Abstract

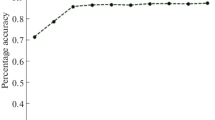

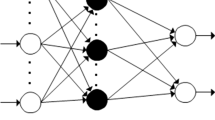

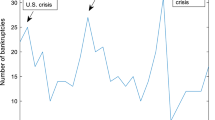

The intent of this study is to compare the predictive strength of two neural network models —a standard feedforward neural network trained using a genetic algorithm and the more recently developed collapsible neural network using genetic algorithms — to determine corporate financial distress (bankruptcy). This research expands existing bankruptcy models on several levels. First, it utilizes financial ratios based on the cash flow statements in addition to the usual ratios based on balance sheets and income statements. It also incorporates qualitative data that may indicate financial distress such as change in management and change in auditor. Lastly, it provides a promising algorithm using collapsible neural networks to provide parsimony in the model structure and insight into the process used by the neural network in its decision making process.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

Bibliography

E. I. Altman, “Financial Ratios Discriminant Analysis, and the Prediction of Corporate Bankruptcy.” Journal of Finance, (September 1968), pp. 589–609.

E. I. Altman, Corporate Financial Distress. New York: John Wiley and Sons. 1993.

E. I. Altman, G. Marco, F. Varetto, “Corporate distress diagnosis: Comparisons using linear discriminant analysis and neural networks (the Italian experience),” Journal of Banking & Finance, 18 no. 3 (May 1994), pp. 505–529.

A. Aziz, D. Emanuel, and G. H. Lawson, “Bankruptcy Prediction — An Investigation of Cash Flow Based Models,” Journal of Management Studies 25 no. 5 (September 1988), pp. 419–437.

W. H. Beaver, “Financial Ratios as Predictors of Failure,” Empirical Research in Accounting: Selected Studies, (1966), pp. 71–111.

R. Blankenship, Modeling Consumer Choice: An Experimental Comparison of Concept Learning System, Logit, and Artificial Neural Network, dissertation (August 1994).

Q. Booker, T. Greer, T. Sudderth, “Predicting Corporate Bankruptcy Using Qualitative and Quantitative Variables: A Comparison of Traditional Statistical Methods and Neural Networks,” forthcoming Advances in Artificial Intelligence in Economics, Finance, and Management, 1997.

P. K. Coats, L. F. Fant, “A Neural Network Approach to Forecasting Financial Distress,” Journal of Business Forecasting 10 no. 4 (Winter 1991-1992), pp. 9–12

R. A. Collins and R. D. Green, “Statistical Method for Bankruptcy Forecasting,” Journal of Economics and Business 32 (1982), pp. 349–54.

Robert E. Dorsey Robert O. Edmister, and John D. Johnson, Financial Distress Prediction Using Multi-Layered Feed Forward Neural Nets, Charlotte: Research Foundation of the Chartered Financial Analysts, 1995.

John D. Johnson and Robert E. Dorsey, “Evolution of Dynamic Reconfigurable Neural Networks: Energy Surface Optimality Using Genetic Algorithms,” Optimality in Biological and Artificial Networks, 1997.

B. S. Everitt and G. Dunn, Applied Multivariate Data Analysis. New York: Halsted Press. 1991.

J. A. Gentry, P. Newbold, and D. T. Whitford, “Classifying Bankrupt Firms with Funds Flow Components,” Journal of Accounting Research 23(Spring 1985), pp. 146–60.

D. Hawley, J. Johnson, and D. Riana, “Artificial Neural Systems: A New Tool for Financial Decision-Making,” Financial Analysts Journal,(November/December, 1992), pp. 63-72.

C. Klimasauskas., 1992, ‘Applying Neural Networks,’ in Trippi R.R. and E. Turban (Eds.), Neural Networks in Finance and Investing.

R. Mills, “Developments in Corporate Finance,” Manager Update 7 no. 22 (October 28, 1996), pp. 161–2.

J. R. Koza, Genetic Programming: On the Programming of Computers by Means of Natural Selection, The MIT Press, 1992.

W. Raghupathi, L. Schkade, and B. S. Raju, “A Neural Network Application for Bankruptcy Prediction,” IEEE, 1991, pp. 147–55.

E. Rahimian, S. Singh, T. Thammachote, and R. Virmani, “Bankruptcy Prediction by Neural Network,” Neural Networks in Finance and Investing, Chicago: Irwin Professional Publishing, 1996.

B. D. Ripley, 1993, ‘Statistical Aspects of Neural Networks,’ in O.E. Barndorff-Nielsen, J.L. Jensen and W.S. Kendall (Eds.), Networks and Chaos-Statistical and Probabilistic Aspects, Chapman and Hall, 40–123.

K. Y. Tam and M. Kiang, “Predicting Bank Failures: A Neural Network Approach,“ Applied Artificial Intelligence 4 no. 4 (1990) pp. 265-82.

R. Wilson and R. Sharda, “Bankruptcy Prediction Using Neural Networks,” Neural Networks in Finance and Investing, Chicago: Irwin Professional Publishing, 1996.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 1998 Springer Science+Business Media Dordrecht

About this chapter

Cite this chapter

Booker, Q., Johnson, J.D., Dorsey, R.E. (1998). Predicting Corporate Financial Distress Using Quantitative and Qualitative Data: A Comparison of Standard and Collapsible Neural Networks. In: Refenes, AP.N., Burgess, A.N., Moody, J.E. (eds) Decision Technologies for Computational Finance. Advances in Computational Management Science, vol 2. Springer, Boston, MA. https://doi.org/10.1007/978-1-4615-5625-1_27

Download citation

DOI: https://doi.org/10.1007/978-1-4615-5625-1_27

Publisher Name: Springer, Boston, MA

Print ISBN: 978-0-7923-8309-3

Online ISBN: 978-1-4615-5625-1

eBook Packages: Springer Book Archive