Abstract

In June 2014, General Secretary Xi Jinping remarked at a conference of the Communist Party of China’s (CPC) Central Leading Group for Financial and Economic Affairs Commission that a revolution in energy production and consumption was needed to safeguard national energy security. New patterns in supply and demand, compounded by changing trends in international energy development, were presenting China with opportunities to develop and drive a new energy era.

DRC Team Lead for the Overview:

Xu Zhaoyuan, Research Department of Industrial Economy, DRC of the State Council of China.

Shell Team Lead for the Overview:

Mallika Ishwaran, Global Business Environment, Shell International B.V.

Contributors:

Zhou Yi, Research Department of Industrial Economy, DRC of the State Council of China.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

In June 2014, General Secretary Xi Jinping remarked at a conference of the Communist Party of China’s (CPC) Central Leading Group for Financial and Economic Affairs Commission that a revolution in energy production and consumption was needed to safeguard national energy security. New patterns in supply and demand, compounded by changing trends in international energy development, were presenting China with opportunities to develop and drive a new energy era.

In December 2016, the Chinese government published its Energy Production and Consumption Revolution Strategy (2016–30), which set out the specific actions needed to promote the energy revolution that President Xi had referred to. In October 2017, the report of the 19th CPC National Congress noted that:

Socialism with Chinese characteristics has crossed the threshold into a new era. China’s economy is transitioning from a phase of rapid growth to a stage of high-quality development.

China must put quality first and prioritise performance; and China should make supply-side structural reform its main task and work hard to achieve better quality, higher efficiency, and more robust drivers of economic growth.

The new era provides a new background and poses new requirements for China to deepen its study of the energy revolution. Global practices show that all countries have undergone an energy transition in the course of their development, albeit along different paths. From the perspective of the global energy system as a whole, the current energy transition towards a greener and more sustainable energy system is significantly different from the energy transitions of the past.

China needs to learn from other countries’ practices in promoting energy transition. It must keep up with the latest trends in global energy transitions, take account of the needs of economic, social and environmental development in China, vigorously develop energy technologies, and conduct an in-depth study on how to achieve China’s energy revolution.

1 Global Energy Transitions: Historical Experience and the Latest Trends

The energy system is comprehensive in scope, integrating energy production, conversion, transmission, consumption and management into a single system.

Energy transition is a long-term structural change to the energy system, where entirely new components arise or old patterns fundamentally change. The energy system is in a constant state of evolution. For example, China’s and India’s energy systems have been organised to date around low-cost energy; France’s transition to nuclear power in the 1970s was driven by the desire for security after the oil price shocks of that decade; and Germany’s energy transition in the 2010s was propelled by the desire for clean energy. Transition also occurs when new end uses require new forms of energy. For example, the development of electric vehicles changes the transport industry’s demand for oil into the need for electric power.

1.1 Energy Demand Changes with Economic Development

Countries generally go through an energy transition as they develop. Energy demand can be divided into three broad categories (Fig. 1). In the first category, countries with an income per person of less than $5,000 in purchase power parity (PPP) have less economic development and therefore low energy consumption. Second, countries with an income per person of between $5,000 and $15,000: as these countries industrialise, energy demand growth accelerates due to the high energy intensity of industrialisation, urbanisation and large-scale infrastructure construction. And third, countries with an income per person of more than $15,000: once these countries have industrialised, the growth rate of energy demand starts to slow down.

While there is a general trend of energy transition that countries go through as they develop, national experience shows that the energy demand path that a country follows can vary significantly.

The USA and Canada are typical examples of high-income countries with high energy consumption. As Fig. 2 shows, the USA and Canada rapidly increased their energy consumption per person between 1960 and the late 1980s, during which time income per capita doubled. This rapid increase in energy consumption was the outcome of fast growth in energy-intensive industries and high domestic energy consumption. Energy consumption in the transport sector was high due to both countries’ low population densities. Since the late 1980s, incomes continued to grow, albeit more slowly, while energy consumption was relatively flat.

Japan and major European countries experienced a slower increase in energy consumption than the USA and Canada. These countries have reached similar levels of income per capita as the USA and Canada, but with around half the level of energy consumption per person. In addition to having more light industry and less transport demands, these economies generally focus more on energy efficiency, often driven by policy. Spain and Italy have lower energy use per person than other developed economies. This is because they are more service-oriented, with fewer energy-intensive industries and a Mediterranean climate that reduces the need for heating and cooling relative to other countries.

The data for Australia, South Korea and Sweden show how countries with energy-intensive industries can have higher energy consumption. These three countries form a cluster between the USA and Canada, which have high energy consumption, and Japan and major European countries, which have lower energy consumption, as shown in Fig. 2. This is because although Australia, South Korea and Sweden have large energy-intensive industries, they are more energy efficient than the USA and Canada. Australia has built an energy-intensive industrial system on its extensive natural resources, primarily non-ferrous metals, iron and steel, mining and chemicals. It also has a high transport energy use per person due to its low population density and large size. South Korea is an example of a country that has increased GDP per capita through high-value industrialisation, despite not having domestic energy resources. Sweden is somewhat unique as its energy use is increased by a large pulp and paper industry, which is very energy intensive, and a very high level of energy use in buildings for heating.

1.2 Previous Global Transitions in Energy Supply

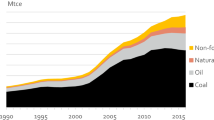

The global energy system undergoes transitions. There have been three global energy transitions since 1800 (Fig. 3). The first was the rise of coal to fuel the Industrial Revolution; the second was the use of oil for mass transport; and the third was the rise of gas, hydropower and nuclear power in electrification. In recent years, a fourth energy transition has begun with the use of renewables to provide clean and sustainable energy.

History shows that rising societal demand for energy and advances in technology can lead to global energy transitions. For example, energy supply shifted from traditional biofuels to coal in the 19th century to fuel industrialisation in the UK and other countries in Europe. After the oil price shocks in the 1970s, many countries needed to secure energy supply, stimulating the transition from oil to gas and nuclear power in electricity. Since the beginning of this century, demand for clean energy is also driving an energy transition. Transitions also occur when significant improvements are made in energy technologies or when new energy carriers offer the flexibility of providing a range of increasingly sophisticated services and end uses, as electricity does for buildings and industry.

1.3 Energy Technologies are Undergoing Significant Change

New energy and information technologies are developing rapidly and having a significant impact on energy production and consumption.

1.3.1 The Cost of Clean Energy Technologies is Declining Rapidly

Since the early 2010s, the cost of renewable energy technologies such as wind and solar have fallen by more than half. Lithium-ion batteries, which have the potential for use in the transport and power sectors, have also seen similar cost reductions (Fig. 4).

Note Cost does not include subsidies. *The calculated cost of solar energy is based on utility-scale monocrystalline silicon solar panels. Source The cost data of wind and solar energy are from Lazard (2016), while the **cost data of batteries are from Bloomberg New Energy Finance (2017)

The cost of many clean energy technologies is declining rapidly.

1.3.2 New Information and Communications Technologies (Digitalisation) are Increasingly Being Used in the Energy System, with Several Important Implications

To begin with, digitalisation increases the demand-response potential for electricity. According to International Energy Agency (IEA) forecasts, digitalisation could increase global electricity demand-response potential from 3,900 terrawatt-hours (TWh) in 2015 to 6,900 TWh in 2040, up 77%. This level of demand-response can free up some 185 GW of generating capacity and reduce the need for investment in new generation, transmission and distribution on a cumulative basis by $270 billion (calculated in 2016 $).

