Abstract

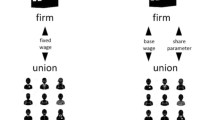

Profit sharing schemes have been analysed assuming Cournot competition and decentralised wage negotiations, and it has been found that firms share profits in equilibrium. This paper analyses a different remuneration system: employee share ownership. We find that whether firms choose to share ownership or not depends on both the type of competition in the product market and the way in which workers organise to negotiate wages. If wage setting is decentralised, under duopolistic Cournot competition both firms share ownership. If wage setting is centralised, only one firm shares ownership if the degree to which goods are substitutes takes an intermediate value; otherwise, the two firms share ownership. In this case, if the union sets the same wage for all workers neither firm shares ownership. Therefore, centralised wage setting discourages share ownership. Finally, under Bertrand competition neither firm shares ownership regardless of how workers are organised to negotiate wages.

Similar content being viewed by others

Notes

Fakhfakh and Pérotin (2000) argue that profit sharing has been regarded as a way of improving employee motivation and performance or simply of redistributing to employees a share of the wealth they helped to create.

Using data from 2010 for firms with at least 200 employees (6258 companies were surveyed) the Cranfield Network on International Human Resource Management (Cranet) shows the following (see the Inter-University Centre for the European Commission’s DG MARKT 2014): Finland (SO: 9.3 %, PS: 71.4 %), France (SO: 11.9 %, PS: 69.5 %), Germany (SO: 11.8 %, PS: 45.6 %), Ireland (SO: 39.3 %, PS: 27.6 %), Italy (SO: 7.3 %, PS: 5.8 %), United Kingdom (SO: 30 %, PS: 9.8 %). The discrepancy in the data between the two surveys is because ECS uses more data than Cranet; the former uses data from EU companies with ten or more employees, and the 2013 survey contained 27,300 companies.

Bensaïd and Gary-Bobo (1991) also consider spatial competition assuming a Hotelling-like duopoly and find that the non-cooperative equilibrium in contracts Pareto-dominates the standard wage-duopoly solution.

There are related papers analysing the strategic use of profit sharing: Tanaka (1994) extends the analysis to consider an export subsidy; Mauleon and Vannetelbosch (1999) consider incomplete-information and the possibility of strikes or lockouts; Takami and Nakamura (2012) analyse the effect of profit sharing on the endogenous order of moves; Buscella (2016) studies the optimal choice of the pay scheme in a right-to-manage framework assuming potential market entry and decentralised bargaining. There are also other papers such as Chang (2006) and Lin and Chan (2011) that analyse profit sharing using a macroeconomic model.

In countries such as the United States and the United Kingdom wage bargaining is decentralised while in Continental Europe it is centralised at industry or national level (see, for example, Bárcena-Ruiz 2002; Haucap and Wey 2004). Current data for the European Union can be found in the report by European Commission (2015, pp. 22-23).

Evidence may be found in a study prepared by the Inter-University Centre for the European Commission’s DG MARKT (2014).

The website of the European Federation of Employee Share Ownership contain evidence supporting the timing proposed in the paper (http://www.efesonline.org/LIBRARY/2009/CISL/CompanyCases.pdf). For example, the board of Handelsbanken, which operates in Sweden, Denmark, Findland, Noorway and Great Britain, dedicates part of the bank’s extra profits to a profit sharing scheme for the benefit of its employees. All employees get the same benefit, regardless of individual performance. A considerable part of these funds is invested in shares in the bank. These shares are managed by the Oktogonen Foundation which is currently the bank’s largest shareholder (with around 10.7 % of its shares). However, salaries are set individually and processed in a system with annual individual wage negotiations.

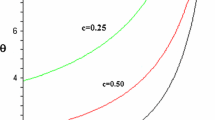

This asymmetric equilibrium disappears if the maximum percentage of the shares that the unions may obtain is lower than 0.3610 (see Appendix).

The model can be extended to consider a more general Stone Geary utility function for the union of the form: U i = (w i + α i π i /L i )θ L i . Assuming a decentralised wage setting it is obtained that the two firms share ownership under Cournot Competition and neither firm shares ownership under Bertrand competition. Moreover, this result holds if unions and firms negotiate wages with different bargaining powers. When wage setting is centralised the game cannot be solved considering the above utility function for the union and considering different bargaining powers.

