Abstract

An intense process of deregulation and financial liberalization in Latin America has increased competitive pressures and led to bank restructuring and consolidation. This chapter looks at firm access to credit in the region, focusing on the role of credit market structure. Using firm-level data from the World Bank Enterprise Survey, we find that access to bank credit is very heterogeneous. On average, smaller and less productive firms are less likely to apply for credit and more likely to be financially constrained. We also find that a high degree of bank penetration and competition are significantly correlated with a lower probability that borrowers are financially constrained. The penetration of foreign banks has a negative effect on access to credit, particularly in less developed and more concentrated markets, while it has a positive influence in more competitive and financially developed markets.

The views expressed herein are those of the authors and should not be attributed to the IMF, its Executive Board, or its management. We thank Gustavo Crespi, Matteo Grazzi, Siobhan Pangerl, Carlo Pietrobelli, Joan Prats, Eddy Szirmai, and the participants at the IDB workshop “Determinants of Firm Performance in LAC: What Does the Micro Evidence Tell Us?” for useful comments on an earlier draft.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

Access to bank credit is often indicated as one of the main constraints impairing firm growth, productivity, innovation, and export capacity, particularly as it affects small- and medium-sized enterprises (SMEs). As most of the literature on small business lending is focused on the United States and Europe (Berger and Udell 2002; Berger et al. 2005; Beck and Demirgüç-Kunt 2006), results are not easily applicable to emerging and developing countries because of significant differences in firm size distributions and characteristics as well as in institutional, macroeconomic, and financial structures.

The extent to which firms may be financially constrained varies across countries according to both micro and macro-factors. Based on the World Bank Enterprise Surveys (WBES), which provide cross-country comparable firm-level data, several studies investigate the existence of common micro-determinants in financing constraints (for example, see Beck et al. [2006], and for a recent comprehensive survey, Ayyagari et al. 2012). The data has also been used to study how different institutional frameworks and credit market structures affect access to credit (Beck et al. 2004, 2011; Clarke et al. 2006).

Among the few studies of Latin America, Galindo and Schiantarelli (2003) undertook a number of country case studies to assess how the characteristics of firms and credit markets shape access to external finance. In another study, Stallings (2006) reported that access to finance is a key problem for SMEs in Latin America, with significant variations across countries. The Organisation for Economic Co-operation and Development (OECD) recently described a similar picture and argued that, notwithstanding improvements in the depth of the financial systems in the region, a significant proportion of Latin American SMEs still had limited access to finance (OECD 2013).

Some recent literature has shown that the lack of adequate access to finance is an important constraint to productivity growth at the firm level (De Mel et al. 2008; Banerjee and Duflo 2014), profoundly undermining aggregate output growth. The focus of this book is on the sources of and constraints on productivity growth at the firm level. The book shows how economic growth largely depends on the dynamics of productivity. It is therefore important to investigate the extent and the determinants of financing constraints in Latin America and the Caribbean (LAC). We want to clarify from the beginning that the link between access to finance and productivity is complex because it can go in two directions. Further, the link can be indirect given that, for instance, the lack of credit could hamper innovation and foreign competitiveness, which impact productivity. In fact, the evidence collected in this book suggests that there are several other factors that deeply affect productivity and are related to access to credit. For example, innovation (see Chap. 2) and the limited openness to exports, foreign investments, and global value chains (see Chap. 9) affect productivity.

In this chapter, we aim to uncover the possible heterogeneities in financing constraints across both firms and countries, and to explain them according to differences in the micro-characteristics, as well as the institutional, macroeconomic, and financial settings at the country level. The empirical analysis uses the comprehensive data from the WBES for 31 countries in LAC, providing information about the sources of finance and access to credit for firms with five or more employees. 1 This data is matched with macroeconomic data on credit market structure and the institutional setting.

We address the following research questions:

-

1.

Regarding the extent of financing constraints on firms: What is the share of firms that lack access to bank financing? How do firms finance themselves in the short and long term? How diffuse are different forms of credit?

-

2.

Regarding the characteristics of financially constrained firms: Which firms are more likely to be financially constrained? To address this issue, we focus on the differences across several characteristics at the firm level—productivity, size, age, ownership structure, gender of the owner, location, and financial structure.

-

3.

Regarding the role of external factors: Do differences in macroeconomic, financial, and institutional variables (income levels, presence of credit registries, financial development, presence of foreign banks, market competition) across countries help explain the variability in access to finance?

In the next section, we review the literature on credit market structure and financing constraints on firms. Then we describe the main characteristics of the banking systems in the region and provide an overview of the financing structure. Then we look at firms’ access to bank financing in LAC. We examine firm-specific characteristics and country-specific credit market features associated with financing constraints. Finally, we provide some conclusions.

The Literature

Credit Market Structure and Financing Constraints on Firms

Credit markets are characterized by asymmetric information between borrowers and lenders, imperfect screening and monitoring technologies, and a paucity of collateral that can be pledged; therefore, financial constraints emerge as an equilibrium phenomenon (Jaffee and Russell 1976; Stiglitz and Weiss 1981). This phenomenon implies that firms that are more informationally opaque are more likely to be financially constrained, given that they cannot communicate their creditworthiness to lenders. This problem is particularly binding for small and young firms that cannot overcome the information asymmetry by pledging collateral, and for firms in countries where there are no credit registries, which is the case in many LAC countries (see “Credit Markets in LAC” below).

On the lender side, banks use imperfect screening technologies and rely as much as possible on transactional lending schemes, addressing the informational opacity of potential borrowers using hard, codified information. Lending technologies may overcome informational asymmetries by using soft (non-codified, difficult to summarize numerically) information, but this requires building a long-term lending relationship.

