Abstract

We estimate the effects of a European Carbon Border Adjustment (CBA) mechanism on exports, real GDP, welfare and emissions using the multi-region, multi-sector structural gravity model of Larch and Wanner (2017). Incorporating the main industries covered in the proposal of the European Commission from mid-2021, as well as its other design features, and assuming prevailing CO2 prices, we find only small effects of the European CBA mechanism. EU exports are estimated to decline by 0.04%, while CO2 emissions in EU countries increase by 0.24%. These negligible results mask larger adjustments at the sectoral level. The structural changes will shift the EU economy towards more emission-intensive industries, which will make achieving its climate goals harder. On the positive side, the European CBA mechanism will reduce global emissions by 0.08%. Given the minute economic costs in terms of GDP and welfare losses, the CBA mechanism seems an appropriate policy tool, though its proposed design will not be able to make a significant contribution to mitigating global climate change.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

One of the most progressive elements in the EU’s European Green Deal (EGD) is the introduction of a Carbon Border Adjustment (CBA) mechanism (European Commission 2019). According to schedule, the European Commission unveiled the first draft for a European CBA in July 2021 (European Commission 2021) which could be implemented as of 2023. The CBA mechanism constitutes a supplementary measure to the European Emissions Trading System (ETS), the EU’s internal carbon pricing system, introduced in 2005, and one of its major instruments for achieving the emissions reduction target the EU committed to under the Paris Agreement and its stepped-up internal reduction target of 55% by 2030 (compared with levels in 1990).

The CBA mechanism has two main objectives, both of which are linked to the European ETS. The first objective is to counter ‘carbon leakage’, that is, additional imports due to the relocation of energy-intensive industries to countries without any domestic carbon pricing mechanism (Felder and Rutherford 1993).Footnote 1 By correcting negative externalities associated with CO2 emissions, the European ETS also creates further asymmetries in CO2 costs between the EU and third-country producers, with detrimental consequences for the competitiveness of EU exporters and the Single Market’s locational attractiveness. Given these unintended distortions, the second objective of the CBA mechanism is to improve the export competitiveness of EU exporters by restoring a level playing field.

By imposing a particular tariff on EU imports, known as ‘Carbon Border Tax’ (CBT) or ‘carbon tariff’, the size of which depends on the carbon intensity of the imported product, the CBA mechanism will reduce (and in the ideal case eliminate) the existing asymmetries in CO2 costs between the EU and third-country producers in the Single Market.

In this paper, we use the structural gravity model of Larch and Wanner (2017) to model the effects of the introduction of a CBA mechanism as envisaged in the current Commission proposal on exports, emissions, GDP and welfare for the EU and the global economy for more than 120 economies. While the focus is on the outcomes for the EU as the entity implementing the CBA mechanism, we also present results for the global economy because of the relevance global emission levels have for the climate. Moreover, the results for partner countries are interesting in light of possible retaliation measures (Felbermayr and Peterson 2020) or countries joining a ‘carbon club’ (Nordhaus 2015). Apart from modelling this ‘base’ scenario, we also provide results for different levels of carbon prices and other design features, including the addition of carbon rebates for exporters, the application of an alternative method for calculating the carbon intensity of imports and a wider industry coverage as the one foreseen in the current proposal. The comparisons of the results from the different scenarios will on the one hand shed light on the effectiveness of the European CBA mechanism as currently proposed and on the other hand reveal how sensitively the CBA mechanism reacts to individual design features.

We find that the introduction of the CBA mechanism in the proposed version leads to a decline in EU and world exports. EU GDP and welfare, however, increase due to increased domestic production. Moreover, as the emission-intensive sectors in the EU benefit from the carbon border tax, these will expand, causing EU CO2 emissions to increase. However, at the global level, CO2 emissions fall. Importantly, all global effects are very small in magnitude, amounting to − 0.12% for exports and − 0.08% for CO2 emissions. By changing specific design features, we can show that the effects increase to various degrees, and in some cases also change direction from negative to positive, but in general remain small in absolute terms. Overall, these results suggest that the CBA mechanism is an appropriate, if not very effective, instrument for reducing global emissions and levelling the playing field for carbon-intensive industries.

We contribute to the literature by adding a very detailed study on the quantitative implications of the proposal for an EU CBA mechanism in the form it has been proposed. The results obtained for the base scenario are therefore a plausible prediction for the short-term economic and environmental effects of the CBA mechanism. Combined with the most suitable data available on CO2 emissions, including official data on the verified emission in the ETS, we use all available information on the different elements of the CBA mechanism to develop a simple though plausible methodology to calculate expected carbon border tariffs applicable under the CBA mechanism. We feed these tariffs into a state-of-the-art multi-region, multi-sector structural gravity model that allows calculating effects for GDP and emissions.

The remainder of the paper is structured as follows. Section 2 reviews the literature on the effects of CBA mechanisms. Section 3 presents the different CBA scenarios investigated and the data used. Section 4 presents the model and the results of the quantitative analysis. Section 5 concludes with some reflections on the policy implications.

2 Related literature

The most commonly used tools for ex-ante assessments of the effects of a CBA mechanism are Computable General Equilibrium (CGE) models. Böhringer et al. (2012a) summarise findings of 29 different studies based on multi-region, multi-sector CGE models and conclude that CBA mechanisms are effective at reducing carbon leakage by a third of its benchmark value (the new mean leakage rate is 8%), and at maintaining domestic sectors’ competitiveness by reducing output losses incurred due to domestic climate policy by almost two-thirds. Thus, the CBA mechanism has a slightly positive impact on the welfare of the implementing countries, and a negative effect on all other countries (Böhringer et al. 20192012b). These findings are generally confirmed in a meta-regression analysis of 25 empirical studies that rely mainly on CGE models and partial equilibrium (PE) models to a lesser extent (Branger and Quirion 2014). Similar conclusions are drawn, among others, by Elliot et al. (2015), Mattoo et al. (2013), Zhang (2012), Bednar-Friedl et al.(2012) and Fischer and Fox (2012).

Larch and Wanner (2017) construct a multi-region, multi-sector structural gravity model to decompose CO2 emission changes arising from stricter emission regulations due to the Copenhagen Accord into scale, composition and technique effects. They show that carbon tariffs can help to reduce emissions worldwide, but at the expense of trade and welfare, especially for developing countries. The framework from Larch and Wanner (2017) is of particular relevance for this paper because it is used for all simulations of the European CBA mechanism.

Compared to the previously mentioned literature, which usually focuses on more ambitious configurations of a CBA mechanism, the economic and environmental effects of more recent simulations of a European CBA mechanism are very small, as shown in Table 1. In large part, this is because they correspond to scenarios with limited sector coverage and scope of the CBA mechanism, as well as the carbon price, and are thus closer to the proposal tabled by the European Commission in July 2021. One such example, though pre-dating the Commission proposal, is Kuusi et al. (2020). The authors simulate the effects of a CBA mechanism on the Finnish economy. The used GTAP CGE model shows decreased imports from non-EU countries, substituted by imports from EU countries, and increased Finnish exports to EU countries, with negligible, or slightly negative impacts on GDP, depending on the scope of the CBA. Pyrka et al. (2020) use the same CGE model to assess the effects of a carbon border tax (CBT) on imports in the European economy. The introduction of import tariffs ranging from 0.6% to 3% causes a slight increase in domestic consumption, offset by the drop in domestic production, producing a small decline in GDP.

Bellora and Fontagné (2021) use a dynamic general equilibrium model with endogenous CO2 prices which delivers larger effects for European exports and GDP ranging from − 5% (intermediate goods) to 8.8% (final goods) and − 0.7% (GDP), respectively, in the scenario for a CBA mechanism that is limited to a carbon border tax and uses the actual emissions of the EU’s partner countries for determining the size of those border taxes. In a revised version of the paper (Bellora and Fontagné 2022), these numbers change slightly but not dramatically. In comparison to these results, much larger effects on CO2 emissions are reported by Mahlkow et al. (2021) who model a CBA mechanism, accompanied by an EU-wide carbon tax. In this case, EU emissions drop by 30% and world emissions drop by 2.7%, compared to a 2.5% drop in a scenario with a carbon tax only. Hence, the additional emission-reducing effect of the CBA mechanism is only 0.2 percentage points. These results are contrasting to the gains of a potential carbon club (see Nordhaus 2015), which is shown to be much more effective at reducing world emissions.

