Abstract

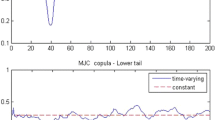

The unstable nature of business cycles makes it necessary to study the relationships between stock performance and economic activity. Novel to this multifaceted mix are Islamic equity markets which have witnessed tremendous growth over the last decade. This suggests a causal relationship between the performance of the stock market and business cycles. This study attempts to analyse the relationship between the volatility of Islamic stock indices and business cycles and assess how Islamic stock fairs compared with conventional stock indices. Spanning over 10 years, our results indicate that across regions, Islamic indices appeared to be more volatile during times of economic downturn and less volatile during the growth phase of a business cycle.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Alexander, C. (2009). Practical financial econometrics. Chichester: Wiley.

Al-Zoubi, H. A., & Maghyereh, A. I. (2007). The relative risk performance of Islamic finance: A new guide to less risky investments. International Journal of Theoretical and Applied Finance, 10(2), 235–249.

Antonios, A., (2010). Stock market and economic growth: An empirical analysis for Germany. Business and Economics Journal.BEJ-1, 1–5.

Arshad, S., & Rizvi, S. A. R. (2013). The impact of global financial shocks to Islamic indices: Speculative influence or fundamental changes? Journal of Islamic Finance, 2(1), 13–22.

Arshad, S., & Rizvi, S. A. R. (2015). The troika of business cycle, efficiency and volatility. An East Asian perspective. Physica A: Statistical Mechanics and its Applications, 419, 158–170.

Arshad, S., Rizvi, S. A. R., & Ibrahim, M. H. (2014). Tripartite analysis across business cycles in Turkey: A multi-timescale inquiry of efficiency, volatility and integration. Borsa Istanbul Review, 14(4), 224–235.

Avoyui-Dovi, S., & Matheron, J. (2005). Interactions between business cycles, stock market cycles and interest rates: The stylised facts (Working papers 121). Banque de France.

Azarmi, T., Lazar, D., & Jeyapaul, J. (2005). Is the Indian stock market a Casino? Journal of Business & Economics Research, 3(4), 63–72.

Barro, R. J. (1989). New classical and Keynesians, or the good guys and the bad guys. Swiss Journal of Economics and Statistics (SJES), Swiss Society of Economics and Statistics (SSES), 125(III), 263–273.

Binswanger, M. (2000). Stock market booms and real economic activity: Is this time different? International Review of Economics & Finance, 9(4), 387–415.

Bowden, R. J., & Martin, V. L. (1995). International business cycles and financial integration. The Review of Economics and Statistics, 77(2), 305–320.

Brooks, C. (2008). Introductory econometrics for finance. Cambridge: Cambridge University Press.

Charles, A., Pop, A., & Darne, O. (2011, May). Is the Islamic Finance model more resilient than the conventional finance model? Evidence from sudden changes in the volatility of Dow Jones indexes. International Conference of the French Finance Association (AFFI).

Christiano, L. J., & Fitzgerald, T. J. (2003). The band pass filter. International Economic Review, 44(2), 435–465.

Crosby, M. (2003). Business cycle correlations in Asia-Pacific. Economic Letters, 80, 35–44.

Dewandaru, G., Rizvi, S. A. R., Bacha, O., & Masih, M. (2014a). What factors explain stock market retardation? Islamic vs developed countries. Emerging Markets Review, 19(2), 106–127

Dewandaru, G., Rizvi, S. A. R., Masih, R., Masih, M., Alhabshi, S. O. (2014b). Stock market co-movements: Islamic versus conventional equity indices with multi-timescales analysis. Economic Systems, 38, 553–571.

Enisan, A., & Olufisayo, A. (2009). Stock market development and economic growth: Evidence from seven sub-Sahara African countries. Journal of Economics and Business, 61(2), 162–171.

Everts, M. (2006). Band-pass filters (MPRA paper no. 2049). Available from http://mpra.ub.uni-muenchen.de/2049/

Fama, E. F. (1990). Stock returns, expected returns and real activity. The Journal of Finance, 45(4), 1089–1108.

