Abstract

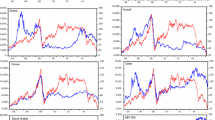

The effects of oil price dynamics on share quotations are discussed in the paper for the 2000–2012 period for two oil exporting countries—Russia and Norway. It has been shown, using a vector autoregressive model, that, in spite of intuitive expectations, oil prices have not been a systematic risk factor for Russian and Norwegian stock market indices. In Norway, share quotations definitely responded to the dynamics of the US dollar exchange rate relative to the world’s main currencies and the S&P 500 stock index, as well as to fluctuations in the global and domestic interest rates, although to a lesser degree. In Russia, share quotations are practically exclusively affected by their own shocks (a factor that is explained by some specific features characterizing Russia’s major public companies).

Similar content being viewed by others

References

World Bank World Development Indicators, 2012: data.worldbank.org.

International Monetary Fund World Economic Outlook, October 2012.

R. Næs, J.A. Skjeltorp and B.A. Øegaard, “Liquidity at the Oslo Stock Exchange,” Norges Bank Res. Dep., Oslo, Work. Pap., no. 9, Apr. 24 (2008)

http://www.oslobors.no (uploaded Jan. 28, 2013)

The Financial Market in Norway 2009: Risk Outlook, Finanstilsynet, Oslo, Mar. 2010.

T. Yu. Teplova, Postprivatizatsionnoe funktsionirovanie kompanii na trekh rynkakh postsovetskogo prostranstva: sopostavlenie chastnykh i smeshannykh po strukture sobstvennosti kompanii (Postprivatization Performance of Companies in Tree of the Post-Soviet Markets: Comparison of Private and Mixed Companies by Their Property Structure), (NIU VShE, Ìoscow, 2012).

J.-M. Moberg and G. Sucarrat, Stock Market Return, Order Flow and Financial Market Linkages, Norw. Sch. Econ. Bus. Adm., Aug. 2 (2007).

L. Che, Investors’ Performance and Trading Behavior on the Norwegian Stock Market, BI Norw. Bus. Sch. Ser. Dis., 5 (2011).

Obzor finansovogo rynka (Financial Market Review), Res. Inf. Dep., Bank of Russia, No. 2 (71) (2011).

Obzor finansovogo rynka (Financial Market Review), (Annu. Surv. 2012), Res. Inf. Dep., Bank of Russia.

Yu. Orlova and M. Yakovleva, “Instrumenty s garantirovannoi bednost’yu” (Instruments with Guaranteed Poverty), Kommersant, Mar.19 (2013).

http://www.rts.micex.ru (uploaded Jan. 28, 2013)

C. A. Sims, “Macroeconomics and Reality,” Econometrica 48(1) (1980).

I. A. Kopytin, Rynochnyi risk i risk-faktory rossiiskogo fondovogo rynka, Magister. Dis., (NIU VShE, Moscow, 2009) [in Russian].

Source: Energy Information Administration.

S. V. Zhukov, Tsentral’naya Aziya: imperativy ekonomicheskogo rosta v usloviyakh globalizatsii, Doct. Dis. in Econ. (IMEMO, Moscow, 2005) [in Russian].

Taylor. L. Economic Openness — Problems to the Century’s End, World Inst. Dev. Econ. Res. Work. Pap. No. 41 (Helsinki, Apr. 1988).

S. V. Zhukov, I. A. Kopytin, and I. A. Maslennikov, Integratsiya neftyanogo i finansovogo rynkov i sdvigi v tsenoobrazovanii na neft’ (Integration of Oil and Finance Markets and Shifts in Oil Pricing), INP RAN, Open seminar “Economic Prospects of Energy Market” (INP, Moscow, 2012) [in Russian].

L. E. O. Svensson, R. Clarida, J. Gali, and M. Getler, “Optimal Monetary Policy in Open Versus Closed Economies: An Integrated Approach,” Am. Econ. Rev. Pap. Proc. 91 (2001).

S. Zhukov, “Inostrannye investitsii v Rossii: opyt 1992–1998 gg.” (Foreign Investments in Russia: Experience of 1992–1998) in Perekhodnaya ekonomika: teoreticheskie aspekty, rossiiskie problemy, mirovoi opyt (Transition Economy: Theoretical Aspects, Russian Problems and World’s Experience), V.A. Martynov, V.S. Avtonomov, and I.M. Osadchaya, Eds., (Ekonomika, Moscow, 2005) [in Russian].

E. T. Gurvich, V. N. Sokolov, and A. V. Ulyukaev, “Analiz svyazi mezhdu kursovoi politikoi TsB i protsentnymi stavkami: nepokrytyi i pokrytyi paritet” (Analysis of the Linkage between the Central Bank’s Exchange Rate Policy and Interest Rates: Covered and Uncovered Parity), Zh. Novoi Ekon. Assoc., Nos. 1–2 (2009).

Economic Survey of Russia 2009. OECD, July 15 (Paris, 2009).

Central Bank of the Russian Federation: Exchange Rate Flexibility and Russia’s Monetary Policy Shift; The Influence of External Factors on Monetary Policy Frameworks and Options, Bank of International Settlements (BIS) Background Pap. No. 57 (October 2010).

H. C. Bjorland, “Oil Price Shocks and Stock Market Booms in An Oil Exporting Country,” Norges Bank Discuss. Pap. No. 16 (2008).

K. Olsen, J. F. Qvigstad, and O. Roisland, “Monetary Policy in Real Time: The Role of Simple Rules, BIS Pap., No. 19 (2003).

R. Næs, J. A. Skjeltorp and B. A. Odegaard, “Liquidity at the Oslo Stock Exchange,” Norges Bank Res. Dep., Work. Pap., No. 9, Apr. 24 (Oslo, 2008).

S. A. Ross, “The Arbitrage Theory of Capital Asset Pricing,” J. Econ. Theory 13 (1976).

N. M. Viktor, “On Measuring the Performance of National Oil Companies (NOCs),” Stanford Univ. Work. Pap. No. 64. (Sept. 2007).

Energy Intelligence; www.energyintel.com/Pages/EIG.

Bloomberg; www.bloomberg.com/

Yu. N. Bobylev, G. I. Idrisov, and S. G. Sinel’nikov-Murylev, “Eksportnye poshliny na neft’ i nefteprodukty: neobkhodimost’ otmeny i stsenarnyi analiz posledstvii,” Gaidar Institute of Economic Problems (IEP), IEP Nauchn. Tr., No. 161R (2012).

Author information

Authors and Affiliations

Additional information

Original Russian Text © I.A. Kopytin, 2014.

Rights and permissions

About this article

Cite this article

Kopytin, I.A. Influence of oil prices on stock market indexes in Russia and Norway. Stud. Russ. Econ. Dev. 25, 99–110 (2014). https://doi.org/10.1134/S1075700714010109

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1134/S1075700714010109