Abstract

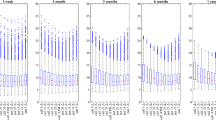

This research paper examines one-day-ahead out-of-sample performance of the volatility smirk-based options pricing models, namely, Ad-Hoc-Black–Scholes (AHBS) models on the CNX Nifty index options of India. Further, we compare the performance of these models with that of a TSRV-based Black–Scholes (BS) model. For the purpose, the study uses tick-by-tick data. The results on the AHBS models are highly satisfactory and robust across all the subgroups considered in the study. Notably, a daily constant implied volatility based ad-hoc approach outperforms the TSRV-based BS model substantially. The performance of the ad-hoc approaches improves further when the smile/smirk effect is considered. For the estimation of the implied volatility smile, we apply three weighting schemes based on the Vega and liquidity of the options. All the schemes offer equally competing results. The major contribution of the study to the existing literature on options pricing is in terms of the ex-ante examination of the ad-hoc approaches to price the options by calibrating volatility smile/smirk on a daily basis.

Similar content being viewed by others

Notes

From the preliminary analysis, we find that the AHBS models provide considerable improvements over the BS model, both in terms of the MAPE and the MPE. However, the SDs for the AHBS models are comparable to those of the BS; and in some cases, even higher. This indicates the presence of outliers in the data (especially, in the case of the AHBS models). However, in the case of the BS model, the SD fails to reflect the presence of outliers in the data. This may be traced to the considerably biased MPE. Further investigation of the data corroborates the presence of outliers (in some cases the MPE is as high as 10,000% or more). To remove the effect of such extreme outliers on the results, a 5% trimming scheme is applied on the overall mispricing data.

A non-parametric test is applied in view of the stylised fact that the financial data, in general, is expected to show non-normality. The Jarque Bera test is conducted to confirm the non-normality of pricing errors. The test reveals that the data is not normally distributed since the null hypothesis of normality can be rejected with a very high level of confidence (p-value \(2.2\times 10^{-16})\). In view of this, it is appropriate to use a non-parametric test. The Wilcoxon Rank-Sum test is also known as the Mann-Whitney U test/Mann–Whitney–Wilcoxon test.

References

Aït-Sahalia, Y., P.A. Mykland, and L. Zhang. 2005. How often to sample a continuous-time process in the presence of market microstructure noise. Review of Financial Studies 18: 351–416.

Andersen, T.G., T. Bollerslev, and N. Meddahi. 2005. Correcting the errors: Volatility forecast evaluation using high-frequency data and realized volatilities. Econometrica 73: 279–296.

Beckers, S. 1981. Standard deviations implied in option prices as predictors of future stock price variability. Journal of Banking and Finance 5: 363–381.

Bakshi, G., C. Cao, and Z. Chen. 1997. Empirical performance of alternative option pricing models. Journal of Finance 52: 2003–2049.

Ball, C.A., and W.N. Torous. 1985. On Jumps in Common Stock Prices and Their Impact on Call Option Pricing. Journal of Finance 40 (1): 155–173.

Baruníková, M.V. 2009. Option Pricing: The empirical tests of the Black–Scholes pricing formula and the feed-forward networks, IES Working Papers.

Chance, D.M. 1988. Boundary condition tests of bid and ask prices of index call options. The Journal of Financial Research 11 (1): 21–31.

de Almeida, C.I.R., and S. Dana. 2005. Stochastic Volatility and Option Pricing in the Brazilian Stock Market: An Empirical Investigation. Journal of Emerging Market Finance 4: 169–206.

Dumas, B., J. Fleming, and R. Whaley. 1998. Implied volatility functions: Empirical tests. Journal of Finance 53: 2059–2106.

Grover, R., and S. Thomas. 2012. Liquidity Considerations in Estimating Implied Volatility. Journal of Futures Markets 32 (8): 714–741.

Heston, S. 1993. A closed form solution for options with stochastic volatility with applications to bond and currency options. Review of Financial Studies 6: 327–343.

Heynen, R. 1993. An Empirical Investigation of Observed Smile Patterns. Review of Future Markets 13: 317–353.

Huang, J., and L. Wu. 2004. Specification Analysis of Option Pricing Models Based on Time-Changed Lévy Processes. The Journal of Finance 59 (3): 1405–1440.

Hull, J., and C. and Basu, S. 2013. Options, Futures, And Other Derivatives, 8th ed. New Delhi: Pearson Publication.

Jackwerth, J. C., and M. Rubinstein. 2001. Recovering stochastic processes from option prices. University of Konstanz and University of California at Berkeley Working Paper.

Kim, S. 2009. The Performance of Traders’ Rules in Options Market. Journal Futures Markets 29: 999–1020.

Kim, I.J., and S. Kim. 2004. Empirical comparison of alternative stochastic volatility option pricing models: Evidence from Korean KOSPI 200 index options market. Pacific-Basin Finance Journal 12: 117–142.

Kirgiz, I. 2001. An empirical comparison of alternative stochastic volatility option pricing models. Dubai Group Working Paper.

Koopman, S.J., B. Jungbacker, and E. Hol. 2005. Forecasting daily variability of the S&P 100 stock index using historical, realized and implied volatility measurements. Journal of Empirical Finance 12: 445–475.