We assume that b < 1 to ensure that the function U(q 1 , q 2) is strictly concave (see Vives 1984).

The assumption α i ≤1/2 means that employees have a share in the ownership of the firm, but not in the decision making. This assumption is also employed in models assuming that firms acquire a stake in their rivals (see, for example, Macho-Stadler and Verdier 1991; Malueg 1992; Gilo et al. 2006). Even when α i =1/2, i.e. owners and employees own the same percentages of the firm, we assume that decisions are taken by the owners.

As in Fung (1989a), to capture the wage-setting power of workers we consider a monopoly union, though the results remain qualitatively similar if we consider that firms and unions bargain over wages.

The second order conditions of the problems that we analyse are always satisfied (see Appendix).

As 0 < b < 1 all expressions are non-negative. The same applies to other expressions in the paper.

A greater share in ownership makes the union more concerned about profits and thus leads it to set a lower wage, which permits the firm to be more competitive in the product market. To avoid losing market share, its rival reacts by giving more shares to its employees. Moreover, the wages paid by both firms decrease with the incentive schemes of both firms.

For this range of values of parameter b, when b 1 > b > b 2 it is obtained that π YY > π NY but α YY is high enough since it increases with b. Although π NY decreases with b since α NY increases with b (i.e. the rival encourages its union to set a lower wage with b), as α YY is high enough it is obtained that B YY < B NY . When b 3 > b > b 1, it is obtained that π YY > π NY but for these values of parameter b it is obtained that α YY =1/2, the maximum value possible, which implies that B YY < B NY.

When only one firm shares ownership there are two equilibria: in each of them one firm shares ownership and the other chooses the wage system. As B YN > B NY both owners prefer to share ownership. To select one equilibrium additional factors would need to be included in the model. For example, as products are imperfect substitutes, if the demand is sufficiently greater for one good than for the other the firm with the product for which there is greater demand chooses to share ownership and the other chooses the wage system.

This assumption is usually made to simplify computations introducing an additional parameter (the cut-off) makes the resolution of the game cumbersome.

References

Bárcena-Ruiz JC (2002) Politically preferred wage bargaining structures. Eur J Polit Econ 689:1–13

Bensaïd B, Gary-Bobo RJ (1991) Negotiation of profit-sharing contracts in industry. Eur Econ Rev 35(5):1069–1085

Blanchflower DG, Oswald AJ (1987) Profit sharing-can it work? Oxf Econ Pap 39(1):1–19

Booth AL (1995) The economics of the trade unions. Cambridge University Press, Cambridge

Buscella D (2016) Profit sharing as entry deterrence mechanism. Port Econ J 15:17–31

Chang J (2006) Profit-sharing, risk sharing, and firm size. implications of efficiency wages. Small Bus Econ 27:261–273

Estrin S, Pérotin V, Robinson A, Wilson N (1997) Profit-sharing in OECD countries: a review and some evidence. Bus Strat Rev 8(4):27–32

European Commission (2015) Industrial Relations in Europe 2014. Available at http://ec.europa.eu/social/main.jsp?catId=738&langId=en&pubId=7739

Fakhfakh F, Pérotin V (2000) The effects of profit-sharing schemes on enterprise performance in France. Econ Anal 3(2):93–112

Fung KC (1989a) Unemployment, profit-sharing and Japan’s economic success. Eur Econ Rev 33(4):783–796

Fung KC (1989b) Profit-sharing and European unemployment. Eur Econ Rev 33(9):1787–1798

Gilo D, Moshe Y, Spiegel Y (2006) Partial cross ownership and tacit collusion. RAND J Econ 37:81–99

Haucap J, Wey C (2004) Unionisation structures and innovation incentives. Econ J 114:C149–C165

Inter-University Centre for the European Commission’s DG MARKT (2014) The promotion of employee ownership and participation. Available at: http://ec.europa.eu/internal_market/company/docs/modern/141028-study-for-dg-markt_en.pdf

Lin C, Chan J (2011) Macroeconomic implications of a sharing compensation scheme in a model of endogenous growth. J Econ 102:57–75

