Abstract

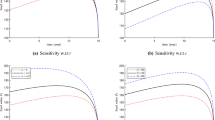

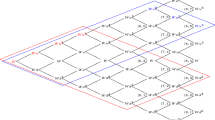

In this paper we describe and compare different numerical schemes for the valuation of unit-linked contracts with and without surrender option. We implement two different algorithms based on the Least Squares Monte Carlo method (LSMC), an algorithm based on the Partial Differential Equation Approach (PDE) and another based on Binomial Trees. We introduce a unifying way to define and solve the valuation problem in order to include the case of contracts with premiums paid continuously over time, along with that of single premium contracts, usually considered in the literature. Finally, we analyse the impact on the fair premiums of the main parameters of the model.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Areal, N., Rodrigues, A., Armada, M.R.: On improving the least squares Monte Carlo option valuation method. Rev Deriv. Res. 11(1–2), 119–151 (2008)

Bacinello, A.R.: Endogenous model of surrender conditions in equity-linked life insurance. Insur. Math. Econ. 37(2), 270–296 (2005)

Bacinello, A.R., Biffis, E., Millossovich, P.: Pricing life insurance contracts with early exercise features. J. Comput. Appl. Math. 233(1), 27–35 (2009)

Bacinello, A.R., Biffis, E., Millossovich, P.: Regression-based algorithms for life insurance contracts with surrender guarantees. Quant. Financ. P.(9), 1077–1090 (2010)

Black, F., Scholes, M.: The pricing of options and corporate liabilities. J. Polit. Econ. 81(3), 637–654 (1973)

Boyle, P.P., Schwartz, E.S.: Equilibrium prices of guarantees under equity-linked contracts. J. Risk Insur. 44(4), 639–660 (1977)

Brennan, M.J., Schwartz, E.S.: The pricing of equity-linked life insurance policies with an asset value guarantee. J. Financ. Econ. 3(3), 195–213 (1976)

Duffie, D.: Dynamic asset pricing theory, 3rd edn. Princeton University Press, Princeton (2001)

Friedman, A., Shen, W.: A variational inequality approach to financial valuation of retirement benefits based on salary. Financ. Stoch. 6(3), 273–302 (2002)

Glasserman, P.: Monte Carlo methods in financial engineering. Springer (2003)

Longstaff, F.A., Schwartz, E.S.: Valuing American options by simulation: a simple leastsquares approach. Rev. Financ. Stud. 14(1), 113–147 (2001)

Milevsky, M.A., Posner, S.E.: The Titanic option: valuation of the guaranteed minimum death benefit in variable annuities and mutual funds. J. Risk Insur. 68(1), 93–128 (2001)

Moreno, M., Navas, J.F.: On the robustness of least-squares Monte Carlo (LSM) for pricing American derivatives. Rev. Deriv. Res. 6(2), 107–128 (2003)

Shen, W., Xu, H.: The valuation of unit-linked policies with or without surrender options. Insur. Math. Econ. 36(1), 79–92 (2005)

Stentoft, L.: Assessing the least squares Monte Carlo approach to American option valuation. Rev. Deriv. Res. 7(2), 129–168 (2004)

Stentoft, L.: American option pricing using simulation and regression: numerical convergence results. In: Cummins, M., Murphy, F., Miller, J.J.H. (eds.) Topics in Numerical Methods for Finance. Springer Proceedings in Mathematics & Statistics 19, pp. 57–94 (2012)

Wilmott, P., Dewynne, J., Howison, S.: Option pricing: mathematical models and computation. Oxford Financial Press (1993)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Bacinello, A.R., Millossovich, P., Montealegre, A. (2014). A Comparison Between Different Numerical Schemes for the Valuation of Unit-Linked Contracts Embedding a Surrender Option. In: Corazza, M., Pizzi, C. (eds) Mathematical and Statistical Methods for Actuarial Sciences and Finance. Springer, Cham. https://doi.org/10.1007/978-3-319-02499-8_3

Download citation

DOI: https://doi.org/10.1007/978-3-319-02499-8_3

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-02498-1

Online ISBN: 978-3-319-02499-8

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)