Therefore, the pervasiveness of financing constraints depends not only on firm characteristics, but also on the structure of the local credit markets in which they operate. The degree of market concentration, the proximity between lenders and borrowers, and the types of banks operating locally affect firms’ access to credit. In fact, different banks may apply different lending technologies and may adopt different organizational structures (Berger et al. 2005; Beck et al. 2011). Moreover, the bank–borrower distance and the degree of market competition also affect the collection and transmission of soft information and lenders’ market power (Petersen and Rajan 1995; Degryse and Ongena 2005; Cetorelli and Strahan 2006).

Among these factors, the growing importance of foreign-owned banks in a number of emerging and developing countries has sparked a broad discussion about their effect on market competition and credit availability (Claessens and Van Horen 2014). On the one hand, the size of the bank and the distance that separates its decision-making center from local firms could reduce the capacity and willingness of foreign banks to engage in SME lending and induce them to choose borrowers selectively, especially in developing countries (Mian 2006; Detragiache et al. 2008). On the other hand, some people argue that foreign multiservice banks are more efficient, especially in developing and emerging markets. They believe that foreign banks have a comparative advantage in offering a wide range of products and services by using new technologies, business models, and risk management systems. On this basis, their presence could be associated with reducing financing constraints on firms (de la Torre et al. 2010). In addition, foreign bank penetration could increase credit availability because it increases market competition and exerts competitive pressures on domestic banks. Domestic banks could be forced to reorient their lending activity to informationally opaque borrowers, with whom they have a relative advantage compared to foreign competitors (Dell’Ariccia and Marquez 2004). 2

Finally, the literature stresses the role that the institutional setting and the legal infrastructure can play in easing access to finance. The efficiency of the legal system, the enforcement of contracts, and mechanisms that enable information sharing among lenders can attenuate adverse selection and moral hazard, improving credit availability (Beck et al. 2006; Pagano and Jappelli 1993; Padilla and Pagano 1997).

Empirical Evidence

In this section we selectively review the extensive literature on the micro-determinants of financing constraints and credit market structures. We pay special attention to the empirical studies with a global perspective, using firm-level data—especially the WBES—specifically focusing on LAC.

Firm-Level Characteristics

The literature has consistently shown that older, larger, more productive, and foreign-owned firms are less likely to encounter financing obstacles. Beck et al. (2006) and Cole and Dietrich (2014) used the WBES database to show that there was a robust correlation around the world (including the LAC region) between firm size and access to finance and that SMEs were more likely to face credit constraints. Kuntchev et al. (2013) also found that internationalized and more productive firms were less likely to suffer from difficulties in accessing credit, with the latter association being stronger for larger firms. Specifically using WBES data for Argentina, Brazil, Chile, and Mexico, Makler et al. (2013) supported the standard hypothesis that smaller and younger firms are disadvantaged when it comes to securing bank credit compared to larger and older enterprises.

Based on surveys conducted in Argentina, Colombia, Costa Rica, Ecuador, Mexico, and Uruguay investigating the determinants of financing constraints on firms, Galindo and Schiantarelli (2003) found empirical evidence supporting theoretical predictions about the importance of asymmetric information. 3 The severity of financing constraints did not only depend on observable firm balance sheet characteristics (i.e. hard [quantifiable] information), but also on the strength of the bank–firm relationship, on the firm’s credit history, and on the firm’s characteristics, which, on average, were correlated with creditworthiness. Furthermore, they confirmed that financing constraints were less binding for larger firms and for those that were foreign-owned or belonged to a business group.

Credit Market Structure

An important strand of the literature on bank credit investigates how financial development, market competition, and foreign bank presence affect firm access to finance. In a seminal contribution, Beck et al. (2004) combined firm-level data from 74 countries to show that market concentration was positively associated with financing obstacles, especially in developing countries. However, this negative effect of market concentration was mitigated in countries with a large presence of foreign banks and where credit registries facilitated information sharing, while it was magnified in countries with high government interference and a dominant presence of state-owned banks.

Clarke et al. (2006) did not confirm the widespread concerns that foreign banks reduce credit availability for SMEs. The authors found that, in countries with a strong presence of foreign-owned banks, access to bank credit was perceived as less constraining on enterprises, including SMEs. In a similar vein, focusing on Argentina, Chile, Colombia, and Peru and using bank-level data, Clarke et al. (2005) showed that the effect of foreign presence on small business lending was heterogeneous but, on average, small firms were more likely to take advantage of the presence of foreign banks when these institutions had a significant local presence.

Claessens and Van Horen (2014) collected the most comprehensive dataset on foreign bank presence and documented the sharp expansion of foreign banks since the mid-1990s, especially in emerging and developing countries. Their country-level data showed that foreign bank presence was negatively related to private credit in developing countries, especially in countries where foreign banks had a low market share, high costs of contract enforcement, and low credit information.

Finally, there is a large strand of evidence supporting the importance of credit registries for business lending. Djankov et al. (2007) found that private and public registries were associated with more private credit, especially in poor countries. Similarly, Jappelli and Pagano (2002) used aggregate data to show that bank lending was higher in countries where lenders shared information, regardless of the private or public nature of the information sharing mechanism.

Credit Markets in LAC

Since the mid-1990s, there has been a structural change in credit markets around the world. Financial liberalization has contributed to a general contraction of the role played by state-owned banks and to increasing penetration of foreign banks in domestic credit markets. LAC is no exception. After the financial crises in the 1990s, banking systems in LAC underwent significant changes. Deregulation and the opening of the financial markets to foreign competition helped increase competitive pressures and led to an intense process of bank restructuring, privatization, and consolidation (Cardim De Carvalho et al. 2012).

A recent study by the World Bank (2012) benchmarked financial development in the LAC-7 countries 4 against countries at comparable levels of economic development and advanced countries. The authors found that, since the early 2000s, there was a general deepening of the domestic financial systems in the region. However, there were still significant gaps and, in general, there had not been a convergence toward the indexes of financial maturity observed in more developed countries. More developed credit markets emerged in certain countries within the region, especially the offshore centers in the Caribbean (World Bank 2012; Čihák et al. 2012; Cardim De Carvalho et al. 2012; Didier and Schmukler 2014).