Studies on a sector level usually show that the more trade-exposed and energy-intensive EU-based sectors, such as cement, steel and aluminium, are more sensitive to the CBA mechanism and may experience output losses, although the cumulative effect of the CBA mechanism could still be positive (e.g. Bellora and Fontagné 2021; Pyrka et al. 2020; Monjon and Quirion 2011; Manders and Veenendaal 2008).

3 Definition of scenarios and data

3.1 Definition of European CBA scenarios

The economic and environmental effects of a European CBA mechanism will depend on its design. To this end, the proposal by the European Commission (2021) for how a European CBA mechanism could look like, tabled in July 2021, provides a natural starting point and serves as the base scenario for the analysis of the impact of the European CBA mechanism. Among the numerous design options and their consequences discussed in the literature,Footnote 2 five characteristics can be modelled within our model framework by Larch and Wanner (2017). These are (i) the general regime of the CBA mechanism; (ii) the applicable price of 1 t of CO2 emissions; (iii) the carbon benchmark for the application of the carbon border tax; (iv) the treatment of free allowances granted within the ETS and (v) the sector coverage of the CBA mechanism. Each of these elements is briefly discussed below, and together they define our base scenario which reflects as closely as possible the European Commission’s proposal.

(i) Regime

There are two possible regimes for a CBA mechanism: either the mechanism is limited to a carbon border tax (‘CBT only regime’) or it comprises additional rebates for EU producers to cover their carbon costs incurred for the part of the production that is exported to extra-EU countries (‘comprehensive regime’). The economic argument in favour of a ‘CBT only regime’ is that a partial rebate of the carbon costs for EU producers undermines the effectiveness of the ETS.Footnote 3 The economic argument in favour of a ‘comprehensive regime’ is that it allows for establishing a level playing field in terms of carbon costs not only in the Single Market but also in third markets. With regard to the effects on CO2 emissions, one may assume that export rebates — in essence a form of export subsidies — will favour more production in CO2-intensive sectors making the ‘CBT only regime’ the more attractive option. However, in the presence of differences in technologies across countries, this is not necessarily the case. If the export rebates shift production towards countries with less CO2-intensive production methods global emissions could be lower in the ‘comprehensive regime’, making the choice of the preferred regime an empirical question. The European Commission’s proposal for a CBA mechanism foresees a ‘CBT only regime’.

(ii) CO2 price

There are several estimates and proposals for the adequate price of 1 t of CO2, also referred to as carbon price, such as the Stiglitz-Stern proposal (High-Level Commission on Carbon Prices 2017), a recent proposal by the IMF (2019) or the estimate of the shadow price by the European Investment Bank (2020). Since the CBA mechanism is a supplement to the European ETS, we use the current price of one European Union Allowance (EUA), which is a certificate that grants the right to emit 1 t of CO2, and amounts to EUR 62 (the 'current price').Footnote 4 The direct correspondence between the ETS price and the CO2 price underlying the calculation of carbon tariffs is warranted to avoid discrimination against trading partners (which is required by the WTO GATT). This seems in line with the European Commission’s proposal (respectively the accompanying staff working document) which states that the EU seeks ‘to align, to the extent possible, the price paid under the CBAM with the price paid under the EU ETS’ (European Commission 2021; p. 85).

(iii) Within-industry coverage ratio

There are two issues to be considered when establishing the costs of carbon in any of the EU industries covered by the ETS. First, not all plants operating in all ETS sectors need to be registered. In particular, in some sectors firms below a certain size do not need to participate and hence are not required to buy emission certificates for their CO2 emissions. This means that for some industries, the within-industry coverage ratio is lower than 100%. This within-industry coverage ratio needs to be taken into account in the calculation of the carbon border tax. A second complication for establishing the proper price of carbon within the ETS arises from the common practice of granting free emission allowances to producers in energy-intensive industries. This means that the carbon price for EU producers will be lower than the price of a EUA. In the extreme case, if a sector receives 100% of its required EUAs for free, its carbon costs will be zero. The proposal by the European Commission, while emphasising that free allowances will be reduced over time, is not very explicit, about how — if at all — the free allowances will be reflected in the CBA mechanism. As will be seen in the discussion of the carbon benchmarks, the free allowances cannot be properly accounted for in the base scenario. In the base scenario, it is therefore assumed that free allowances remain in place, though they do affect the size of the carbon border tariff (‘no free allowances’). In any case, both issues, the exemption of plants from the ETS and the granting of free allowances, imply that the amount of CO2 emissions ‘used’ by a sector is not necessarily equal to the amount of CO2 emissions paid for. We define the within-industry coverage ratio as the ratio between the used CO2 emissions and the paid CO2 emissions in any sector.

(iv) Carbon benchmark

Another element that strongly affects the carbon price charged within the CBA mechanism, and therefore also the carbon tariffs, is the method for calculating the carbon intensity of imports. Leaving aside plant-specific calculations, the literature has identified two main methods which are known as avoided emissions approach and embodied emissions approach, respectively (Rocchi et al. 2018). The avoided emissions approach applies the CO2 intensity of EU producers for the calculation of the carbon border tariff on imported products. In contrast, the embodied emissions approach uses the CO2 intensity of individual trading partners for the calculation of the carbon border tariff. The embodied emissions approach is the one opted for in the European Commission’s proposal. The argument supporting this design choice is that ‘the CBAM should ensure that imported products are subject to a regulatory system that applies carbon costs equivalent to the ones that otherwise would have been borne under the EU ETS’ (European Commission 2021, p. 16). The equivalence here refers to the fact that in applying the embodied emissions approach, the size of the carbon tariffs imposed on imported products reflects — to the extent possible — their actual carbon content. In all likelihood, the EU CBA mechanism allows producers to report their firm-specific emissions. Such a procedure, however, requires detailed monitoring, reporting and verifying procedures for emissions and will not be a viable option for producers from numerous countries (see Eicke et al. 2021). In the absence of reported verified emissions, the carbon tariffs in the CBA mechanism will be set according to country-specific emission benchmarks. These benchmarks will have to be based on the average emission intensity of the respective country.Footnote 5 As we have no knowledge of future firm-specific verified emissions by importers and because it is not known to what extent this possibility will be used anyways, the best way to model the embodied emissions approach is to use sector-specific average emission intensities of partner countries for the calculation of the carbon tariffs. The embodied emissions approach is therefore the relevant carbon benchmark in the base scenario. Apart from being relevant for the size of the carbon border tax — most extra-EU trading partners have higher CO2 intensities than the EU average — the embodied emissions approach also implies that the free allowances granted in the ETS are irrelevant, because free allowances only affect EU producers’ carbon costs while for the emobdied emissions approach emissions of trading partners serve as benchmarks.

(v) Sector coverage

The final element is the sector coverage. In this respect, our modelling must make some approximations. While the European Commission’s proposal contains a very detailed list of products suggested to be covered by the CBA mechanism, our data on CO2 emissions is available at a sector level.Footnote 6 Therefore, we assume that carbon tariffs are imposed in sectors whose products are predominantly included in the list of products in the European Commission’s proposal for a CBA mechanism. These sectors are the basic chemicals, the basic metals and the non-metallic minerals sector.Footnote 7 As a consequence, in the base scenario, only these three sectors will carry a carbon border tariff as foreseen in the proposal for a CBA mechanism (‘CBAM proposal’).

Against the backdrop of the discussions on the optimal design of the CBA mechanism, we define a comprehensive set of scenarios to be investigated, taking the European Commission’s CBA mechanism proposal (2021) as the starting point and therefore serving as the base scenario. The characteristics of the base scenario are summarised in the second column of Table 2 labelled ‘base scenario’. To see how strongly the results react to changes in all of the discussed design options, we change each of them individually to arrive at a sort of sensitivity analysis. For example, to test the sensitivity of the results with regard to the choice in favour of a carbon tariff-only regime, an alternative ‘comprehensive CBA regime’ scenario is defined which deviates from the base scenario only in this one characteristic. The same principle is applied to each of the five characteristics discussed. In the case of the price of CO2 emissions, we take two well-known carbon prices from the literature which are the Stiglitz-Stern-Proposal, suggesting a carbon price of USD 100 (EUR 85) (High-Level Commission on Carbon Prices 2017), and the more recent estimation of the shadow price of carbon for 2030 of EUR 250 by the European Investment Bank (2020). These two price suggestions form scenarios 1a and 1b.

