle. The end-of-life (Phase 4) describes the fourth phase, consisting of the removal from the EV and the subsequent second life or recycling of the valuable materials (Ciulla et al., 2021; Lebedeva et al., 2017). The first steps, including material procurement, processing, and component and cell production, are cost-driven; therefore, they are subject to global competition. Subsequently, the focus lies on the application and the specific customer requirements, which leads to a value orientation in the downstream area (Steen et al., 2017).

The high demand for Li-ion batteries is reflected noticeably in the upstream process step in the demand for raw materials. The raw materials required for Li-ion batteries are further subdivided into their criticality based on expected demand, natural occurrence, and production capacities. As discussed above, the literature defines cobalt, graphite, lithium, manganese, and nickel as critical materials. By nature, there is strong dependence on individual mineral-rich countries and regions, which leads to cooperation with countries with different labor conditions and standards of human dignity (Ciulla et al., 2021).

The extracted raw materials in their original form must be further processed and refined for use in production. Depending on the material, different purity and particle size requirements apply. These specific requirements must be met in order to be able to produce cell components. In 2020, the majority of the global processing capacity was in China (52%) and Japan (31%), highlighting the strong dependence on the Asian region (Bobba et al., 2020).

The subsequent midstream, starting with component production as the third step, is also dominated by China. Overall, 60% of manufacturing occurs in China, followed by Japan and Korea (Ciulla et al., 2021). Together, they cover around 85% of global component production, consisting of positive and negative electrodes, separators, electrolytes, and housing (Bobba et al., 2020). The valuable production of the electrodes consists of the successful coating of the carrier foil and follows a six-step process (Heimes et al., 2018).

Cell production describes the assembly of the components and is the fourth step of value creation. Like the previous one, this step is also strongly dominated by the Asian market. To minimize this regional domination, companies like BMW Group have already made decisions to locate and develop battery cell production in Europe and North America. The individual components are assembled into a battery cell representing the smallest unit. The assembly, including final finishing and testing, follows a seven-step process (Heimes et al., 2018). In general, the resulting production costs are divided into three phases: electrode production (39%), cell assembly (20%), and cell finishing (41%) (Kuepper et al., 2018).

The downstream is described by battery pack manufacturing and subsequent integration into the electric vehicle. This step takes place at the automotive OEM. For this purpose, several cells are combined to form modules, which are then bundled as a battery system. In addition to the modules, the battery system includes several mechanical and electrical components, such as housing, electronics, and a battery management system. The downstream phase concludes with the final assembly of the battery in the vehicle.

After reaching the minimum battery capacity and its end-of-life, the battery is removed from the vehicle. This is followed by the disposal or recycling of valuable components. Due to the increasing importance of this step for the fulfillment of a closed loop, the linear recycling process chain will be discussed in more detail in the following section.

6.3.1 Recycling of Lithium-Ion Batteries (LIBs)

The phases of the battery life cycle can mainly be divided into production, use, and recycling, including disposal (Fan et al., 2020). While the focus in the past was clearly on the first two phases, the latter will become increasingly important as the significance and demand for Li-ion batteries grow. The methods for dealing with LIBs are time-delayed due to the increase in battery demand; therefore, they must be established on an industrial scale. The increasing demand for raw materials can also be better met by additional recycling (Fan et al., 2020). Nevertheless, the recycling of LIBs is an emerging field that has not yet defined standardized and final processes (Neumann et al., 2022). This is also reflected in the literature, as most publications and research activities deal with necessary substeps within the recycling chain, but hardly examine the holistic chain with its supporting processes. The literature describes several approaches for future process steps concerning a holistic circular economy, but still shows considerable gaps between academic approaches and industrial reality (Neumann et al., 2022). The circular economy challenge has been identified as one of the pressing tasks and accelerating trends. The basis for the circular economy is the linear process flow for the recycling of spent Li-ion batteries on an industrial level.

In general, the process can be divided into four phases: The reverse logistics of the EV packs (Phase 1), the pretreatment of the EV packs to break them into enriched materials (Phase 2), the metallurgical treatment by recycling methods to preserve the specific materials (Phase 3), and the reintroduction of the pure materials into the market (Phase 4). The aim is to extract the valuable materials from the used batteries and return them to production. Current approaches focus mainly on recycling valuable and scarce materials mostly found in cathodes, such as cobalt, lithium, and nickel (Hua et al., 2020). In the future, the recycling of anodes and electrolytes should be included to increase the economic feasibility and sustainability of battery recycling. The necessary process steps are mostly academic approaches and far from industrial reality, but have gained increasing attention in recent years (Neumann et al., 2022). These developments are fundamental to ultimately speaking of recycling all parts and a holistic circular economy (Neumann et al., 2022).

6.3.2 Reverse Logistics (Phase 1)

The foundation for a successful and holistic recycling strategy is laid by reverse logistics (Voigt & Thiell, 2004), which is responsible for taking the used batteries out of circulation and transporting them to the subsequent recycling steps. The substeps of reverse logistics can be divided into material collection and sorting and transport and handling.

At present, no uniform and large-scale processes exist for collecting and sorting spent EV batteries. Standards and specifications are missing to enable the holistic recycling of all spent batteries in the future (Steward et al., 2019). In theory, the necessary steps are known and follow a simple sequence. The end-of-life vehicles must be collected as soon as the vehicles are taken out of service at the dealership or scrap yard. This is followed by transport to the disassembly plant, where they might be stored for some time. Here, the batteries are separated from the vehicle and collected (Steward et al., 2019). There are two main challenges at this stage: the heterogeneity in size and design and the difference in battery chemistries. To prevent a mix of materials and to increase the recycling efficiency of the subsequent metallurgical treatment, attention must be paid to ensure uniform battery chemistries. The lack of labels with essential information on the characteristics and composition of the batteries makes uniform sorting difficult, indicating that mandatory labeling will be essential in the future (Neumann et al., 2022).