Second, digitalisation has improved the flexibility of the power system to integrate renewable energy. For example, the IEA estimates that digitalisation and demand-side response technologies can limit total wind and solar power curtailment to less than 1.6%. By 2040, total wind and solar curtailment will be 79% lower than in 2015. This will enable the global power system to accommodate 67 TWh of new renewable energy annually by around 2040 and avoid about 30 Mt of CO2 emissions per year.

Third, digitalisation can help improve electrification in the transport sector. Smart charging of electric vehicles can greatly reduce the demand for power generation. With the added flexibility that smart charging provides to power grids, investment in grids can be reduced by $100 to $280 billion by 2040 (in 2016 $).

Fourth, digitalisation may affect the energy use and consumption patterns of manufacturing. Industry 4.0—the trend towards greater use of automation and data exchange—will have a significant impact on energy demand. As shown in Fig. 5, the adoption of 3D printing in US commercial aircraft manufacturing can reduce energy use in production and in flight, thanks to the use of more lightweight components.

1.4 Main Characteristics of the New Global Energy Transition

The global energy system is undergoing a major transition, after a period of relative stability. Before 1985, the energy systems of the G7 countries experienced significant changes as a result of oil price fluctuations, the discovery of new oil and gas reserves, the emergence of new energy carrier networks and the development of new technologies like nuclear power. However, the global energy system has been relatively stable over the past 30 years, with little change in the energy mix of the G7 countries (Fig. 6). Over the next 30 years, digitalisation, new technologies, decarbonisation, more stringent environmental requirements and new forms of economic activity are expected to transform the energy system.

1.4.1 Clean and Low-Carbon Energy are Driving the New Global Energy Transition

The unprecedented attention paid by countries to climate change and environmental protection, along with increasing consumer demand for cleaner energy services, is driving the global transition to clean and low-carbon energy.

Compared with previous drivers of energy transition, climate change is a global concern, the solution to which requires the engagement of all countries. Both energy consumption and CO2 emissions per unit of GDP are now declining. There is a sign that energy consumption and CO2 emissions have been decoupling from economic growth increasingly rapidly since 2010. The Paris Agreement of 2015 shows that the world is paying more attention to climate change and strengthening its efforts to disconnect CO2 emissions from economic growth. In this respect, the European Union is in a leading position, with GDP increasing by 50% between 1990 and 2015 and CO2 emissions dropping by more than 20% over the same period. The USA and Japan have also remained generally stable in CO2 emissions (Fig. 7), but the USA’s withdrawal from the Paris Agreement and President Trump’s new energy policies bring some uncertainties.

1.4.2 Significantly More Electrification Characterises the New Global Energy Transition

To achieve the ambitions of the Paris Agreement, more electrification is required to decarbonise the global economy. This process is accelerating in the major economies, especially in transport. Figure 8 shows growth in electric car registrations in several countries over recent years. Electric vehicles remain an important area of growth, despite their current small market share (except in some Nordic countries).

Economic restructuring is also driving electrification. As developing countries like China move towards a service-oriented economy, and consumers are keen to get cleaner and more flexible types of energy, such as gas and electricity, electrification continues to increase. During the current energy transition, this trend has become more and more obvious—emerging economies such as China and Brazil have achieved higher levels of electrification at a lower level of per capita income—and is expected to continue (Fig. 9).

1.4.3 Policy Plays a More Important Role in This Energy Transition

While policy has been a key driver of previous energy transitions, the scope of the policy challenge this time is vast. This is because the goal of the new transition is to promote the development of clean and renewable energy. To level the playing field, the negative environmental effects of fossil fuels, such as air pollution and carbon emissions, compared to the positive environmental effects of clean energy, must be reflected in economic decisions. Policy interventions are needed to rectify the economic distortions caused by such market failures. In addition, the introductory and growth periods of new energy need support policies. Due to the complexity of the energy system, the energy transition must use market forces to promote innovation and find effective and flexible ways to deliver desired goals. Many governments have realised this and are taking measures to ensure market failures are corrected. Figure 10 shows the countries that have implemented, are about to implement, or are considering implementing carbon pricing (in the form of a carbon tax or emissions trading system).

1.5 Developing and Emerging Economies Can Leapfrog Ahead

International experience shows that while there is a general route for countries to follow in energy transition as they develop, the path that a country takes can vary significantly, depending on its economic structure, improvements in energy efficiency, consumption patterns, population density and climate, among other things.

Countries such as China, Brazil and Malaysia are at a crossroads. Their path to energy transition may diverge from international experience. These countries need to choose between the energy development paths available to them: whether to have a level of energy consumption per person similar to that of the USA (high), South Korea (medium) or Spain (low) as income per capita increases. Alternatively, they can use policy to leapfrog historical patterns of energy system development to achieve high income per capita and lower and cleaner energy consumption.

By leveraging advanced technologies and learning from, then adapting, the policies and institutional frameworks of other countries, developing and emerging economies can achieve lower energy consumption and greenhouse gas emissions per capita earlier than high-income countries (as shown in Fig. 11). Developing and emerging economies have the potential to provide advanced energy services without the negative environmental impact that advanced economies have had, and they can exploit their late-mover advantage in the growing global market for energy services.

2 From Quantity to Quality: The Goal and Approach of China’s Energy Revolution

2.1 The Goal of China’s Energy Revolution

In 2015, China’s 13th Five-Year Plan (2016–20) proposed to empower low-carbon cyclic development by promoting an energy revolution, accelerating energy technology innovation, and setting up a clean, low-carbon, secure and efficient energy system. In 2017, the report of the 19th National Congress of the Communist Party of China noted that China’s economy has moved from a phase of rapid growth to one of high-quality development. China, it said, must focus on improving the supply system and strengthening the economy in terms of quality. Quality energy is an important part of the supply system and a key objective of the energy revolution.

2.1.1 What is a High-Quality Energy System?

Based on the 13th Five-Year Plan, the report of the 19th National Congress of the CPC and development strategies such as Made in China 2025 state that China’s high-quality energy system should feature the following three characteristics:

First, it should be clean and low carbon. A clean energy system is one in which the entire energy life cycle—from production and conversion to transmission and consumption—achieves the lowest possible levels of pollution and emissions. Low carbon is a key part of this. CO2 itself is not a polluting gas, but it has significant impacts on the environment. Moreover, the Chinese government has made a solemn commitment to the international community, as part of its nationally determined contributions, to reduce global carbon emissions. The energy system is the largest carbon emitter, so low carbon is undoubtedly an important characteristic of a high-quality energy system.

Second, it should be efficiently priced and affordable. Affordability means that the price of energy should be competitive internationally to allow manufacturing to compete with global manufacturing powers like the USA, Japan and Germany. China is now in an important period of making itself a manufacturing power. Energy cost is a key element of the real economic cost, so a high-quality energy system should be able to supply energy at a competitive price. Efficiency means that existing technologies should be leveraged in energy production, conversion, transmission and consumption to save energy and improve efficiency.

Third, it should be secure and reliable. Secure means that energy sources are diverse and that they ensure a stable supply for economic development, even during natural disasters or times of geopolitical change. Reliable means that as the amount of renewable energy increases, the energy system has the flexibility to adapt and maintain a sustainable and stable energy supply for the national economy.