Scenario 2, the ‘avoided emissions scenario’ assumes that all imports use EU-based carbon intensities to calculate carbon tariffs imposed by the EU. This means that the carbon intensities of countries of production are considered. This is contrary to the way the implicit carbon tariffs are calculated in the base scenario, which uses the ‘embodied emissions approach’. The details of these calculations are explained further in the following.

Importantly, as the free allowances, which are still frequent in the European ETS, cannot be considered in the embodied emissions approach, no specific scenario for the within-industry coverage ratio is considered in the sensitivity analysis. The sensitivity scenario for the avoided emissions approach (scenario 2), however, assumes that free allowances are granted to EU producers as of 2014 (which is the last date for which we have all the necessary data). Therefore, technically, the free allowances are in place, but, as mentioned above, they do not make a difference in the embodied emissions approach.

The sector coverage in the base scenario is limited to three sectors: basic chemicals, basic metals and non-metallic minerals. This selection closely reflects the sectors outlined in the CBA mechanism proposal, subject to the limitations of the sectoral structure of GTAP data. Scenario 3 extends the sector coverage by assuming that carbon border taxes are imposed in all industries currently covered by the ETS (’current ETS coverage’). Scenario 4 assumes a comprehensive CBA regime where the carbon border tariffs are supplemented with export rebates.

We also present three additional scenarios of the CBA mechanism (Table 3). The first, labelled the ‘WTO safe bet’ scenario, maximises the chance of passing WTO scrutiny given ongoing legal discussions (e.g. Ismer et al. 2020; Mehling et al. 2019; Marcu et al. 2020). It employs the avoided emissions approach and expands the sector coverage to all ETS sectors. The avoided emissions approach is less problematic with a view to WTO/GATT compatibility because potential discrimination against foreign producers (in the form of higher carbon costs imposed on imports for a given product) is ruled out by construction.Footnote 8 Similarly, the ETS sector coverage should not be contentious either because foreign producers are charged the carbon tax in exactly those industries in which EU producers must pay for emission certificates.

The second additional scenario, labelled’feasible’ scenario, features a design of the CBA mechanism that is likely to bring larger economic benefits for the EU compared to the base scenario, and at the same time has realistic chances of being politically and socially acceptable by all stakeholders. It uses the current carbon price and keeps most design options in the Commission’s proposal, except an expanded sector coverage, which is assumed to cover all sectors. The ‘Maximum’ scenario uses the high carbon price suggestion (EUR 250) and also full sector coverage. Both scenarios also come in a comprehensive version, featuring export rebates.

Given that the CBA mechanism is primarily a trade instrument, all scenarios will assume that EU member states set a common carbon tariff, and where applicable also grant common carbon rebates for exports for each industry. Moreover, in all scenarios, trade with the UK, all EFTA membersFootnote 9 and Canada, New Zealand and South Korea is exempted from the CBA mechanism, as these countries have a domestic carbon pricing mechanism in place. For all other trading partners, the implicit carbon tariffs in Eq. (1) are imposed and the implicit carbon border rebatesFootnote 10 in Eq. (2) are added to the pre-existing (bilateral) tariffs.

The carbon tariffs are calculated as implicit tariff equivalents of the carbon costs imposed on EU producers with the ETS. The calculation of this implicit price of the CO2 emissions (pEUA)Footnote 11 resulting from the EU ETS (or an EU carbon tax), proceeds in two steps. First, the (scenario-specific) emission price is multiplied by the volume of emissions in each industry. For the embodied emissions approach, the volume of emissions is that of the respective trading partner. In principle, to benchmark against costs faced by EU producers in the ETS, the number of free allowances (EUAf) has to be considered by deducting them from the emissions covered by the EU ETS/carbon tax. But this information is not available and is also not operational. Therefore, we assume that the firms in partner countries have to pay for all their CO2 emissions. Second, the resulting ‘CO2 emission costs’ at the industry level are divided by gross industry output (GO). The tariff equivalent of the implicit ‘domestic’ carbon price is assumed to define the size of the CBT (τCBT) to be imposed on imports from non-EU partners. Hence, the CBT on EU imports of industry k from trading partner j is defined as:

In contrast, when the implicit carbon tariffs are calculated according to the avoided emissions approach, as we do in one of the sensitivity analyses, the relevant CO2 emissions (\({\mathrm{CO}2}_{k})\), free allowances (\({EUA}_{k}^{f}\)) and gross outputs (\({GO}_{k}\)) are those of the EU and no partner-specific information is needed:

Equations (1a) and (1b) illustrate that correcting the CO2 costs for the free allowances is only possible in those scenarios that apply the avoided emissions approach.

Table 4 shows a summary of the implicit bilateral carbon tariffs levied by EU member states in selected scenarios, including the base scenario. In the base scenario, the simple average tariff in each of the three ‘CBAM sectors’ is around 1%. More telling than simple averages are, however, weighted averages. The comparison of the two shows that the EU’s major trading partners face higher tariffs than marginal trading partners. This pattern is strongly influenced by the relatively high carbon intensity of Russia, India and also China. Russia is also the country that faces the highest tariffs on average, for example, in the metals sectors amounting to more than 10%. This summary of the tariffs also helps to illustrate the differences among the different elements of the CBA mechanism scenarios.

For example, the described variation of carbon tariffs across partners is, by definition, only present if the embodied emissions approach is applied. This is why in scenario 2, which assumes the avoided emissions approach, there is a uniform tariff for each sector across all trading partners.

Differences in relative emission intensities (i.e. technology) can lead to high variance in the size of the carbon tariffs (see also Kuusi et al. 2020; Rocchi et al. 2018). For example, the maximum carbon tariff for the metals sector in the base scenario (10.7%) is almost ten times higher than the average one (1.3%). In the scenario which expands the sector coverage to all ETS sectors, the paper and mining industries also face sizeable carbon tariffs with significant tariff hikes against individual partners. Overall, the average tariffs indicate that the overall economic effects of the CBA mechanism might be small due to mild carbon tariffs, but also that trade with individual partner countries could be severely affected.

3.2 Data

As this paper relies on the model from Larch and Wanner (2017), the main data sources are those of that model. At the core is the Global Trade Analysis Project (GTAP) 8 database (see Narayanan et al. 2010), which features 128 regions and 57 sectors. For the simulations, these very detailed sectors are aggregated to 14 tradable and 1 non-tradable sector. Real GDP is taken from the Penn World Table 9.1.Footnote 12 For estimating the social cost of carbon in the welfare function, the approach by Shapiro (2016) is utilized, together with estimates provided by the Interagency Working Group on the Social Cost of Carbon (2013).

The calculation of the implicit carbon tariffs across the different scenarios explained in Sec. 3.1 required several data sources. First, information on the ETS sector coverage, the amounts of emission allowances handed out for free (‘free allowances’) and those actually paid for are taken from the ETS Database (EEA 2020).Footnote 13 This information is only relevant (and therefore available) for the countries participating in the ETS (i.e. EU member states, Iceland, Lichtenstein and Norway) as was already mentioned in the context of the role of free emissions in the embodied and avoided emissions approach. This data is available at the level of so-called ETS categories, which we mapped into NACE Rev. 2 industries.Footnote 14 The ETS data is combined with information from the WIOD Environmental Accounts on CO2 emissions at the industry level (NACE Rev. 2) (Corsatea et al. 2019).Footnote 15 Nicely, the CO2 emission data from the Environmental Accounts match perfectly with the industry structure (consisting of 56 industries) in the World Input–Output Database (WIOD) Release 2016 (Timmer et al. 2015) and the country coverage (43 economies plus the Rest of the World) coincides as well. The WIOD Release 2016 provides the gross output data. Moreover, WIOD trade data is used for the calculation of weighted carbon tariffs in the process of collapsing the 56 WIOD industries to the 15 GTAP sectors used in Larch and Wanner (2017). One complication is that the country coverage of the WIOD Release 2016 is limited to 43 economies, while GTAP 8 contains 128 countries and regions. We solve this by calculating the implicit carbon tariffs of the countries not covered in the WIOD data by assuming the (sector-specific) average CO2 emission intensity of six emerging countries in the WIOD data.Footnote 16 This imputation, however, does not affect the main results in any significant way as the share of these countries in total EU trade is negligible.