The dismantled batteries are then transported to the recycling facilities for further processing. Due to the inherent dangers of Li-ion batteries, special safety requirements are imposed for further transport and handling. The hazards result from the high energy density and the toxic and flammable substances inside the battery. The greatest danger comes from thermal runaway, which is a cascade of uncontrolled exothermic reactions. This can be triggered by external heat sources, external and internal short circuits, or mechanical stresses and can lead to the ignition of the entire battery. For this reason, severe restrictions are placed on shipping quantities, safe packaging, size specifications, labeling requirements, and regulations for safety testing. These significantly affect transport costs, determined primarily by transport distance, transport volumes, capacity utilization, and additional safety precautions. On average, transport costs account for 41% of the total recycling costs and greatly influence the profitability of recycling. They also harm the balance sheet in terms of emissions, especially carbon dioxide (CO2) emissions (Neumann et al., 2022).

6.3.3 Pretreatment (Phase 2)

The second phase comprises the pretreatment, intended to prepare the batteries for the material extraction process. Valuable components and materials must be separated and enriched based on differences in various physical properties (shape, density, and magnetic properties). Thus, higher recovery rates, lower energy consumption, fewer safety risks, and fewer environmental threats can be achieved. The pretreatment consists of a series of chemical and physical operations within the individual steps of discharging, disassembly, crushing, and separation (Hua et al., 2020).

The residual energy present in the spent batteries can lead to short circuits, resulting in explosions during the pretreatment process. The tiniest sparks can cause the ignition of volatile organic compounds during the crushing process that can lead to a fire. To counteract this danger to man and machine, batteries are first discharged and thereby stabilized (Neumann et al., 2022). Various industrial methods are available for discharging, with the brine method (salt-water-based baths) and the ohmic discharge method (controlled discharging via external circuits) being the most commonly used (Hua et al., 2020).

The second step in pretreatment is the disassembly of the EV packs. Here, the battery system is disassembled from the pack level to the module and cell levels. The aim is to achieve an initial rough presorting of the components to maximize economic benefits. First, the battery framework is opened, and the electrical connections between the components are cut. The mechanical connections between the components and the base are then released, and the electronic parts are removed. Finally, the spent battery cells are exposed. The lack of standards for the design and configuration of battery packs complicates any machine automation of the disassembly steps. Widely varying designs and configurations still require a high level of human involvement and manual handling (Hua et al., 2020).

Crushing is a further refinement of batteries at the cell level. In coarse shredding or fine crushing, the granularity of the materials is reduced for the subsequent processing steps. To reduce pollution and the risk of thermal runaway, the battery shredding or crushing processes can be carried out in an inert gas environment using carbon dioxide. Alternatively, crushing can be performed in a lithium brine to neutralize the electrolyte and avoid gas emissions (Hua et al., 2020).

The crushed materials, the so-called “black mass,” are then separated in a multistage separation process. The main focus is the separation of the metallic particles (casing, copper, and aluminum foil) from the black mass. The latter consists of a mix of the active materials from the anode and cathode. It is the most valuable battery cell component and is to be maximally recovered in pretreatment (Neumann et al., 2022). The materials can be separated based on their differences in physical properties, such as size, density, ferromagnetism, and hydrophobicity. This is done in a multistage physical separation process consisting of multiple crushing and sieving steps, magnetic separation, and/or flotation (Hua et al., 2020).

6.3.4 Metallurgical Treatment (Phase 3)

The third phase of the recycling process describes the metallurgical treatment of the previously obtained enriched materials. For this purpose, the following metallurgical technologies are available, differing significantly in their design, properties, and degree of maturity: hydrometallurgy, pyrometallurgy, a mixture of both, biohydrometallurgy (bioleaching), and direct recycling (Hua et al., 2020). While the first two have already reached a sufficient level of technological maturity for industrial implementation, the latter two are still at the laboratory stage and have only demonstrated their technological feasibility under research conditions (Neumann et al., 2022).

Pyrometallurgical technology is based on the thermal treatment of spent batteries. A high-temperature furnace reduces the valuable metal oxides to a mixed alloy (Neumann et al., 2022). This process can be divided into three steps: preheating, plastic burning, and valuable metal reduction. The first two steps describe the thermal treatment, which first evaporates the electrolyte, thereby reducing the risk of explosion. This is followed by the burning of organic materials (e.g., plastics). Finally, at a temperature of 800–1000 °C, the materials are smelted and reduced to an alloy of valuable materials, such as copper, iron, cobalt, and nickel. The resulting slag contains lithium, aluminum, and calcium (Hua et al., 2020). Extensive pretreatment is not necessary. Nevertheless, the output alloy must be posttreated and the materials preserved. Also, the slag should receive posttreatment to avoid discarding resources. The method is not economically interesting for batteries that do not contain cobalt and nickel (e.g., lithium ferrophosphate [LFP] batteries).

Hydrometallurgical technology is based on the leaching and extraction of valuable metals from spent LIBs using water-based solutions. The pretreated battery materials undergo a multistage process, with the following key procedures: leaching, precipitation, and solvent extraction (Hua et al., 2020). First, black mass is leached using mineral acids. The resulting leachate is precipitated of impurities to subsequently recover the valuable materials in a multistep solvent extraction process. By varying the pH of the acid used, manganese, cobalt, and nickel can be extracted successively in the form of salt mixtures. The final precipitation enables the lithium to be obtained as a salt mixture (Neumann et al., 2022).

The techniques of pyrometallurgy and hydrometallurgy can be combined to increase the recycling yield. The alloy resulting from pyrometallurgical treatments is refined using a hydrometallurgical process to isolate the metals. This allows a higher recovery rate for nickel and cobalt and increases the process robustness and flexibility to chemistry changes. However, this method does not solve the problem of slag, which remains unused as a waste product (Roland Berger, 2022).

Biohydrometallurgy uses microorganisms to recover valuable materials from spent batteries and offers a cost-efficient and eco-friendly alternative to the abovementioned approaches. As one of the biohydrometallurgical processes, bioleaching has gained a further attention in LIB recycling (Roy et al., 2021). Chemolithotrophic and acidophilic bacteria serve as the processing microorganisms. Iron ions and sulfur are energy sources used by these microorganisms to produce metabolites in the leaching medium (Moazzam et al., 2021). The microorganisms’ activity produces organic and inorganic acids. These are applied to leach metals by converting the insoluble solids into soluble and extractable forms (Moazzam et al., 2021). They can dissolve several metals, such as cobalt, copper, lithium, manganese, and nickel. Nevertheless, this technology is still conducted only on a laboratory scale and is very time-consuming due to the time for cultivation of the microorganisms. After 10–15 days, the metals can be extracted with 80–95% efficiency (Roy et al., 2021).