2.1.2 Three Characteristics of the Energy Revolution

(1) Clean and low carbon

According to research by the Institute of Resources and Environmental Policy of the Development Research Center of the State Council, total emissions of major air pollutants in China are likely to peak during the 13th Five-Year Plan (2016–20), after which the country’s energy system will be much cleaner. Total inhalable particulate matter (PM10) emissions have been declining since the 1990s. Sulphur dioxide emissions reached their highest point in 2006, and have since declined steadily. Nitrogen oxide (NOx) emissions dropped for the first time (in 2012) since reliable databases were established and are expected to flatten, then fall. The research initially concludes, therefore, that air pollutant emissions have reached a turning point. Combined emissions of major water pollutants are estimated to peak in 2016–20, then flatten, flowed by a gradual decline.

In terms of CO2 emissions, more effort is needed to achieve a turning point by 2030. According to the Energy Production and Consumption Revolution Strategy (2016–30), by 2020, China’s CO2 emissions per unit of GDP will decrease by 18% compared to 2015, and by 2030 they will drop by 60–65% compared to 2005. The findings of this report show that to achieve the goal of carbon intensity reduction, additional policies and measures—including carbon pricing and subsidies for non-fossil energy sources—need to be gradually introduced to achieve tangible results.

In terms of the energy mix, the share of clean energy should increase significantly. According to the Energy Production and Consumption Revolution Strategy (2016–30), the share of non-fossil energy in China will be 15% by 2020, increasing to about 20% by 2030. In the Recommended scenario of this report, in which the energy revolution is strongly promoted, the share of non-fossil energy is expected to reach 15.7% by 2020, 22.5% by 2030, and more than 40% by 2050.

(2) Affordable and efficient

According to the above-mentioned strategy, energy consumption per unit of GDP is expected to drop by 15% by 2020 (compared to 2015), reach the current world average by 2030 (based on current prices), and achieve stability by 2050.

In the Recommended scenario of this report, energy consumption per unit of GDP will be 19.7% lower in 2020 than in 2015. This exceeds the 15% reduction target of the Energy Production and Consumption Revolution Strategy (2016–30). Energy intensity in 2030 will be 35.1% lower than in 2020, and 54.1% lower in 2050 than in 2030 (Fig. 12).

Energy cost per unit of GDP, which reflects the quantity and price of energy consumed to produce a unit of GDP, needs to be reduced significantly. Energy consumption per unit of GDP is an indicator of energy consumption efficiency but does not take price into consideration. In fact, energy price has an obvious impact on economic and social development. On the one hand, the price of energy can incentivise the whole economy and society to save energy. On the other hand, it constitutes a major cost to the real economy. To sharpen China’s international competitive edge, energy cost per unit of GDP should be significantly lower.

Historical statistics show that China’s energy cost per unit of GDP has followed an inverse U-shape path. It increased rapidly from 0.1 in 1990 to 0.18 in 2005, up by 80%. It then peaked around 2005 and decreased to 0.12 in 2012.

The current energy cost per unit of GDP in China is comparable to that of South Korea, but notably higher than the USA and Japan. South Korea’s energy cost per unit of GDP in 2011 was 0.18, slightly higher than China’s. But the figure in Japan is only 0.09 and 0.08 in the USA, about 66% lower than in China. Since 2011, energy cost per unit of GDP in the USA declined rapidly, down to 0.04 in 2016 (Fig. 13).

(3) Secure and reliable

Energy supply sources should be diverse. To achieve energy supply diversity, China should develop new and unconventional energy sources domestically by leveraging its own energy resources and reducing the use of coal, while increasing the share of clean coal facilities in its fleet of coal-fired power plants. Externally, China should seize the opportunities of economic globalisation and diversify its international energy supply sources, by increasing imports of oil and gas from regions other than the Middle East to spread risk and secure supply.

The reliability of the energy system should be improved. Efforts should be made to:

-

(i)

promote Internet+ smart energy development and establish an Energy Internet by 2025;

-

(ii)

build smart wind farms and smart solar photovoltaic power plants; a smart system for the recovery, processing and use of coal, oil and gas; and a cloud-based platform to enable intelligent energy production;

-

(iii)

deploy grid-scale energy storage of appropriate size at large-scale power generation sites to coordinate and optimise the operation of energy storage systems, renewable energy sources and power grids;

-

(iv)

build smart homes, smart buildings, smart communities and smart factories, featuring smart end-use technologies and flexible energy trading to help create smart cities; and

-

(v)

strengthen demand-side management, popularise intelligent energy consumption metering and diagnostic technologies, accelerate the deployment of energy management centres for industrial companies, and build an Internet-based information service platform.

2.2 To Achieve the Energy Revolution, China Needs to Get Five Driving Forces into Play: Four Pillars and International Cooperation

To achieve an energy revolution requires identifying, guiding and strengthening the driving forces behind it. Analysis of energy transitions in G20 countries since the 1970s shows that the drivers of energy transition include four pillars and international cooperation. Often several drivers must be in place before transition can develop momentum. Individually, these drivers are insufficient to start the process of systemic change. The G20 energy transitions were driven mainly by economic growth, energy security concerns, new market incentives or price shocks, with new technology playing a supporting role. They occurred primarily in the upstream and midstream sectors, with the energy mix remaining relatively constant (Fig. 14).

Supply

Historically, the abundance or scarcity of local energy resources is a fundamental driver of transition. The greatest transitions occur at the extremes, either when resources are plentiful or extremely scarce. In the current transition, technology is making unconventional and renewable energy resources increasingly available and competitive, and doing so in geographies that do not have access to conventional resources.

Demand

Rapid economic growth is usually accompanied by a change in industrial structure, often to higher added-value economic activities that favour a new energy mix based on natural gas and renewable electricity. Furthermore, consumers tend to choose cleaner and more flexible fuels as their income rises. This is a major trigger of energy transition, especially when accompanied by new low-cost supplies of energy. Energy security is also an important driver. For example, the oil crisis of the 1970s and the shutting down of Japan’s fleet of nuclear power plants following the Fukushima tsunami and nuclear accident in 2011 increased people’s awareness of the need for energy security, resulting in significant energy transition events.

Technology

Many energy technologies like nuclear power require vast investment in research and development. Once deployed, such technologies can transform the energy system through scale effects. International experience shows that government deployment of capital-intensive technologies is a common way to deliver energy system requirements such as supply security. Technologies that can plug and play into existing networks tend to be more successful than those requiring new networks to be built, thereby contributing more to the energy transition.

Markets

Markets have an important role to play. They can accelerate the process of innovation and adoption of new technologies through liberalisation and reform. Governments also have an important role to play. They can ensure markets operate efficiently through pricing externalities and regulatory oversight. Policies and institutions that increase the efficiency of markets like market liberalisation and reform can help the energy transition progress faster.

International cooperation

An increase in a country’s participation in global energy trade can also trigger an energy revolution. For example, new gas pipelines or liquefied natural gas (LNG) infrastructure could increase trade in natural gas. New technologies and infrastructure can deepen international cooperation and have a transformational impact on future development. For example, extra high voltage power transmission enables long-distance power trade between countries.

2.3 Accelerating the Energy Transition Requires Four Intensifiers

Once the drivers for transition are in place, positive feedback loops (intensifiers) can accelerate transition or increase its scale. Our review of historical transitions concludes that while the four pillars and one cooperation can provide the necessary conditions for a transition and the momentum for change, these drivers only cause real transition when reinforced by positive feedback (intensifiers). Policymakers can often directly influence these intensifiers and should use them to control the speed and scale of transition (Fig. 15).

