Abstract

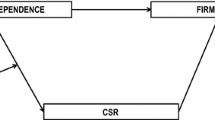

This article deals with the influence of the structure of the Board of Directors, external and internal discipline and size on corporate performance in the economic and financial fields. By using firstly, self organising maps, and secondly, panel data, we highlight three main results. Firstly, our results suggest, from a sample of 136 firms, that the relation between the structure of the Board of Directors and performance is non-linear. Furthermore, one can observe that the least effective firms are those in which the proportion of outside directors is the highest. Secondly, variables of leverage, and stock turnover are the main explanatory variables of performance. Although leverage has a negative influence on performance (Opler, Titman 1994) conversely, stock turnover has a beneficial impact (Charreaux 1997). Thirdly, variables of concentration of ownership structure and size have a positive, but non-significant, influence on performance.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Agrawal A., Knoeber C.R. (1996), “Firm performance and mechanisms to control agency problems between managers and shareholders”, Journal of Financial and Quantitative Analysis, 31 (3), 377–397.

Altman E.I. (1984), “A Further empirical investigation of the bankruptcy cost question”, Journal of Finance, 39 (4), 1067–1089.

Bethel J.E., Liebeskind J. (1993), “The effects of Ownership and Corporate Restructuring”, Strategic Management Journal, 14, 15–31.

Bhagat S., Black B. (1998), “Board Independance and Long Term Firm Performance”, Working Paper, 143, The Center for Law and Economic Studies-Columbia Law School.

Chameaux G. (1997), Le gouvernement des entreprises: Corporate Governance, Théories et Faits,Economica.

Cottrell M., Fort J.C., Pages G. (1994), “Two or three things that we know about the Kohonen algorithm”, in Proceedings of ESANN, Bruxelles, 235–244.

Cottrell M., Fort J.C., Pages G. (1998), “Theoretical Aspects of the SOM Algorithm”, NeuroComputing, 21, 119–138.

Cottrell M., Letremy P, Roy E. (1993), “Analysing a Contingency Table with Kohonen Maps: a Factorial Correspondence Analysis”, in Proceedings ofIWANN’93, Springer Verlag, 305–311.

Dormant B. (1989), Introduction à l’économétrie des données de panel: théorie et applications à des échantillons d’entreprises, Monographies d’économétries, Editions du CNRS.

Eisenhardt K., Bourgeois L. (1988), “Politics of strategic decision making in high-velocity environments: toward a midrange theory”, Academy of Management Journal, 31, 737–770.

Fama E.F., Jensen M.C. (1983a), “Separation of ownership and control”, Journal of Law and Economics, 26, 301–324.

Fort J.C., Pages G. (1995), About Kohonen algorithm: strong or weak self organization,Neural Networks.

Hermalin B.E., Weisbach M.S. (1988), “The determinants of board composition”, Rand Journal of Economics, 19 (4), 589–606.

Jensen M.C. (1986), “Agency costs of free cash flow, corporate finance and takeovers”, American Economic Review, 76, 323–329.

Jensen M.C. (1993), “The modern industrial revolution, exit and the failure of internal control systems”, Journal of Finance, 48 (3), 831–880.

Kohonen T. (1982), “Self organized formation of topologically correct feature maps”, Biological Cybernetics, 43, 115–164.

Kohonen T. (1995), “Self Organizing Maps”, Springer Series in Information Sciences, 30, 12–27.

Kosnik R. (1990), “Effects of board demography and directors’ incentives on corporate greenmail decisions”, Academy of Management Journal, 33, 129–151.

Maati J. (1998), “Le conseil d’administration: outil de contrôle et d’ordonnancement social des firmes en France”, Colloque de l’Association Française Financière (AFFI).

Mace L. (1986), Directors, myth and reality, Harvard Business School Press, Boston. Malecot J.-F. (1984), “Théorie financière et coûts de faillite”, PhD Thesis, France.

McConnell J.J., SERVAES H. (1990), “Additional evidence on equity ownership and corporate value”, Journal of Financial Economics, 27, 595–612.

Modigliani F., Miller M., (1963), “Corporate income taxes and the cost of capital: a correction”, American Economic Review, 53, 433–443.

Morck R., Shleifer A., Vishny R.W. (1988), “Management Ownership and Market Valuation”, Journal of Financial Economics, 20, 293–315.

Opler T., Titman S. (1994), “Financial Distress and Corporate Performance”, Journal of Finance, 49 (3), 1015–1040.

Patton A. Baker J. (1987), “Why do not directors rock the board ?”, Harvard Business Review, 65, 10–12.

Ritter H., Schulten K. (1988), “Convergence Properties of Kohonen’s Topology Conserving Maps: Fluctuations, Stability and Dimension Selection”, Biol Cybernetics, 60, 59–71.

Robins H. Monro H. (1951), “A Stochastic Approximation Method”, Annales de Mathématiques et de Statistiques, 22, 400–407.

Rosenstein S., Wyatt J.G. (1990), “Outside directors, board independence and shareholder wealth”, Journal of Financial Economics, 26, 175–191.

Rosenstein S., Wyatt J.G. (1997), “Inside directors, board effectiveness and shareholder wealth”, Journal of Financial Economics, 44, 229–250.

Sevestre P. (1992), “L’économétrie sur données individuelles-temporelles: une note introductive”, INSEE, 9204.

Shleifer A., Vishny R.W. (1986), “Large shareholders and corporate control”, Journal of Political Economy, 94, 461–479.

Short H., Keasey K. (1999), “Managerial Ownership and the performance of firms: evidence from the UK”, Journal of Corporate Finance, 5, 79–101.

Sundaramuthy C., Mahoney J., Mahoney J. (1997), “Board structure, antitakeover provisions and stockholder wealth”, Strategic Management Journal, 18, 3, 231–245.

Titman S., Wessels R. (1988), “The determinants of capital structure choice”, Journal of Finance, 43 (1), 1–19.

Vancil R. (1987), Passing the baton: managing the process of CEO succession, Harvard Business School Press, Boston.

Volle M. (1981), Analyse des données. Economica, 2° ed., Paris.

Weisbach M.S. (1988), “Outside directors and CEO turnover”, Journal of Financial Economics, 20, 431–460.

Wruck K.H. (1990), “Financial distress, reorganization, and organizational efficiency”, Journal of Financial Economics, 27, 419–444.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2003 Springer Science+Business Media Dordrecht

About this chapter

Cite this chapter

Severin, E. (2003). Mechanisms of discipline and corporate performance: Evidence from France. In: Lesage, C., Cottrell, M. (eds) Connectionist Approaches in Economics and Management Sciences. Advances in Computational Management Science, vol 6. Springer, Boston, MA. https://doi.org/10.1007/978-1-4757-3722-6_9

Download citation

DOI: https://doi.org/10.1007/978-1-4757-3722-6_9

Publisher Name: Springer, Boston, MA

Print ISBN: 978-1-4419-5379-7

Online ISBN: 978-1-4757-3722-6

eBook Packages: Springer Book Archive