4 Model framework and results

4.1 Model framework

We use a structural gravity model to estimate the economic and environmental effects of a carbon border tax designed in the way described in Sec. 3 for all EU and EFTA countries as well as major extra-EU partner countries, in total 128 countries, for each industry. The structural gravity model is the workhorse framework for trade policy analysis as it performs well empirically to explain bilateral flows and is consistent with a comparably large set of trade models (see Arkolakis et al 2012). For example, the gravity framework is consistent with the assumption of goods differentiated by place of origin combined with monopolistic competition (Anderson 1979; Anderson and van Wincoop 2003), a Heckscher-Ohlin framework (Bergstrand 1985; Deardorff 1998), a Ricardian framework (Eaton and Kortum 2002) and heterogeneous firms, which select into markets (Chaney 2008; Helpman et al. 2008), and with models allowing for sectors and input–output links (e.g. Costinot et al. 2012; Caliendo and Parro 2015). Most of the frameworks, however, do not account for any dynamics (exceptions are Eaton et al. 2016, and Anderson et al. 2020) and assume homothetic preferences (an exception is Fieler 2011), and therefore are less suited to allow for structural change. This is also true of the employed framework by Larch and Wanner (2017), which assumes constant spending shares, homothetic preferences and constant factor inputs in production. Furthermore, the models depend on strong functional form assumptions for the demand and production structure. Only recently, semi- and non-parametric approaches for counterfactual analysis were developed and introduced into the trade literature (see Adao et al. 2017; Allen et al. 2020). We believe that performing non-parametric counterfactual analysis for the evaluation of environmental policies in a trade context is a fruitful area for future research.

As accounting for emissions alongside the trade and welfare effects is crucial for evaluating the effects of carbon tariffs, we use the recent framework from Larch and Wanner (2017) which was explicitly developed to quantify the effects of carbon tariffs on trade, GDP, welfare and carbon emissions.Footnote 17 It is a multi-sector, multi-factor structural gravity model that allows the decomposition of the emission changes into scale, composition and technique effects, as famously introduced by Grossman and Krueger (1993) and formalised by Copeland and Taylor (1994). Note that the decomposition into scale, composition and technique effect is based on a total differential. Hence, the decomposition depends on the model structure and is a linear approximation of the non-linear effects. Impact factors and relationships that we did not account for in our model are therefore also not reflected in our decomposition. Further, the approximation works very well for small changes but will be a bit off for larger changes.

The model has 14 tradable sectors and one non-tradable sector. The trade costs are estimated using a structural gravity model that includes multilateral resistance terms.Footnote 18 Most importantly, the model includes energy as a production factor and treats the emissions as a proportional side output. Additionally, the utility function includes multiplicative damages from CO2 pollution following Shapiro (2016).

Taking the abovementioned limitation into account, this framework nevertheless allows us to quantify the effects of the European CBA measures. Hence, considering its trade relationships in a framework with many countries seems crucial to us. Furthermore, country-specific environmental policies that specifically target global pollutants, such as CO2 emissions, need to be seen in light of their effects on trading partners to properly quantify their effectiveness in terms of emission reductions. In other words, potential leakage effects need to be properly accounted for, which the suggested model framework ensures not only by incorporating trade and emissions in an integrated manner but also by using a multi-country framework featuring a very large number of countries. Sector differentiation enables the study to differentiate the impact by industries, which are also heterogeneous in terms of their dependence on energy as input.

For the baseline, we use the data from Larch and Wanner (2017). For the scenario analysis, we rely on the tariff equivalents for the carbon border tariffs, τCBT, obtained for the base CBA mechanism scenario and the different variants in the previous section. Note that by modelling the CBA mechanism in the form of exogenous tariff equivalents (which vary across scenarios), we implicitly assume that all adjustments on the producer side will take the form of quantitative changes to production and exports. Therefore, we have to assume that within the EU, the induced quantitative adjustments remain within the total amount of available emission allowances corresponding to EU production.Footnote 19

4.2 Results and discussion

The counterfactual results for exports, real GDP, welfare and CO2 emissions of the base scenario and the sensitivity analysis for changing individual parameters are shown in Table 5. The outcomes are reported for the EU as a group, all other third countries, the EFTA members and the world as a whole. The reported aggregate values for trade flows and emissions are obtained by summing trade flows and emissions of the respective groups for the baseline and counterfactual and then calculating the changes based on these aggregated values for the respective groups. For real GDP and welfare, we calculate the reported aggregate values as GDP-weighted averages of the country-specific changes. The effects for individual countries are reported in Appendix 3.Footnote 20

4.2.1 Base scenario — the European Commission’s CBA mechanism proposal

As a first observation, the size of the effects is small. We find that global exports decline by 0.11% and total exports for the EU decline by 0.03%. This suggests that the concerns about green protectionism on the side of important emerging countries and the warning of the CBT ‘jolting’ world trade (Aylor et al. 2020) are unwarranted. In all likelihood, the introduction of a European CBT will not rock world trade. There are several reasons for these small effects. First of all, a large share of EU countries’ trade is intra-EU trade, which is not directly affected by the carbon tariffs. Second, the carbon price in the base scenario is modest. This small drop in EU exports is noteworthy, given the huge debate about the effects of a carbon border tax. Third, in the form the CBA mechanism is suggested, it affects only three sectors directly (which account for about 13.1% of EU imports).

EU imports from third countries will become relatively more expensive as a result of the CBT. The effect is small as intra-EU trade and trade with EFTA partners are not directly affected by the measure. The pro-export effect for EU member states is counteracted by a general equilibrium effect that works via reduced real GDP and associated lower import demand from third countries. The net result is a small drop in the export volume of EU countries. The abovementioned cost imposed on third countries by the CBT is also the reason for the decline in exports in non-EU countries (− 0.16%). And as they are exempted from the CBT, the EFTA members’ exports increase slightly (+ 0.046%) as a result of both trade diversion effects and higher incomes in EU member states, many of which are important trading partners.

The global real GDP and welfare effects are also close to zero. Note that the difference between real GDP and welfare is that the latter also takes the negative effects of pollution on welfare into account following Shapiro (2016). Given the social costs of carbon, the difference between real GDP and welfare is not huge (see also Larch and Wanner 2017; and Shapiro 2016). The GDP effects for EU countries are slightly positive (+ 0.02%), while non-EU countries’ GDP declines by 0.01%.

As the carbon tariffs are closely related to the European Green Deal (EGD) and one of its objectives is the reduction of carbon leakage, the effects on CO2 emissions are of major importance. For the EU as a whole, CO2 emissions are estimated to increase slightly (+ 0.24%). This outcome for emissions is almost uniform across member states, with Latvia, Slovenia and Slovakia as the only exceptions. This increase in EU emissions, however small it may be, is in contrast with a global decline in emissions, which amounts to less than 0.1% though.

As mentioned above, our quantitative model does not consider any dynamic effects. As suggested by Sampson (2016) and Anderson et al. (2020), dynamic forces have the potential to magnify the static gains substantially. Sampson (2016) finds that dynamic selection may triple the static gains from trade, while Anderson et al. (2020) report a dynamic path multiplier of 1.8. Taking into account dynamic effects will therefore very likely also lead to larger effects of the CBA mechanism on exports, GDP and emissions. Indeed, comparing the effects resulting from our base scenario with, for example, those in Bellora and Fontagné (2022) in the literature section (see Table 1), illustrates the potential importance of these dynamic effects. Their CGE model, the MIRAGE-VA, models energy inputs as direct substitutes for capital in the production function and features endogenous CO2 prices in the ETS certificates and the CBA, including feedback effects between the two.Footnote 21 Their exporter-tax base scenario (scenario 2), which roughly corresponds to our ‘ETS sectors’ scenario, leads to a decrease in exports between 8.6% (intermediate goods) and 6% (final goods) which contrasts with our marginal decrease in exports of 0.04% (see model (3) in Table 5). Hence, our quantitative results are very likely a lower bound. Apart from the larger multipliers, the endogenous prices also mean that the effects on GDP differ not only in magnitude but may also have a different sign. For example, comparing the same scenarios as for exports, Bellora and Fontagné (2022) find a decrease in EU GDP of 0.7%, while we obtain a slight increase in real GDP of 0.03%.

The constellation where EU-wide emissions increase while emissions in third countries go down, potentially pointing to a ‘carbon leakage reversal’, is not exactly in accordance with the general objectives of the EGD and the EU’s emission-reduction targets. Such a reversal may not seem desirable from an environmental perspective as it would imply increasing CO2 emissions in the EU and would go against the spirit and objectives of the EGD. However, this carbon leakage reversal, overall, results in a reduction of global emissions, which is what ultimately matters for the world climate. The fact that global CO2 emissions are slightly reduced while global GDP remains de facto unchanged is explained by different technologies in the EU and third countries. Hence, there is a trade-off between the specific objectives of the CBA mechanism and the EU’s general environmental objectives as envisaged by the EGD.