Preferences cause society to act

Transition can be accelerated and intensified if people’s preferences are influenced by the belief that energy transition is good. The reason is simple: when some people think something is good or bad, they can influence or persuade others, which can cause their preferences to spread. This creates a positive feedback loop, which makes the next action easier. Value preferences about what society should or should not be doing have been powerful forces in past energy transitions. For example, Japan and France’s embrace of nuclear power was a signifier of a technologically advanced society, whereas Germany’s anti-nuclear movement saw the same technology as an environmental threat.

Expectations cause consumers to act

Expectations are also an intensifier: as more and more people expect transition to happen, they will act as if it is already happening. As with preferences, when people expect the world to change they will act accordingly and convince others that it will change. This creates a positive feedback loop. An expectation describes what is likely to happen, while a preference is a view about what ought to happen. For example, a person can expect something to happen even if he or she has no preference for it. Consumer expectations were important in past energy transitions, as it is consumers who select and purchase the products they expect to serve them best in the future. For example, consumers in the present transition may purchase an electric vehicle in expectation of future climate policies and legislation.

Private economics cause businesses to act

Energy transition may improve the private economics of businesses through positive spillover effects, which encourage further action. Businesses will act if it creates value for them, or if the benefits from energy transition are greater than the cost. When businesses take action this can change the private value of future action via externalities, positive spillovers or complementary goods. For example, the cost of wind power decreased as deployment increased due to the positive spillover of learning effects. Because action now increases the net private value of future action, this encourages future action, which then further increases the net private value of future action, creating a positive feedback loop.

Public good causes government to act

Government tends to act if the economics or the politics of the transition improve.

If energy transition generates value for society, it will win the public’s backing, and in turn it can generate national political support or directly drive policy action. International political support can also modify national political support. For example, the Paris Agreement and the International Energy Agency have affected national political support for climate action and energy security respectively.

During energy transition, there is a strong positive feedback loop between private economics and the public good. As Fig. 16 shows, private economics and the public good are closely interrelated. If private actions by businesses can have positive externalities, such as reducing carbon emissions, or negative externalities, such as pollution, then government action will increase net private value, thereby creating an additional feedback loop between public and private action in a virtuous and reinforcing cycle.

The four intensifiers of the transition come together to accelerate and scale change. As Fig. 15 shows, social preferences, consumer expectations, the private economics of businesses and the public good all contain positive feedback loops that can intensify the motivation to act. Furthermore, these all work together so that if, for example, social preferences are causing people to act in a way (such as demanding low-carbon energy and related products and services) that makes a particular investment more valuable, then businesses will act. This, in turn, may create political conditions and support for government actions intended to promote energy transition.

2.4 Policy Plays a Crucial Role in Effectively Leveraging the Drivers and Intensifiers of Energy Transition

Compared with previous transitions, the current energy transition is more complex and has stronger externalities. For example, in the current transition the increasing complexity of a diverse and decentralised power sector requires system-wide change to drive down the cost of renewables and integrate them effectively into the power grid. The need for change affects the entire power value chain—flexible low-carbon generation, dispatch, balancing and ancillary services, transmission and distribution networks, and consumer participation in retail markets through mechanisms such as demand-response to prices—and the incentives to support a more flexible and complex system.

In this case, policy plays a crucial role in supporting the drivers of transition. For example, policies help shift energy demand to cleaner and more efficient end uses, support a cleaner energy mix, develop efficient market mechanisms, stimulate innovation in clean and efficient technologies, and support national energy transition by leveraging international energy cooperation and governance.

Policies accelerate transition by giving the intensifiers momentum. As shown in Fig. 17, given the policy-directed nature of the current transition, government must take action to address environmental market failures, encourage change in consumer behaviour (and in broader society) and prompt businesses to invest in new low-carbon technologies. For example, subsidies or other policy tools could be offered to improve businesses’ risk-return structure.

In short, policy plays a crucial role in energy transition. Perhaps a more important role for policy than giving the intensifiers momentum is keeping the rate and scale of change in social preferences, consumer expectations, private economics and the public good in sync as energy transition happens.

3 Adopt Multiple Measures: A Roadmap for China’s Energy Revolution

3.1 Continuously Improve Energy Consumption Efficiency by Saving First

3.1.1 Optimise China’s Industrial Structure by Reducing the Proportion of Energy-Intensive Industries

As China’s economic development enters the later stages of industrialisation, there is a drive to upgrade the country’s industrial structure, which, together with guiding policies, may lead to cleaner and more environmentally friendly industries.

It can be seen from the demand structure of investment, consumption and export that the share of investment in economic growth gradually declines as the share of consumption steadily grows. In this way, China is undergoing a shift from production-driven to consumption-driven economic growth, leading to accelerated industrial restructuring.

Moreover, there is great potential for adjusting the energy consumption mix.

First, with mechanisation at saturation point, agricultural modernisation will shift focus to biotechnology and digitalisation, which is expected to further reduce the energy consumption per unit of added value (Fig. 18).

Second, optimisation of the country’s industrial structure and changes to production processes will significantly improve the efficiency of industrial energy consumption. Starting with the 13th Five-Year Plan (2016–20), the amount of energy-intensive products—such as steel, cement, glass, aluminium and synthetic ammonia—has begun to peak and may drop.

Third, energy consumption in buildings is expected to grow steadily. Based on the experience of developed countries, China’s urban residential floor space per person is likely to peak at about 40 square metres and public floor space per person at about 20 square metres. Estimates based on future population trends show that the floor space peak in China should remain at about 90 billion square metres.Footnote 1 To ensure steady and sustainable development of the real estate industry, the peak should occur around 2040. However, with the development of energy-efficient buildings, energy consumption per unit of building area will be significantly reduced, even though the total energy consumption of buildings in China is expected to increase steadily.

Fourth, energy consumption in the service sector is expected to continue to grow as it scales up, but will be constrained by the total stock of commercial floor space. Based on forecasts of added value in the service sector and commercial floor area, end-use energy consumption will increase to 350 Mt of coal equivalent (Mtce) by 2035 and 470 Mtce by 2050.

Fifth, residential end-use energy consumption will continue to grow, but could remain significantly lower than that in developed countries. With people’s living standards improving, household energy consumption is expected to reach 520 Mtce by 2035 and 660 Mtce by 2050.

3.1.2 Use New Technologies, Processes and Products to Save Energy

Efforts should be made to promote the development of green and low-carbon buildings. In China, energy consumption in buildings accounts for nearly half of the country’s total energy consumption, far higher than that of developed economies.

Government ministries and agencies introduced a series of plans, including the 12th Five-Year Plan for Developing Green Buildings and Eco-Cities (2012–17). However, further improvements in green building systems and standards and increased R&D of green building technologies and life cycle management of green buildings are required. Technology innovation in green buildings is currently focused on lighting and heating. Energy-efficient lighting is one of the most effective ways to reduce greenhouse gas emissions from buildings in almost all countries. The Roadmap for the Phase-out of Incandescent Lamps in China, issued by the National Development and Reform Commission (NDRC), banned the import and sale of incandescent lamps of 15 W or more from October 2016. If all existing incandescent lamps are replaced with energy-efficient lamps, 48,000 GWh of power would be saved annually, equivalent to a reduction in CO2 emissions of 48 Mt. It is estimated that China’s cumulative newly built urban residential areas will exceed 5 billion square metres by 2020, and that the newly added energy consumption from heating in north China (the coldest part of the country) will be about 125 Mtce. If heating from renewable sources is deployed in all these new residential areas, the resulting reductions in CO2 emissions would be 375 Mt.

