Abstract

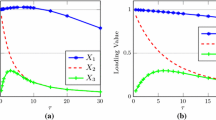

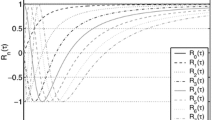

In this paper we develop a generic, flexible fitting method that can be applied to no arbitrage term structure models. Flexibility in the model fitting methodology is generated by assuming that observed prices are not exact but have a bid/ask spread. A regularisation term is incorporated into the model’s fitting algorithm in order to generate smoother expected interest rates while still enforcing the no arbitrage constraint. The regularisation term acts as a roughness penalty term by measuring the smoothness of the models expected future interest rates. This fitting technique more closely reflects the market expectation of a smooth transition between consecutive points on the yield curve. We demonstrate this model fitting approach by applying it to the single factor Black-Derman-Toy interest rate model. The model is calibrated to observed quarterly term structure data from the US treasury market. The results compare this new fitting method using a regularisation term with the traditional calibration method of matching the observed mid prices. Graphs show how this new approach to model fitting more closely reflects market expectation leading to a smoother evolution of the term structure of interest rates.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Black F., Derman E., Toy W., “A One-Factor Model of Interest Rates and its Application to Treasury Bonds,” Financial Analysts Journal, 1990.

Black F., Karasinski, P., “Bond and Option Pricing when Short Rates are Lognormal.” Financial Analysts Journal, July-August, pages 52–59, 1991.

Connor J., Bolland P., Lajbcygier P., “Intraday Modelling of the Term Structure of Interest Rates,”, Proceedings of the Neural Networks in the Capital Markets, 1996.

Connor J., Towers N., “Modelling the term structure of interest rates: A neural network perspective”, unpublished technical report, London Business School, 1997.

Duffie D., “State space models of the term structure of interest rates” in Vasicek and Beyond, 1990.

Heath D., Jarrow R., Morton A., “Bond Pricing and the Term Structure of Interest Rates: A New Methodology for Contingent Claims Valuation” Econometrica, 1991.

Ho S. Y. and Lee S., “Term Structure Movements and Pricing Interest Rate Contingent Claims,” in Vasicek and Beyond: Journal of Finance, 1990.

Hull J., White A., “The pricing of options on interest rate caps and floors using the Hull-White model“, Journal of Financial Engineering, Vol. 2, 1993

Jamshidian F., “Forward induction and construction of yield curve diffusion models”, Journal of Fixed Income, June 1991.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 1998 Springer Science+Business Media Dordrecht

About this chapter

Cite this chapter

Towers, N., Connor, J.T. (1998). Fitting No Arbitrage Term Structure Models Using a Regularisation Term. In: Refenes, AP.N., Burgess, A.N., Moody, J.E. (eds) Decision Technologies for Computational Finance. Advances in Computational Management Science, vol 2. Springer, Boston, MA. https://doi.org/10.1007/978-1-4615-5625-1_25

Download citation

DOI: https://doi.org/10.1007/978-1-4615-5625-1_25

Publisher Name: Springer, Boston, MA

Print ISBN: 978-0-7923-8309-3

Online ISBN: 978-1-4615-5625-1

eBook Packages: Springer Book Archive