Table 6 shows the sector-level effects of the base scenario in the EU member states. These show on a more granular level that exports, output and CO2 emissions increase in all sectors covered by the CBA mechanism. On average, the metals sector benefits the most with a 1.6% increase in exports, a 1.9% increase in output and a 1.9% rise in emissions. Meanwhile, most other sectors see a slight decline in exports and output, as well as in emissions. Only the non-tradables sector, which also includes most activities, related to fuel combustion, sees a large increase in output. All of the sectors not covered by the CBA experience a decline in emissions. However, in the EU, these drops are overpowered by the increased emissions resulting from the increased output in the emission-intensive sectors, now protected by the CBA mechanism. This shows the relative importance of these sectors to the efforts to reduce emissions in the EU. Although they represent 14% of the total exports of all ETS sectors, they contribute 44% of all emissions.

How should we assess these outcomes given the two main objectives of the proposed CBA mechanism: the restoring of EU competitiveness and mitigating carbon leakage? At least at the economy-wide level, the proposed EU CBA mechanism is only of limited effectiveness when it comes to pushing exports. Although the effects induced by the CBT tend to be positive, they are small. Turning to the environmental effects, they too tend to be small but they have the desired effect at the global level, that is, to reduce emissions.

4.2.2 Sensitivity analysis and alternative scenarios

The first set of additional scenarios tests the price sensitivity of the CBA mechanism proposal. With the CBT imposed based on a CO2 price of EUR 85 (scenario 1a in Table 5) as suggested by the IMF (2019), the effects on exports, real GDP, welfare and emissions are larger in magnitude than in the base scenario. Increasing the carbon price increases the economic effects of the CBA mechanism, but not proportionally. To illustrate this point, scenario 1b includes a carbon price of EUR 250, more than four times higher than that in the base scenario (EU 62). The higher carbon price leads to a decline in exports by a factor of 2.2 for the EU, and by a factor of 2.6 for the world. The reason for the less than proportional decrease in total exports is that only three sectors are directly affected by the tariff. While in the affected sectors within the EU exports increase, in all other sectors we see a decrease in exports. The effect of high carbon prices is more pronounced for emissions, which increase for the EU (+ 0.82%) and decline for the world (− 0.25%) by factor 3 compared to the base scenario. The reason for the relatively stronger reaction of emissions is that the affected sectors are the most emission-intensive sectors.

Changing to the ‘avoided emissions’ approach (scenario 2) decreases the effects further, to almost negligible sizes. Unsurprisingly, this design option produces the smallest effects of all scenarios. The reason for this is lower carbon tariffs, which are now determined based on the comparatively lower emission intensities of EU producers. The embodied emissions approach is therefore superior since it leads to higher carbon tariffs, and consequently to larger effectiveness of the CBA. However, this assessment is also made without considering the legal aspects.

Extending the CBA mechanism to cover all ETS sectors (scenario 3) tends to increase the effects but does not lead to qualitative changes compared to our base scenario, although the CBA mechanism now encompasses significantly more sectors. EU exports decline by 0.04% while GDP rises by 0.03%. Both cases represent a 10% increase in effects compared to the base scenario. World exports take a harder hit and now decrease by 0.15%. Once again, the effect of the CBA mechanism is more pronounced for emissions. Extending sector coverage increases EU emissions by 0.42% and amplifies the decrease in world emissions by 46% compared to the base scenario, although the absolute terms, the effect is still very small (− 0.12%). The main reason why expanding sector coverage brings smaller gains than expected is that the base scenario covers the three sectors which together contribute to almost half of all emissions by ETS sectors.

Turning to the comprehensive regime of the CBA mechanism (scenario 4), we find that the granting of export rebates (in addition to the carbon border tax) leads to similar quantitative changes in CO2 emissions compared to the base scenario. In addition, it also causes a switch in the change of EU exports, which now increase by + 0.02%. This is because the export rebates act like an export subsidy for EU exporters, leading to an increase in trade with non-EU countries. The EU’s real GDP and welfare effects remain essentially unchanged compared to the base scenario. This finding differs from the findings in several studies which report larger GDP and welfare effects resulting from a comprehensive CBA mechanism (e.g. Branger and Quirion 2014; Böhringer et al. 2012a; Fischer and Fox 2012).

The combination of higher EU exports and higher production means that the increase in CO2 emissions in the comprehensive CBA regime (0.27%) is slightly larger than in the base scenario. What is also important to note is that at the global level, the reduction in CO2 emissions is higher despite comparable effects on global GDP and welfare. The reason for this is that with export rebates in place, more production shifts to the EU, in combination with comparably lower EU emission intensity.

In addition to the ‘sensitivity scenarios’, where in each case only one element of the CBA mechanism was changed, we also perform several additional scenarios where we change several elements of the CBA mechanism (Table 7).

Most illustrative are the ‘maximum’ scenarios (scenarios 7a and 7b in Table 7) which combine the highest carbon price (EUR 250) with full sector coverage and full within-sector coverage. In the comprehensive CBA regime, the maximum scenario unleashes a veritable export push for the EU, with exports increasing by 6.67%. EU GDP also increases more strongly in both versions of the maximum scenario compared to the base scenario. Compared to the heightened effect on exports, the extra boost for GDP (+ 0.3% and + 0.76% respectively) is more limited. Interestingly, the comprehensive version of the CBA mechanism emerges as the preferred option if judged by the effect on global emissions: global CO2 emissions are reduced by 0.52%. The flip side of this is a 2.5% increase in EU CO2 emissions.

What do the results mean for assessing the attractiveness of alternative configurations of the proposed CBA mechanism and higher carbon prices? In general, all scenarios achieve the economic objective of increasing export competitiveness, as well as the environmental objective of fighting carbon leakage — without having large, negative effects on GDP for all involved parties — but to various extents and not without trade-offs. The analysis of scenarios shows that the environmental effects of the CBA mechanism are more sensitive to changes in the carbon price than to sector coverage or other design options.

The comprehensive design of the CBA mechanism that includes export rebates emerges as the most feasible single design option to strengthen the EU’s exports. The reason is simple: because the carbon tariff leads to the desired effects, i.e. strengthening of the EU’s export competitivenessFootnote 22 and counteracting carbon leakage, and the export rebates magnify these effects, a mechanism that includes such export rebates is more attractive. However, all scenarios featuring export rebates provide less environmental benefits for the world compared to the base scenario. The reason for this is a combination of differences in technology across countries and the fact that EU producers will produce more in energy-intensive industries if they receive an export subsidy.

Free allocation of emissions permits effectively reduces carbon costs for companies and leads to a lower carbon tariff. However, its elimination only affects the model outcomes in scenarios that assume that the avoided emissions approach is used. Therefore, its relevance to the modelling results is less impactful.

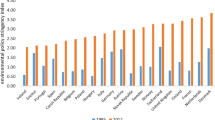

Figure 1 focuses on the results for the EU and global outcomes for exports and CO2 emissions across the scenarios. Exports and emissions have been chosen as they are most relevant for the CBA mechanism’s main objectives. As the maximum of the vertical axis is a 1% change induced by the CBA mechanism, this shows that the aggregate results are small by any standard, which is especially true for the global outcomes. Hence, the results suggest that carbon prices ought to be quite high for a CBA mechanism to yield substantial results which may, in turn, be seen as support for a floor for carbon prices (see e.g. Rey 2021), and should also be accompanied by extending the sector coverage. However, even in more extreme configurations, the absolute size of the environmental effects is still limited to less than 0.4%. This points to the fact that the EU CBA mechanism by itself will not be the solution to the climate challenge, but it can be a useful part of a wider package of measures to fight climate change.

Source: Results in Table 5

Base scenario results for the EU and globally, exports and CO2 emissions.

