Abstract

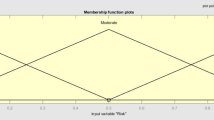

Technical indicators are developed for monitoring the movement of stock prices from different perspective. They are widely used to define trading rules to assist investors to make the buy-sell-hold decision. Most of these trading rules are vague and fuzzy in nature. Since the stock prices are affected by the artificial news factors from time to time, investors cannot be the winner all the time on using the same set of trading rules. The weight (i.e., the significance) of a trading rule to investors is varying with time. The problem of determining the weight of the trading rules can be modelled as an optimization problem. In this paper, we propose a Genetic Fuzzy Expert Trading System (GFETS) for market timing. We apply the fuzzy expert system to simulate vague and fuzzy trading rules and give the buy-sell signal. The set of trading rules adopted in the system will vary with time and is optimized using Genetic Algorithm (GA). Two training approaches—incremental and dynamic—are designed and studied. The system was evaluated with the stocks in NASDAQ market. Experimental results showed that the system can give reliable buy-sell signals and using the system to perform buy-sell can produce significant profit.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Allen, F. and R. Karjalainen (1999). “Using Genetic Algorithm to Find Technical Trading Rules,” Journal of Financial Economics, 51, 245–271.

Dawid, H. (1996). Adaptive Learning by Genetic Algorithms: Analytical Results and Applications to Economical Models. Springer.

Driankov, D., H. Hellendoorn, and M. Reinfrank (1993). An Introduction to Fuzzy Control. Springer.

Edmonds, A. N., D. Burkhardt, and O. Adjei (1996). “Genetic Programming of Fuzzy Logic Production Rules with Application to Financial Trading,” Neural Networks in Financial Engineering, 179–188. World Scientific Publishers.

Holland, J. H. (1975). Adaption in Natural and Artifical Systems. MIT Press.

Houck, C. R., J. A. Joines, and M. G. Kay (1995). “A Genetic Algorithm for Function Optimization: A Matlab Implementation”.

Klir, G. J. and B. Yuan (1995). Fuzzy Sets and Fuzzy Logic: Theory and Applications. Prentice Hall.

Lynch, P. and J. Rothchild (2000). One Up on Wall Street, 1st ed. Fireside.

NASDAQ website, “The NASDAQ Stock Market,” <http://www.nasdaq.com/about/about-nasdaq.stm>.

Richard, J., Jr. Bauer and D. R. Julie (1999). “Technical Market Indicators: Analysis and Performance”. John Wiley and Sons.

Surgeno, M. and K. Murakami (1985). “An Experimental Study on Fuzzy Parking Control Using a Model Car,” in M. Sugeno (ed.), Industrial Applications of Fuzzy Control. North-Holland.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2002 Springer Science+Business Media New York

About this chapter

Cite this chapter

Lam, S.S., Lam, K.P., Ng, H.S. (2002). Genetic Fuzzy Expert Trading System for Nasdaq Stock Market Timing. In: Chen, SH. (eds) Genetic Algorithms and Genetic Programming in Computational Finance. Springer, Boston, MA. https://doi.org/10.1007/978-1-4615-0835-9_9

Download citation

DOI: https://doi.org/10.1007/978-1-4615-0835-9_9

Publisher Name: Springer, Boston, MA

Print ISBN: 978-1-4613-5262-4

Online ISBN: 978-1-4615-0835-9

eBook Packages: Springer Book Archive