Abstract.

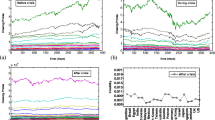

We examine the volatility of an Indian stock market in terms of correlation of stocks and quantify the volatility using the random matrix approach. First we discuss trends observed in the pattern of stock prices in the Bombay Stock Exchange for the three-year period 2000–2002. Random matrix analysis is then applied to study the relationship between the coupling of stocks and volatility. The study uses daily returns of 70 stocks for successive time windows of length 85 days for the year 2001. We compare the properties of matrix C of correlations between price fluctuations in time regimes characterized by different volatilities. Our analyses reveal that (i) the largest (deviating) eigenvalue of C correlates highly with the volatility of the index, (ii) there is a shift in the distribution of the components of the eigenvector corresponding to the largest eigenvalue across regimes of different volatilities, (iii) the inverse participation ratio for this eigenvector anti-correlates significantly with the market fluctuations and finally, (iv) this eigenvector of C can be used to set up a Correlation Index, CI whose temporal evolution is significantly correlated with the volatility of the overall market index.

Similar content being viewed by others

References

L. Bachelier, Theorie de la speculation [Ph.D. thesis in mathematics], Annales Scientifiques de l'École Normale Superieure III-17, 21-86 (1900)

S.N. Kulkarni, Sankhya-The Indian Journal of Statistics 40, Series D (1978)

R.N. Mantegna, H.E. Stanley, An Introduction to Econophysics (Cambridge University Press, 2000)

Y. Liu, P. Gopikrishnan, P. Cizeau, M. Meyer, C.K. Peng, H.E. Stanley, Phys. Rev. E 60, 1390 (1999)

C. Shalen, International Stock Index Spread Opportunities in Volatile Markets, The CBOT Dow Jones Industrial Average Futures and Future Options, 02613 (1999)

S.B. Lee, K.J. Kim, Rev. Financial Econom. 3, 89 (1993)

G.A. Karolygi, R.M. Stulz, J. Finance 51, 951 (1996)

L. Ramchand, R. Susmel, J. Empirical Finance 5, 397 (1998)

R. Engle, V.K. Ng, J. Finance, XLVIII, No. 5 (1993)

V. Plerou, P. Gopikrishnan, B. Rosenow, L.A. Amaral, T. Guhr, H.E. Stanley, Phys. Rev. E 65, 066126 (2002)

P. Gopikrishnan, B. Rosenow, V. Plerou, H.E. Stanley, Phys. Rev. E 64, 035106 (2001)

D. Kim, H. Jeong, Phys. Rev. E 72, 046133 (2005)

H.E. Stanley, L.A.N Amaral, X. Gabaix, P. Gopikrishnan, V. Plerou, Physica A 126 (2001)

L. Laloux, P. Cizeau, J.P. Bouchaud, M. Potters, Phys. Rev. Lett. 83, 1467 (1999); Risk 12, No. 3, 69 (1999); V. Plerou, P. Gopikrishnan, B. Rosenow, L.N. Amaral, H.E. Stanley, Phys. Rev. Lett. 83, 1471 (1999); M. Potters, J.P. Bouchaud, L. Laloux, arXiv: Physics/0507111

A.M. Sengupta, P.P. Mitra, Phys. Rev. E 60, 3389 (1999)

F. Lillo, R. Mantegna, Phys. Rev. E 62, 6126 (2000); Eur. Phys. J. B 15, 603 (2000); Eur, Phys. J.B 20, 503 (2001); F. Lillo, G. Bonanno, R.N. Mantegna, Empirical Science of Financial Fluctuations, Econophysics on the Horizon, edited by H. Takayasu (Springer-Verlag Tokio, 2002); S. Micciche, G. Bonanno, F. Lillo, R. Mantegna, Physica A 314, 756 (2002); F. Lillo, R.N. Mantegna, Phys. Rev. E 72, 016219 (2005)

S. Drozdz, F. Grummer, A.Z. Gorski, F. Ruf, J. Speth, Physica A 287, 440 (2000); S. Drozdz, F. Grummer, F. Ruf, J. Speth, Physica A 294, 226 (2001); Empirical Science of Financial Fluctuations, edited by H. Takayasu (Springer-Verlag Tokio 2002), p. 41

Z. Burda, J. Jurkiewiez, M.A. Nowak, G. Papp, I. Zahed, e-print cond-mat/0103108; Z. Burda, A. Goerlich, A. Jarosz, J. Jurkiewicz, e-print cond-mat/0305627

D. Wilcox, T. Gebbie, arXiv:cond-mat/0402389; arXiv:cond-mat/0404416

C. Mounfield, P. Ormerod, Market Correlation and Market Volatility in US Blue Chip Stocks, Crowell Prize Submission, 2001

S.S.S. Kumar, Forecasting volatility - Evidence from Indian Stock and Forex Markets, IIMK/WPS/08/FIN/2006/06

S. Bianco, R. Reno, Unexpected Volatility and intraday serial correlation, arXiv:physics/0610023, v1 3 October, 2006

Technical Analysis of Indian stock market BSE Sensex Index, Trend trading Newsletter, Traders Edge India

An Introduction to High Frequency Finance, G. Ramazan, M. Dacorogna, U. Muller, R. Olsen, O. Pictet (Academic Press Inc., London Ltd)

M. Mehta, Random Matrices (Academic Press, 1991)

Standard formula's for Karl Pearson's correlation coefficient can be found at http://en.wikipedia.org/wiki/Correlation

R. Rak, S. Drozdz, J. Kwapien, arXiv:physics/0603071; R. Rak, S. Drozdz, J. Kwapien, P. Oswiecimka, arXiv:physics/0606041

R. Johnson, D.W. Wichern (Applied Multivariate Statistical Analysis) (Prentice Hall International Inc., London, 1982)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kulkarni, V., Deo, N. Correlation and volatility in an Indian stock market: A random matrix approach. Eur. Phys. J. B 60, 101–109 (2007). https://doi.org/10.1140/epjb/e2007-00322-1

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1140/epjb/e2007-00322-1