A useful view of financial development across LAC is provided by the ratio between bank credit and GDP, a measure of financial depth calculated on the basis of the Global Financial Development Database. On average, this ratio is 40 %, ranging from very low values in Argentina, Mexico, Peru, and Uruguay—similar to what we find in much poorer countries such as Tanzania, Ghana, and Mozambique 5 —to high ratios in Chile (64 %) and some of the Caribbean countries, especially in the offshore centers (e.g. The Bahamas, Barbados, and Panama), which are the clear outliers.

Other indicators can be used to investigate the structure of domestic credit markets: the number of bank branches per 100,000 adults, which is a standard measure of the development of and access to credit markets; the degree of competition, as measured by the share of the banking assets of the three largest national banks over total banking assets; and the presence of foreign banks, measured as the share of the total number of banks operating in the country. All these three indicators are from the Global Financial Development Database.

The number of bank branches can be considered a prerequisite for financial inclusion, facilitating access to financial services for individuals and firms. According to the World Bank (2012), the median number of branches (13) and ATMs (37) per 100,000 adults in the LAC-7 is lower than in Eastern European countries (22 branches and 54 ATMs) and in the G7 economies (24 and 118), but it is similar to the Asian economies (11 and 34). Based on the Global Financial Development Database and considering Latin America as a whole, the median number is 20 branches per 100,000 adults, with very large differences among countries. Of the LAC-7, only Brazil and Peru have a number of branches above the median in the region; some small Caribbean island countries are also above the median.

In contrast to what has happened in other regions since the 2000s, credit markets in the LAC-7 countries have become more concentrated (Didier and Schmukler 2014). The share of bank assets held by the three largest banks represents credit concentration. Of the LAC-7, the most concentrated banking sector is in Peru and the least is in Argentina (based on the Global Financial Development Database). In the rest of the region, concentration is relatively high, especially in many small Caribbean countries, such as Suriname, Guyana, Barbados, Antigua, Belize, Trinidad and Tobago, and Jamaica.

LAC’s financial systems show a very high penetration of foreign banks. The ratio of foreign banks to total banks has increased sharply since 1995 (28 %), reaching 42 % in 2009, similar to Eastern Europe (47 %) and much higher than East Asia (24 %) and the OECD countries (24 %). Considering the share of assets held by foreign banks, the differences between LAC (29 %), East Asia (4 %), and OECD countries (11 %) are even larger (Claessens and Van Horen 2014). Of the LAC-7, Mexico and Peru have a large presence of foreign banks, and Brazil and Colombia have a smaller presence.

Finally, the region is also characterized by a certain degree of heterogeneity in the presence of credit registries, which had been established in about half of the countries by 2010. 6

Firm Financing in LAC

In this section we present some facts about the financing structure in LAC and access to bank financing by firms, exploring a set of well-defined firm characteristics:

-

Size: Micro (10 or less employees), small (11 to 50), medium (51 to 250), and large (more than 250).

-

Productivity: The logarithm of labor productivity; low and high productivity defined as below and above the median.

-

Age: New (three years or less since inception), young (four to ten years) and mature (older than ten years).

-

Degree of internationalization:

-

Foreign-owned enterprises: 10 % or more of the firm is owned by foreign private individuals or companies.

-

Exporters: Direct exports account for 10 % or more of annual sales.

-

-

Female owned: At least one woman among the firm’s owners.

-

Sector: Services or manufacturing. 7

Financing Structure

The WBES provide information about the sources of finance for working capital expenditures in a subsample of 13,676 firms. Table 8.1 presents the differences across some firm characteristics and across countries. 8 The table clearly shows that firms primarily finance their working capital through internal sources (58 %), followed by trade credit (21 %), with bank credit (17 %) being the third source.

Table 8.1 also shows the significant degree of variability in the use of bank credit across the different firm characteristics. Its use is limited for micro 9 and new firms, while it is the second source of financing (after internal funds) for large firms. The difficulty that small firms have accessing bank credit is statistically significant, confirming the findings of the OECD (2013), which found that less than 15 % of lending in the region goes to smaller firms even though they provide almost 80 % of jobs.

More productive firms rely less on internal funding to finance working capital and tend to use more bank and trade credit. Exporters are significantly more likely to use bank credit than non-exporting firms (possibly because they tend to be larger), while foreign-owned firms rely significantly less on bank credit than do domestic firms. Foreign firms mainly finance their working capital internally, possibly because of availability of resources in multinationals. There are no significant differences in financing between male-owned businesses and those with a female owner. Across sectors, manufacturing firms on average are more dependent on internal financing and less on trade credit than services enterprises, but there is no significant difference in accessing bank credit.

Access to Banking Products

In LAC, 90 % of the firms in the sample have a bank account, similar to Europe and Central Asia but somewhat higher than in Asia and Africa. However, there is a certain degree of variability in the use of banking products (Table 8.2). For instance, almost 18 % of micro-enterprises have neither savings nor a checking account. From a country perspective, while almost all firms sampled in Argentina, Brazil, Chile, and Colombia have a banking account, only 61 % of Mexican firms have one.

Access to bank credit (overdraft, line of credit, or loan) is less widespread and more heterogeneous. On average, less than two-thirds of all firms surveyed have an overdraft facility, with this instrument being less frequent among micro (46 %), new (52 %), and non-exporter (62 %) firms. In addition, only 54 % of LAC firms have a line of credit or a loan, and the diffusion of these instruments is again significantly different across firm size, age, and export status. Access to bank credit is also highly heterogeneous across countries: in Mexico only 24 % of firms have an overdraft and only 30 % have a line of credit or a loan. These shares are much higher in Brazil, Colombia, and Chile, while Argentinian firms are somewhat in the middle. In the Caribbean, there is almost universal access to a bank account, even if loans and overdraft facilities are far less diffused (see, for instance, Barbados and Jamaica in Table 8.2).

