Abstract

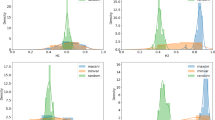

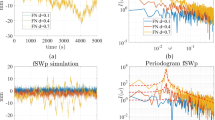

In this paper, three new algorithms are introduced in order to explore long memory in financial time series. They are based on a new concept of fractal dimension of a curve. A mathematical support is provided for each algorithm and its accuracy is tested for different length time series by Monte Carlo simulations. In particular, in the case of short length series, the introduced algorithms perform much better than the classical methods. Finally, an empirical application for some stock market indexes as well as some individual stocks is presented.

Similar content being viewed by others

References

A.W. Lo, Econometrica 59, 1279 (1991)

A.W. Lo, A.C. MacKinlay, Long-term memory in stock market prices, in A Non-Random Walk Down Wall Street (Princeton University Press, 1999), Chap. 6

M. Greene, B. Fielitz, J. Financ. Econ. 4, 339 (1977)

J. Hampton, Rescaled range analysis: Approaches for the financial practitioners, Part 3, Neuro Vest Journal 27 (1996)

F. Lillo, J.D. Farmer, Studies in Nonlinear Dynamics and Econometrics 8, 1 (2004)

E. Panas, Appl. Financ. Econ. 11, 395 (2001)

E. Peters, Financ. Anal. J. 48, 32 (1992)

B.B. Mandelbrot, J.R. Wallis, Water Resourc. Res. 5, 967 (1969)

C.M. Jensen, J. Financ. Econ. 6, 95 (1978)

B.G. Malkiel, J. Econ. Perspect. 17, 59 (2003)

W. Goetsmann, Journal of Business 66, 249 (1993)

E. Peters, Chaos and Order in the Capital Markets: A New View of Cycles, Prices and Market Volatility (John Wiley & Sons Inc., New York, 1996)

R. Weron, Physica A 312, 285 (2002)

M. Ausloos, Physica A 285, 48 (2000)

T. Di Matteo, T. Aste, M. Dacorogna, J. Bank. Financ. 29, 827 (2005)

J.W. Kantelhardt, E. Koscielny-Bunde, H.H.A. Rego, S. Havlin, A. Bunde, Physica A 295, 441 (2001)

J.W. Kantelhardt, S.A. Zschiegner, E. Koscielny-Bunde, S. Havlin, A. Bunde, H.E. Stanley, Physica A 316, 87 (2002)

Y. Liu, P. Cizeau, M. Meyer, C. Peng, H. Stanley, Physica A 245, 437 (1997)

M. Ausloos, N. Vandewalle, Ph. Boveroux, A. Minguet, K. Ivanova, Physica A 274, 229 (1999)

M.A. Sánchez-Granero, J.E. Trinidad Segovia, J. García Pérez, Physica A 387, 5543 (2008)

E. Bayraktar, H.V. Poor, K.R. Sircar, Int. J. Theor. Appl. Finance 7, 615 (2004)

S.-H. Chen, T. Lux, M. Marchesi, J. Econ. Behav. Organ. 46, 327 (2001)

S. Mercik, K. Weron, Acta Physica Polonica B 34, 3773 (2003)

B.B. Mandelbrot, The Fractal Geometry of Nature (W.H. Freeman & Company, New York, 1982)

C. Brown, L. Liebovitch, Fractal Analysis (SAGE Publications Inc., California, 2010)

C. Bandt, T. Retta, Fund. Math. 141, 257 (1992)

F.G. Arenas, M.A. Sánchez-Granero, Rend. Istit. Mat. Univ. Trieste, Suppl. XXX, 21 (1999)

F.G. Arenas, M.A. Sánchez-Granero, A characterization of self-similar symbolic spaces, Mediterr. J. Math., in press, doi: 10.1007/s00009-011-0146-4

M.A. Sánchez-Granero, M. Fernández-Martínez, Fractal dimension for fractal structures, preprint, arXiv:1007.3236v1 [nlin.CD] (2011)

M.A. Sánchez-Granero, Applications of fractal structures, in Proceedings of the Workshop in Applied Topology WiAT’10 (2010), pp. 1–10

K. Falconer, Fractal Geometry, Mathematical Foundations and Applications (John Wiley & Sons Inc., Chichester, 1990)

M. Fernández-Martínez, M.A. Sánchez-Granero, Fractal dimension for fractal structures: A Hausdorff approach, Topol. Appl., in press, doi: 10.1016/j.topol.2011.04.023

B.B. Mandelbrot, Gaussian self-affinity and fractals (Springer-Verlag, New York, 2002)

M. Maejima, Sugaku Expositions 2 1, 103 (1989)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Sánchez-Granero, M.J., Fernández-Martínez, M. & Trinidad-Segovia, J.E. Introducing fractal dimension algorithms to calculate the Hurst exponent of financial time series. Eur. Phys. J. B 85, 86 (2012). https://doi.org/10.1140/epjb/e2012-20803-2

Received:

Revised:

Published:

DOI: https://doi.org/10.1140/epjb/e2012-20803-2