Abstract

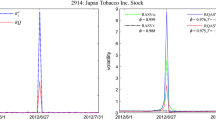

Equity returns and firm’s default probability are strictly interrelated financial measures capturing the credit risk profile of a firm. Following the idea proposed in [20] we use high-frequency equity prices in order to estimate the volatility risk component of a firm within a structural credit risk modeling approach. Differently from [20] we consider a more general framework by introducing market microstructure noise as a direct effect of using noisy high-frequency data and propose the use of non-parametric estimation techniques in order to estimate equity volatility. We conduct a simulation analysis to compare the performance of different non-parametric volatility estimators in their capability of i) filtering out the market microstructure noise, ii) extracting the (unobservable) true underlying asset volatility level, iii) predicting default probabilities deriving from calibrating Merton [17] structural model.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Aït-Sahalia, Y., Mykland, P., Zhang, L.: How often to sample a continuous-time process in the presence of market microstructure noise. Review of Financial Studies 18, 351–416 (2005)

Bandi, F.M., Russel, J.R.: Separating market microstructure noise from volatility. Journal of Financial Economics. 79, 655–692 (2006)

Bandi, F.M., Russell, J.R.: Market microstructure noise, integrated variance estimators, and the accuracy of asymptotic approximations. Working paper, Univ. of Chicago (2006). http://faculty.chicagogsb.edu/federicobandi

Barndorff-Nielsen, O.E., Hansen, P.R., Lunde, A., Shephard, N.: Designing realised kernels to measure the ex-post variation of equity prices in the presence of noise. Econometrica 76(6), 1481–1536 (2008)

Barndorff-Nielsen, O.E., Hansen, P.R., Lunde, A., Shephard, N.: Multivariate realised kernels: consistent positive semi-definite estimators of the covariation of equity prices with noise and non-synchronous trading. Working paper (2008)

Barndorff-Nielsen, O.E., Hansen, P.R., Lunde, A., Shephard, N.: Subsampling realised kernels. Journal of Econometrics (2010)

Barndorff-Nielsen, O.E., Shephard, N.: Econometric analysis of realized volatility and its use in estimating stochastic volatility models. J. R. Statist. Soc, Ser. B 64, 253–280 (2002)

Duan, J.C.: Maximum likelihood estimation using price data of the derivative contract. Mathematical Finance 4, 155–167 (1994)

Duan, J.C., Fulop, A.: Estimating the structural credit risk model when equity prices are contaminated by trading noises. Journal of Econometrics 150, 288–296 (2009)

Ericsson, J., Reneby, J.: Estimating Structural Bond Pricing Models. Journal of Business 78(2) 707–735 (2005)

Hansen, P.R., Lunde, A.: Realized variance and market microstructure noise (with discussions). Journal of Business and Economic Statistics 24, 127–218 (2006)

Huang, J., Huang, M.: How much of the corporate-treasury yield spread is due to credit risk? Working Paper, Penn State University (2003)

Jacod, J., Li, Y., Mykland, P.A., Podolskij, M., Vetter, M.: Microstructure noise in the continuous case: the pre-averaging approach. Stochastic Processes and their Applications 119, 2249–2276 (2009)

Jones, P.E., Scott, P.M., Rosenfeld, E.: Contingent claims analysis of corporate capital structures: an empirical investigation. Journal of Finance 39, 611–625 (1984)

Malliavin, P., Mancino, M.E.: Fourier series method for measurement of multivariate volatilities. Finance and Stochastics 6(1), 49–61. Springer (2009)

Mancino, M.E., Sanfelici, S.: Robustness of Fourier estimator of integrated volatility in the presence of microstructure noise. Computational Statistics & Data analysis 52, 2966–2989. Elsevier (2008)

Merton, R.C.: On the Pricing of Corporate Debt: The Risk Structure of Interest Rates. The Journal of Finance 29, 449–470 (1974)

Eom, Y.H., Helwege, J., Huang, J.: Structural models of corporate bond pricing: an empirical analysis. Review of Financial Studies 17, 499–544 (2008)

Zhang, L., Mykland, P., Aït-Sahalia, Y.: A tale of two time scales: determining integrated volatility with noisy high frequency data. Journal of the American Statistical Association 100, 1394–1411 (2005)

Zhang, B.Y., Zhou, H., Zhu, H.: Explaining Credit Default Swap Spreads with the Equity Volatility and Jump Risks of Individual Firms. Review of Financial Studies 22(12), 5099–5131 (2009)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Barsotti, F., Sanfelici, S. (2014). Firm’s Volatility Risk Under Microstructure Noise. In: Corazza, M., Pizzi, C. (eds) Mathematical and Statistical Methods for Actuarial Sciences and Finance. Springer, Cham. https://doi.org/10.1007/978-3-319-02499-8_5

Download citation

DOI: https://doi.org/10.1007/978-3-319-02499-8_5

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-02498-1

Online ISBN: 978-3-319-02499-8

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)