Abstract

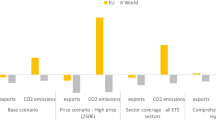

Climate change has become an essential item in the global development agenda. As a result, many countries have started to elaborate and adopt trade measures to reduce climate change risk. For example, on July 14, 2021, European Commission introduced a legislative proposal for a Carbon Border Adjustment Mechanism (CBAM). Under this mechanism, imports of certain products to the EU will be subject to a special fee based on the carbon intensity of the supplied products. CBAM will affect many EU’s partners, including members of the Eurasian Economic Union (EAEU). Estimates show that CBAM may affect up to 58% of EAEU’s exports to the EU, with Russia most affected. This chapter is devoted to analyzing the current CBAM proposal and analysis of its effects on the Russian economy. It is concluded that payments for Russian exports to the EU under CBAM are estimated to vary between 94,3 bln euro and 174,1 bln euro during 2026–2035, depending on CBAM parameters and CBAM pass-through rate to prices.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

Legislative proposals.

- 2.

Defined as the ratio of the increase in GHG emissions outside countries with climate regulations to the amount of emission reductions inside countries with climate regulations.

- 3.

Authors use the term CBAM, but it is different from the EC’s CBAM proposal made in July 2021.

- 4.

Probably because of possible violation of WTO’s most-favored-nation (MFN) principle.

- 5.

The list of these sectors is available in Commission Delegated Decision (EU) 2019/708 of 15 February, 2019.

- 6.

Analysis was conducted on the basis of import statistics (e.g., the share of EU in exports of certain EAEU member-state was calculated as the ratio between imports from such state to EU and the World) during December 2021 - January 2022.

- 7.

EU is also a key export destination for Kazakhstan that exports mainly oil to EU.

- 8.

We do not set a price ceiling for EUA (CBAM rate) in our calculations. However, it may be limited to price of carbon that is needed to encourage the switch to “green products.”

- 9.

For product groups where carbon intensity based on scope 1 emissions equals to carbon intensity on scope 1 and 2 emissions no data was found on scope 2 emissions.

- 10.

E.g., Ecofys prepared several research papers at the request of the European Commission.

- 11.

Many countries may want to avoid payments under the EU CBAM, and there is a high chance that they will adopt domestic carbon pricing regulations mirroring the dynamics of EUA price and covering those sectors and products that fall under EU’s CBAM. To protect the competitiveness of domestic firms countries will adopt their own BCAs reflecting the parameters of domestic regulation (that is tied to EU CBAM). Therefore, it is assumed that BCA parameters of the other countries will be close to the European CBAM. It is oversimplified assumption and in practice BCAs of other countries may differ in part of affected products and rates to be paid. Also trade reorientation requires construction of CGE model which can be difficult taking into account data limitations of this research.

- 12.

We also indirectly assume that Russian companies involved in export operations maximized their profits on the domestic market so that they do not reorient their export to domestic market.

- 13.

As mentioned earlier these estimates are based on assumption that EUA price does not have a ceiling. If we assume that EUA price ceiling is 170 euro per ton of CO2e (that is believed to be a price to reach EU 2030 emission reduction targets), and it will be reached in 2030 (i.e. CBAM rate remains at 170 euro per ton of CO2e after 2030) then our estimates of payments would vary between 88.3 bln euros and 159.4 bln euros over the period from 2026 to 2035.

References

Condon M., and Ignaciuk A. (2013) ‘Border carbon adjustment and international trade: A literature review’. OECD Trade and Environment Working Papers 2013/06.

Dong Y., and Whalley J. (2009) ‘How large are the impacts of carbon motivated border tax adjustments’. NBER Working Paper Series.

Ellis J., Nachtigall D., and Venmans F. (2019) ‘Carbon pricing and competitiveness: Are they at odds?’ OECD Environment Working Paper 52.

Ghodsi M., Grübler J., and Stehrer R. (2016) ‘Import demand elasticities revisited’. wiiw Working Paper, No. 132.

Haites, S. (2018). Carbon taxes and greenhouse gas emissions trading systems: What have we learned? Climate Policy, 18(8), 955–966.

Kuik, O., & Hofkes, M. (2010). Border adjustment for European emissions trading: Competitiveness and carbon leakage. Energy Policy, 38(4), 1741–1748.

Kuusi, T., Björklund, M., Kaitila, V., Kokko, K., Lehmus, M., Mechling, M., et al. (2020). Carbon border adjustment mechanisms and their economic impact on Finland and the EU.

Misch F., and Wingender P. (2021). ‘Revisiting carbon leakage’. IMF Working paper.

Zachmann G., and McWilliams B. (2020). ‘A European carbon border tax: much pain, little gain’. Bruegel Policy Contribution No. 5.

Zhou, X., Kojima, S., & Yano, T. (2010). Addressing carbon leakage by border adjustment measures. Review of current studies. Institute for Global Environmental Strategies.

Online Documents

Carbon pricing dashboard (2021). Available at: https://carbonpricingdashboard.worldbank.org/.