Financing Constraints

The surveys collect information about loan applications and their outcomes for the previous fiscal year. In contrast to most of the literature on access to finance as an obstacle to business activities (Beck et al. 2006), we exploit the richness of information about loan applications to measure demand for credit and the extent of credit availability across firms and countries (Cole and Dietrich 2014). In particular, we define the following binary indicators:

-

Loan Demand: Dummy identifying firms that applied for a bank loan or a line of credit.

-

Loan Denial: Dummy identifying firms that applied for a bank loan or a line of credit but whose request was denied.

-

Constrained: Dummy identifying the borrowers whose loan applications were denied and those who decided not to apply because interest rates and collateral requirements were too high, the size of the loan and the maturity insufficient, or in general, they believed that the loan would not be approved (Hansen and Rand 2014; Presbitero et al. 2014).

-

Discouraged: Dummy identifying the firms that did not apply for credit because the procedures were too complex, interest rates and collateral requirements were too high, the size of the loan and the maturity were insufficient, or in general, they believed that the loan would not be approved (Kon and Storey 2003).

For Latin American firms, Table 8.3 confirms the common patterns observed in the literature: demand for bank credit is more likely to come from larger, older firms that export. This pattern is reflected in a higher share of discouraged borrowers in smaller, younger, domestic companies, which are also more likely to be financially constrained. 10 By contrast, the gender of the owner and the sector are not clearly different. In particular, firms with at least one female owner are more likely to request credit and to perceive access to finance as an obstacle than other firms, but the shares of denied, discouraged, and constrained firms are not statistically different.

We also observe that labor productivity is statistically associated with better access to credit. Demand for credit is more likely to come from highly productive firms, which are also less likely to be constrained, regardless of the definition adopted (i.e. discouraged borrowers or firms with a denied loan application, see Fig. 8.1), than low-productivity firms. While we do not identify any causal impact between higher productivity and better access to finance, the finding suggests that lower productivity and financing constraints are linked, since low-productivity firms are also more likely to be financially constrained and therefore cannot invest to improve their performance. There is wide empirical evidence confirming that SMEs’ lack of finance negatively affects productivity (De Mel et al. 2008; Banerjee and Duflo 2014).

Financing constraints and labor productivity

Source: Authors’ elaboration based on WBES data

Notes: For each category of firms, we report the logarithm of labor productivity (minus 10 to improve the readability of the figure). The differences between firms with and without access to finance are statistically significant at the 95 % level of confidence. YES means that the firm requested a bank loan (loan demand) or suffers from financial constraints (discouraged, constrained, loan denial)

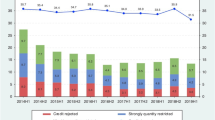

Access to finance is also extremely heterogeneous across LAC countries, as shown in Fig. 8.2. A first difference is LAC-7 countries being significantly less financially constrained than the rest of the sample. Second, large differences are also present within the LAC-7. In Argentina, access to finance is a relevant problem, with 25 % of firms financially constrained compared to the LAC-7 average of 15 %. In Mexico, the share of constrained firms is 23 %, while in Chile, Colombia, and Peru, the share of firms whose loan applications were denied and the share of financially constrained firms are among the lowest in the region. Among the remaining countries, the Caribbean is, on average, the region where access to finance is a most pressing problem.

To investigate the correlation between credit market structure and firm financing constraints at the country level, we plot the country-average residuals of a simple linear regression in which the variable “constrained” is a function of a standard set of firm-specific characteristics divided by a specific measure of credit market structure (see “Credit Markets in LAC” above). By doing this, we purge all individual-specific effects that may impact access to credit (e.g. some countries may have a large share of micro-firms, resulting in an aggregate share of financially constrained firms), and we can better assess the association between credit market structure and access to finance. Figure 8.3 shows that countries with more bank branches per capita (Fig. 8.3a) and with less concentrated credit markets (Fig. 8.3b) have a smaller share of financially constrained firms. In contrast, the presence of foreign banks appears to be positively correlated with financing constraints (Fig. 8.3c). Figure 8.3d shows that financially constrained firms are not significantly correlated with the strength of the rule of law. 11

Financially constrained firms and credit market structure, by country

Source: Authors’ elaboration based on WBES data, Global Financial Development Database, and Worldwide Governance Indicators (Kaufman et al. 2010)

Notes: The vertical axis presents the OLS residuals from a firm-level regression in which the variable “constrained” is a linear function of a set of firm-level characteristics

Considering the average values of the four access-to-credit variables to the presence of a public credit registry in the country, we observe that the existence of credit registries is associated with higher demand for credit and with lower financing constraints, which is consistent with the theoretical predictions that an institutional setting that facilitates information sharing can make a difference in terms of credit access.

Determinants of Firm Financing Constraints

Empirical Models

In this section, we investigate the association between firm-specific characteristics and country-specific credit market features with firm financing constraints, estimating the following model:

where outcome is one of the two binary indicators identifying whether the i-th firm located in country j in year t is, alternatively, financially constrained or discouraged. Firm is a vector of firm-specific characteristics, including labor productivity (measured by the logarithm of labor productivity), 12 size (measured by a categorical variable based on the number of employees and by a dummy for plants belonging to a large firm), age, location, legal status, the tenure of the top manager, and a set of dummies for foreign ownership, exporting capacity (more than 10 % of production), gender of the firm (at least one woman among the owners), and the possession of a quality certification. Country is a set of country-level (time varying) variables that measure the extent that differences in the credit market structure, legal infrastructure, and economic development affect access to credit. The focus of the analysis is on the credit market structure, which is measured by (i) the number of branches per capita (bank penetration), (ii) the share of the three largest banks’ assets over total commercial bank assets (credit market concentration), and (iii) the share of foreign bank assets over total bank assets (foreign bank presence). To minimize the possibility that the credit market structure variables pick up other macroeconomic and institutional effects, we include a measure of rule of law, a dummy for the presence of a credit registry, the log of GDP per capita, the GDP growth rate, and the share of the agricultural value added in total GDP. 13 When we consider firms whose loan applications have been denied, the outcome variable is censored, because we only look at the bank decision to grant credit for the subsample of firms that applied for a bank loan or a line of credit. Hence, we estimate the following binary selection model as per Heckman (1979):

where loan demand is the dummy variable identifying the i-th firm in country j that has applied for bank credit in year t, and loan denial is the binary indicator for the same firm, whose application has been denied by the bank. The set of explanatory variables used in the two-equation model is the same as the one discussed for equation 8.1. The sole exception is the variable sales growth, which measures the annual change in sales; we include it as an excluding restriction because it is expected to influence demand for credit, being a proxy for the firm’s level of economic activity.