Macho-Stadler I, Verdier T (1991) Strategic managerial incentives and cross ownership structure: a note. J Econ 53:285–297

Malueg D (1992) Collusive behavior and partial ownership of rivals. Int J Ind Organ 10(1):27–34

Mauleon A, Vannetelbosch V (1999) Profit sharing and strike activity in Cournot Oligopoly. J Econ 69:19–40

Pendleton A, Poutsma E, Ommeren J, Brewster C (2001) Employee share ownership and profit-sharing in the European Union, EUROPEAN FOUNDATION for the Improvement of Living and Working Conditions. Office for Official Publications of the European Communities, Luxembourg

Sørensen JR (1992) Profit-sharing in a unionized Cournot duopoly. J Econ 55(2):151–167

Stewart G (1989) Profit-sharing in Cournot-Nash oligopoly. Econ Lett 31(3):221–224

Takami H, Nakamura T (2012) Profit-sharing and the endogenous order of moves in oligopoly. Theor Econ Lett 2(2):125–129

Tanaka Y (1994) Profit sharing and welfare in a export subsidy game. Econ Lett 45(3):349–353

Vives X (1984) Duopoly information equilibrium: Cournot and Bertrand. J Econ Theory 34:71–94

Weitzman ML (1983) Some macroeconomic implications of alternative compensation systems. Econ J 93:763–783

Weitzman M (1985) The simple macroeconomics of profit-sharing. Am Econ Rev 75:937–953

Weitzman ML (1987) Steady state unemployment under profit-sharing. Econ J 97:86–105

Acknowledgments

We would like to thank three referees for their helpful suggestions. Financial support from Ministerio de Ciencia y Tecnología (ECO2012-32299, ECO2015-66803-P), Gobierno Vasco (IT1124-16) and the University of the Basque Country (EHU14/05) is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Additional information

An erratum to this article is available at http://dx.doi.org/10.1007/s10258-016-0120-y.

Appendix

Appendix

1.1 Second order conditions under Cournot competition

Decentralised wage setting. In the second stage, firm i chooses the value of α i that maximises B i = (1–α i )π i . Solving this problem we obtain first order conditions:

Thus,

As α i <1/2, α j <1/2 and b is such that 0 < b < 1, we find that b 4 − 2b 2(7 + α i − 2α j ) + 8(1 + α i )(2 − α j ) = (16 − 14b 2 + b 4 − 8α j + 4b 2 α j ) + (16α i − 2b 2 α i − 8α i α j ) > 0, (−8 + b 2 + 4α j ) < 0 and (8 − 2b − b 2 − 4α j )2 > 0. As a result ∂2 B i /∂α i 2 < 0.

Centralised wage setting. In the second stage, firm i chooses the value of α i that maximises B i = (1–α i )π i . Solving this problem we obtain first order conditions:

Thus,

which is negative since α i and α j are lower than 1/2 and b is such that 0 < b < 1.

1.2 Bertrand competition and decentralised wage setting

From (13) the profit of firm i can be expressed as:

It can be shown that ∂πi/∂α i > 0. In the second stage, firm i chooses the value of α i that maximises B i = (1–α i )π i , i = 1, 2. Solving these problems the following is obtained:

The numerator of the above expression is positive and the denominator is negative since b < 1, α i < 1/2 and α j <1/2. This means that B i strictly decreases with α i , and thus α i = 0, i ≠ j; i, j = 1, 2.

1.3 Bertrand competition and centralised wage setting

In the fourth stage, firm i chooses the price, p i , that maximises B i = (1–α i )π i . Solving these problems gives expression (11). In the third stage, the union chooses the wages w i and w j that maximise its total income: I i = α i π i + w i q i + α j π j + w j q j . Solving these problems it is obtained that the wage paid by firm i (i ≠ j; i, j = 1, 2) is:

Thus, the profit of firm i can be expressed as:

In the second stage, firm i chooses the value of α i that maximises B i = (1–α i ) π i . Solving these problems the following is obtained:

The numerator of the above expression is positive and the denominator is negative since b < 1, α i < 1/2 and α j <1/2. This means that B i strictly decreases with α i , and thus α i = 0, i ≠ j; i, j = 1, 2.