Climate Action Tracker (2021). Glasgow’s 2030 credibility gap: net zero’s lip service to climate action. Available at: https://climateactiontracker.org/publications/glasgows-2030-credibility-gap-net-zeros-lip-service-to-climate-action/.

Ember-climate (2021). Available at: https://ember-climate.org/.

European Commission (2021a). Carbon border adjustment mechanism: Questions and answers. Available at: https://ec.europa.eu/commission/presscorner/detail/en/qanda_21_3661.

European Commission (2021b). Emissions cap and allowances. Available at: https://ec.europa.eu/clima/eu-action/eu-emissions-trading-system-eu-ets/emissions-cap-and-allowances_en.

European Commission (2021c). Proposal for a regulation of the European Parliament and of the Council establishing a carbon border adjustment mechanism. COM(2021) 564 final, − 14/07/2021. Available at: https://ec.europa.eu/info/sites/default/files/carbon_border_adjustment_mechanism_0.pdf.

Eur-lex (2021a). Commission Decision (EU) 2020/1722 of 16 November 2020 on the Union-wide quantity of allowances to be issued under the EU Emissions Trading System for 2021 (notified under document C(2020)7704). Available at: https://eur-lex.europa.eu/legal-content/GA/TXT/?uri=CELEX:32020D1722.

Eur-lex (2019). Commission Delegated Decision (EU) 2019/708 of 15 February 2019 supplementing Directive 2003/87/EC of the European Parliament and of the Council concerning the determination of sectors and subsectors deemed at risk of carbon leakage. Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=uriserv%3AOJ.L_.2019.120.01.0020.01.ENG&toc=OJ%3AL%3A2019%3A120%3AFULL.

Eur-lex (2021b). Commission Delegated Regulation (EU) 2019/331 of 19 December 2018 determining transitional Union-wide rules for harmonised free allocation of emission allowances pursuant to Article 10a of Directive 2003/87/EC of the European Parliament and of the Council. Available at: https://eur-lex.europa.eu/eli/reg_del/2019/331/oj.

Eur-lex (2021c). Commission Regulation (EU) No 860/2010 of 10 September 2010 establishing for 2010 the ‘Prodcom list’ of industrial products provided for by Council Regulation (EEC) No 3924/91. Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32010R0860.

Eur-lex (2021d). Directive 2003/87/EC of the European Parliament and of the Council of 13 October 2003 establishing a system for greenhouse gas emission allowance trading within the Union and amending Council Directive 96/61/EC. Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A02003L0087-20210101&qid=1639751241352.

European Roundtable on Climate Change and Sustainable Transition (2021). EU CBAM Proposal in the Fit for 55 Package. Available at: https://ercst.org/event/eu-cbam-proposal-discussion/.

Eurostat (2021). Available at: https://ec.europa.eu/eurostat.

Federal Service of Russia for Hydrometeorology and Environmental Monitoring (2020). National report on inventory of anthropogenic emissions by sources and removals by sinks of all greenhouse gases not controlled by the Montreal Protocol for 1990–2018. Available at: http://downloads.igce.ru/kadastr/rus-2022-crf-15apr22.zip

Intergovernmental Panel on Climate Change (2021) Climate change 2021. The physical science basis. Available at: https://www.ipcc.ch/report/ar6/wg1/downloads/report/IPCC_AR6_WGI_Full_Report.pdf.

Ministry of economic development of Russian Federation (2018). Socio-economic forecast for Russian Federation for the period until 2036. Available at: https://www.economy.gov.ru/material/directions/makroec/prognozy_socialno_ekonomicheskogo_razvitiya/prognoz_socialno_ekonomicheskogo_razvitiya_rossiyskoy_federacii_na_period_do_2036_goda.html.

UNFCC (2020a). Nationally Determined Contribution of the Russian Federation. Available at: https://www4.unfccc.int/sites/ndcstaging/PublishedDocuments/Russian%20Federation%20First/NDC_RF_eng.pdf.

UNFCC (2021). Paris Agreement. Available at: https://unfccc.int/sites/default/files/english_paris_agreement.pdf.

UNFCC (2020b). Submission by Germany and European Commission on behalf of the European Union and its Member States. Available at: https://www4.unfccc.int/sites/ndcstaging/PublishedDocuments/European%20Union%20First/EU_NDC_Submission_December%202,020.pdf.

World Integrated Trade Solution (2021). Available at: http://wits.worldbank.org/.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Lazaryan, S., Sudakov, S. (2023). Impact of EU’s CBAM on EAEU Countries: The Case of Russia. In: Devezas, T.C., Leitão, J.C.C., Yegorov, Y., Chistilin, D. (eds) Global Challenges of Climate Change, Vol.2. World-Systems Evolution and Global Futures. Springer, Cham. https://doi.org/10.1007/978-3-031-16477-4_9

Download citation

DOI: https://doi.org/10.1007/978-3-031-16477-4_9

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-16476-7

Online ISBN: 978-3-031-16477-4

eBook Packages: Economics and FinanceEconomics and Finance (R0)