Centralised coal-fired power generation and coal-fired combined heat and power (CHP) should be increased to save energy and reduce emissions. Currently, centralised coal-fired power generation at large power plants accounts for only 48% of total coal consumption in China, compared to 99% in the USA. The extremely large number of distributed, small-scale coal-fired facilities in China, which do not have the capability to treat pollutants, offers great potential for energy saving and emissions reduction. China needs to take several measures to significantly shift coal use from small-scale to large-scale centralised generation. This will reduce pollutant emissions from coal combustion and improve the heat to electricity conversion efficiency of coal.

3.1.3 Introduce Carbon Pricing to Improve Energy Consumption Efficiency

Carbon pricing can have a significant energy saving effect as it increases the cost of fossil fuels and causes a shift in the energy mix towards lower-carbon fuels. The increase in the price of energy will also drive energy efficiency and reduce total energy consumption—as the carbon price goes up, total energy consumption will decrease. In the policy scenarios of $30 per tonne CO2 equivalent (tCO2e), $60/tCO2e and $90/tCO2e, total energy consumption will be 7.4%, 14.0% and 19.4% lower respectively than in the zero-carbon-tax scenario. Furthermore, the effects of carbon pricing policy will become significant over time.

3.2 Enable Cleaner Energy Consumption by Using Less Scattered Coal and by Increasing Electrification

3.2.1 Substitute Electricity and Gas for Scattered Coal

In 2015, China’s scattered coal consumption reached 617 million tonnes (Mt), mainly used in coal mining (120 Mt), household heating (93 Mt) and chemical production (90 Mt). A further 260 Mt of scattered coal was used by light industries—food, textiles, equipment manufacturing and services.

To replace scattered coal in residential heating, China will encourage central heating (gas-fired boilers, geothermal heating and waste heat recovery) and increasingly substitute electricity and gas for scattered coal (such as wall-mounted gas-fired heaters) in areas where central heating is not possible. The measures for substituting electricity and gas for scattered coal in the industrial and commercial sectors include replacing small coal-fired boilers with gas-fired boilers or installing waste heat recovery or other intensive heating methods. According to the Energy Production and Consumption Revolution Strategy (2016–30), more than 35% of scattered coal will be replaced by 2020 and about 70% by 2030. In this way, scattered coal consumption will decrease to 400 Mt in 2020, 180 Mt in 2030 and 60 Mt in 2050.

3.2.2 Speed Up Electric Vehicle Development to Promote Clean Energy Consumption

In the Recommended scenario, the number of registered electric vehicles (EV) in China will reach 3 million in 2020, 80 million in 2030 and 270 million in 2050. However, the industry’s current strong momentum indicates the possibility of faster development.

First, there is a global boom in EV R&D, mainly around such critical technologies as batteries, automated driving systems and charging facilities. New concepts in leasing, business models and financial services are expected to accelerate developments in the EV market.

Second, as artificial intelligence technologies evolve, automated driving +EV is expected to become a standard travel model in the future, extending vehicles from a travel tool to a home on wheels. This new way of travelling can speed up the transition from conventional vehicles to EVs in the medium and long terms.

Third, EVs can serve as both a means of transport and a distributed energy storage facility. With expanding battery (energy storage) size and support from smart grid technologies, EVs can make the most of renewable energy and support its long-term development.

To this end, and based on its findings in the Recommended scenario, this report proposes an Accelerated development scenario in which we investigate energy demand in transport and its impact on China’s energy supply mix. EV development scenarios are set up as follows (Table 1).

Estimates for vehicle energy consumption in the Accelerated scenario are shown in Fig. 19. They assume vehicle ownership remains unchanged and newly added EVs replace mainly diesel and petrol vehicles and do not affect the number of natural gas-fuelled vehicles. Petrol and diesel consumption are expected to decrease by 100 Mt by 2030 and by 130 Mt by 2050. Meanwhile, electricity demand is projected to increase by 200,000 GWh by 2030 and by 340,000 GWh by 2050, compared to the Recommended scenario.

3.2.3 Accelerate Electrification by Decarbonisation

In 2014, electricity accounted for nearly a quarter of China’s end-use energy demand. The country’s electrification rate is comparable to that of many OECD economies. As China’s society and economy develop, consumer demand for higher quality energy will grow, and technological and structural shifts will drive further change. Historical experience suggests that the electrification rate in 2030 will grow by 5.5% compared to 2015, thanks to higher incomes; and by 6.4% due to technological progress; but shrink by −2.6% as a result of economic restructuring. Together, these factors may lead the electrification rate to rise from 23% today to 32% by 2050.

Decarbonisation will further drive the process of electrification. The electrification rate is expected to increase by 5–10% due to accelerated EV development in the transport sector, by 2.5–5% from decarbonisation in construction projects, and by 0.5% from decarbonisation in industry, reaching more than 40% by 2050 (Fig. 20).

Through the rapid development of clean energy and the use of clean coal, the share of electricity in the end-use energy mix will gradually increase from 22% in 2015 to 30% by 2030 and to around 40% by 2050, significantly improving the electrification rate.

3.3 Develop a Clean Energy Production Mode Featuring the Efficient Development of Conventional Energy and a Combination of Centralised and Distributed Energy Systems

3.3.1 Increase the Proportion of Scientific Coal Capacity

Coal-dominated conventional energy will remain the main energy source in China, both now and in the longer term. To address the requirements of the energy revolution, production needs to be safe, efficient and sustainable. In mining, coal production will shift from extensive development to intensive, green production. In conversion, priority will be given to upgrading coal-fired generation from high to ultra-low emissions.

Taking into account the geology, coal reserves, water resources and ecology of China’s coal-producing regions, the one-third of coal mines that meet the criteria for scientific capacity will be retained, the one-third that fail to meet the criteria will be upgraded, and the one-third that are backward or not possible to be upgraded will be gradually shut down.

3.3.2 Maintain Steady Development of Oil Supply Capacity

Although EV development can significantly reduce future oil demand, in the Recommended scenario China’s oil demand and oil processing capacity peaks will exceed 650 Mt and 720 Mt respectively in 2030. Even in 2050, China’s oil demand will still be around 650 Mt. Currently, China’s oil processing capacity has been close to its peak, so it is necessary to continue to constrain total demand and accelerate the shift from oil refining to chemical production.

3.3.3 Significantly Increase Gas Supply Capacity

In the future, China’s natural gas demand is expected to see fast growth. To ensure that demand can be met, which will increase as gas is substituted for scattered coal, supply capacity must be significantly improved. It is forecast that 260 billion cubic metres (bcm), 450 bcm and 490 bcm of natural gas will be needed by 2020, 2030 and 2050 respectively.Footnote 2 Therefore, China needs to vigorously explore and exploit conventional gas, tight gas, shale gas and coalbed methane, and drive research forward into natural gas hydrate exploitation technologies.

3.3.4 Develop Clean Energy (Mostly Renewable Energy) in a Well-Planned Manner

China’s clean energy sources and load centres are located in west and east China respectively. As the energy supply revolution progresses, the development of clean energy in these two regions should be coordinated.

First, there needs to be coordination between renewable energy generation and transmission and distribution networks to connect regions rich in renewables to demand centres, provide energy storage to manage intermittency, and optimise demand (including the use of demand-side response to manage peaks and intermittency).