We estimate equations 8.1 and 8.2 using a sample of data collected between 2006 and 2010 in 30 LAC countries (see Table 8.9 in the Appendix). We include a large set of dummies to control as much as possible for the unobserved firm-level heterogeneity that may affect credit market outcomes. In particular, we include dummies to control for the possibility of year- and industry-specific shocks. Given that, in the first set of regressions, we do not include any country-specific variables, we add country fixed effects and interact them by year and by a dummy for sector (manufacturing or services) to allow for sector-specific fixed effects varying by country and over time. 14 Finally, to deal with possible serial correlation across firms interviewed in each survey, we cluster the standard errors at the country-year level.

The Relative Role of Firm-Level and Country-Level Characteristics

Tables 8.4 and 8.5 present the estimates for equations 8.1 and 8.2, including firm-specific control variables and checking for unobserved heterogeneity with country, year, and industry dummies. To check whether significant differences emerge, for each model we present the results for the whole sample, for the LAC-7, and for the remaining countries.

Considering firm-level characteristics, our results confirm the existing evidence (Brown et al. 2011; Cole and Dietrich 2014) that shows smaller and less productive firms are less likely to apply for credit and more likely to be financially constrained. Foreign-owned firms and exporters are also less likely to apply for bank credit than domestically oriented ones, while there is no robust evidence that they are more likely to be financially constrained. 15 Firms with a quality certification are less likely to be discouraged from applying for a bank loan.

Moreover, we assess the relative importance of firm- and country-specific factors in explaining the variability of firm financing constraints, estimating a linear probability model and comparing the R-squared when (i) using only firm-specific factors (used in the regressions reported in Tables 8.4 and 8.5), and (ii) including country fixed effects. In line with the previous evidence using the WBES (Beck et al. 2004, 2006), our results (Table 8.6) show that the firm-level variables explain only a small fraction of the variance of the dependent variables, irrespective of the measure of financing constraints adopted. The inclusion of country fixed effects does not dramatically improve the fit of the model in absolute terms. However, the increase in the explanatory power of the model is quite relevant in relative terms, as the R squared increases by 55 to 80 %, depending on the measure of financing constraints.

This exercise points to two important considerations for interpreting our findings. First, a lot of the variability in financing constraints is due to unobservable heterogeneity at the firm level. Second, country-specific factors can potentially explain about 40 % of the “explained part” of the variability in financing constraints. Even if the role of unknown and unmeasured firm-specific factors is dominant, there is still a significant wrole for policy at the country level to ease financing constraints on firms. Therefore, in what follows, we try to assess whether some specific structural characteristics of the credit markets are more likely to be associated with better access to bank credit.

Role of Credit Market Structure

Adding country-specific controls to our estimations of equations 8.1 and 8.2 indicates that the macroeconomic and institutional settings are significant predictors of access to credit. Financing constraints seem to be worse in richer countries but less prohibitive in countries experiencing faster GDP growth. Moreover, contract enforcements, property rights, and the quality of the legal system, as measured by the rule of law indicator, are associated with stronger demand for bank credit and a lower share of financially constrained and discouraged borrowers (Beck et al. 2006). The presence of credit registries is associated with less access to bank credit, which is apparently counter-intuitive with the descriptive evidence. Of note, the positive association between credit registries and better access to finance becomes negative once firm characteristics are taken into account, confirming the relevance of the heterogeneity of firms in different countries

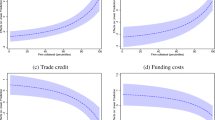

The results for the credit variables lend support to the descriptive evidence (see Figs. 8.4) and to the hypothesis that the credit market structure is not neutral with respect to financing constraints on firms (Table 8.7).

The heterogeneous effect of foreign banks on financing constraints

Source: Authors’ elaboration based on WBES data, Global Financial Development Database and Credit Reporting Database (Bruhn et al. 2013)

Notes: Panel (a) plots the estimated probability that a firm is financially constrained for different shares of foreign bank assets in total bank assets, disaggregating between countries with and without a credit registry. Panels (b) and (c) plot the effects of the share of foreign bank assets in total bank assets on the probability that a firm is financially constrained, for different values of the number of bank branches per 100,000 adults (panel b), and the share of top three banks in total commercial bank assets (panel c). The vertical lines represent the 95 % confidence intervals. The diagrams are based on the estimates reported in Table 8.8, respectively columns 1, 2, and 3

Bank penetration, measured by the number of branches per capita, is significantly correlated with a lower probability that borrowers are financially constrained (Column 1) and discouraged (Column 2). This finding is consistent with the hypothesis that physical proximity in credit markets helps mitigate informational asymmetries between lenders and borrowers. Controlling for the degree of competition, a larger number of branches per capita reduces the average distance between firms and banks and a smaller distance reduces informational asymmetries and facilitates the screening and monitoring activities of banks.

