Abstract

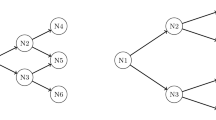

We consider a perfectly competitive situation consisting of an electricity market (2nd stage) preceded by investment in generating plant capacity (1st stage). The second stage environment is uncertain at the time of investment, hence the first stage also involves trading in financial instruments, eg, hedges against high generation costs due to rising fuel costs.

The classical Invisible Hand says that if generators and consumers act in their own best interests, the result will be to minimize the net cost (or max net welfare) of the system. This holds true in the stochastic risk neutral case, when a probability distribution of future events is known and used by all generators to evaluate their investment strategies (via two stage stochastic programming with recourse).

Motivated by energy developments in the European Union, our interest is the case when electricity generators are risk averse, and the cost of future production is assessed via coherent risk measures instead of expectations. This results in a new kind of stochastic equilibrium framework in which (risk neutral) probability distributions are endogenous can only be found at equilibrium.

Our main result is that if there are enough financial products to cover every future situation, ie, the financial market is complete, then the Invisible Hand remains in force: system equilibrium is equivalent to system optimization in risk averse investment equilibria. Some practical implications will be discussed.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2010 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Ralph, D., Smeers, Y. (2010). The Invisible Hand for Risk Averse Investment in Electricity Generation. In: Chen, B. (eds) Algorithmic Aspects in Information and Management. AAIM 2010. Lecture Notes in Computer Science, vol 6124. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-14355-7_2

Download citation

DOI: https://doi.org/10.1007/978-3-642-14355-7_2

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-14354-0

Online ISBN: 978-3-642-14355-7

eBook Packages: Computer ScienceComputer Science (R0)