Direct recycling recovers materials without affecting their original compound structure and decomposition (Hua et al., 2020). The fundamental idea lies in the refreshment and reactivation of active materials with still functional morphology. The capacity and properties lost through cycling can be restored, rather than breaking down active materials into their components for subsequent resynthesis. The methods used for this are still under research. They include thermal reactivation methods, hydrothermal relithiation, electrochemical methods for relithiation, short high-voltage pulses, and exposure to high lithium moieties, including re-sintering (Neumann et al., 2022). The active cathode material is recovered from the black mass without smelting or leaching (Roland Berger, 2022). Thus, the number of processing steps required to resynthesize the cathode materials can be reduced, lowering the environmental impact. It is currently the only process that enables economically viable LFP and lithium manganese oxide (LMO) cathode recycling. When selecting input materials, care must be taken to ensure uniform cathode chemistry. Like bioleaching, direct recycling is still limited to the laboratory scale, but it holds great potential for the future (Neumann et al., 2022).

6.3.5 Reintroduction into the Market (Phase 4)

After successfully extracting and recycling the pure materials, the raw materials can be put back into circulation in the fourth phase. They are again available as raw materials for new batteries and other products and must be distributed to the respective manufacturers.

With CO2 emissions arising from both the manufacturing and recycling of batteries, the decarbonization of the automotive industry poses a cross-company challenge, as the vast majority of the ecological footprint is created in the supply chain. This creates the need to share emissions-related data across the value chain. Several digital solutions are currently emerging to address this need. With the ecosystem-based SiGreen approach for exchanging emissions data, Siemens developed a solution for efficiently querying, calculating, and passing on information about the real CO2 footprint of products. This allows emission data to be exchanged along the supply chain and combined with the emission data from one’s own value chain to create a real CO2 footprint for products. This not only increases transparency in the automotive value chain, but also opens up new opportunities for making it more sustainable (Siemens, 2021). In the automotive industry, Catena-X emerges as a digital industrial data platform that allows OEMs and suppliers to share life-cycle-oriented data along the entire value chain (Catena-X, 2023). On the Road to Net Zero, Catena-X aims to establish standardized measurements to document real carbon data that reflect the real processes and location factors over the supply chain. In addition, Catena-X seeks to facilitate the data needed to improve traceability, efficiency, and circularity across value chain steps. As sustainability requires a transformation of entire industries, such digital ecosystems and new forms of data sharing will be crucial for fostering the value chains of the future.

6.4 Expert Conversation on Sustainability in the Supply Chain

Is Supply Chain Transparency the Key to Sustainability?

-

Voigt: Sustainability has gained strategic importance in the automotive industry, with significant relevance in its supply chains. BMW is a worldwide leader concerning sustainability aspects. Could you reflect on how you approach supply chain management (SCM) from a sustainability point of view? What are the major changes in the BMW supply chain network concerning digitalization, sustainability, or even the lessons learned from coronavirus disease (COVID-19)?

-

Zipse: The industry is right in the middle of society because our cars—our products—are very visible in the streets. Everyone knows the brand. There is a lot of discussion about sustainability. Society will not accept if you are not complying with specific regulations such as emissions or safety standards—regardless of whether you are in Europe, the United States, or Asia. Even worse: Your brand image and your value in the marketplace will immediately be diminished if you are not compliant, so you simply have to be. Otherwise, it would be very harmful. The diesel scandal is much more than a technical issue. It destroyed a lot of market value and future capital.

-

Voigt: How does BMW address this situation?

-

Zipse: BMW goes one step further. We put sustainability right into the core of our company policy and strategy. But that means we have to fulfill this promise. You must walk the talk. You cannot only say “I will do a statement” or “I will set a new target until 2050.” It starts today! Otherwise nowadays the press will report that you say something but do something else.

-

Voigt: What role does the value chain play in this regard?

-

Zipse: Over 85% of our added value in the car is not manufactured or sometimes not even designed by us. It is designed by the supply chain and our partners. However, at the end of the day, you are responsible for aggregating all these supply chain components into a final product. So, there is a specific responsibility for any car manufacturer to be knowledgeable about the status of the supply chain, specifically when we talk about emissions, most prominently CO2, and that you are aware of whom you give contracts. It is for this reason that we have implemented very close rules of conduct for all our supply chain members and rules about the transparency of what they are doing.

How to Establish Standards in a Contract Culture?

-

Zipse: Supply chains always have to deal with resource scarcity. That is of eminent importance for the future of any industry, and the automotive industry operates the largest supply chain in the world. What approaches can academia offer to improve managing resource scarcity in our supply chains?

-

Voigt: Every economic thought, every economic model, is centered around resource scarcity because we never have enough. We must decide what to use and what not to use. We see highly complex international value chain networks, especially in the automotive industry. As you mentioned, 85% of the value is created upstream, and you as the OEM have to measure this.

-

Zipse: How advanced are the measurement tools discussed in academia?

-

Voigt: Fortunately, our methods and systems are very effective in measuring economic impacts like costs and value created. You will likely know every cost in the whole value chain from every supplier. By contrast, we lack competence in measuring the social or ecological impact. That is the task of academia and practice to develop. It is not easy to do because economists have only one dimension—it is Dollar or Euro. Yet, in the ecological area, we have different emissions, so we need sensors for every possible emission that we have to measure. Subsequently, you have to react to these data wisely and therefore develop and implement decision systems. The head of procurement for Daimler cars, Dr. Güthenke, is working on a system using blockchain to measure the carbon footprint with every supplier. Do you have similar initiatives at BMW? How difficult is it to develop such a measuring system? How important is it to measure and acquire data to make decisions?

-

Zipse: BMW has more than 4000 direct suppliers and more than 12,000 suppliers overall. What kind of relationship do you have with them? Would you push responsibility to the supply chain and say: “You must be compliant with social standards and emission standards and cost contracts and so on.” No. Delegating the problem is not the solution. The right approach is to do it together and support your suppliers. In many cases, they do not have the knowledge or economic power to implement specific steps, such as installing blockchain and reporting systems. The most important aspect is having a cooperative culture and not a contract culture. You need to nurture transparency over the supply chain.