Second, a mix of multiple sources of energy and technologies is needed to ensure a stable supply of electricity. These would include small wind farms; solar photovoltaic; combined cooling, heat and power plants; and others.

Third, collaboration across the entire electricity supply chain (generators, grid operators and consumers) is essential to optimise supply, distribution and consumption.

Fourth, in west China, energy should be generated at large utility-scale renewables plants and connected to national and regional transmission and distribution networks. In east and central China, generation should be smaller scale—distributed renewables and low carbon in microgrids or community power grids.

3.4 Gradually Establish an Energy Mix Centred on Conversion to Electricity

In the end-use energy mix, electricity’s share will progressively increase from 22% in 2015 to 30% by 2030, and then to around 38% by 2050. This electricity-centred energy mix is made possible mainly by the rapid development of clean power technologies and clean coal utilisation (Fig. 21).

3.4.1 Increase the Proportion of Renewable Energy (Mostly Wind, Solar and Biomass) and Nuclear Power

Based on an optimal design of the future power supply mix, the research team recommends the following roadmap for clean energy development:

-

the proportion of wind power and solar photovoltaic will increase from 4.9% in 2015 to about 15% in 2030 and more than 25% by 2050;

-

the share of gas-fired power will increase steadily from 3% in 2015 to 9% in 2030 and around 10% by 2050; and

-

although hydropower capacity will continue to grow, the rapid development of other power sources will lower its share of the energy mix from 17% in 2015 to 14% in 2030 and around 13.5% by 2050.

Overall, the proportion of clean power, not fuelled by coal or oil, will increase from 30% in 2015 to 38% in 2020 and 52% by 2030. By 2050, non-fossil fuel generation will increase to more than 70% of installed capacity and 66% of power output.

In the medium term, total consumption of coal as a primary energy source will not change greatly, but its share of energy supply will decrease sharply. The energy supply revolution will drive the shift from direct coal use to its conversion into an electricity-oriented secondary energy source of efficient and clean coal utilisation.

3.4.2 Encourage the Substitution of Non-fossil Fuel Energy for Oil and Coal

Coal consumption will fall sharply from about 44% in 2015 to 27% by 2050. Oil consumption will first increase and then decrease, returning to its current share of around 16% at mid-century. Natural gas, which is a cleaner energy source than coal and oil, will enjoy rapid growth in the medium term, rising to 15% in 2030 and staying stable thereafter. Non-fossil fuel energy will increase substantially, rising to more than 20% in 2030 to replace oil as the second-largest energy source. By 2050, non-fossil fuels’ share of the energy mix will be more than 40%, replacing coal as the number-one energy source (Fig. 22).

3.5 Build an Internet+ Intelligent Energy System

Internet+ is an intelligent energy system of the future that uses digitalisation to integrate a greater share of distributed renewables into the power system. It will need to incorporate micro-, community and regional grids and coordinate their activities into a greater, harmonised whole. It will use energy storage and demand-side response to manage solar and wind intermittency. And it will encompass a range of low-carbon energy sources and technologies (horizontal integration), as well as the various parts of the electricity value chain—generation, transmission, distribution and consumers (vertical integration). This will help manage the impacts of intermittency that distributed renewable energy systems can have on local grids and provide a feasible pathway for connection of distributed renewable energy at large scale.Footnote 3

3.5.1 Promote Intelligent Energy Consumption

The development of smart homes, buildings, communities and factories featuring smart meters and flexible energy trading should be encouraged to help create smart cities and leverage intelligent technologies to reduce residential energy consumption.

A smart energy system, through the use of smart grids and smart meters, should be developed to enable real-time measurement, information exchange and active control of energy consumption for electricity, heating and cooling. The implementation of such an intelligent and advanced measurement system will be enriched to enable remote, automatic and centralised acquisition and collection of water, gas, heating and electricity consumption data, thereby realising multi-meter integration. The networking structure and information interface of the advanced measurement system will be standardised throughout the whole system to achieve secure, reliable and fast two-way communication with all users.

Efforts should also be made to strengthen demand-side management and increase the use of intelligent energy consumption monitoring and diagnosis technologies. Additionally, the creation of energy management centres for industrial companies needs to accelerate and an Internet-based information service platform should be built, so that businesses can monitor and analyse energy consumption in each production process and intelligently dispatch water, electricity, gas and fuel whenever changes in production parameters are made. This will enable real-time monitoring, timely adjustment, automatic alarm and other functions throughout the production process (from procurement to use), thereby realising intelligent energy management and tapping energy saving potential.

3.5.2 Establish Micro-Balancing Systems that Allow Energy End Users to Participate in Energy Markets

Equipment, facilities and platforms need to be established to allow energy users—homes, businesses, industrial parks and communities—to participate in the energy market and provide balancing services to the microgrid or community grid to which they are connected. This would be in the form of, for example, behind-the-meter storage, electric vehicle batteries as storage, or demand-side response. It would promote flexible and interactive energy use, support distributed energy trading and feature multi-energy source integration, openness and sharing, real-time two-way communication and intelligent control.

3.5.3 Accelerate the Construction of Integrated Energy Network Infrastructure

An integrated energy network, based on the smart grid concept, should interconnect with other networks such as those for district heating or cooling, natural gas distribution and various transport networks. It would enable efficient conversion from one energy form to another, such as natural gas into heating or cooling, and allow centralised and distributed energy operations to be coordinated in a single smart system. Deployment would initially be made in new urban areas, new industrial parks, or in districts affected by air pollution. The objective would be to create a highly integrated energy system that provides flexible, controllable, safe and stable energy transmission.

3.5.4 Set up Internet+ Intelligent Energy Development

In 2017–20: (i) distributed power generation and storage technologies will be promoted and deployed at scale; (ii) the digital multi-energy trading system will go live; and (iii) pilot and demonstration projects featuring interconnectivity among various energy networks, energy sources and technologies will be launched.

In 2021–25: (i) optimisation across diversified energy carriers will be gradually made possible, and distributed power generation and storage systems widely deployed; and (ii) urban smart and diversified energy networks will be established to optimise energy from different sources and address various energy requirements.

In 2026–30: (i) new electricity microgrids and an interconnected non-fossil energy network that features multiple and complementary energy sources and technologies will be promoted and constructed across China; and (ii) an open and sharing smart energy ecosystem will take shape to significantly improve overall energy efficiency.

After 2030: (i) renewable energy will be widely used in such sectors as agriculture, industry, transport, commercial and residential; and (ii) the industry ecosystem supporting rapid and sound development of renewable energy will continue to fast-track renewable energy development.

3.6 Develop New Energy Technologies that Fully Support the Energy Revolution

3.6.1 Continuously Promote the Smart Power Grid

The smart power grid is an important means to integrate energy production and consumption, as well as new technologies and system revolutions. It is also the enabler of the Energy Internet. In April 2016, the National Development and Reform Commission (NDRC) and the National Energy Administration (NEA) published their Action Plan for Innovation in the Energy Technology Revolution (2016–30)Footnote 4 and their Roadmap for Major Innovation Actions in the Energy Technology Revolution,Footnote 5 which launched a plan to develop smart grid power transmission and smart end-user devices.

To develop a smart grid, China will: (i) strive to make breakthroughs in key technologies and core equipment that it currently imports from other countries, especially in the fields of direct current, power electronics and renewable energy; and (ii) develop a national and industry standards system for smart grids as soon as possible to support the building of smart grids.