5 Conclusions

This paper translates the information contained in the European Commission’s proposal on the numerous characteristics of the European CBA mechanism, scheduled to be introduced in 2023, into a model scenario. The key element of this model scenario is the implicit carbon tariff that the EU is going to levy in (presumably) three sectors for trade with extra-EU partners. The simulation results obtained from a multi-country, multi-sector gravity model for our base model suggest that both the economic effects and the environmental effects are somewhere between modest (exports and emissions) and negligible (GDP and welfare). The good news from an environmental perspective is that the European CBA mechanism will reduce global CO2 emissions. Depending on the design features, this emission reduction is close to zero, which is for example the case in a very prudent scenario which is designed to avoid any clash with the EU’s WTO obligations, amounts to 0.08% in the base scenario and reaches 0.34% in the ‘maximum’ scenario.

The order of magnitude of these changes in CO2 emissions makes clear that the European CBA mechanism, on its own, lacks the potential to save the climate. Certainly, saving the world climate makes great demands on the CBA mechanism. Being a supplementary instrument to the domestic carbon pricing system of the EU, its role must be seen as much more modest. It serves two specific objectives, i.e. countering potential carbon leakage effects and restoring EU producers’ export competitiveness. The former is achieved to some extent if the identified increase in CO2 emissions in the EU economy is interpreted as a reversal of the suspected carbon leakage effect. Note, however, that such reverse carbon leakage implies a structural shift towards more CO2-intensive industries and in turn a situation where EU member states’ efforts at achieving the emission reduction targets become even more challenging. Regarding export competitiveness, the base scenario clearly shows that an increase in EU exports following the introduction of carbon tariffs cannot be taken for granted. The general equilibrium effects outweigh the export-promoting effect that comes along with the additional tariffs. One way to ensure a positive effect for EU exports is to opt for a comprehensive regime in the CBA mechanism, that is, to complement the carbon border tax with export rebates of domestic carbon costs for EU producers.

This brings us to the sensitivity of the results concerning changes in the characteristics of the CBA mechanism. The main insight from the sensitivity analysis is that no single design element of the CBA mechanism has the potential to boost either the economic or the environmental effects. Certainly, raising the price of CO2, and hence the resulting carbon tariffs, yields larger effects across all dimensions but even a high price of CO2 (EUR 250) will only have marginal effects on EU exports. It requires the combination of more elements, in particular, the granting of export rebates, to make high carbon prices achieve sizeable results. However, even in this case, there might be trade-offs between the EU-specific and global environmental performance of the CBA mechanism.

To summarize, the main reason why a European carbon border tax seems as an appropriate policy instrument is because it helps reduce global emissions, however small the impact may be. Since the economic costs for trading partners, in the form of negative GDP and welfare effects, are very small, the uproarious concerns about green protectionism appear to be misplaced in the context of the European CBA mechanism. There is no reason to believe that this measure will push the world trading system into turmoil.

Notes

For a detailed discussion on policies to combat carbon leakage, see Zhang (2012).

The economic and legal consequences of different design options for a CBA mechanism are discussed for example in Mehling et al. (2019); Cosbey et al. (2012); Cosbey et al. (2019); Mattoo et al. (2013); Böhringer et al. (2012b); Fischer and Fox (2012) and Kuik and Hofkes (2010). A more focused discussion on designing a potential European CBA mechanism is found, inter alia, in Ismer et al. (2020); Garicano (2021); and Marcu et al. (2020).

A ‘CBT only regime’ also seems preferable from a legal perspective as rebates for exporters may constitute a form of export subsidies which are prohibited under the WTO Agreement on Subsidies and Countervailing Measures (ASCM) (e.g. Hillman 2013; Boratinsky et al. 2020; Krenek et al. 2020; WTO-UNEP 2009).

Price as of end of September 2021.

To the best of our knowledge, the exact modalities of the benchmarks for emissions of imported products are not known yet.

Data on CO2 emissions is available for 56 industries. The model by Larch and Wanner (2017) features 14 sectors.

In fact, the proposal for a CBA mechanism by the European Commission contains a fourth sector, which is electricity generation. Electricity generation is a very important sector in terms of CO2 emissions. However, given the limited extra-EU trade in electricity, the sector is largely irrelevant in the context of a CBA mechanism. For this reason, electricity sector is treated as a non-tradable sector in the scenario analysis.

The deeper issue here is that the production method is not part of the likeness concept in the GATT (Low et al., 2012).

While EFTA members are part of the European ETS or linked to it (Switzerland), it is assumed that they do not impose carbon border taxes themselves.

As the carbon border rebates have a negative sign, adding them to the existing tariffs reduces trade costs.

EAU stands for Emissions Allowance Units.

The data is available at https://www.rug.nl/ggdc/productivity/pwt/?lang=en.

For details, see Appendix 1.

The data is available at https://ec.europa.eu/jrc/en/research-topic/economic-environmental-and-social-effects-of-globalisation.

These countries are Brazil, China, India, Indonesia, Russia and Turkey.

Multilateral resistance terms account for the potential trade diversion effects that arise for third parties when country pairs lower their bilateral tariffs, as is the case with FTAs. Technically, they are captured by exporter and importer fixed effects in our sector-wise estimates.

Given that so far the ETS did not suffer from any shortages in available allowances (but rather an oversupply) and that with the market stability reserve (MSR) there is a mechanism in place to counteract potential imbalances according to pre-defined rules, we believe that this modelling approach is adequate. Extending the analysis to capture the potential overall quantity constraint within EU ETS would, however, be an interesting avenue for future extensions.

We chose the scaled equilibrium price in the agricultural sector (first sector in alphabetical order in our data) in Albania (first country in alphabetical order in our data) as the numéraire. Note that real GDP, welfare, and emissions are not affected by the choice of the numéraire, while nominal trade flows and output are. Hence, the results for trade flows and output have to be interpreted relative to the price change in agriculture in Albania.

In contrast to Bellora and Fontagné (2022), we do not explicitly model the EU ETS itself. For this reason, and also because our scenarios assume a fixed carbon border tariff, we cannot integrate feedback effects of this kind into our analyses.

In this context, it should be mentioned that export competitiveness is a rather narrow definition of international competitiveness.

The sum of free allowances and paid allowances equals the total number of allowances in each year. However, the number of total allowances does not coincide exactly with number of verified emissions because firms can carry over EAUs from 1 year to the next. Moreover, allowances can be sold and bought (auctioned) across ETS industries.

Of course, in this example, the German firm that sells the allowances earns additional income, but we have no information on which firms in which sectors sell allowances, who they sell them to or whether they sell them at all.

According to the Commission website (https://ec.europa.eu/clima/policies/ets_en), emissions of greenhouse gases from the following industries are covered: (i) power and heat generation; (ii) energy-intensive industry sectors comprising oil refineries, steel works and production of iron, aluminium, metals, cement, lime, glass, ceramics, pulp, paper, cardboard, acids, and bulk organic chemicals; and (iii) commercial aviation (coverage is limited to flights between destinations within the European Economic Area).

References

Adao R, Costinot A, Donaldson D (2017) Nonparametric counterfactual predictions in neoclassical models of international trade. Am Econ Rev 107(3):633–689

Aichele, R. (2013), Carbon leakage with structural gravity, Beiträge zur Jahrestagung des Vereins für Socialpolitik 2013: Wettbewerbspolitik und Regulierung in einer globalen Wirtschaftsordnung - Session: Climate Policy I, A04-V3

Allen T, Arkolakis C, Takahashi Y (2020) Universal gravity. J Polit Econ 128(2):393–433

Anderson JE (1979) A theoretical foundation for the gravity equation. Am Econ Rev 69(1):106–116

Anderson JE, van Wincoop E (2003) Gravity with gravitas: a solution to the border puzzle. Am Econ Rev 93(1):170–192

Anderson JE, Larch M, Yotov YV (2020) Transitional growth and trade with frictions: a structural estimation framework. Econ J 130(630):1583–1607

Arkolakis C, Costinot A, Rodriguez-Clare A (2012) New trade models, same old gains? Am Econ Rev 102(1):94–130

Armington PS (1969) A theory of demand for products distinguished by place of production. Staff Pap - Int Monet Fund 16(1):159–178

Aylor B, Gilbert M, Lang N, McAdoo M, Öberg J, Pieper C, Sudmeijer B, Voigt N (2020) How an EU carbon border tax could jolt world trade, Boston Consulting Group. Available at: https://www.bcg.com/publications/2020/how-an-eu-carbon-border-tax-could-jolt-world-trade

Bednar-Friedl B, Schinko T, Steininger KW (2012) The relevance of process emissions for carbon leakage: a comparison of unilateral climate policy options with and without border carbon adjustment. Energy Econ 34:168–180