1.4 Cut-off \( \overline{\alpha} \) lower than 1/2

Decentralised wage-setting. It can be shown that when \( \alpha =\overline{\alpha} \) the income of each owner, in the different cases, is:

For \( \overline{\alpha}=0.01 \) it is obtained that \( {\alpha}^{YY}\le \overline{\alpha} \) for b = 0.1631, and \( {\alpha}^{YN}\le \overline{\alpha} \) for b = 0.1632. Therefore, if b < 0.1631 we obtain the same result as in Section 3 (since \( {\alpha}^{YY}<\overline{\alpha} \) and \( {\alpha}^{YN}<\overline{\alpha} \)). If 0.1630 ≤ b < 0.1632, we find that α YY = 0.01, α YN < 0.01, \( {\overline{B}}^{YY}>{B}^{NY} \) and \( {\overline{B}}^{YN}>{B}^{NN} \). Finally, if b ≥ 0.1632 we find that α YY = 0.01, α YN = 0.01, \( {\overline{B}}^{YY}>{\overline{B}}^{NY} \) and \( {\overline{B}}^{YN}>{B}^{NN} \). Therefore, the best response of each firm in all three cases is to share ownership, so in equilibrium that is what the firms do. A similar result is obtained for other values of \( \overline{\alpha} \) (for example, for \( \overline{\alpha} \) =0.1 and \( \overline{\alpha}=0.05 \)).

Centralised wage-setting. It can be shown that when \( a=\overline{\alpha} \) the income of each owner, in the different cases, is:

For \( \overline{\alpha} \) =0.05 it is obtained that \( {\alpha}^{YY}\le \overline{\alpha} \) for b = 0.3122, and \( {\alpha}^{YN}\le \overline{\alpha} \) for b = 0.3162. Therefore, if b < 0.3122 we obtain the same result as in Section 3 (since \( {\alpha}^{YY}<\overline{\alpha} \) and \( {\alpha}^{YN}<\overline{\alpha} \)). If 0.3122 ≤ b < 0.3162 we find that α YY = 0.05, α YN < 0.05, \( {\overline{B}}^{YY}>{B}^{NY} \) and \( {\overline{B}}^{YN}>{B}^{NN} \). Finally, if b ≥ 0.1632 we find that α YY = 0.05, α YN = 0.05, \( {\overline{B}}^{YY}>{\overline{B}}^{NY} \) and \( {\overline{B}}^{YN}>{B}^{NN} \). Therefore, the best response of each firm in all three cases is to share ownership, so in equilibrium that is what the firms do. Therefore, for a low cut-off the asymmetric equilibrium disappears. There is an asymmetric equilibrium as long as b 3 > b 2. Therefore, when b 3 ≤ b 2 the only equilibrium is that in which both firms share ownership. It is shown in Section 4 that B YY = B NY for b = b 2 = 0.7691 (note that it does not depend on \( \overline{\alpha} \)). Moreover, b 3 is such that \( {\overline{B}}^{YY}={B}^{NY} \). It can be shown that b 3 = b 2 = 0.7691 for \( \overline{\alpha} \) = 0.3610. Therefore, if \( \overline{\alpha} \) ≤ 0.3610 we obtain that in equilibrium both firms share ownership for all values of parameter b.

1.5 Welfare analysis under Cournot competition

Decentralised wage setting. In this case we obtain the following:

From the above expressions we obtain the following:

Therefore: W YY > W YN > W NN for all b. Operating in a similar way we obtain the following: CS YN > CS YY > CS NN >, PS NN > PS YN > PS YY, and 2I YY > I YN + I NY > 2I NN.

Centralised wage setting. In this case we obtain the following:

From the above expressions we obtain the following:

Therefore: W YY > W YN > W NN for all b. Operating in a similar way we obtain the following: CS YY > CS YN > CS NN, PS NN > PS YN > PS YY and 2I NN > 2I YY > I YN + I NY for all b.

About this article

Cite this article

Bárcena-Ruiz, J.C. Employee share ownership in a unionised duopoly. Port Econ J 15, 173–195 (2016). https://doi.org/10.1007/s10258-016-0119-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10258-016-0119-4