Abstract

In this paper, we discuss impact of the Covid-19 pandemic on the North American financial markets and propose a framework for stress testing and financial scenario generation of market indicators. This framework includes the following main components:

-

Epidemiological dynamic model describing evolution of the number of Susceptible, Infected, Recovered and Death cases with social distancing,

-

Dynamical model describing dependence between financial indicators and growth of the pandemic in different geographical areas,

-

Conditional stress scenario generation and financial portfolio analysis.

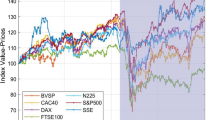

We apply an extended epidemiological model to analysis of Covid-19 pandemic spread and analyze its impact on some of the main financial indicators, including stock indices, credit spreads and FX rates, and characteristics of the pandemic process in different geographical areas. This analysis results in a model connecting the dynamics of the pandemic and that of the main financial indicators. The model allows one to generate pandemic scenarios under different assumptions on the parameters of the infectious disease and that of the social distancing policies. Once the pandemic scenarios are generated, one can transform them into a set of scenarios on macro-economic risk factors. Then, applying the conditional scenario technique we obtain a set of Monte Carlo scenarios on the risk factors driving the portfolio dynamics. The proposed dynamic models allow one to generate various financial stress scenarios on market indicators and compute the distribution of financial portfolio losses and their risk measures.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

Similar shape is observed in the case of the European indices MIB and FTSE100.

- 2.

28 days since the beginning of the pandemic.

- 3.

In order to have a well defined time-dependent process we restrict time-dependent parameters \((\beta (t),\gamma (t),\eta (t)), \, t\in [0,T],\) be continuous functions except for a finite number of discontinuities (e.g., stepwise function).

- 4.

We use the repository available in https://github.com/pomber/covid19, which in turn cleans and processes the data from Johns Hopkins CSSE (see also, https://github.com/CSSEGISandData/COVID-19).

- 5.

Weak convergence of stochastic processes discussed in this section represents an independent interest. The rigorous presentation with the proof of (20) is deferred to a more specialized journal on stochastic processes.

- 6.

We hope that in the nearest future we will have more reliable data that would allow us to infer the statistical properties of the sickness time distribution.

- 7.

The measurement date is 29/03/2020.

- 8.

Recall that since we are not including the bias corrector \(\beta _0\), then there may be a small, but insignificant, mean in the distribution of \(\epsilon \).

References

Brauer, F., Driessche, P., Wu.: Mathematical Epidemiology. Springer, Berlin Heidelberg (2008)

Cushing, J.M.: Integro-differential Equations and Delay Models in Population Dynamic. Springer-Verlag, Berlin Heidelberg (1977)

Daley, D.J., Gani, J.: Epidemic Modeling: An Introduction. Cambridge University Press (2005)

Grassly, N.C., Fraser, C.: Mathematical models of infectious disease transmission. Nat. Rev. Microbiol. 6(6), 477–487 (2008). https://doi.org/10.1038/nrmicro1845

Hoppensteadt, F.C.: Mathematical Methods of Population Biology. Cambridge University Press (1982)

Sameni, R.: Mathematical Modeling of Epidemic Diseases; A Case Study of the COVID-19 Coronavirus. Working paper, Grenoble, France 24 March (2020)

Feller, W.: An Introduction to Probability Theory ant its Applications. John Wiley & Sons, New York (1968)

IIDDA. The International Infectious Disease Data Archive, http://iidda.mcmaster.ca

The John Hopkins University coronavirus dash board. https://coronavirus.jhu.edu

Coronavirus Dashboard. https://ncov2019.live

Goldstein, J.A.: Abstract evolution equations. Trans. Am. Math. Soc. 141, 159–185 (1969)

Isham, V.: Assessing the variability of stochastic epidemics. Math. Biosci. 107(2), 209–224 (1991)

Keeling, M.J.: Meta-population moments: coupling, stochasticity and persistence. J. Animal Ecol. 69(5), 725–736 (2000)

Kermack, W., McKendrick, A.: Contributions to the Mathematical Theory of Epidemics–I. 1927. Bull. Math. Biol. 53(1-2), 33–55 (1991)

Kermack, W., McKendrick, A.: Contributions to the Mathematical Theory of epidemics–II. The Problem of endemicity.1932. Bull. Math. Biol. 53(1-2), 57–87 (1991)

Kermack, W., McKendrick, A.: Contributions to the Mathematical Theory of epidemics–III. Further Studies of the Problem of Endemicity. 1933. Bull. Math. Biol. 53(1-2), 89–118 (1991)

Lanchester, F.: Mathematics in Warfare. The World of Mathematics 4, 2138–2157, (1956); anthologised from Aircraft in Warfare (1916)

Lloyd, A.L.: Estimating variability in models for recurrent epidemics: assessing the use of moment closure techniques. Theoret. Popul. Biol. 64, 49–65 (2004)

https://www.theguardian.com/business/2020/mar/28/how-coronavirus-sent-global-markets-into-freefall

Aas, K., Haff, I.: The generalised hyperbolic skew student t-distribution. J. Finan. Econometr. 4(2),(2006)

Breymann, W., Luthi, D.: Ghyp: a package on generalized hyperbolic distributions, November 2014

Acknowledgements

We are very grateful to Rustom Barua, Yijun Jiang, Alan Yang, Ken Wang, Rob Seidman, Andrew Marchenko, Yuliy Koshevnik, Ken Jackson and Vladimir Vinogradov for the interesting discussions and suggestions.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Burmeister, C., Kreinin, A., Mendoza-Arriaga, R., Rasouli, H., Romanko, O. (2021). Analysis of Impact of Covid-19 Pandemic on Financial Markets. In: Agarwal, P., Nieto, J.J., Ruzhansky, M., Torres, D.F.M. (eds) Analysis of Infectious Disease Problems (Covid-19) and Their Global Impact. Infosys Science Foundation Series(). Springer, Singapore. https://doi.org/10.1007/978-981-16-2450-6_15

Download citation

DOI: https://doi.org/10.1007/978-981-16-2450-6_15

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-16-2449-0

Online ISBN: 978-981-16-2450-6

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)