Bellora C, Fontagné L (2021) The EU in search of a WTO-compatible carbon border adjustment mechanism, draft, available for download at: http://cepii.fr/PDF_PUB/wp/2022/wp2022-01.pdf

Bellora, C, Fontagné L (2022) EU in search of a WTO-compatible carbon border adjustment mechanism, CEPII Working Paper, 2022-01, May. Available at: http://www.cepii.fr/PDF_PUB/wp/2022/wp2022-01.pdf

Bergstrand JH (1985) The gravity equation in international trade: Some microeconomic foundations and empirical evidence. Rev Econ Stat 67(3):474–481

Böhringer C, Balistreri EJ, Rutherford TF (2012a) The role of border carbon adjustment in unilateral climate policy: overview of an Energy Modelling Forum study (EMF 29). Energy Econ 34:97–110

Böhringer C, Carbone JC, Rutherford TF (2012b) Unilateral climate policy design: efficiency and equity implications of alternative instruments to reduce carbon leakage. Energy Econ 34:208–217

Böhringer C, Rosendahl KE, Storrosten HB (2019) Smart hedging against carbon leakage, Working Paper Series 4–2019, Norwegian University of Life Sciences, School of Economics and Business, October. Download available at https://www.nmbu.no/download/file/fid/40211

Boratinsky J, Pyrka M, Tobiasz I, Jeszke R, Sekula M (2020) The effects of the implementation of BTA in the context of more stringent EU climate policy until 2030, Centre for Climate and Energy Analyses, September 2020

Branger F, Quirion P (2014) Would border carbon adjustments prevent carbon leakage and heavy industry competitiveness losses? Insights from a Meta-Analysis of Recent Economic Studies. Ecol Econ 99:29–39

Caliendo L, Parro F (2015) Estimates of the trade and welfare effects of NAFTA. Rev Econ Stud 82(1):1–44

Caron J, Fally T (2022) Per Capita Income, Consumption Patterns, and CO2 Emissions. J Assoc Environ Resour Econ 9(2)

Chaney T (2008) Distorted gravity: the intensive and extensive margins of international trade. Am Econ Rev 98(4):1707–1721

Copeland BR, Taylor MS (1994) North-south trade and the environment. Quart J Econ 109(3):755–787

Corsatea TD, Lindner S, Arto I, Román MV, Rueda-Cantuche JM, Velázquez Afonso A, Amores AF, Neuwahl F (2019) World input-output database environmental accounts. Update 2000–2016, Publications Office of the European Union, Luxembourg. Download available at: https://op.europa.eu/de/publicationdetail/-/publication/df9c194b-81ba-11e9-9f05-01aa75ed71a1/language-en

Cosbey A, Dröge S, Fischer C, Munnings C (2019) Developing guidance for implementing border carbon adjustments: lessons, cautions, and research needs from the literature. Rev Environ Econ Pol 13(1):3–22

Cosbey A, Droege S, Fischer C, Reinaud J, Stephenson J, Weischer L, Wooders P (2012) A guide for the concerned: guidance on the elaboration and implementation of border carbon adjustment, Pol Rep No. 03. ENTWINED. Download available at: https://www.iisd.org/publications/report/guide-concerned-guidance-elaboration-and-implementation-border-carbon

Costinot A, Donaldson D, Komunjer I (2012) What goods do countries trade? A Quantitative Exploration of Ricardo’s Ideas. Rev Econ Stud 79(2):581–608

Deardorff A (1998) Determinants of bilateral trade: does gravity work in a neoclassical world? National Bureau of Economic Research Inc, The Regionalization of the World Economy’, pp 7–32

Eaton J, Kortum S (2002) Technology, geography and trade. Econometrica 70(5):1741–1779

Eaton J, Kortum S, Neiman B, Romalis J (2016) Trade and the global recession. Am Econ Rev 106(11):3401–3438

EEA (2020) ETS database, v38. European Environment Agency, Copenhagen. https://www.eea.europa.eu/data-and-maps/dashboards/emissions-trading-viewer-1

Egger P, Nigai S (2012) The Copenhagen accord: on required implicit carbon tax rates and their economic consequences, unpublished working paper. Available for download at https://sites.google.com/site/sergeynigai/research

Egger P, Nigai S (2015) Energy demand and trade in general equilibrium. Environ Resour Econ 60(2):191–213

Eicke L, Weko S, Apergi M, Marian A (2021) Pulling up the carbon ladder? Decarbonization, dependence, and third-country risks from the European carbon border adjustment mechanism. Energy Res Social Sci 80(102240):1–13

Elliott J, Foster I, Kortum S, Khun Jush G, Munson T, Weissbach D (2015) Unilateral carbon taxes, border tax adjustments and carbon leakage. Theor Inquiries Law 14(1):207–244

European Commission (2019) The European green deal, Communication by the Commission, COM(2019)640 final, 11 December, Brussels

European Commission (2010) Guidance on interpretation of Annex I of the EU ETS directive (excl. aviation activities), 18 March, Brussels. Download available at: https://www.mite.gov.it/sites/default/files/archivio/allegati/emission_trading/guidance_on_interpretation_annex_I_final.pdf

European Commission (2021) The proposal for a carbon border adjustment mechanism, COM(2021)564, 14 July, Brussels. Available for download at https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52021PC0564&from=EN

European Investment Bank (2020) EIB group climate bank roadmap 2021–2025, November 2020, European Investment Bank. Download available at: https://www.eib.org/attachments/thematic/eib_group_climate_bank_roadmap_en.pdf

Felbermayr G, Peterson S (2020) Economic assessment of carbon leakage and carbon border adjustment, Briefing requested by the INTA committee, Directorate General for External Policies of the Union, April. Download available at: https://www.europarl.europa.eu/RegData/etudes/BRIE/2020/603501/EXPO_BRI(2020)603501_EN.pdf

Felder S, Rutherford TF (1993) Unilateral CO2 reductions and carbon leakage: the consequences of international trade in oil and basic materials. J Environ Econ Manag 25(2):162–176

Fieler AC (2011) Nonhomotheticity and bilateral trade: evidence and a quantitative explanation. Econometrica 79(4):1069–1101

Fischer C, Fox AK (2012) Comparing policies to combat emissions leakage: border carbon adjustments versus rebates. J Environ Econ Manag 64(2):199–216

Garicano L (2021) Towards a feasible carbon border adjustment mechanism: explanation and analysis of the European Parliament´s proposal, mimeo. Download available at: https://luisgaricano.eu/wp-content/uploads/2021/03/CBAM_WorkingPaper_LuisGaricano-1.pdf

Gores S, Cludius J, Graichen V, Healy S, Nissen C, Zell-Ziegler C (2019) EU Emissions trading system data viewer: background note, Working Paper – ETC/CME, July. Download available at: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwj8gKvqvdn7AhVdRPEDHVTmDfgQFnoECBcQAQ&url=https%3A%2F%2Fwww.eea.europa.eu%2Fdata-and-maps%2Fdata%2Feuropean-union-emissions-trading-scheme-17%2Feu-ets-background-note%2Feu-ets-background-note%2Fdownload&usg=AOvVaw1Bnq2oznj72haplxcetVJ2

Grossman GM, Krueger AB (1993) Environmental impacts of a North American Free Trade Agreement, in: P.M. Garber (ed.), The U.S.-Mexico Free Trade Agreement. MIT Press, Cambridge, Massachusetts, pp. 13–56

Helpman E, Melitz M, Rubinstein Y (2008) Trading partners and trading volumes. Q J Econ 123(2):441–487

High-Level Commission on Carbon Prices (2017) Report of the high-level commission on carbon prices. World Bank, Washington, DC

Hillman J (2013) Changing climate for carbon taxes: who’s afraid of the WTO? Climate & Energy Policy Paper Series, Georgetown University Law Center, July. Download available at: https://scholarship.law.georgetown.edu/cgi/viewcontent.cgi?article=3048&context=facpub

IMF (2019), Fiscal monitor: how to mitigate climate change. Fiscal Affairs Department, IMF, Washington, DC

Interagency Working Group on the Social Cost of Carbon (2013) Technical support document: technical update of the social cost of carbon for regulatory impact analysis under executive order 12866 (updated November 2013) Technical Report, US Government. https://www.ourenergypolicy.org/wp-content/uploads/2013/06/social_cost_of_carbon_for_ria_2013_update.pdf