-

Voigt: Could you give an example?

-

Zipse: Look at the scarcity of automotive chips. If we had more transparency and reliability about the n-tier supply chain, such as knowing where our orders are or the capacity status in factories, the problem would be diminished and much easier to solve because it is based on data.

-

Voigt: Interesting example! I see the huge potential of data sharing across the value chain.

-

Zipse: Yes. But supply chain partners will only be enticed to share data with you if they trust you. Of course, we have tremendous technical possibilities, like blockchain. But look at what could happen with GAIA-X: Instead of the Internet of things, you could have the Internet of companies. The technical possibility is there. The rest is trust. This is a great opportunity.

How Can Suppliers Contribute?

-

Voigt: If you come up to any of your 4000 direct suppliers telling them “Your EMAS certification and ISO 14001 is not enough. You must do more in this area.”, they will react “OK, but then we have a lot more costs and no benefit.” But we know that the suppliers’ contribution is needed. Otherwise, we cannot reach our goals. The situation was quite similar back when we introduced quality systems: Suppliers were unhappy, but eventually, they did it. What is your message to key suppliers?

-

Zipse: Doing everything yourself is not impactful enough. If you have contracts with suppliers, it is good if your fellow competitors do the same. When we have sustainability clauses in our contracts, we try to ensure that they are similar within the automotive industry. That is very important because then the supplier has no choice. Look at electric cars. The biggest CO2 footprint comes from the supply chain, 60% just from the sourcing and production of the battery cell, as opposed to the internal combustion engine, where it comes from the life cycle of the car.

-

Voigt: So how do you reduce the overall footprint of electric cars?

-

Zipse: All of our five battery cell suppliers have to comply and be transparent about where their energy source comes from—it is all 100% green energy. It is a matter of contract negotiations. When you put that into a contract, you assume it will cost more. But this is your proof that you have a functioning sustainability strategy in place. Suppliers understand that this is very important. So, in the long run, this will be the industry standard.

How Can Autonomous Driving Improve Sustainability?

-

Voigt: Academia and research prove that in the long run everybody has an advantage. Let’s move to another topic: Do you think autonomous driving can bring ecological advantages?

-

Zipse: The basic question is “How is traffic organized?” Solving traffic problems is not the goal of our industry. But improving the situation so that you have fewer traffic jams is our concern. If you look at certain cities like Los Angeles or Chinese cities, the average driving speed is 20 km/h. The car is standing more than it is driving.

-

Voigt: What can technology offer to address this challenge?

-

Zipse: Self-driving cars offer an improvement when automated driving allows them to find their own way through very complex traffic situations. There will be an effect if we organize this in a good way. In addition to the impact on traffic, the productivity and well-being level of passengers will be increased. Even sleeping could be a productivity measure. Autonomous driving, even Level 2+, where you can take your mind off driving a little bit, would be a big step forward.

Do you have any scientific evidence of how autonomous driving could improve sustainability?

-

Voigt: I have been working in the automotive industry academically for 20 years, but I have not conducted any research on this topic myself, nor have I read any market study on how car-buyers are reacting to this. In all the discussions about electromobility and autonomous driving, the customer is barely mentioned. That is surprising, because a company has to produce products and services for customers, and the customer’s desire should be the starting point.

How Can Customer Needs Be Integrated in the Process?

-

Zipse: The strategy of any product-driven company starts with the customer. The goal is to connect the customer with other stakeholder interests. Today’s customer is very much aligned with societal goals. A car that obviously does not contribute to social and environmental aspects will have a reduced market share—even though there will always be some kind of niche.

-

Voigt: So you see the customer as potential drivers for sustainability?

-

Zipse: If you have an attractive product that also contributes to sustainability, it will have great market access. Look at sneakers: A fully recyclable sneaker is more expensive than a regular sneaker. You can create extremely attractive products and at the same time integrate sustainability and impact into the process. It is not a contradiction. Quite the opposite: If you neglect the customer, you are not even contributing.

-

Voigt: From the concept of market diffusion, we know that we do not have the whole market from the very beginning. Opening the market and developing the market are tasks of successful innovation management. How do you develop the market?

-

Zipse: BMW is proud to be a pioneer for driving dynamic cars, but we also integrate sustainability into our strategy. Customers are surprised that this integration works. You do not give something up to gain something else; you integrate it into a strategy. Only financially very successful companies have the resources to take the next step. Capital markets these days are very much linked to sustainability targets. It is again no contradiction. Capital markets demand more than just financial targets. Take the Taxonomy or the Corporate Sustainability Reporting regulations in the EU. Such frameworks are becoming more and more a part of your reporting.

Can Industry 4.0 Contribute to a More Sustainable Future?

-

Voigt: Let us move on to Industry 4.0. I was pleased to lead a research project at the University of Erlangen-Nuremberg to investigate whether Industry 4.0 can be a concept for more sustainable value creation in the industry. The automotive industry has always been an innovator in production technologies, so you could even do without Industry 4.0. But what is BMW’s strategy with regard to Industry 4.0? Do you see any sustainability benefits from using Industry 4.0?

-

Zipse: Industry 4.0 is a German brand. If you go to Japan or the United States, they will say, “Industry 4.0? That comes from Germany.” It is the combination of digitalization of factories with production systems, efficiency, waste reduction, and so on. Industry 4.0 and the Internet of things have made a huge step forward in terms of profitability. Maybe that would be an interesting area of research. How big was the actual cost reduction per unit through Industry 4.0? You see it in all factories.

-

Voigt: So do you see differences between Germany or Europe and the rest of the world?

-

Zipse: The most interesting thing is to look at large-scale digitalization in different application contexts. On the retail side, you would immediately assume that the American companies, the big-scalers, are leading the pack. On the industrial side, it is exactly the opposite. Europe, and Germany in particular, is leading the world in terms of value creation through Industry 4.0 in the industrial context—we see this through our own experience and research. In our factories, Industry 4.0 is the standard, which has a big impact on sustainability issues. Now, we are going to the next step: The Internet of companies—let’s call it Industry 5.0.

