Abstract

This paper analyses the relation between firms’ productivity and the different modes of participation in international trade. In particular, it accounts for the possibility that firms can not only export their products, but also internationally source their inputs, either directly or indirectly. Using a cross section of firm level data for several advanced and developing economies, the study confirms the productivity-sorting prediction according to which domestic firms are less efficient than those that resort to an export intermediary, while the latter are less productive than producers which export directly. We show that the same sorting exists on the import side. By considering firms involved in both exporting and importing activities, we also find that direct two-way traders are on average more productive than firms trading indirectly on one of the two trade sides. The latter are in turn more efficient than indirect two-way traders. Finally, we investigate the effects of source-country characteristics on the sorting of firms into different modes of international trade.

Similar content being viewed by others

Notes

As emphasized by Bernard et al. (2010b), there also exist firms that engage in a mix of those activities.

However, McCann (2009) obtained a different ranking for a large panel of Irish manufacturing firms. Indeed, two-way traders and only exporters were found to be the most productive firms, with a significant gap between them and only importers and non-traders.

Kugler and Verhoogen (2012) observe a positive relationship among plant size, input and output prices using a representative sample of Colombian manufacturing firms. The assumption that marginal costs increase in output quality is also supported by the empirical results set out in Brambilla et al. (2012). These authors find a positive relationship between the income level of destination countries, proxying consumers’ preference for high-quality goods, and the wages of workers employed by Argentinean exporters.

All data are freely accessible to researchers at http://www.enterprisesurveys.org.

Unfortunately, not all the analyses could be conducted on the pooled data because the information contained in the two standardized datasets did not completely overlap.

The cleaning procedures are described in “Appendix 1”, the Stata do file used to replicate the analysis is available upon request.

This high-income group consists of Argentina, Germany, Greece, Ireland, Oman, Portugal, Slovenia, Spain, and South Korea. GDP per capita, constant 2000 US$, downloaded from http://data.worldbank.org/indicator. Countries belonging to “High Income” groups are marked in Tables 1 and 2 with *.

We thank an anonymous referee for the suggestion to investigate the distribution of the shares of direct and indirect exports further.

The very few firms that are both direct and indirect exporters are assigned to the category direct (indirect) if the share of direct exports is bigger (smaller) than the share of indirect exports. The same procedure is applied to importers.

The share of indirect exporters for High Income is 5.5 %.

Note that the data at our disposal do not allow decomposition of total exports (imports) across different destinations (country of origin).

Details on the construction of such variables to account for country-level fixed costs are provided in Bernard et al. (2015).

Producers may export indirectly through wholesale firms or through other manufacturing firms, so-called “carry-along trade” (Bernard et al. 2012). We could not distinguish between these modes of indirect export in the BEEPS data.

We use sales because the data does not include measures of value added.

The BEEPS Standardized Data 2006–2011 does not contain the break-down of input purchases into domestic, indirect and directly imported. Hence it is possible to replicate only the analysis on the export side.

We do not replicate the analysis for high-income countries because the sample sizes become too small within some cells.

Note that our results are roughly consistent with those of Davies and Jeppesen (2015) even if we consider a different wave of Enterprise Surveys.

As described in Sect. 3 there exists a source-specific market costs for exporting and a source-specific market costs for importing. Hence, for two-way traders we consider the average between the cost of importing and the cost of exporting. Note also that the correlation between the two measures of cost is rather high (93 %) so that employing one or the other does not change the results.

Stata do files with the cleaning procedures and regressions are available upon request.

References

Abel-Koch, J. (2013). Who uses intermediaries in international trade? Evidence from firm-level survey data. The World Economy, 36(8), 1041–1064.

Ahn, J., Khandelwal, A. K., & Wei, S.-J. (2011). The role of intermediaries in facilitating trade. Journal of International Economics, 84(1), 73–85.

Akerman, A. (2010). A theory on the role of wholesalers ininternational trade based on economies of scope, (Research papers in economics), Stockholm University, Department of Economics.

Altomonte, C., & Bekes, G. (2009). Trade complexity and productivity (IEHAS Discussion Papers 0914), Institute ofEconomics, Centre for Economic and Regional Studies, HungarianAcademy of Sciences.

Antràs, P., & Costinot, A. (2011). Intermediated trade. The Quarterly Journal of Economics, 126(3), 1319–1374.

Bernard, A. B., Blanchard, E. J., Beveren, I. V., & Vandenbussche, H. Y. (2012). Carry-along trade, (Technical Report 18246), National Bureau of Economic Research.

Bernard, A. B., Grazzi, M., & Tomasi, C. (2015). Intermediaries in international trade: Products and destinations. Review of Economics and Statistics, 97(4), 916–920.

Bernard, A. B., Jensen, J. B., Redding, S. J., & Schott, P. K. (2007). Firms in international trade. Journal of Economic Perspectives, 21(3), 105–130.

Bernard, A. B., Jensen, J. B., Redding, S. J., & Schott, P. K. (2010a). Intrafirm trade and product contractibility. American Economic Review, 100(2), 444–448.

Bernard, A. B., Jensen, J. B., Redding, S. J., & Schott, P. K. (2010b). Wholesalers and retailers in U.S. trade. American Economic Review, 100(2), 408–413.