Kumar, A.V., and S. Jaiswal. 2013. The Information Content of Alternate Implied Volatility Models: Case of Indian Markets. Journal of Emerging Market Finance 12: 293–321.

Latane, H.A., and R.J. Rendleman Jr. 1976. Standard deviations of stock price ratios implied in option prices. Journal of Finance 31: 369–381.

Li, M., and N.D. Pearson. 2007. A horse race among competing option pricing models using S&P 500 index options. Georgia Institute of Technology and University of Illinois at Urbana-Champaign Working Paper.

Liu, Y. 1996. Numerical pricing of path-dependent options, unpublished doctoral dissertation. University of Toronto.

Macbeth, James D., and J.M. Larry. 1979. An Empirical Examination of the Black-Scholes Call Option pricing Model. Journal of Finance 34: 1173–1186.

Martens, M. 2002. Measuring and Forecasting S&P 500 Index-Futures Volatility Using High-Frequency Data. Journal of Futures Markets 22 (6): 497–518.

McKenzie, S., D. Gerace, and Z. Subedar. 2007. An empirical investigation of the Black-Scholes model: Evidence from the Australian Stock Exchange. Australasian Accounting Business and Finance Journal 1: 71–82.

Nagendran, R., and V. Vadivel. 2005. A Study on the Biases of Black-Scholes European Formula in Pricing the Call Options with Reference to Indian Stock-Option Market, Business Management Practices, Policies and Principles, Allied Publishers Private Limited, New Delhi, pp. 206–214 (ISBN: 81-7764-841-1).

Rubinstein, M. 1994. Implied binomial trees. Journal of Finance 49: 771–818.

Scholes, M., and J. Williams. 1977. Estimating betas from nonsynchronous data. Journal of Financial Economics 5: 309–327.

Singh, V.K. 2013. Empirical Performance of Option Pricing Models: Evidence from India. International Journal of Economics and Finance 5: 141–154.

Singh, S., and A. Dixit. 2016. Performance of the Heston’s Stochastic Volatility Model: A Study in Indian Index Options Market. Theoretical Economics Letters 6 (2): 151–165.

Singh, V.K., and P. Pachori. 2013. A Kaleidoscopic Study of Pricing Performance of Stochastic Volatility Option Pricing Models: Evidence from Recent Flaring up of Indian Economic Turbulence. Vikalpa-Journal of IIM Ahmadabad 38: 21–39.

Singh, S., and Vipul. 2015. Performance of Black-Scholes model with TSRV estimates. Managerial Finance 41 (8): 857–870.

Tan, S. 2008. The Role of Options in Long Horizon Portfolio Choice. Journal of Derivatives 20: 60–77.

Vipul., 2005. Futures and options expiration-day effects: The Indian evidence. Journal of Futures Markets 25: 1045–1065.

Vipul, and J. Jacob., 2007. Forecasting performance of extreme value volatility estimators. Journal of Futures Markets 27: 1085–1105.

Vipul,. 2008. Cross-Market Efficiency in the Indian Derivatives Market: A Test of Put-Call Parity. Journal of Futures Markets 28: 889–910.

Whaley, R.E. 1982. Valuation of American call options on dividend-paying stocks: Empirical tests. Journal of Financial Economics 10: 29–58.

Yan, S. 2011. Jump risk, stock returns, and slope of implied volatility smile. Journal of Financial Economics 99 (1): 216–233.

Zhang, L., P.A. Mykland, and Y. Aït-Sahalia. 2005. A tale of two time scales: Determining integrated volatility with noisy high-frequency data. Journal of the American Statistical Association 100: 1394–1411.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A

Appendix B

The Kruskal-Wallis multiple comparison test for AS\(_1\) in the case of call options, p value: 0.05 | |||

|---|---|---|---|

Comparisons | Obs. dif | Critical dif | diff |

DOTM-OTM | 108,403.590 | 2412.981 | TRUE |

DOTM-ATM | 370,232.951 | 2372.076 | TRUE |

DOTM-ITM | 520,651.343 | 6490.112 | TRUE |

DOTM-DITM | 519,609.229 | 18,971.560 | TRUE |

OTM-ATM | 261,829.361 | 2060.493 | TRUE |

OTM-ITM | 412,247.752 | 6382.823 | TRUE |

OTM-DITM | 411,205.639 | 18,935.125 | TRUE |

ATM-ITM | 150,418.392 | 6367.472 | TRUE |

ATM-DITM | 149,376.278 | 18,929.956 | TRUE |

ITM-DITM | 1042.114 | 19,870.532 | FALSE |

Rights and permissions

About this article

Cite this article

Dixit, A., Singh, S. Ad-Hoc Black–Scholes vis-à-vis TSRV-based Black–Scholes: Evidence from Indian Options Market. J. Quant. Econ. 16, 57–88 (2018). https://doi.org/10.1007/s40953-017-0078-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40953-017-0078-3

Keywords

- Black–Scholes

- Ad-Hoc Black-Scholes

- Implied volatility

- Volatility smile

- Two scale realized volatility

- Tick-by-tick data

- Indian options market