3.6.2 Develop New Energy Technologies

In wind power, China will work to achieve breakthroughs in fields such as aerodynamics, flow field analysis, load calculation, as well as high-end technologies like large wind turbine design, wind turbine bearings, and wind farm control and pitch control systems. This will address the country’s current weakness in conducting basic research on wind power and critical wind power equipment.

In solar photovoltaic, China needs to significantly improve photovoltaic conversion efficiency and make breakthroughs in areas like interdigitated back contact, heterojunction with intrinsic thin layer cells, passivated emitter cells and rear cell technology, metallisation wrap through, bifacial modules and boost the efficiency of battery technologies.

In new energy technologies that have great potential in the short and medium terms—such as solar thermal power and ocean power—China will continue to develop demonstration projects to rapidly accumulate experience in planning, design, construction, operation and management. Such an approach will lay a solid foundation for policy studies and the development of industrial-scale technologies. It will also improve international competitiveness and reduce costs.

3.6.3 Increase Support for the Development of Energy Storage Technologies

Energy storage technologies are the key to the electricity revolution. They are also at the cutting edge and the site of fierce competition. Currently, China sees severe wind, solar and hydro curtailment and nuclear power restriction, which result in more than 100,000 GWh of wasted power output. Energy storage is an important means to use currently wasted output and integrate unstable energy supply and consumption. Technologies such as physical and chemical energy storage, hydrogen fuel cells and heat storage are at the forefront. Ultimately, one or two of these technologies will survive the competition and grow.

3.6.4 Prioritise Nuclear Power Development

Nuclear power is indispensable to China’s development and one of the energy pillars China must secure strategically. To this end, China will: (i) invest more in scientific research to enhance basic capabilities in nuclear technologies; and (ii) establish scientifically based decision-making and interaction mechanisms to win the public’s recognition of the importance of nuclear power and enable the safe development of nuclear energy in China.

3.6.5 Make Unconventional Gas a Major Component of New Gas Capacity

China will increase its collaborative R&D efforts with overseas organisations to innovate advanced technologies, especially exploration and production technologies suitable for China’s unconventional oil and gas resources. This will speed up the development and scale-deployment of critical technologies with Chinese characteristics. Moreover, China will focus on the development of unconventional natural gas resources like tight gas, shale gas and natural gas hydrates.

3.7 Strengthen China’s Energy Security by Improving Global Energy Governance

3.7.1 Cooperate with and Reform Existing International Energy Governance Organisations

Make sure energy security is in line with countries’ interests. With the strengthening of its global influence, China should participate deeply in global energy governance systems as soon as possible. This, to make them more widely representative and better reflect the interests of developing and emerging countries, thereby promoting a global energy community with a common future. China should implement international energy cooperation strategies that integrate multi-level international energy cooperation partners, diversified international energy cooperation forms, multi-channel international energy cooperation methods, multi-area international energy cooperation content and multi-task international energy cooperation processes to adapt to the changes in the global energy landscape and meet its own development demand. High-quality development of China’s energy system should be promoted while accelerating the global transition to clean, low-carbon, affordable, efficient, secure and reliable energy.

3.7.2 Seek G20 Support to Facilitate the Energy Transition by Aligning Global Energy and Climate Governance

Attempts should be made to get the G20 to attach more importance to the energy transition and reach agreement on the transition to a low-carbon and secure energy future. This could be achieved by the G20 issuing statements and commitments on energy security and long-term decarbonisation and by making collective efforts to raise the ambitions of nationally determined contributions (NDCs) to reduce greenhouse gas emissions. Long-term G20 ministerial conferences on energy should be set up and institutional capacity built by establishing energy secretariats in relevant international organisations.

3.7.3 Reduce the Risk of Investing in Partner Countries to Improve China’s Energy Security

Over the past decade, China’s Go Out strategy to encourage its enterprises to invest abroad has rapidly increased foreign direct investment (FDI) in overseas energy sectors. In the coming decade, the Belt and Road Initiative (BRI) will further channel Chinese capital into energy resources and infrastructure. It is necessary for China to ensure good energy sector governance in those partner countries where it invests. This will mitigate the risk of instability and underinvestment in those countries, enhancing China’s energy security as a result. China can also cooperate with partner countries to support them through the energy transition, especially by providing access to China’s low-carbon technologies.

In-depth cooperation on energy between China and the BRI countries should be strengthened. Through its cooperation in the BRI, China plays a unique role in low-carbon energy, energy security and the energy transition. A framework for FDI and energy infrastructure development in clean energy technologies should be created. At the same time, China should work with others to enhance the governance and transparency of energy sector investment.

The way that China invests in countries in the BRI will be a measure of its commitment to green and sustainable growth, both at home and abroad. The risk of investment disputes with host countries would be minimised by learning from historical experience, adhering to high standards of social and environmental governance, and developing appropriate risk management tools.

3.7.4 Strengthen Global Electricity Cooperation

One of the principal solutions to achieve power supply security, reduce curtailment and ensure balance in power systems with a high penetration of renewables is to increase electricity trading through interconnected grids. As the largest battery manufacturer and generator of renewable power in the region, China could take the lead in cooperation and governance reforms to facilitate cross-border grid interconnections with neighbouring countries.

China and its regional partners should harmonise national electricity markets to enable power trading through such interconnections. Connecting high renewable supply areas with load centres requires regional planning to avoid lock-in of fossil-based assets and infrastructure and lock-out of renewables. Further, as electricity markets become increasingly interconnected the risk of cyberattack is best mitigated by strengthening and harmonising regulations across jurisdictions.

China can benefit from the opportunities to export surplus electricity and reduce electricity costs through grid interconnections and balancing: regional electricity trading saves consumers money and decreases the capacity margin requirements for China and its partners. Cooperation on energy interdependence can build trust among partners, creating wider benefits.

Regarding electricity market reform (EMR), regional differences in capacity, dispatch and balancing and political willingness to align reforms may be difficult to overcome. A stepped approach to EMR could be adopted, so that the benefits of progressive reform are tangible to each partner country.

4 Systematically Build a High-Quality Energy System: Policy Suggestions for Promoting the Energy Revolution

4.1 Structural Change Is Necessary for China’s Energy Revolution

China’s strategic goal of supporting high-quality economic development with high-quality energy requires China to create a global and modern energy system with effective market mechanisms, moderate macro-control, vibrant enterprises and clean, low-carbon, economic, efficient, secure and reliable energy. To achieve this, the government has a key role to play in setting the policy framework that levels the playing field between low- and high-carbon sources of energy. Once the government does this, markets will seek out the cheapest energy sources and drive innovation in low-carbon technologies and investment in enabling infrastructure.

4.1.1 Strategic Goals

-

Well-designed market system. The objective is to create a modern energy market system based on harmonisation, openness and orderly competition. Market monopolies will be eliminated. Instead, a market will be shaped comprising large energy companies cooperating, coexisting and competing fairly with a range of companies of different scale and ownership across the energy value chain—in energy production, transmission and sales. This will address issues such as the misallocation of resources caused by the unequal status of market players and disorderly competition.

-

Sound price mechanism. In competitive segments, prices will be decided by the market. In natural monopoly segments such as pipeline transmission, prices will be controlled by the government. A price mechanism and a fiscal and taxation system that truly reflect market supply and demand, resource scarcity and environmental impact will be created to address current unreasonable price formation mechanisms.

