Abstract

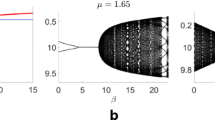

The present paper introduces a majority orienting model in which the dealers’ behavior changes based on the influence of the price to show the oscillation of stock price in the stock market. We show the oscillation of the price for the model by applying the van der Pol equation which is a deterministic approximation of our model.

Similar content being viewed by others

References

M. Aoki, New Approaches to Macroeconomic Modeling (Cambridge University Press, New York, 1996)

K. Binder, D.W. Heermann, Monte Carlo Simulation in Statistical Physics, 2nd edn. (Springer, Berlin Heidelberg, 1997)

R. Cont, J.P. Bouchaud, Macroeconomic Dynamics 4, 170 (2000)

H.M. Tayler, S. Karlin An Introduction to Stochastic Modeling, 3rd edn. (Academic Press, San Diego, 1998)

G. Iori, J. Economic behavior & Org. 49, 269 (2002)

Y. Itoh, S. Ueda, The Institute of Statistical Mathematics Research Memorandum, No. 753 (2000). Preprint available at http://xxx.lanl.gov/abs/nlin.AO/0106006

E.A. Jackson, Perspectives of Nonlinear Dynamics (Cambridge University Press, Cambridge, 1989)

M. Matsumoto, T. Nishimura, ACM Trans. Modeling Computer Simulation 8, 3 (1998), C and Fortran codes are available at http://www.math.keio.ac.jp/| |matumoto/emt.html

T. Lux, M. Marchesi, Nature 397, 498 (1999)

T. Ozaki, Int. J. Control 57, 75 (1993)

J.E. Stiglitz, Microeconomics, 2nd edn. (W.W. Norton & Company, Inc., 1997)

H. Takahashi, The Institute of Statistical Mathematics Research Memorandum, No. 853 (2002)

W. Weidlich, Br. J. Math. Stat. Psychol. 27, 251 (1971)

Author information

Authors and Affiliations

Corresponding author

Additional information

Received: 29 October 2003, Published online: 15 March 2004

PACS:

89.65.Gh Economics; econophysics, financial markets, business and management - 05.45.Tp Time series analysis - 02.50.Ey Stochastic processes

Y. Itoh: Also at The Graduate University for Advanced Studies

Rights and permissions

About this article

Cite this article

Takahashi, H., Itoh, Y. Majority orienting model for the oscillation of market price. Eur. Phys. J. B 37, 271–274 (2004). https://doi.org/10.1140/epjb/e2004-00054-8

Published:

Issue Date:

DOI: https://doi.org/10.1140/epjb/e2004-00054-8