Abstract

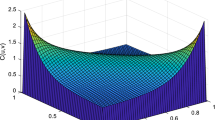

Agricultural insurance in China has in recent years been skyrocketing. However, the catastrophic risk management system is relatively lagging behind in China hence affecting the sustainable development of Chinese agricultural insurance program. Chinese government especially provincial governments are trying to develop a mechanism to stabilize crop insurance program by sharing some risk with insurer when CAT events happen. But the critical issue which is to layer the risk responsibility between insurer and local government is still unsolved. Therefore, this paper aims to provide a quantitative methodology of estimating the optimal risk sharing ratio between insurer and provincial government from the government perspective adopting the approaches in actuarial sciences, such as Copula, Monte Carlo and stochastic. After a robust empirical study, it is found that the optimal risk sharing ratio is 210 % in the case of taking account of non-accumulative loss ratio and 130 % in the case of taking account of accumulative loss ratio of insurer. It is believed that this paper has significant implications for China to set up crop reinsurance system because we proposed a suitable methodology to identify the responsibility of government and insurers in crop insurance.

The former three authors are assistant professor, master student and professor respectively at Agricultural Information Institute of CAAS. Dr. Zhou is an associate prof. at CIAS of CUFE. Authors can be available atwangkeable@gmail.com, charlieme@163.com, zhangqiao@caas.cn, and zhouxh@cufe-ins.sinanet.com.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

2010 Asia-Pacific international symposium on agricultural insurance and reinsurance.

- 2.

In fact, there is more than one agricultural insurance company to undertake the crop insurance business in Jilin although more than 90 % market are taken by Anhua Agricultural Insurance Co.

References

Cai J, Tan KS (2007) Optimal retention for stop-loss reinsurance under the VaR and CTE risk measure. ASTIN Bull 37:93–112

Cai J, Tan KS, Weng C, Zhang Y (2008) Optimal reinsurance under VaR and CTE risk measures. Insur Math Econ 43:185–196

Coble K, Dismukes R, Glauber JW (2007) Private crop insurers and the reinsurance fund allocation decision. J Agric Econ 89(3):582–595

Deng GQ (2008) Analysis on agricultural catastrophe economic impact — floods in China. Collect Essay Financ Econ 4:21–26. (in Chinese)

Feng WL (2004) Market failure and institution supply of agriculture insurance in China. J Financ Res 4:124–129. (in Chinese)

Gao T, Li SP, Xing L (2009) A study on diversification of catastrophic risks in agricultural insurance. Chin Rural Econ 3:34–37. (in Chinese)

Hayes DJ, Lence SH, Mason C (2003) Could the government manage its exposures to crop reinsurance risk? Agric Financ Rev 63:127–142

Hi Y, Tan KS (2011) Optimal reinsurance under VaR and CVaR risk measures: a simplified approach. ASTIN Bull 41(2):487–509

Liu JS (2006) The construction of multi-layer agricultural reinsurance system. China Financ 2006(11):53–53. (in Chinese)

Long WJ, Wan KL, Li XM (2007) Study on Chinese agricultural reinsurance construction. Issues Agric Econ 6:56–59. (in Chinese)

Mason C, Hayes DJ, Lence SH (2003) Systemic risk in U.S. crop reinsurance programs. Agric Financ Rev 63(1):23–39

Miranda M, Glauber J (1997) Systematic risk, reinsurance, and the failure of crop insurance markets. Am J Agric Econ 79:206–215

Pai J, Boyd M (2010) A decision framework for optimal crop reinsurance selection. China Agric Econ Rev 2(2):48–166

Porth L, Tan KS, Weng CG (2013) Optimal reinsurance analysis from a crop insurer’s perspective. Agricultural Finance Review 73(2):310–328

Tuo GZ, Wang BD (2010) Study on agricultural catastrophic risk indemnity system. Rural Financ Res 2010(6):13–18. (in Chinese)

Turvey CG, Nayak G, Sparling DH (1999) Reinsuring agricultural risk. Can J Agric Econ 47:281–291

Xie JZ (2003) Study on government-induced development pattern of agricultural insurance. Insur Stud 11:42–44. (in Chinese)

Xu JF (2008) Construction of multi – level agricultural catastrophe risk distribution system. Newsl About Rural Work 1:46–46. (in Chinese)

Zhao S (2007) Study on the catastrophe and agricultural insurance system. Insur Stud 2007(12):50–54. (in Chinese)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Wang, K., Huo, R., Zhang, Q., Zhou, X. (2014). Study on Optimal Risk Sharing Issue for Chinese Crop Insurance: A Case Study from Government Perspective. In: Xu, S. (eds) Proceedings of 2013 World Agricultural Outlook Conference. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-54389-0_16

Download citation

DOI: https://doi.org/10.1007/978-3-642-54389-0_16

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-54388-3

Online ISBN: 978-3-642-54389-0

eBook Packages: Business and EconomicsEconomics and Finance (R0)