-

Voigt: I see the link to our value chain discussion…

-

Zipse: Absolutely. We have already touched upon it: A supply chain is an Internet of companies. To create transparency in the supply chain, we need an Internet of companies. We have an automotive alliance that we founded together with SAP, Bosch, ZF, and also Continental. In this alliance, Catena-X, we have decided to build platforms to connect companies with each other, under specific safety rules. We want to make that a contribution to the broader EU policy concept of GAIA-X.

-

Voigt: We surveyed about 500 major industrial companies, and cost reduction was a key benefit of Industry 4.0. Yet, Industry 4.0 is not only a way to reduce costs, but in the electronics industry, for example, all the standard products can be transformed into more customer-oriented products. You could deliver millions of variants of each car. Do you see such benefits of Industry 4.0 beyond cost reduction?

-

Zipse: Of course. These benefits include not only cost savings but also quality improvements and your enhanced ability to manage complexity. But every transformation demands an initial investment. And we are getting there. Especially the Internet of tools is becoming a standard more and more. If you buy a new factory machine, it is already part of this world. Germany, but also Europe as a whole, is developing amazing applications based on the Internet of things, especially when practice and academia work together. I appreciate that you are doing this research in the application world. Another important research topic could be to define the next step in supply chain management in terms of creating transparency for regulatory purposes, quality purposes, cost purposes, and, of course, sustainability.

-

Voigt: We are willing to do this research, but we need practical partners to create value.

6.5 Closing the Loop

Coming back to the manufacturing and recycling of batteries, the linear value chain for Li-ion batteries is currently the dominant approach in the industry (Di Persio et al., 2020). Recent developments regarding future demand and supply, sustainability, and compliance with climate targets require closing the linear chain to a closed loop. Thus, the circular economy approach will have to be pursued, which is inevitable for future sustainable development. The circular economy is an economic system based on avoiding waste and promoting the continuous use of resources rather than sourcing new materials in the current linear economy. It focuses on waste management and aspects related to material reduction, reuse, recycling, and responsible manufacturing. It aims to develop new industries and jobs, reduce emissions, and increase efficiency in the use of natural resources.

In the transportation and power sectors, the circular economy is seen as a significant near-term driver of compliance with the Paris Agreement on climate change. The closed-loop approach would allow for a 30% reduction in CO2 emissions from these sectors (Zhao et al., 2021). In the near future, a large number of Li-ion batteries will be retired and become part of the waste stream (Hua et al., 2020). To maximize the value of end-of-life batteries, they will be reused in various forms, such as remanufacturing and repurposing into new systems. In the final step, the valuable materials are to be extracted through recycling in order to be returned to the initial steps of the cycle (Hua et al., 2020).

The stages of the battery life cycle in a circular economy, and thus the sequence of steps in the value chain, consist of two interrelated cycles. First, the primary life cycle includes all steps up to the use of the battery in the vehicle and ends with recycling. In addition, the secondary life cycle will become increasingly important, which describes the reuse of the used EV batteries in new applications, the so-called “second life” (Gernant et al., 2022). This combination is intended to achieve the maximum yield from the materials and efforts expended, thereby reducing the relative resource consumption and emissions over the life cycle and maximizing the return on carbon investment incurred to produce it (Niese et al., 2020). Regardless of whether a battery has only completed the first life cycle or also through the second life cycle, the recycling of the batteries and thus the extraction of valuable materials close the circle.

The primary life cycle is initially characterized by the substeps already known from the linear value chain. Strictly speaking, the closed loop does not allow the process steps to be divided into upstream, midstream, and downstream anymore. However, the respective substeps are still reflected in the circular economy. The upstream consists of the extraction and processing of raw materials. This is followed in the midstream by the production of the individual cell components and their subsequent completion as finished cells. Finally, in the downstream, the battery pack is manufactured by the OEM and then installed in the EV. The completion of vehicle production marks the beginning of the first utilization phase of the battery in the EV. The total range of an EV is reported to be between 120,000 km and 240,000 km, with most manufacturers guaranteeing a range of around 160,000 km and a lifetime of 8 years (Hua et al., 2020). As usage increases and capacity losses occur, LIBs can no longer meet performance and energy requirements, such as driving range and acceleration (Hua et al., 2020). This is reflected in the battery’s state of health, which typically reaches end-of-life at a capacity loss of 20–30%. Even during initial use, degraded or defective battery modules can be replaced with end-of-life modules as part of reconditioning and repair to further utilize the capacity of the remaining modules. Due to homogeneous battery aging resulting from more mature technologies and battery management systems, reconditioning will be limited to only 5% of end-of-life batteries in the long term (Zhao et al., 2021). Based on the analysis and the characteristics of the battery, it must be decided whether the battery will be part of the secondary life cycle and thus of the second use or whether it will be directly part of the recycling step.

The secondary life cycle and its applications focus on the value of repurposing a partially used battery, as opposed to subsequent recycling, which focuses on the value of the battery’s metal content (Niese et al., 2020). The sequence of steps follows battery screening, battery disassembly and reassembly, and the subsequent application of repurposed batteries (Shahjalal et al., 2022). The technical feasibility of the battery chemistry and the associated economic viability of the second life are fundamental to the secondary life cycle. This consideration takes place after the first life cycle in reverse logistics and analytics as part of a precise suitability test. Methods such as electrochemical impedance spectroscopy, current interruption analysis, and capacity analysis are used (Kehl et al., 2021). The predominant use of used Li-ion batteries is in energy storage systems (ESSs). In addition, they can be used to refurbish and repair defective first-life battery modules. Repurposed Li-ion batteries will become increasingly important in sectors such as microgrids, smart grids, renewable energy, and area and frequency regulation. Specifically, they can be used in stationary grid applications, off-grid stationary applications, and mobile applications (Shahjalal et al., 2022). In particular, the increasing integration of renewable energies into the energy grid will boost the demand for stationary energy storage systems. They allow balancing between the irregularity of renewable energy generation with demand deviations and act as a buffer for grid stabilization (Shahjalal et al., 2022). The requirements for batteries in EVs differ from those in ESS, especially regarding cycling stability, power density, cooling, shock resistance, and safety. The requirements for ESS are significantly lower and easier to meet than those for EVs. Factors such as power density and shock resistance are less relevant than before. Differences can also be seen in the individual battery chemistries. Low-cost cell chemistries, in particular, seem to be more attractive for the second life, as they are technically more feasible and less interesting for direct recycling due to less expensive cell materials. LFPs, for example, have higher cycle stability, intrinsic safety, and lifetime than high-end technologies. The end-of-life in the second use occurs when a health state of 40–50% is reached. Subsequently, the materials should be extracted in the final recycling step and added to the beginning of the cycle (Gernant et al., 2022).