Bernard, A. B., Jensen, J. B., & Schott, P. K. ( 2009). Importers, exporters and multinationals: A portrait of firms in the U.S. that trade goods. Producer Dynamics: New Evidence from Micro Data, NBER Chapters, National Bureau of Economic Research, Inc, pp. 513–552.

Brambilla, I., Lederman, D., & Porto, G. (2012). Exports, export destinations, and skills. American Economic Review, 102(7), 3406–3438.

Castellani, D., Serti, F., & Tomasi, C. (2010). Firms in international trade: Importers’ and exporters’ heterogeneity in Italian Manufacturing Industry. The World Economy, 33(3), 424–457.

Davies, R., & Jeppesen, T. (2015). Export mode, firm heterogeneity, and source country characteristics. Review of World Economics (Weltwirtschaftliches Archiv), 151(2), 169–195.

Djankov, S., Freund, C., & Pham, C. S. (2010). Trading on time. Review of Economics and Statistics, 92(1), 166–173.

Eaton, J., Kortum, S. S., & Kramarz, F. (2011). An anatomy of international trade: Evidence from French firms. Econometrica, 79(5), 1453–1498.

Halpern, L., Koren, M., & Szeidl, A. ( 2011). Imported inputs and productivity (CeFiG Working Papers 8), Center for Firms in the Global Economy.

Hummels, D., Ishii, J., & Yi, K.-M. (2001). The nature and growth of vertical specialization in world trade. Journal of International Economics, 54(1), 75–96.

Kaufman, D., Kraay, A., & Mastruzzi, M. (2009). Governance matter VIII: Aggregate and individual governance indicators 1996–2008 (Policy Research Paper 4978), World Bank.

Kugler, M., & Verhoogen, E. (2009). Plants and imported inputs: New facts and an interpretation. American Economic Review, 99(2), 501–507.

Kugler, M., & Verhoogen, E. (2012). Prices, plant size, and product quality. Review of Economic Studies, 79(1), 307–339.

McCann, F. (2009). Importing, exporting and productivity in Irish manufacturing (Working Papers 200922), School of Economics, University College Dublin.

McCann, F. (2013). Indirect exporters. Journal of Industry, Competition and Trade, 13(4), 519–535.

Melitz, M. J. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71(6), 1695–1725.

Melitz, M. J., & Ottaviano, G. I. P. (2008). Market size, trade, and productivity. Review of Economic Studies, 75(1), 295–316.

Muls, M., & Pisu, M. (2009). Imports and exports at the level of the firm: Evidence from Belgium. The World Economy, 32(5), 692–734.

Petropoulou, D. (2011). Information costs, networks and intermediation in international trade (Globalization and Monetary Policy Institute Working Paper 76), Federal Reserve Bank of Dallas.

Rauch, J. E., & Watson, J. (2004). Network intermediaries in international trade. Journal of Economics & Management Strategy, 13(1), 69–93.

Roberts, M. J., & Tybout, J. R. (1997). The decision to export in Colombia: An empirical model of entry with sunk costs. American Economic Review, 87(4), 545–564.

Serti, F., Tomasi, C., & Zanfei, A. (2010). Who trades with whom? Exploring the links between firms’ international activities, skills, and wages. Review of International Economics, 18(5), 951–971.

Smeets, V., & Warzynski, F. (2010). Learning by exporting, importing or both? Estimating productivity with multi-product firms, pricing heterogeneity and the role of international trade (Working Papers 10–13), University of Aarhus, Aarhus School of Business, Department of Economics.

Acknowledgments

We thank Andrew B. Bernard for insightful discussions and an anonymous referee. Marco Grazzi gratefully acknowledges Fondazione Cassa dei Risparmi di Forl, Grant ORGANIMPRE, for financial support. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Appendix 1: Variables description and data cleaning

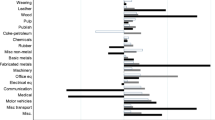

The empirical analysis was performed employing the dataset “Standardized data 2002–2005” which was downloaded from www.enterprisesurveys.org. Although a more recent dataset is available, covering the period 2006–2014, it does not contain the breakdown for the purchase of material inputs into domestic, indirectly, and directly imported. The dataset originally contains 71,789 observations from 151 countries.Footnote 20 Once we focus on firms in the manufacturing sectors we are left with 45,137 observations from 102 countries. Removing firms without information on the breakdown of sales (purchase of inputs) drops 1096 (10,985) observations. We also drop more than 5000 observations not reporting either sales or employment. At this stage we are left with 27,298 observation from 95 countries, which is the total number of observation reported in Tables 1 and 2. In order to get rid of outliers which might bias the results we set as missing observations reporting with productivity, employment and sales figures smaller than the first and bigger that the 99th percentile on a year-country basis (some countries are surveyed in more than 1 years). Davies and Jeppesen (2015) also resort to a question of the 2006–2014 BEEPS dataset about the quality of the responses to the survey. The wave of the survey that we employ (2002–2005) does not contain such question (Table 9).

1.2 Appendix 2: Robustness checks

About this article

Cite this article

Grazzi, M., Tomasi, C. Indirect exporters and importers. Rev World Econ 152, 251–281 (2016). https://doi.org/10.1007/s10290-016-0245-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-016-0245-1

Keywords

- Heterogeneous firms

- Direct and indirect exports

- Direct and indirect imports

- Two-way traders

- Intermediation