Abstract

This paper considers pollution tax rate functions that decrease progressively with distance in order to examine in depth the effectiveness of pollution tax incentives. We find that pollution tax incentive policies, regardless of the level of incentives or the size of increases in incentives, can impel the firm to purchase anti-pollution equipment. However, increases in the size of incentives cause the firm to relocate back to city centers. The size of incentive increase thus has an uncertain impact on location choice, suggesting that increases may also produce the opposite of the intended effect by “pulling” plants back to city centers. This confirmed the argument of Oates and Baumol (Economic analysis of environmental problems, Columbia University Press, New York, 1975, p. 104) that taxes on polluting activities may fail to do their job with full effectiveness. In addition, we have also found that increased uncertainty over pollution tax policies tends to increase purchases of anti-pollution equipment for a risk-averse firm. This impact is unrelated to the investment flexibility of anti-pollution equipment. These results are different from those of Carlsson regarding risk-neutral firms. In addition, the findings of this study that increases in pollution taxes tend to cause a firm to purchase additional anti-pollution equipment and leave city centers differ from those of Hwang and Mai in the latter result.

Similar content being viewed by others

Notes

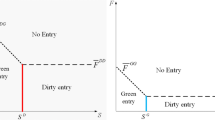

Though the regulator does not adopt an environmental policy of direct control, such as programs of zoning on polluting activities, he sets an unit pollution tax function to force the polluter to relocate and leave city centers via programs of taxation. This specification will be appropriately viewed as a mixed policy of tax incentives and direct controls, as mentioned by Oates and Baumol(1975, p. 105).

If the unit pollution tax function slope \(-1\) is set as the firm’s location limit \(\bar{{u}}\) where incentives begin to quickly increase, then \(z^{\prime }(\bar{{u}})=-z_1 -z_2 \bar{{u}}=-1\) can be used to solve \(\bar{{u}}={(1-z_1 )}/{2z_2 }\).The maximum taxation distance \(\hat{{u}}\) can be found using \(z(\hat{{u}})=0\).

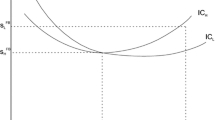

A steeper slope of marginal production cost implies a lower flexibility of anti-pollution equipment investment. The concept is firstly provided by Stigler (1939).

In view of a greater scale of production leads to a higher relocation cost, we can follow Forslid and Okubo(2010, p. 6) to set a per unit of production fixed relocation cost function. That is, we decompose \(aQ\) in the profit function into two parts: \(aQ=a_1 Q-a_2 Q\), where \(a_1 Q\) is a part of revenue and \(-a_2 Q\) is the relocation cost. This specification will not change the theoretical results in our framework of spatial monopoly.

Since \(\pi =E(\pi )\) at \(\varepsilon =E(\varepsilon )\), by following Pratt(1964, p. 125), we expand \(U^{\prime }(\pi )\varepsilon \) and \(U^{\prime }(\pi )\) around \(\varepsilon =E(\varepsilon )\) in a small risk to obtain \({E[U^{\prime }(\pi )\varepsilon ]}/{E[U^{\prime }(\pi )]}={U^{\prime }[E(\pi )]E(\varepsilon )}/{U^{\prime }[E(\pi )]}=E(\varepsilon )=0\) approximately.

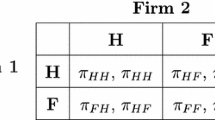

This assumption is similar to the concept of the open loop analysis in dynamic game setting in that the firm takes output of the second stage as given without taking into account the effect of anti-pollution equipment on output.

