Abstract

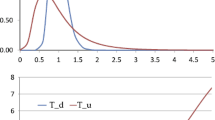

We study some properties of a continuous local martingale stopped at the first time when its range (the difference between the running maximum and minimum) reaches a certain threshold. The laws and the conditional laws of its value, maximum, and minimum at this time are simple and do not depend on the local martingale in question. As a consequence, the price and hedge of options which mature when the range reaches a given level are both model-free within the class of arbitrage-free models with continuous paths, which makes these products very convenient for hedging.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Bick, A.: Quadratic-variation-based dynamic strategies. Manag. Sci. 41, 722–732 (1995)

Borodin, A., Salminen, P.: Handbook of Brownian Motion—Facts and Formulae. Birkhäuser, Basel (2002)

Revuz, D., Yor, M.: Continuous Martingales and Brownian Motion, 3rd edn. Springer, Berlin (1999)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Copyright information

© 2009 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Cherny, A., Dupire, B. (2009). On Certain Distributions Associated with the Range of Martingales. In: Optimality and Risk - Modern Trends in Mathematical Finance. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-02608-9_2

Download citation

DOI: https://doi.org/10.1007/978-3-642-02608-9_2

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-02607-2

Online ISBN: 978-3-642-02608-9

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)