6.6 Outlook and Further Challenges

The challenges of the future automotive battery value chain are seen in the overarching issues of the battery industry as well as in further subcategories. With the introduction of autonomous driving, the classic value creation system in the automotive industry is seen in danger and significant disruptions are expected, especially in customer–OEM business relationships and ownership models. Nonautomotive players, such as Google, Waymo, Huawei, and Apple, are seen as disruption drivers. In general, (technical) challenges are expected in all areas of the automotive battery value chain. These are complemented by the importance of economies of scale, whose influence will increase sharply in the future. To be economically attractive, any future technology will require a high degree of standardization on the material side and in the cell format (shape and design). In particular, the need for standardization will increase as soon as it is considered from a total cost of ownership model perspective. In addition, the cost of battery technology in general will remain a challenge. This is primarily due to manufacturing, production processes, and raw materials. The need to balance user requirements with the cost of battery technology will be another challenge. To reach the mass market and mainstream electrification, many technology points still need to be improved to reduce costs. Apart from the battery, the development of the electrical infrastructure, including charging speed, is also seen as a key challenge for successful implementation.

Several experts see the circular economy of battery technology as a key challenge. This starts with the visibility of the batteries. Within the EU, the car manufacturers are legally responsible for the battery once it has reached its end-of-life (EoL) stage. To ensure this, they should always know where their EoL battery is located. This overview is significantly complicated in today’s widespread classic car ownership model and is still an unsolved problem. The development of a comprehensive data infrastructure with information about the vehicle’s current position in the value chain is becoming inevitable, in view of the increasing number of vehicles. To date, the foundations for this are lacking; the first step in this direction is the introduction of standardized battery passports and a digitally networked value chain that includes all relevant suppliers and partners. Furthermore, a closed material cycle for batteries and the necessary materials is perhaps the most crucial point for establishing the value chain in the long term. Procuring the necessary materials for market ramp-up should not cause any problems currently. However, in the long term, beyond 2050, the system is unlikely to work without an almost 100% closed-loop economy. For this, the cycle must be closed, and interfaces must be established. The question of who will be responsible for the division, one player for the entire cycle or different players, still needs to be clarified and increases the relevance of the intersections. Some experts address the degree of circularity and emphasize its importance in meeting carbon intensity and environmental impact expectations. Many projections for reducing the carbon footprint of battery production are based on the use of recycled materials. To meet the expected levels, experts see strong political action as imperative.

The material chain describes another challenge. The supply of resources and raw materials is a weak point and represents a major challenge in Europe, which requires a more sovereign positioning concerning its dependence. As a solution, a more sustainable design of the established supply chains and efforts to enter into partnerships with other countries are discussed. Even if the dependency cannot be resolved, Europe should try to adapt the value chain conditions to its sustainability vision and ideals. It should promote a sustainable value chain design around the extraction and processing of resources and pay attention to working and social conditions. Furthermore, changes in battery technologies are expected to have a significant impact on the material chain. These will lead to a change in material requirements, for example, with the decreasing demand for cobalt, the increasing demand for manganese, and the trend toward LFP chemistry. The shift to solid-state technology and metallic anodes will also overturn the current situation.

Expert opinions diverge in the area of capacity-building. While some experts believe that there is no problem in scaling up and meeting battery demand as long as sufficient raw materials are available, others see substantial challenges in building up production capacity and the associated need for materials. They also mention the current strategic planning conflict on capacity building. Decisions to build battery manufacturing and recycling capacity, in terms of location and battery chemistries, and to cooperate with energy storage system operators, must be made now so that sufficient capacity will be available a decade from now. This leads to the problem that many strategic decisions must be made based under uncertainty.

The production processes represent a further challenge. The robustness of all raw material and material processing synthesis processes is considered to be sufficiently high, as experience from the fast-moving consumer goods sector can be passed on here. The situation is different for innovations in the process steps, where uncertainties arise for the next-generation batteries regarding how raw materials or precursors for syntheses can be produced on a large scale. The same applies to the production of cell components and cells, for which there are no empirical values from large-scale industrial handling, highlighting the lack of technology and the need for technology development. On the production side, the processing of the solid-state electrolyte and the metallic anodes are seen as major issues. While some subprocesses of the next-generation batteries, such as dry pressing, are already at a medium level of maturity on an industrial scale, many other steps, especially in assembly, still pose significant challenges. Moreover, experts see significant cost reduction potential in establishing a dry coating process, which is still a complex process with high labor and energy costs. In the future, they see water-based processes with no solvents.

And as if that was not enough, experts see reverse logistics as another challenge. The difficulty of returning the EoL batteries is evident in the entire organization of the logistics chain for second life and recycling. It requires holistic cooperation between established and new players who have not yet worked together to this extent. The complexity is also reflected in the logistics costs. In the EU, batteries are classified as hazardous goods, requiring many obligations, certificates, and agreements for their transport. Due to the different implementation of regulations in the EU countries, country-specific adaptation and verification of the transport are required. This makes the transportation of batteries a slow and an expensive process. Even further challenges are seen in the collection of EoL batteries. Although the visibility of automotive batteries at the end-of-life is higher than for batteries from consumer goods, the different possibilities for second-life applications make highly efficient and high-quality recycling of critical materials still challenging. A clear separation of battery chemistries is necessary to ensure high quality and clean recycling. The problem of classification of EoL batteries is still unresolved. This requires information from the OEMs, which is currently difficult to obtain.