Ismer R, Neuhoff K, Pirlot A (2020) Border Carbon Adjustments and Alternative Measures for the EU ETS: an evaluation, Discussion Papers, 1855, Deutsches Institut für Wirtschaftsforschung, March. Download available at: https://www.diw.de/documents/publikationen/73/diw_01.c.743698.de/dp1855.pdf

Krenek A, Sommer M, Schratzenstaller M (2020) A WTO-compatible border tax adjustment for the ETS to finance the EU budget, WIFO Working Paper, 569, March. Download available at: https://www.wifo.ac.at/jart/prj3/wifo/resources/person_dokument/person_dokument.jart?publikationsid=65841&mime_type=application/pdf

Kuik O, Hofkes M (2010) Border adjustment for European emissions trading: competitiveness and carbon leakage. Energy Pol 38(4):1741–1748

Kuusi T, Björklund M, Kaitila V, Kokko K, Lehmus M, Mehling M, Oikarinen T, Pohjola J, Soimakallio S, Wang M (2020) Carbon border adjustment mechanisms and their economic impact on Finland and the EU, Publications of the Government´s analysis, assessment and research activities 2020:48, Helsinki. Download available at: https://julkaisut.valtioneuvosto.fi/handle/10024/162510

Larch M, Wanner J (2017) Carbon tariffs: an analysis of the trade, welfare, and emission effects. J Int Econ 109:195–213

Low P, Marceau G, Reinaud J (2012) The interface between the trade and climate change regimes: scoping the issues. J World Trade 46(3):487–544

Mahlkow H, Wanner J, Felbermayr G, Peterson S (2021) EU-Klimapolitik, Klimaclubs und CO2-Grenzausgleich, GED Fokus Papier, Kurzbericht des Instituts für Weltwirtschaft im Auftrag der Bertelsmann Stiftung, Berterlsmann Stifung, Juli. Download available at: https://www.bertelsmann-stiftung.de/de/publikationen/publikation/did/euklimapolitik-klimaclubs-und-co2-grenzausgleich

Manders T, Veenendaal PJJ (2008) Border tax adjustment and the EU-ETS, a quantitative assessment, CPB Document 171, CPB Netherlands Bureau for Economic Policy Analysis. Downlaod available at: https://www.cpb.nl/sites/default/files/publicaties/download/border-tax-adjustment-and-eu-ets-quantitative-assessment.pdf

Marcu A, Mehling M, Cosbey A (2020) Border carbon adjustments in the EU – issues and options, ERCST Roundtable n Climate Change and Sustainable Transition, September. Download available at: https://ercst.org/wp-content/uploads/2021/08/20200929-CBAM-Issues-and-Options-Paper-F-2.pdf

Mattoo A, Subramanian A, van der Mensbrugghe D, He J (2013) Trade effects of alternative carbon border-tax schemes. Rev World Econ 149(3):587–609

Mehling M, van Asselt H, Das K, Dröge S, Verkuijl C (2019) Designing border carbon adjustments for enhanced climate action. Am J Int Law 113(3):433–481

Monjon S, Quirion P (2011) Addressing leakage in the EU ETS: border adjustment or output-based allocation? Ecol Econ 70(11):1957–1971

Narayanan B, Aguiar A, McDougall, (eds) (2010) Global trade, assistance, and production: the GTAP 8 data base. Purdue University, Center for Global Trade Analysis

Nordhaus W (2015) Climate clubs: overcoming free-riding in international climate policy. Am Econ Rev 105(4):1339–1370

Pyrka I, Boratinsky JM, Tobiasz, Jeszke R, Sekula M (2020) The effects of the implementation of BTA in the context of more stringent EU climate policy until 2030. Institute of Environmental Protection - National Research Institute (IOŚ-PIB), August. Download available at: http://climatecake.pl/wp-content/uploads/2020/09/The-effects-of-the-implementation-of-the-Border-Tax-Adjustment-in-the-context-of-more-stringent-EU-climate-policy-until-2030.pdf

Rey H (2021) Observing the green swans, Project Syndicate, June, download available at: https://www.project-syndicate.org/commentary/green-swans-how-central-banks-should-manage-climate-risk-by-helene-rey-2021-06

Rocchi P, Serrano M, Roca J, Arto I (2018) Border carbon adjustments based on avoided emissions: addressing the challenge of its design. Ecol Econ 145:126–136

Sampson T (2016) Dynamic selection: an idea flows theory of entry, trade, and growth. Q J Econ 131(1):315–380

Shapiro JS (2016) Trade costs, CO2, and the environment. Am Econ J - Econ Pol 8(4):220–254

Shapiro JS, Walker R (2018) Why is pollution from US manufacturing declining? The Roles of Environmental Regulation, Productivity, and Trade. Am Econ Rev 108(12):3814–3854

Timmer MP, Dietzenbacher E, Los B, Stehrer R, de Vries GJ (2015) An illustrated user guide to the world input-output database: the case of global automotive production. Rev Int Econ 23:575–605

WTO-UNEP (2009) Trade and climate change. WTO Publications, Geneva, available for download at https://www.wto.org/english/res_e/booksp_e/trade_climate_change_e.pdf

Zhang Z (2012) Competitiveness and leakage concerns and border carbon adjustments. Int Rev Environ Resour Econ 6(3):225–287

Acknowledgements

We thank an anonymous reviewer for helpful comments. This paper is based on a report entitled ‘Comparing Scenarios for a European Carbon Border Adjustment Mechanism: Trade, FDI and Welfare Effects with a Focus on the Austrian Economy’ which was commissioned by the Austrian Federal Ministry for Digital and Economic Affairs.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1 CO2 emissions, ETS categories and industry correspondences

1.1 Verified emissions, paid emissions and free allocations in the ETS

The construction of the scenarios and the implied CO2 tariffs relied on several data sources. The first of these data sources was the ETS databaseFootnote 23 from which the number of verified emissions of CO2 equivalents within the ETS system were obtained. This is the sum of emissions by installations registered in the ETS that were verified (across all so-called categories). The ETS database also provides information on the number of free allowances granted to each participating country. The number of verified emissions is available at the level of each category, and the same is true for free emissions. In contrast, the ETS database does not hold information on the emissions paid at the category level, but only at the aggregate level (for all industrial sectors and aviation). Therefore, we need to calculate the number of paid emissions at the category level as the difference between verified emissions and free emissions.Footnote 24 The total volume of paid emissions across all ETS categories for the EU27 are shown in Fig. 2.

Source: ETS Database. Available at: https://www.eea.europa.eu/data-and-maps/data/european-union-emissions-trading-scheme-14

Total verified emissions and free allowances in the European ETS system, EU27, 1995–2019. Note: emissions and free allowances in all ETS categories (including industrial installations and aviation). The peak in free emissions in 2012 is due to the inclusion of the aviation sector.

1.2 Correspondence between ETS categories industries and NACE industries

Most of the ETS categories (i.e. sectors) correspond one to one to an industry in the Standard Industry Classification (NACE), Revision 2. For example, the ETS categories ‘21 Refining of mineral oil’ and ‘22 Production of coke’ both match the NACE Rev.2 industry ‘Manufacture of coke and refined petroleum products’ (NACE 19) (see Table 8 below). The identification of the allowances that have to be paid for by EU companies at the ETS sector level is done in the same way as described above, as the difference between the verified emissions and the free allowances.

The identification of allowances must be done at an individual ETS sector level for each EU member state. This is important because excess free allowances in, say, the German ETS sector ‘Production of bulk chemicals’ (42), does not mean that an excess demand of allowances in the Finnish paper ETS sector ‘Production of pulp’ (35) does not have to be paid for in the latter.Footnote 25 In other words, we assume that an excess supply of free allowances in one ETS sector does not cancel out the excess demand of allowances in another ETS sector.

The ETS category ‘combustion of fuel’ (20) has no correspondence with a NACE industry. The bulk, about 75% of the emissions in this ETS category, is attributable to power stations (with a capacity of 20 MW or more) (Gores et al. 2019) and can therefore be assigned to the electricity sector (D35 – Electricity, gas, steam and air conditioning supply). However, the ETS category ‘combustion of fuel’ also comprises industrial installations that are listed in Annex I of the ETS Directive. The guiding document to this Annex I (European Commission, 2010, p. 6) states that ‘… the activity ‘combustion of fuels’ can occur in all types of NACE categories, not only industrial ones. Examples of such non-industrial installations are combustion units in greenhouses, hospitals, universities and office buildings, booster stations in natural gas transport networks etc.’