Abstract

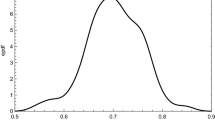

Based on a stochastic dynamic general equilibrium model with heterogeneous households, this paper analyzes the effects of positional preferences on the interaction between the distribution of wealth and endogenous economic growth. Households exhibit positional preferences, i.e., they derive utility not only from their own consumption level, they are also concerned about their wealth-rank, i.e., their relative wealth position in the distribution of wealth in the society. Contrary to adopting ad hoc assumptions regarding the specification of the wealth rankings, we demonstrate that the distribution of wealth ranks necessarily follows a power law. Under this power law, individual wealth growth rates differ, although the aggregate distribution converges to a stationary distribution in the balanced growth path. Differences in individual growth rates are due to differences in the return to households’ assets (e.g., differences in the return to one’s human capital—considered as part of the total capital). Moreover, the endogenous growth rate is shown to strongly depend on the power-law exponent, which is itself an endogenous variable that is determined by the standard deviation of the individual growth rates and the minimum level of the wealth distribution.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

Different authors employ various terms, with slightly varying meanings, to describe positional preferences. These terms include (negative) consumption externality, relative wealth or consumption, jealousy, envy, keeping or catching up with the Joneses, external habits, positional concerns, conspicuous wealth or consumption. In this article, we use these terms synonymously, though we focus on relative wealth.

- 2.

We may consider a government that redistributes income—in a budget neutral way—so as to ensure a minimum income of the poorest households.

- 3.

Observe that the cumulated distribution function is given by \(F(\omega ) = 1 - (\omega /\omega _{min})^{-\kappa }\).

- 4.

The relationship between the shape of the distribution function and the Gini-coefficient is given in Appendix.

References

Alesina A, Rodrik D (1994) Distributive politics and economic growth. Q J Econ 109:465–490

Alpizar F, Carlsson F, Johansson-Stenman O (2005) How much do we care about absolute versus relative income and consumption? J Econ Behav Organ 56:405–421

Alvarez-Cuadrado F, Casado JM, Labeaga JM, Sutthiphisal D (2012) Envy and habits: panel data estimates of interdependent preferences. Banco de Espana working paper 1213. Available at SSRN: http://ssrn.com/abstract=2014005+

Bertola G (1993) Factor shares and savings in endogenous growth. Am Econ Rev 83:1184–1198

Cowan R, Cowan W, Swann GMP (2004) Waves in consumption with interdependence among consumers. Can J Econ 37:149–177

Corneo G, Jeanne O (2001) Status, the distribution of wealth, and growth. Scand J Econ 103(2):283–293

Darwin C (1871) The descent of men and selection in relation to sex. John Murray, London

Easterlin RA (1995) Will raising the incomes of all increase the happiness of all? J Econ Behav Organ 27:35–47

Fehr E, Schmidt K (1999) A theory of fairness, competition, and cooperation. Q J Econ 114:817–868

Ferrer-I-Carbonell A (2005) Income and well-being: an empirical analysis of the comparison income effect. J Public Econ 89:997–1019

Gabaix X (2009) Power laws in economics and finance. Annu Rev Econ 1:255–293

Groth C, Wendner R (2014) Embodied learning by investing and speed of convergence. J Macroecon 40:245–269

Johansson-Stenman O, Carlsson F, Daruvala D (2002) Measuring future grandparents’ preferences for equality and relative standing. Econ J 112:362–383

Johansson-Stenman O, Martinsson P (2006) Honestly, why are you driving a BMW? J Econ Behav Organ 60:129–146

Jones CI (2014) Pareto and Piketty: the macroeconomics of top income and wealth inequality. NBER working paper 20742

Luttmer EFP (2005) Neighbors as negatives: relative earnings and well-being. Q J Econ 120:963–1002

Mujcic R, Frijters P (2013) Economic choices and status: measuring preferences for income rank. Oxf Econ Pap 65:47–73

OECD (2011), Divided We Stand: Why Inequality Keeps Rising. http://www.oecd.org/els/soc/dividedwestandwhyinequalitykeepsrising.htm

OECD (2014) Growth and inequality: a close relationship? http://www.oecd.org/economy/growth-and-inequality-close-relationship.htm

Ostry JD, Andrew B, Tsangarides CG (2014) Redistribution, inequality, and growth. IMF staff discussion note SDN 14/02

Oswald AJ (2004) Well-being over time in Britain and the USA. J Public Econ 88:1359–1386

Pareto V (1897) Cours d’économie politique, Lausanne: F. Rouge

Persson T, Tabellini G (1994) Is Inequality Harmful for Growth? Am Econ Rev 84:600–621

Piketty T (2014) Capital in the twenty-first century. Harvard University Press, Cambridge, MA

Reed WJ (2003) The Pareto law of incomes - an explanation and an extension. Physica A 319:469–486

Smith A (1759) The theory of moral sentiments. In: Raphael DD, Macfie AL (eds) (1976). The theory of moral sentiments. Oxford University Press, Oxford

Solnik SJ, Hemenway D (1998) Is more always better? A survey on positional concerns. J Econ Behav Organ 37:373–383

Solnik SJ, Hemenway D (2005) Are positional concerns stronger in some domains than in others? Am Econ Rev 95:147–151

Stark O, Taylor JE (1991) Migration incentives, migration types: the role of relative deprivation. Econ J 101:1163–1178

Truyts T (2010) Social status in economic theory. J Econ Surv 24:137–169

Veblen T (1899) The theory of the leisure class, in the theory of the leisure class. Houghton-Mifflin edition (1973). Houghton Mifflin, Boston

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix

Appendix

The Gini coefficient \(\Gamma \) of a continuous distribution F(w) is given by

where μ denotes the distribution’s mean. If the distribution F(w) follows a power-law with \(F(w) = \left (\frac{w_{min}} {w} \right )^{\kappa }\) and w min ≤ w, \(\mu = \frac{\kappa } {\kappa -1}w_{min}\) and the equation above is solved by

yielding the Gini coefficient

Rights and permissions

Copyright information

© 2016 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Kleinert, J., Wendner, R. (2016). Status, Wealth Distribution, and Endogenous Economic Growth. In: Bednar-Friedl, B., Kleinert, J. (eds) Dynamic Approaches to Global Economic Challenges. Springer, Cham. https://doi.org/10.1007/978-3-319-23324-6_7

Download citation

DOI: https://doi.org/10.1007/978-3-319-23324-6_7

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-23323-9

Online ISBN: 978-3-319-23324-6

eBook Packages: Economics and FinanceEconomics and Finance (R0)