Girard, E. C., & Hassan, M. K. (2008). Is there a cost to faith-based investing: Evidence from FTSE Islamic indices. The Journal of Investing, 17(4), 112–121.

Hakim, S., & Rashidian, M. (2002). Risk & return of Islamic stock market indexes (Working paper). Available from http://www.mafhoum.com/press4/136E15.pdf

Hassan, M. K. (2002). Risk, return and volatility of faith-based investing: The case of Dow Jones Islamic index. Paper in proceedings of the 5th Harvard University Forum on Islamic Finance, University of Harvard, USA.

Hussin, M. Y., Muhammad, F., Abu-Hussin, M. F., & Abdul Razak, A. (2012). The relationship between oil price, exchange rate and Islamic stock market in Malaysia. Research Journal of Finance and Accounting, 3(5), 83–92.

Ibrahim, M. (2003). Macroeconomic forces and capital market integration: A VAR analysis for Malaysia. Journal of the Asia Pacific Economy, 8, 19–40.

Milly, M., & Sultan, J. (2009). Portfolio diversification during financial crisis: An analysis of Islamic asset allocation strategy (Bentley University working paper).

Mirakhor, A. (1993). Equilibrium in a non-interest open economy. Journal of King Abdulaziz University, 5, 3–23.

Mun, H. W., Siong, E. C., & Long, B. S. (2008). Stock market and economic growth in Malaysia: Causality test. Asian Social Science, 4, 86–92.

Nelson, D. B. (1991). Conditional heteroskedasticity in asset returns: A new approach. Econometrica, 59(2), 347–370.

Pearce, D. K. (1983). Stock prices and the economy. Economic Review. Federal Reserve Bank of Kansas City, issue Sep, pp. 7–22.

Peek, J., & Rosengren, E. (1994). Bank real estate lending and the New England capital crunch. Journal of the American Real Estate and Urban Economics Association, 22, 33–58.

Rizvi, S. A. R., & Arshad, S. (2014). An empirical study of Islamic equity as a better alternative during crisis using multivariate Garch DCC. Islamic Economics Studies, 22(1), 159–184.

Rizvi, S. A. R., Arshad, S., & Alam, N. (2015). Crises and contagion in Asia Pacific-Islamic v/s conventional markets. Pacific-Basin Finance Journal, 34, 315–326.

Schwert, G. W. (1989). Tests for unit roots: A Monte Carlo investigation. Journal of Business and Economic Statistics, 7, 147–160.

Shyu, Y.-W., & Hsia, K. (2008). Does stock market volatility with regime shifts signal the business cycle in Taiwan? International Journal of Electronic Finance, 2(4), 433–450.

Siegel, J. J. (1991). The behaviour of stock returns around N.B.E.R. turning points: An overview. Philadelphia: Rodney L.White Center for Financial Research, Wharton School.

Silverstovs, B., & Duong, M. H. (2006). On the role of stock market for real economic activity: Evidence for Europe. DIW Berlin discussion paper 559.

Wang, X. (2010). The relationship between stock market volatility and macroeconomic volatility: Evidence from China. International Research Journal of Finance and Economics, Issue 49.

Yusof, R. M., & Majid, M. S. A. (2007). Stock market volatility transmission in Malaysia: Islamic versus conventional stock market. Journal of King Abdulaziz University: Islamic Economics, 20(2), 17–35.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2016 The Editor(s) (if applicable) and The Author(s)

About this chapter

Cite this chapter

Arshad, S. (2016). The Relationship Between Islamic Stock Markets and Business Cycles: A Regional Perspective. In: Alam, N., Rizvi, S. (eds) Islamic Capital Markets. Palgrave CIBFR Studies in Islamic Finance. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-319-33991-7_4

Download citation

DOI: https://doi.org/10.1007/978-3-319-33991-7_4

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-319-33990-0

Online ISBN: 978-3-319-33991-7

eBook Packages: Economics and FinanceEconomics and Finance (R0)