Market concentration shows a negative correlation with the measures of financing constraints, even if the coefficient is significant only when explaining the probability that a firm is discouraged from demanding credit. In other words, more concentrated markets seem to favor access to finance, in line with the hypothesis that a certain degree of market power is necessary for banks to invest in a lending relationship, especially with informational opaque firms (Petersen and Rajan 1995). Finally, the positive coefficients for foreign banks suggest that their larger presence is associated with a higher probability that domestic borrowers are financially constrained (Gormley 2010), but it is not statistically significant. Given the relevance of foreign banks in a number of countries in Latin America and the Caribbean, the next section focuses on their role in assessing whether the non-significant average effect could mask a non-linearity.

Role of Foreign Banks

To shed light on how the presence of foreign banks affects access to credit, we inspect the possibility that their effect could differ across markets depending on the degree of domestic competition and on some institutional features. Thus, we interact the share of foreign banks with (i) a dummy that signals the existence of a public credit registry, (ii) the number of bank branches per capita, and (iii) a measure of market concentration.

The results reported in Table 8.8 show that the correlation between foreign banks and financing constraints depends on the development and institutional setting of national credit markets. The association between foreign banks and the share of financially constrained and denied borrowers turns from positive to negative moving from countries without a public credit registry to those with one (columns 1 and 4). Moreover, in countries where there are public credit registries, a larger share of foreign banks is associated with a higher likelihood that firms demand bank credit and a lower probability that their loan applications are denied (columns 7 and 8).

We also find that the correlation between foreign bank presence and financing constraints turns from positive to negative as the number of branches per capita in the country increases and the degree of market concentration decreases. While Brown et al. (2011) found that foreign banks were associated with a larger share of discouraged borrowers, we find that this correlation holds exclusively in countries lacking credit registries and in concentrated credit markets. Hence, foreign banks seem to have a detrimental effect on access to credit in less developed and more concentrated markets, but they are indeed beneficial in more competitive and financially developed ones.

To assess the economic relevance of these effects, Fig. 8.4 plots the results of columns 1 through 3 of Table 8.8, considering the differentiated effects of foreign bank penetration on the probability that the average firm is financially constrained. Figure 8.4a shows that foreign banks are associated with more binding financing constraints only in countries that do not have a credit registry. In the other countries, there is no evidence that a larger presence of foreign banks penalizes local firms, consistent with what was recently shown by Claessens and Van Horen (2014). Figures 8.4b and 8.4c show that the average partial effect of foreign banks on the probability of being credit constrained decreases from positive (and statistically significant) to negative as the number of per capita branches increases. By contrast, the same average partial effect increases with the share of bank assets held by the three largest banks and moves from negative to positive (with statistically significant values) when the asset share of the top three banks is above 60 %.

Conclusions

In this chapter, we provided a thorough analysis of firm credit access in LAC countries based on the data available in the WBES. We also aimed to explore the role played by heterogeneity in micro-firm characteristics and in macro-institutional credit market structures. Three main sets of issues were addressed: (i) financing constraints on firms and the types of credit accessed; (ii) the characteristics of the financially constrained firms; and (iii) the role of the differences across countries in terms of their financial development and credit market structure. We found access to bank credit among LAC firms to be very heterogeneous with a lot of variety according to firm characteristics such as size, productivity, and informational transparency. Demand for bank credit was more likely to come from larger, older, and less export-oriented firms, and consequently these firms were less likely to be discouraged or constrained. Labor productivity was also positively associated with higher demand for credit and better access to finance. Even if we were unable to identify the causality of the relationship, this was an important result, signaling the existence of a trap between low productivity and financing constraint that needs to be addressed using policies designed to strengthen economic growth in the region.

In addition to individual firms’ characteristics, we also found the structure of the credit market to be important for explaining the heterogeneity in credit access. In particular, we found that a high degree of bank penetration and competition were significantly correlated with a lower probability of borrowers being financially constrained. Interestingly, we found that the presence of foreign banks had a differentiated effect on financing constraints: foreign bank penetration had a negative effect on access to credit in less developed and more concentrated markets, while it had a positive influence in more competitive and financially developed markets.

Some interesting policy implications can be drawn from our findings. In LAC there is a widely acknowledged low productivity trap, which slows economic growth (IDB 2010). Improving access to credit should help escape this trap. Our empirical results underline the importance of improving the functioning of the domestic market structures. Interventions aimed at increasing the degree of bank penetration and the competition in financial markets should positively impact firms’ access to credit and their productivity. From this point of view, the large heterogeneity in LAC financial markets opens up a crucial space for intervention aimed at increasing productivity in many countries in the region.

References

Ayyagari, M., A. Demirgüç-Kunt, and V. Maksimovic. 2012. Financing of Firms in Developing Countries. Policy Research Working Paper, No. 6036. Washington, DC: The World Bank.

Banerjee, A., and E. Duflo. 2014. Do Firms Want to Borrow More? Testing Credit Constraints Using a Direct Lending Program. The Review of Economic Studies 81: 572–607.

Beck, T., and A. Demirgüç-Kunt. 2006. Small and Medium-Size Enterprises: Access to Finance as a Growth Constraint. Journal of Banking & Finance 30(11): 2931–2943.

Beck, T., A. Demirgüç-Kunt, L. Laeven, and V. Maksimovic. 2006. The Determinants of Financing Obstacles. Journal of International Money and Finance 25(6): 932–952.

Beck, T., A. Demirgüç-Kunt, and V. Maksimovic. 2004. Bank Competition and Access to Finance: International Evidence. Journal of Money, Credit, and Banking 36(3): 627–648.

Beck, T., A. Demirgüç-Kunt, and M.S. Martínez Pería. 2011. Bank Financing for SMEs: Evidence Across Countries and Bank Ownership Types. Journal of Financial Services Research 39(1–2): 35–54.

Berger, A.N., N.H. Miller, M.A. Petersen, R.G. Rajan, and J.C. Stein. 2005. Does Function Follow Organizational Form? Evidence from the Lending Practices of Large and Small Banks. Journal of Financial Economics 76: 237–269.