The final challenge lies in recycling and the revision of current recycling processes. Many difficulties and unresolved issues are currently seen here, with a clear gap between recyclers and producers. The current recycling processes are seen as inefficient and misrepresented. Recyclers often simply shred batteries and dispose of the so-called black mass in landfills, with no recovery and processing of raw materials. However, even companies that do recover raw materials use processes that call for further improvements. The established recycling processes are not the most efficient because they require a great deal of energy and cost to break everything down. What is needed instead is the development of gentler recycling methods. The problem currently lies in the small scales and the heterogeneity of cell chemistries. A process can only be properly optimized when the defined cell chemistries with expected materials are available. Another threat lies in the increasing popularity of LFP batteries. Due to the excellent availability of materials and their low cost, these batteries are becoming increasingly popular for nonpremium vehicles. At the end of their service life, in 10 to 15 years, many LFP batteries will be available that no one wants to recycle due to their lack of valuable materials and economic calculations. Companies and governments are not attacking the issue of LFP recycling. It is up to the government to implement regulatory policies to incentivize the recycling of LFPs.

6.7 Conclusion

The transition to a carbon-free economy is essential to limit global warming, and using renewable energy and electromobility is critical for achieving this. In the automotive industry, however, the transition to EVs shifts carbon footprint considerations upstream. Understanding, managing, and innovating the value chains of the future are therefore key on the Road to Net Zero.

How can sustainable value chains for the future be developed?—We would like to highlight five takeaways from this chapter that invite further discussion:

-

1.

Reducing negative ecological and social impacts, not only for electric vehicles but more generally, requires a value chain perspective and circular thinking.

-

2.

While closing the loop of material flows offers huge potential for meeting carbon reduction and environmental impact expectations, there are significant technological, organizational, and regulatory barriers at each step of the circular value chain.

-

3.

Since circularity requires adequate data, further digitization such as the digital battery passport and adequate forms of data sharing are needed.

-

4.

No single company can address the challenges of circular value chains alone. Instead, collaboration is needed, both along value chains and within industries.

-

5.

The consistent further development of battery storage technologies can make a further decisive contribution to counteracting the prevailing scarcity of resources and will significantly influence the design of future sustainable supply chains.

On the Road to Net Zero, value chains thus play a pivotal role. Despite the importance of the upstream value chain, however, the core activities of industrial OEMs still lie in their own manufacturing processes. This is where the various components of complex supply networks are assembled into valuable products. Moreover, manufacturing is where companies have the greatest degree of control and can directly address their environmental footprint. For this reason, the following chapter (Chap. 7) now looks at Sustainability in Manufacturing.

References

Basia, A., Simeu-Abazi, Z., Gascard, E., & Zwolinski, P. (2021). Review on state of health estimation methodologies for lithium-ion batteries in the context of circular economy. CIRP Journal of Manufacturing Science and Technology, 32, 517–528. https://doi.org/10.1016/j.cirpj.2021.02.004

Roland Berger (Ed.). (2022). The Lithium-Ion (EV) battery market and supply chain: Market drivers and emerging supply chain risks. Retrieved June 26, 2023, from https://content.rolandberger.com/hubfs/07_presse/Roland%20Berger_The%20Lithium-Ion%20Battery%20Market%20and%20Supply%20Chain_2022_final.pdf

Bielewski, M., Blagoeva, D., Cordella, M., Di Persio, F., Gaudillat, P., Hildebrand, S., Mancini, L., Mathieux, F., Moretto, P., Paffumi, E., Paraskevas, D., Ruiz, V., Sanfélix, J., Villanueva, A., & Zampori, L. (2021). Analysis of sustainability criteria for lithium-ion batteries including related standards and regulations. Publications Office of the European Union. https://doi.org/10.2760/811476

BloombergNEF (Ed.). (2022). Electric vehicle Outlook 2022: Executive summary. Retrieved June 26, 2023, from https://about.newenergyfinance.com/electric-vehicle-outlook

Bobba, S., Carrara, S., Huisman, J., Mathieux, F., & Pavel, C. (2020). Critical raw materials for strategic technologies and sectors in the EU: A foresight study. Publications Office of the European Union. https://doi.org/10.2873/58081

Catena-X. (2023). The Vision of Catena-X. Retrieved July 9, 2023, from https://catena-x.net/en/vision-goals

Ciulla, F., Dayal, N., & Gujral, A. (2021). Charged-up demand brings challenges to the battery value chain. L.E.K. Consulting, 2021(23). Retrieved June 26, 2023, from https://www.lek.com/insights/ei/charged-demand-brings-challenges-battery-value-chain

Deutscher Industrie- und Handelskammertag (DIHK) (Ed.). (2022). Versorgung mit Rohstoffen. Retrieved June 26, 2023, from https://www.dihk.de/de/themen-und-positionen/wirtschaftspolitik/rohstoffe/versorgung-mit-rohstoffen-6254

Di Persio, F., Huisman, J., Bobba, S., Alves Dias, P., Blengini, G. A., & Blagoeva, D. (2020). Information gap analysis for decision maker to move EU towards a circular economy for the lithium-ion battery value chain. Publications Office of the European Union. https://doi.org/10.2760/069052

Fan, E., Li, L., Wang, Z., Lin, J., Huang, Y., Yao, Y., Chen, R., & Wu, F. (2020). Sustainable recycling technology for Li-ion batteries and beyond: Challenges and future prospects. Chemical Reviews, 120(14), 7020–7063. https://doi.org/10.1021/acs.chemrev.9b00535

Gernant, E., Seuster, F., Duffner, F., & Jambor, M. (2022). Understanding the automotive battery life cycle: A comprehensive analysis of current challenges in the circular economy of automotive batteries. Porsche Consulting. Retrieved June 26, 2023, from https://newsroom.porsche.com/dam/jcr:5a063b1d-7d12-4072-94ee-e4c479cd1621/Understanding%20the%20Automotive%20Battery%20Life%20Cycle_C_Porsche%20Consulting_2022.pdf

Heimes, H. H., Kampker, A., Lienemann, C., Locke, M., Offermanns, C., Michaelis, S., & Rahimzei, E. (2018). Lithium-ion battery cell production process (3rd ed.). PEM der RWTH Aachen University; DVMA.

