Abstract

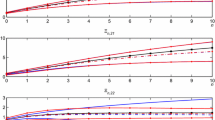

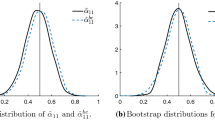

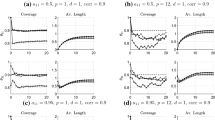

It is emphasized that the shocks in structural vector autoregressions are only identified up to sign and it is pointed out that this feature can result in very misleading confidence intervals for impulse responses if simulation methods such as Bayesian or bootstrap methods are used. The confidence intervals heavily depend on which variable is used for fixing the signs of the responses. In particular, when the shocks are identified via long-run restrictions the problem can be severe. It is pointed out that a suitable choice of variable for fixing the signs of the responses and, hence, of the shocks, can result in substantial reductions in the confidence bands for impulse responses.

Similar content being viewed by others

Notes

The data used in the following are from the archive of the Journal of Applied Econometrics for the article Weber (1995).

The data are available in the JMulTi database, see Lütkepohl and Krätzig (2004), and can be downloaded from http://www.jmulti.com/.

References

Benkwitz A, Lütkepohl H, Wolters J (2001) Comparison of bootstrap confidence intervals for impulse responses of German monetary systems. Macroecon Dyn 5:81–100

Blanchard O, Quah D (1989) The dynamic effects of aggregate demand and supply disturbances. Am Econ Rev 79:655–673

Breitung J, Brüggemann R, Lütkepohl H (2004) Structural vector autoregressive modeling and impulse responses. In: Lütkepohl H, Krätzig M (eds) Applied time series econometrics. Cambridge University Press, Cambridge, pp 159–196

Canova F, DeNicolo G (2002) Monetary disturbances matter for business fluctuations in the G-7. J Monet Econ 49:1131–1159

Christiano LJ, Eichenbaum M, Evans C (1996) The effects of monetary policy shocks: evidence from the flow of funds. Rev Econ Stat 78:16–34

Faust J (1998) The robustness of identified VAR conclusions about money. Carnegie-Rochester Conference Series in Public Policy, vol 49, pp 207–244

Herwartz H, Lütkepohl H (2011) Structural vector autoregressions with markov switching: Combining conventional with statistical identification of shocks. Working Paper series EUI Florence

Kilian L (1998) Small-sample confidence intervals for impulse response functions. Rev Econ Stat 80:218–230

Kilian L (2009) Not all oil price shocks are alike: disentangling demand and supply shocks in the crude oil market. Am Econ Rev 99:1053–1069

King RG, Plosser CI, Stock JH, Watson MW (1991) Stochastic trends and economic fluctuations. Am Econ Rev 81:819–840

Krämer W, Ploberger W, Alt R (1988) Testing for structural change in dynamic models. Econometrica 56:1355–1369

Krämer W, Sonnberger H (1986) The linear regression model under test. Physica-Verlag, Heidelberg

Lanne M, Lütkepohl H (2008) Identifying monetary policy shocks via changes in volatility. J Money Credit Bank 40:1131–1149

Lanne M, Lütkepohl H, Maciejowska K (2010) Structural vector autoregressions with Markov switching. J Econ Dyn Control 34:121–131

Lütkepohl H (1990) Asymptotic distributions of impulse response functions and forecast error variance decompositions of vector autoregressive models. Rev Econ Stat 72:116–125

Lütkepohl H (2005) New introduction to multiple time series analysis. Springer-Verlag, Berlin

Lütkepohl H, Krätzig M (2004) (eds) Applied time series econometrics. Cambridge University Press, Cambridge

Ploberger W, Krämer W (1992) The CUSUM test with OLS residuals. Econometrica 60:271–285

Ploberger W, Krämer W, Kontrus K (1989) A new test for structural stability in the linear regression model. J Econom 40:307–318

Rigobon R (2003) Identification through heteroskedasticity. Rev Econ Stat 85:777–792

Rigobon R, Sack B (2003) Measuring the reaction of monetary policy to the stock market. Q J Econ 118:639–669

Sims CA (1980) Macroeconomics and reality. Econometrica 48:1–48

Sims CA, Waggoner DF, Zha T (2008) Methods for inference in large multiple-equation Markov-switching models. J Econom 146:255–274

Taylor MP (2004) Estimating structural macroeconomic shocks through long-run recursive restrictions on vector autoregressive models: the problem of identification. Int J Finance Econ 9:229–244

Uhlig H (2005) What are the effects of monetary policy on output? Results from an agnostic identification procedure. J Monet Econ 52:381–419

Weber CE (1995) Cyclical output, cyclical unemployment, and Okuns coefficient: a new approach. J Appl Econom 10:433–445

Acknowledgments

I thank Aleksei Netšunajev, Jörg Breitung, Lutz Kilian, and an anonymous referee for helpful comments on an earlier version of this paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Lütkepohl, H. Reducing confidence bands for simulated impulse responses. Stat Papers 54, 1131–1145 (2013). https://doi.org/10.1007/s00362-013-0510-5

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00362-013-0510-5