Berger, A.N., and G.F. Udell. 2002. Small Business Credit Availability and Relationship Lending: The Importance of Bank Organisational Structure. Economic Journal 112: F32–F53.

Brown, M., S. Ongena, A. Popov, and P. Yesin. 2011. Who Needs Credit and Who Gets Credit in Eastern Europe? Economic Policy 26: 93–130.

Bruhn, M., S. Farazi, and M. Kanz. 2013. Bank Competition, Concentration, and Credit Reporting. Policy Research Working Paper, No. 6442. Washington, DC: The World Bank.

Bruhn, M., and D. McKenzie. 2014. Entry Regulation and the Formalization of Microenterprises in Developing Countries. The World Bank Research Observer 29(2): 186–201.

Cardim De Carvalho, F.J., L.F. De Paula, and J. Williams. 2012. Banking in Latin America. In The Oxford Handbook of Banking, ed. A.N. Berger, P. Molyneux, and J.O.S. Wilson. Oxford: Oxford University Press.

Cetorelli, N., and P.E. Strahan. 2006. Finance as a Barrier to Entry: Bank Competition and Industry Structure in Local U.S. Markets. Journal of Finance 61(1): 437–461.

Čihák, M., A. Demirgüç-Kunt, E. Feyen, and R. Levine. 2012. Benchmarking Financial Systems Around the World. Policy Research Working Paper, No. 6175. Washington, DC: The World Bank.

Claessens, S., and N. Van Horen. 2014. Foreign Banks: Trends and Impact. Journal of Money, Credit, and Banking 46(s1): 295–326.

Clarke, G., R.J. Cull, and M.S. Martínez Pería. 2006. Foreign Bank Participation and Access to Credit Across Firms in Developing Countries. Journal of Comparative Economics 34(4): 774–795.

Clarke, G., R.J. Cull, M.S. Martínez Pería, and S.M. Sanchez. 2005. Bank Lending to Small Businesses in Latin America: Does Bank Origin Matter? Journal of Money, Credit, and Banking 37(1): 83–118.

Cole, R.A., and A. Dietrich. 2014 (unpublished). SME Credit Availability around the World: Evidence from the World Bank’s Enterprise Survey. Chicago, IL: DePaul University.

Cull, R., and M.S. Martínez Pería. 2013. Bank Ownership and Lending Patterns During the 2008–2009 Financial Crisis: Evidence from Latin America and Eastern Europe. Journal of Banking & Finance 37(12): 4861–4878.

De la Torre, A., M.S. Martínez Pería, and S.L. Schmukler. 2010. Bank Involvement With SMEs: Beyond Relationship Lending. Journal of Banking & Finance 34(9): 2280–2293.

De Mel, S., D. McKenzie, and C. Woodruff. 2008. Returns to Capital in Microenterprises: Evidence from a Field Experiment. The Quarterly Journal of Economics 124(4): 1329–1372.

Degryse, H., and S. Ongena. 2005. Distance, Lending Relationships, and Competition. Journal of Finance 60(1): 231–266.

Dell’Ariccia, G., and R. Marquez. 2004. Information and Bank Credit Allocation. Journal of Financial Economics 72(1): 185–214.

Detragiache, E., T. Tressel, and P. Gupta. 2008. Foreign Banks in Poor Countries: Theory and Evidence. Journal of Finance 63(5): 2123–2160.

Didier, T., and S.L. Schmukler. 2014. Emerging Issues in Financial Development: Lessons from Latin America. Washington, DC: The World Bank.

Djankov, S., C. McLiesh, and A. Shleifer. 2007. Private Credit in 129 Countries. Journal of Financial Economics 84(2): 299–329.

Galindo, A.J., and F. Schiantarelli, eds. 2003. Credit Constraints and Investment in Latin America. Washington, DC: Inter-American Development Bank (IDB).

Gormley, T.A. 2010. The Impact of Foreign Bank Entry in Emerging Markets: Evidence from India. Journal of Financial Intermediation 19(1): 26–51.

Hansen, H., and J. Rand. 2014. The Myth of Female Credit Discrimination in African Manufacturing. Journal of Development Studies 50(1): 81–96.

Heckman, J.J. 1979. Sample Selection Bias as a Specification Error. Econometrica 47(1): 153–161.

Hulme, D., and T. Arun. 2009. Microfinance—A Reader. Routledge Studies in Development Economics. London: Routledge.

IDB. 2010. The Age of Productivity: Transforming Economies from the Bottom-Up. Washington, DC: IDB.

Jaffee, D.M., and T. Russell. 1976. Imperfect Information, Uncertainty, and Credit Rationing. The Quarterly Journal of Economics 90(4): 651–666.

Jappelli, T., and M. Pagano. 2002. Information Sharing, Lending and Defaults: Cross-Country Evidence. Journal of Banking & Finance 26(10): 2017–2045.

Kaufman, D., A. Kraay, and M. Mastruzzi. 2010. The Worldwide Governance Indicators: Methodology and Analytical Issues. Policy Research Working Paper, No. 5430. Washington, DC: The World Bank.

Kon, Y., and D.J. Storey. 2003. A Theory of Discouraged Borrowers. Small Business Economics 21: 37–49.

Kuntchev, V., R. Ramalho, J. Rodriguez-Meza, and J.S. Yang. 2013. What Have We Learned from the Enterprise Survey Regarding Access to Finance by SMEs? Policy Research Working Paper, No. 6670. Washington, DC: The World Bank.

Makler, H., W.L. Ness, and A.E. Tschoegl. 2013. Inequalities in Firms’ Access to Credit in Latin America. Global Economic Journal 13(3–4): 283–318.

Mian, A. 2006. Distance Constraints: The Limits of Foreign Lending in Poor Economies. Journal of Finance 61(3): 1465–1505.

Micco, A., U. Panizza, and M. Yanez. 2007. Bank Ownership and Performance. Does Politics Matter? Journal of Banking & Finance 31(1): 219–241.

