Abstract

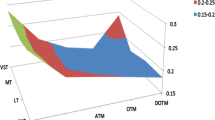

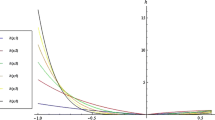

This paper describes a method for recovering the risk neutral market’s perceived probability distribution (RND) of European options on the FTSE100 Index on an hourly time basis. A nonparametric procedure is used to choose probabilities that minimise an objective function subject to requiring that the obtained probabilities comply with observed option prices. The procedure is based on the idea that probability distributions of asset returns can be expressed as a mixture of lognormal variables. The use of a lognormal mixture provides a natural and robust way to model distributions with fat tails, a key feature of financial returns. The optimisation technique for estimating probability distributions incorporates a “smoothness” and a “variability” factor in the objective function to account for situations where little smoothness and high variability in the posterior distributions are plausible due to problems in the data, such as illiquidity. With this method we are able to resolve some of the numerical difficulties presented by earlier procedures, plot consistent pictures in a timely fashion of the implied distribution and measure the first four implied moments of the future probability distribution implied by the FTSE 100 option market.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Aït-Sahalia Y. and Lo, A., Nonparametric estimation of state price densities implicit in financial asset prices. NBER, working paper, No. 5351, 1995.

Arrow K.J., The role of securities in the optimal allocation of risk-bearing, Reviewof Economics Studies 1964, No.2, 91–96.

Bahra B., Implied risk-neutral probability density functions from option prices:theory and application. Working paper series, n. 66. Bank of England 1997.

Banz C.A. and Torous W.N., On jumps in common stock prices and their impact on call option pricing, Journal of Finance 1985, 40, 155–73.

Bates D.S., The crash of 87: was it expected? The evidence from options markets,Journal of Finance 1991, 46, 1099–44.

Black F. and Scholes M., The pricing of options and corporate liabilities, Journalof Political Economy 1973, 81, 637–59.

Breeden D. and Litzenberger R., Prices of state-contingent claims implicit in options prices, Journal of Business 1978, 51, 621–651.

Cox J. and Ross S., The valuation of options for alternative stochastic processes,Journal of Financial Economics 1976, 3, 145–66.

Debreu G, Theory of value, Wiley, NY, 1959.

Derman E. and Kani I., Riding on a smile, RISK 1994, 2, No. 7, 32–38.

Duffie D. and Pan J., An overview of value at risk. Journal of Derivatives 1997, Spring, 7–49.

Härdle W, Smoothing techniques with implementation in S, Sp.-Verlag, NY, 1991.

Jackwerth J. and Rubinstein M, Recovering probability distributions from contemporaneous security prices, Journal of Finance 1996,51, No. 5, 1611–1631.

Jarrow R. and Rudd A., Approximate option valuation for arbitrary stochastic processes, Journal of Financial Economics 1982, 10, 347–69.

Longstaff F., Option pricing and the martingale restriction, Review of Financial Studies 1995, vol. 8, No. 4, 1091–1124.

Melick W.R. and Thomas C.P., Recovering an asset’s implied PDF from option prices: an application to crude oil during the gulf crisis, working paper Federal Reserve Board, Washington, 1994.

Ritchey R.J., Call option valuation for discrete normal mixtures, Journal of Financial Research, vol XIII, No. 4, 285–96, 1990.

Rubinstein M., Implied binomial trees, Journal of Finance 1994, 49, 771–818.

Shimko D., Bounds of probability, RISK 1993, 6, No. 4, 33–37.

Titterington D.M., Smith A.F.M., Makov U.E., Statistical analysis of finite mixture distributions. John Wiley & Sons, Chichester 1985.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 1998 Springer Science+Business Media Dordrecht

About this chapter

Cite this chapter

González Miranda, F., Burgess, A.N. (1998). Using Illiquid Option Prices to Recover Probability Distributions. In: Refenes, AP.N., Burgess, A.N., Moody, J.E. (eds) Decision Technologies for Computational Finance. Advances in Computational Management Science, vol 2. Springer, Boston, MA. https://doi.org/10.1007/978-1-4615-5625-1_17

Download citation

DOI: https://doi.org/10.1007/978-1-4615-5625-1_17

Publisher Name: Springer, Boston, MA

Print ISBN: 978-0-7923-8309-3

Online ISBN: 978-1-4615-5625-1

eBook Packages: Springer Book Archive