-

Well-regulated government management. To clearly define the boundary between government and market and the new round of government reforms, several high-level, consolidated and independent energy management authorities will be created, integrating functions such as industrial development, Five-Year Plans, and energy policies and regulations. They will operate according to the principles of “what is not mandated by the law shall not be done, what is not prohibited can be done, and what is defined as legal responsibility must be done”.

-

Effective market regulation. Unified, independent and specialised regulatory authorities and a modern energy regulation system will be established. The latter will demonstrate clear rights and responsibilities, fairness and impartiality, transparency and efficiency, and effective regulation. It will address issues such as policymaker-regulator overlaps, decentralisation, the current lack of regulatory functions and the shortage of regulatory personnel and powers.

-

Well-developed legal system. A system of regulations and standards will be developed—based on the Energy Law and supported by legislation in the power, coal, oil, and gas sectors—to ensure national energy security and sustainable development. It will address issues across the energy system such as the lack of consistent guidelines and principles for legislation, and the present inconsistency and lack of alignment of the current legal system.

4.1.2 Strategic Priorities

A modern energy market system should be created by:

-

(i)

separating natural monopoly enterprises from competitive businesses, improving market access and encouraging investors to enter the energy sector in an orderly manner;

-

(ii)

establishing and enhancing an energy trading system that integrates the national market with multiple regional markets and applies consistent rules, complementary functions and multi-level coordination;

-

(iii)

establishing power system operators with independent scheduling and trading to effectively separate ownership and operation of power transmission and distribution networks;

-

(iv)

encouraging oil and gas pipeline operators to gain exclusive rights, separating pipeline transport services from downstream retail sales, and providing fair access for third parties to pipeline networks; and

-

(v)

accelerating the development of smart energy systems and an integrated energy services market, and building an energy system where centralised generation, distributed energy, energy storage and demand-side load management enjoy equal access.

The energy market’s price mechanism should be reshaped by:

-

(i)

applying the principle of “allowable costs plus a reasonable profit” to natural monopolies like pipelines, as this incentivises monopoly industries to reduce prices and other companies to innovate;

-

(ii)

deregulating market prices in competing segments to achieve a market-determined price mechanism;

-

(iii)

implementing an electricity price mechanism—that controls power transmission and distribution and deregulates power generation, sales and use—by establishing a well-designed, independent and performance-based power pricing system;

-

(iv)

determining the methods needed to disclose power transmission and distribution costs and pricing;

-

(v)

deregulating the price of oil and natural gas (which will be based on market competition) and taking steps to deregulate pricing in infrastructure like oil and gas pipelines (but not gas distribution networks);

-

(vi)

establishing and improving directional subsidy and relief mechanisms for people in need and some non-profit industries; and

-

(vii)

eliminating cross-subsidies in energy prices.

The energy management system should be improved by:

-

(i)

establishing and strengthening regulatory authorities to better manage state-owned natural resources and monitor natural ecosystems. This should be in line with the new round of institutional reforms to implement responsibilities relating to publicly owned natural resources;

-

(ii)

defining the boundary between government and the market, standardising and simplifying approval procedures, and reducing the administrative burden on companies subject to these approvals;

-

(iii)

addressing grid integration of renewable power and the need for inter-provincial and interregional power transmission and distribution under the national energy strategy; as well as fully deregulating the power generation sector and ensuring all regions purchase and use the legally binding minimum number of hours of wind and solar power generation annually; and

-

(iv)

improving peak shaving and the backup auxiliary service market mechanisms, upgrading thermal power flexibility and increasing energy storage power sources.

The energy regulatory system should be improved by:

-

(i)

promoting policymaker-regulator separation, setting up independent, unified and specialised regulatory authorities, and improving the regulatory system at the national and provincial levels;

-

(ii)

defining regulatory responsibilities (mainly for economic regulation), and strengthening social regulation to ensure competitive outcomes in natural monopoly segments such as network infrastructure (mostly pipelines); and

-

(iii)

improving regulatory capabilities, innovating regulatory approaches, improving regulatory effectiveness and maintaining a fair and competitive market.

A modern energy legal system should be accelerated by:

-

(i)

developing the Energy Law to provide a basis for the creation and revision of other laws and regulations in the energy sector;

-

(ii)

revising the Electric Power Law, developing the Oil and Gas Law, improving the Coal Law as soon as possible, and clarifying the basis for the creation, implementation, assessment, supervision and adjustment of plans and strategies for electricity, coal, oil and gas;

-

(iii)

implementing the Energy Conservation Law and the Renewable Energy Law, and establishing consistent regulatory, coordination, decision-making and social participation mechanisms; and

-

(iv)

developing energy regulations and establishing and improving existing energy rules, requirements, approaches and procedures.

4.2 Create a Nationally Unified and Dynamic Carbon Trading Market

China has announced the launch of a nationally unified carbon trading market, covering key carbon-emitting industries such as steel, electricity, chemicals, building materials, paper and non-ferrous metals. From the progress of ongoing pilot programmes, the following challenges were observed.

First, the failure to achieve market-based electricity pricing is preventing the carbon trading market from working effectively. China hasn’t yet established a new mechanism that enables the market to determine electricity prices. Electricity price control limits the power sector’s potential to tap low-cost emissions reduction.

Second, current regulations on carbon emissions are not sufficiently advanced to support the creation of an effective carbon trading market, as there are no uniform standards yet on assessment and approval, trading and settlement, and their effective supervision is not possible.

Third, the regional carbon trading mechanisms are immature. Domestic products are isolated from the international carbon trading market. It is still under discussion whether China’s future national carbon trading market should choose centralised trading at a single exchange or decentralised trading at several exchanges.

Fourth, the liquidity of the carbon trading market needs further improvement. Pilot carbon trading markets experience the same problem of poor liquidity, with both low volume and low turnover.

To overcome these challenges, efforts need to be made to:

4.2.1 Improve the System of Laws and Regulations to Increase Regulatory Capacity

Relevant legislative procedures should be strictly implemented and the legal system for carbon trading improved. In particular, the system design for the national carbon trading market should be based on experience from pilot schemes. The rights and obligations of carbon emission allowance trading participants, trading methods and rules, dispute resolution mechanisms, type and extent of penalties for violations, and legal authorisation from jurisdictions should be clarified—based on the Measures for the Administration of National Carbon Emission Trading issued by the NDRC.

Moreover, a regulatory mechanism for a carbon emission allowance trading market should be established and a dedicated regulatory authority set up to supervise market operations and participants. The building of a comprehensive risk control system for the carbon trading market should be explored to prevent illegal operations and maintain a well-functioning carbon trading market. A legal supervisory system covering various parties—including the government, service providers, trading platforms and businesses—should be developed. While fulfilling its regulatory role, the government should avoid controlling and commanding the market directly. Rather, it should focus on macro-policy planning and supervision and leave the market to play its intended leading role.Footnote 6

4.2.2 Coordinating the Cap and Quota Structure Correctly

The initial allocation of carbon trading quotas is a core function of a carbon trading market. The regional quota cap should be determined by a combination of factors, including greenhouse gas emissions, economic growth, industrial structure, energy structure, and inclusion of the businesses that fall within the emissions trading scheme. Some quotas should be reserved for auction, held in reserve to regulate the market if needed, and for major projects.

First, the cap should take into account economic growth, technological progress and emissions reduction targets, and follow the principles of “rigid cap, flexible structure, tight stock and optimal increment” in the functioning and evolution of the carbon trading market. Given economic volatility and the uncertainty of technological progress, an adjustment mechanism should be designed to deal with these uncertainties.