References

Bartik TJ (1988) The effects of environmental regulation on business location in the United States. Growth Change 19:22–44

Baumol WJ, Oates WE (1971) The use of standards and prices for protection of the environment. Swed J Econ 73:42–54

Becker R, Henderson JV (2002) Effects of air quality regulation on polluting industries. J Polit Econ 108:379–421

Carlsson F (1999) Effects of uncertainty over environmental taxes on emission-reducing capital in an oligopoly. In: Sterner T (ed) The market and the environment, pp 123–133

Duffy-Deno K (1992) Pollution abatement expenditures and regional manufacturing activity. J Reg Sci 32:419–436

Forslid R, Okubo T (2010) On the development strategy of countries of intermediate size—an analysis of heterogenous firms in a multiregion framework. CEPR discussion papers

Forsund FR (1972) Allocation in space and environment pollution. Swed J Econ 74:19–34

Friedman J, Gerlowski DA, Silberman J (1992) What attracts foreign multinational cooperations? Evidence from branch plant location in the United States. J Reg Sci 32:403–418

Gray WB (1997) Manufacturing plant location: does state pollution regulation matter? Working paper, US census, Economic studies

Gokturk SS (1979) A theory of pollution control, location choice, and abatement decisions. J Reg Sci 19:461–467

Hazilla M, Kopp RJ (1990) The social cost of environmental quality regulations: a general equilibrium analysis. J Polit Econ 98:853–873

Henderson JV (1996) Effects of air quality regulation. Am Econ Rev 86:789–813

Henderson JV (1997) The impact of air quality regulation on industrial location. Annales D’Economie Et De Statistique 45:123–137

Hoel M (1997) Environmental policy with endogenous plant locations. Scand J Econ 99(2):241–259

Hwang H, Mai CC (2004) The effects of pollution taxes on urban areas with an endogenous plant location. Environ Resour Econ 29:57–65

Jeppesen T, List JA, Folmer H (2002) Environment regulations and new plant location decisions: evidence from a meta-analysis. J Reg Sci 42:19–49

Kahn ME (1997) Particulate pollution trends in the United States. Reg Sci Urban Econ 27:87–107

Keller W, Levinson A (1999) Environmental regulations and FDI inflows to U.S. states: the potential for a ‘Race to the Bottom’ of environmental stringency. Paper prepared for the ISIT99 conference, June 4–5 1999

Levinson A (1996) Environmental regulations and manufacturer’s location choices: evidence from the census of manufactures. J Public Econ 62:5–29

List JA, McHone W, Lee J, Soskin M (1999) Effects of air quality regulation on manufacturing births: evidence from a panel of counties in New York State. working paper AREC, University of Maryland

Mai CC (2005) The effects of environmental regulation on the firm’s optimal location under Uncertainties. Manuscript

Mathur VK (1976) Spatial economic theory of pollution control. J Environ Econ Manag 3:16–28

McConnell VD, Schwab RM (1990) The impact of environmental regulation on industry location decisions: the motor vehicle industry. Land Econ 66:67–81

Oates WE, Baumol WJ (1975) The instruments for environmental policy. In: Mills E (ed) Economic analysis of environmental problems. Columbia University Press, New York, pp 95–128

Oates WE, Schwab RM (1988) Economic competition among jurisdictions: efficiency enhancing or distortion induction? J Publ Econ 35:333–354

Pratt JW (1964) Risk aversion in the small and in the large. Econometrica 32:122–136

Stigler G (1939) Production and distribution in the short run. J Polit Econ 47:305–328

Tybout RA (1972) Pricing pollution and other negative externalities. Bell J Econ Manag Sci 3:252–266

White MJ, Wittman D (1982) Pollution taxes and optimal spatial location. Economica 49:297–311

Xing Y, Kolstad CD (2002) Do lax environmental regulation attract foreign investment? Environ Resour Econ 21(1):1–22

Acknowledgments

We are very grateful to anonymous referees for their valuable comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Yang, BS., Mai, CC. The impact of uncertain environmental regulatory policy on optimal plant location and anti-pollution technology selection. Ann Reg Sci 50, 753–769 (2013). https://doi.org/10.1007/s00168-012-0520-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00168-012-0520-6