Hua, Y., Zhou, S., Huang, Y., Liu, X., Ling, H., Zhou, X., Zhang, C., & Yang, S. (2020). Sustainable value chain of retired lithium-ion batteries for electric vehicles. Journal of Power Sources, 478, 228753. https://doi.org/10.1016/j.jpowsour.2020.228753

Huisman, J., Ciuta, T., Mathieux, F., Bobba, S., Georgitzikis, K., & Pennington, D. (2020). RMIS–raw materials in the battery value chain. Publications Office of the European Union. https://doi.org/10.2760/239710

International Energy Agency (Ed.). (2018). Global EV Outlook 2018: Towards cross-modal electrification. Retrieved June 26, 2023, from https://iea.blob.core.windows.net/assets/387e4191-acab-4665-9742-073499e3fa9d/Global_EV_Outlook_2018.pdf

International Energy Agency (Ed.). (2021). The role of critical minerals in clean energy transitions: World energy outlook special report. Retrieved June 26, 2023, from https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf

Kehl, D., Jennert, T., Lienesch, F., & Kurrat, M. (2021). Electrical characterization of Li-ion battery modules for second-life applications. Batteries, 7(2), 32. https://doi.org/10.3390/batteries7020032

Kuepper, D., Kuhlmann, K., Wolf, S., Pieper, C., Xu, G., & Ahmad, J. (2018). The future of battery production in electric vehicles. Boston Consulting Group. Retrieved June 26, 2023, from https://www.bcg.com/publications/2018/future-battery-production-electric-vehicles

Lebedeva, N., Di Persio, F., & Boon-Brett, L. (2017). Lithium ion battery value chain and related opportunities for Europe. Publications Office of the European Union. https://doi.org/10.2760/6060

Moazzam, P., Boroumand, Y., Rabiei, P., Baghbaderani, S. S., Mokarian, P., Mohagheghian, F., Mohammed, L. J., & Razmjou, A. (2021). Lithium bioleaching: An emerging approach for the recovery of Li from spent lithium ion batteries. Chemosphere, 277, 130196. https://doi.org/10.1016/j.chemosphere.2021.130196

Neumann, J., Petranikova, M., Meeus, M., Gamarra, J. D., Younesi, R., Winter, M., & Nowak, S. (2022). Recycling of lithium-ion batteries - current state of the art, circular economy, and next generation recycling. Advanced Energy Materials, 17, 2102917. https://doi.org/10.1002/aenm.202102917

Niese, N., Pieper, C., Arora, A., & Xie, A. (2020). The case for a circular economy in electric vehicle batteries. Boston Consulting Group. Retrieved June 26, 2023, from https://www.bcg.com/de-de/publications/2020/case-for-circular-economy-in-electric-vehicle-batteries

Roy, J. J., Srinivasan, M., & Cao, B. (2021). Bioleaching as an eco-friendly approach for metal recovery from spent NMC-based lithium-ion batteries at a high pulp density. ACS Sustainable Chemistry & Engineering, 9(8), 3060–3069. https://doi.org/10.1021/acssuschemeng.0c06573.s001

Shahjalal, M., Roy, P. K., Shams, T., Fly, A., Chowdhury, J. I., Ahmed, M. R., & Liu, K. (2022). A review on second-life of Li-ion batteries: Prospects, challenges, and issues. Energy, 241, 122881. https://doi.org/10.1016/j.energy.2021.122881

Siemens. (2021). Siemens entwickelt ökosystembasierten Ansatz für den Austausch von Emissionsdaten. Retrieved June 26, 2023, from https://press.siemens.com/global/de/pressemitteilung/siemens-entwickelt-oekosystembasierten-ansatz-fuer-den-austausch-von

Steen, M., Lebedeva, N., Di Persio, F., & Boon-Brett, L. (2017). EU competitiveness in advanced Li-ion batteries for e-mobility and stationary storage applications - opportunities and actions. Publications Office of the European Union https://doi.org/10.2760/75757

Steward, D., Mayyas, A., & Mann, M. (2019). Economics and challenges of li-ion battery recycling from end-of-life vehicles. Procedia Manufacturing, 33, 272–279. https://doi.org/10.1016/j.promfg.2019.04.033

U.S. Geological Survey (Ed.). (2022). Mineral commodity summaries 2022. U.S. Geological Survey. https://doi.org/10.3133/mcs2022

United Nations Framework Convention on Climate Change (Ed.). (2022). The Paris Agreement: What is the Paris Agreement? Retrieved June 26, 2023, from https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement

Vereinigung der Bayerischen Wirtschaft (Ed.). (2021). Rohstoffsituation der bayerischen Wirtschaft. Retrieved June 26, 2023, from https://www.vbw-bayern.de/Redaktion/Frei-zugaengliche-Medien/Abteilungen-GS/Wirtschaftspolitik/2020/Downloads/201202-Studie-Rohstoffe.pdf

Voigt, K.-I., & Thiell, M. (2004). Industrielle Rücknahme- und Entsorgungssysteme. In G. Prockl, A. Bauer, A. Pflaum, & U. Müller-Steinfahrt (Eds.), Entwicklungspfade und Meilensteine moderner Logistik (pp. 389–418). Gabler Verlag. https://doi.org/10.1007/978-3-322-89044-3_19

Weimer, L., Braun, T., & vom Hemdt, A. (2019). Design of a systematic value chain for lithium-ion batteries from the raw material perspective. Resources Policy, 64, 101473. https://doi.org/10.1016/j.resourpol.2019.101473

World Economic Forum (Ed.). (2019). A vision for a sustainable battery value chain in 2030: unlocking the full potential to power sustainable development and climate change mitigation. Retrieved June 26, 2023, from https://www3.weforum.org/docs/WEF_A_Vision_for_a_Sustainable_Battery_Value_Chain_in_2030_Report.pdf

Zhao, Y., Pohl, O., Bhatt, A. I., Collis, G. E., Mahon, P. J., Rüther, T., & Hollenkamp, A. F. (2021). A review on battery market trends, second-life reuse, and recycling. Sustainable Chemistry, 2(1), 167–205. https://doi.org/10.3390/suschem2010011

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2023 The Author(s)

About this chapter

Cite this chapter

Voigt, KI., Czaja, L., Zipse, O. (2023). Transforming Value Chains for Sustainability. In: Zipse, O., et al. Road to Net Zero. Springer, Cham. https://doi.org/10.1007/978-3-031-42224-9_6

Download citation

DOI: https://doi.org/10.1007/978-3-031-42224-9_6

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-42223-2

Online ISBN: 978-3-031-42224-9

eBook Packages: Business and ManagementBusiness and Management (R0)