OECD. 2013. Latin American Economic Outlook 2013—SME Policies for Structural Change. Paris: OECD–ECLAC.

Padilla, A.J., and M. Pagano. 1997. Endogenous Communication Among Lenders and Entrepreneurial Incentives. Review of Financial Studies 10(1): 205–236.

Pagano, M. 2001. Defusing Default: Incentives and Institutions. Washington, DC: Development Centre of the OECD and IDB.

Pagano, M., and T. Jappelli. 1993. Information Sharing in Credit Markets. Journal of Finance 48(5): 1693–1718.

Petersen, M.A., and R.G. Rajan. 1995. The Effect of Credit Market Competition on Lending Relationships. The Quarterly Journal of Economics 110(2): 407–443.

Presbitero, A.F., R. Rabellotti, and C. Piras. 2014. Barking Up the Wrong Tree? Measuring Gender Gaps in Firm Access to Finance. Journal of Development Studies 50(10): 1430–1444.

Stallings, B. 2006. Finance for Development—Latin America in Comparative Perspective. Washington, DC: Brookings Institution Press.

Stiglitz, J.E., and A. Weiss. 1981. Credit Rationing in Markets With Imperfect Information. American Economic Review 71(3): 393–410.

World Bank. 2012. Financial Development in Latin America and the Caribbean—The Road Ahead. Washington, DC: The World Bank.

World Bank. 2013. Global Financial Development Report 2013. Washington, DC: The World Bank.

Author information

Authors and Affiliations

Corresponding authors

Editor information

Editors and Affiliations

Appendices

Appendix

Notes

-

1.

The exclusion of micro-enterprises and of the informal sector could represent a relevant issue in some countries, especially given that micro and informal firms are more likely to be financially constrained and to be less productive. Bruhn and McKenzie (2014) provided a broad and accessible discussion on some important issues about informal firms in developing countries, including access to finance.

-

2.

Similar considerations hold when discussing the entry of large banks and the competitive pressure on small banks to orient their lending activity toward SMEs. Moreover, the literature has also stressed the importance of state-owned banks, but this is beyond the scope of this chapter. A detailed discussion about the role of state-owned banks in developing countries is presented in Micco et al. (2007). Some recent works suggest that state-owned banks could have played a pivotal counter-cyclical role in Latin America during the recent global crisis (Cull and Martínez Pería 2013).

-

3.

These studies are collected in a volume edited by Pagano (2001).

-

4.

The LAC-7 countries are Argentina, Brazil, Chile, Colombia, Mexico, Peru, and Venezuela. Combined, they account for 90 % of Latin America’s GDP.

-

5.

For a recent analysis of the development of the financial systems around the world, see World Bank (2013).

-

6.

A credit registry is defined as an entity managed by the public sector (central bank or superintendent of banks) that collects information on the creditworthiness of borrowers and shares this information with banks and other regulated financial institutions (Bruhn et al. 2013).

-

7.

The WBES provides a more detailed two-digit disaggregation. For the purpose of this descriptive analysis, we limit the disaggregation to services and manufacturing.

-

8.

Tables 8.1, 8.2, and 8.3 do not report the t-test statistics for the differences in the values across firm characteristics. However, the statistical significance of the main results (at the usual 90 % level of confidence) is always indicated in the text.

-

9.

In developing countries, micro-firms typically address their requests for credit to micro-finance institutions (Hulme and Arun 2009).

-

10.

This pattern is confirmed—to a similar extent—considering the subjective indicator of access to finance as an obstacle to business activity, which is not reported here.

-

11.

We measure the rule of law using one of the Worldwide Governance Indicators published by the World Bank (Kaufman et al. 2010). Specifically, the rule of law captures perceptions of the extent to which agents have confidence in and abide by the rules of society, and in particular the quality of contract enforcement, property rights, the police, and the courts, as well as the likelihood of crime and violence.

-

12.

Given that the measure of labor productivity is not available for quite a substantial number of firms, to check the robustness of our findings, we also estimate equation 8.1 on a larger sample of firms, excluding labor productivity. The results are broadly unchanged.

-

13.

When we control for these variables, we cannot add country-fixed effects to equation 8.1 because we only have a survey repeated over time for a few countries.

-

14.

We are not able to go beyond this degree of granularity in modeling the unobserved heterogeneity because using country * year * industry dummies would make a number of cells without variation in the dependent variable. For the same reasons, when estimating equation 8.2, we only have country * manufacturing dummies and, separately, year dummies. See the notes in the tables presenting the results of the regression tests for details.

-

15.

We also control for innovation at the firm level and find no significant correlation between different measures of innovation (R&D spending, or the introduction of process or product innovations) and firm financing constraints. This regression is not included because data availability significantly reduces the sample size. In addition, there are no significant differences in terms of access to credit across sectors, especially separating manufacturing from market and non-market services.

Rights and permissions

This chapter is published under an open access license. Please check the 'Copyright Information' section either on this page or in the PDF for details of this license and what re-use is permitted. If your intended use exceeds what is permitted by the license or if you are unable to locate the licence and re-use information, please contact the Rights and Permissions team.

Copyright information

© 2016 Inter-American Development Bank

About this chapter

Cite this chapter

Presbitero, A.F., Rabellotti, R. (2016). Credit Access in Latin American Enterprises. In: Inter-American Development Bank, Grazzi, M., Pietrobelli, C. (eds) Firm Innovation and Productivity in Latin America and the Caribbean. Palgrave Macmillan, New York. https://doi.org/10.1057/978-1-349-58151-1_8

Download citation

DOI: https://doi.org/10.1057/978-1-349-58151-1_8

Published:

Publisher Name: Palgrave Macmillan, New York

Print ISBN: 978-1-349-58150-4

Online ISBN: 978-1-349-58151-1

eBook Packages: Economics and FinanceEconomics and Finance (R0)