Abstract

We provide an overview of the paths taken to understand existence and efficiency of equilibrium in competitive insurance markets with adverse selection since the seminal work by Rothschild and Stiglitz (1976). A stream of recent work reconsiders the strategic foundations of competitive equilibrium by carefully modelling the market game.

Similar content being viewed by others

Notes

Note that this is different from market unravelling in the sense of Akerlof where an equilibrium exists; however, it is characterised by no trade. See Hendren (2014).

The non-existence problem does not only appear in competitive insurance markets, but more generally in competitive markets with asymmetric information and common values such as credit markets or the screening versions of job market models with adverse selection.

Throughout, we focus on the essential Rothschild and Stiglitz (1976) set-up with a binary loss and no uncertainty/ambiguity where insurance buyers are expected utility maximisers.

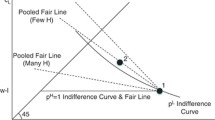

Under asymmetric information, regulation out of efficiency considerations seems warranted if the market does not achieve second-best efficient outcomes. Note that among second-best efficient allocations, the allocation that pools both risk types at the contract with full insurance has the nice property that risk-sharing in the market is efficient. However, selection among second-best efficient allocations is a distributional but not an efficiency consideration.

In the screening game underlying the RS analysis presented here and in most of subsequent work, n ⩾ 2 is sufficient to obtain the results.

Smart (2000), Villeneuve (2003) and Wambach (2000) introduce an additional dimension of asymmetric information by assuming that consumers furthermore differ in wealth/risk aversion. With two dimensions of asymmetric information, the single crossing property may be violated. The authors all consider single contract offers and show that due to violation of single crossing there might be contracts with positive profits offered in equilibrium. For a critical discussion, see Snow (2009).

Insurance purchase is exclusive, that is a consumer is assumed to buy at most one insurance contract at one firm. For non-exclusive contracting see footnote 12.

A second-best efficient allocation is Pareto efficient among those that satisfy self-selection conditions and resource constraints, see Crocker and Snow (1985). The resource constraint here translates to non-negative profits on the whole population.

An easy solution there is to assume a mass point at the higher endpoint.

Note that with full support near p=1 in any allocation different from the endowment some types are cross-subsidised, which is incompatible with a competitive equilibrium with positive insurance in the simple screening game.

For the screening version of Spence’s (1973) signalling model of education that exhibits a similar structure as the RS model, Rosenthal and Weiss (1984) derive an equilibrium in mixed strategies. A somewhat unsatisfying characteristic of that equilibrium is that although there is no profitable deviation for existing firms in the market, an entrant can earn positive expected profits.

Most of these contributions only discuss existence and uniqueness in the two-type case. We will thus continue to concentrate on the two-type case.

For the modelling of competition between the uninformed market side when the informed buyer proposes contract menus in the first stage see Dosis (2014).

Wilson (1977) is the seminal contribution on competitive insurance markets with adverse selection besides Rothschild and Stiglitz (1976) and was reportedly not completed later than Rothschild and Stiglitz’s work.

With single contract offers, anticipatory equilibrium does not always yield a unique equilibrium allocation: If the low risk type is indifferent between his RS contract and the Wilson pooling contract, both the RS allocation and the Wilson pooling allocation can be sustained in an anticipatory equilibrium.

To be precise, any allocation that yields non-negative profits when all firms offer it can be sustained as outcome of a perfect Nash equilibrium. This for example. includes the MWS allocation, but as well the monopoly outcome. Profit making allocations can be sustained as final outcomes, as any deviating offer by an insurer will be followed by (sequences of) retaliating offers by other insurers, which makes deviation unattractive.

In Jaynes (1978) and Hellwig (1988) firms can offer sets of linear contracts; however, menus of nonlinear contracts are not discussed. Ales and Maziero (2013) and Attar et al. (2014) consider non-exclusive contracting in RS environments without information sharing. In both models, a pure strategy equilibrium may fail to exist. The key insight in these models is that in equilibrium, if it exists, contracts are linear and offer positive insurance only for the high risk type.

There exist other symmetric equilibria involving renegotiation; however, they all yield the MWS allocation.

Note that the overall result depends on the assumption that insurers cannot renegotiate contracts individually, which seems unrealistic once consumers have chosen an insurance contract. To our knowledge, there is to date no work on competitive markets with adverse selection where renegotiation is unrestricted.

As an example, some firms offer the RS contracts, while some firms offer MWS contracts. With zero withdrawal costs, if there is no deviation, the latter withdraws the MWS contracts in the second stage and becomes inactive, and customers receive RS contracts.

In a methodologically different approach, Ania et al. (2002) model dynamics in insurance markets using evolutionary game theory. Insurers do not have perfect knowledge about the market and imitate successful behaviour, that is they copy the most profitable contract on the market and in addition, they experiment with their own contracts. RS contracts are the long-run outcome of the evolutionary game if insurers experiment only locally. This is because even if a pooling contract is preferred, the RS contracts cannot be destabilised by small modifications in contract terms, whereas pooling contracts can.

Picard (2010) also analyses the n risk type case and thereby shows coexistence of participating and non-participating contracts, which could be interpreted as coexistence of mutuals and stock insurers.

In the screening version of the standard job market models with adverse selection, von Siemens and Kosfeld (2014) assume that high productivity workers prefer to be pooled with their own type, for example because of bonus payments when a performance target is met in team production. This creates an analogous externality that guarantees equilibrium existence.

Note that the MWS allocation has the nice property of being robust to perturbations of the type space precisely because it allows for cross-subsidisation, whereas the RS allocation is not.

For an overview and discussion of empirical work, see for example Cohen and Siegelman (2010) and Einav et al. (2010).

References

Ales, L. and Maziero, P. (2013) Adverse selection and non-exclusive contracts, mimeo.

Ania, A. B., Tröger, T. and Wambach, A. (2002) ‘An evolutionary analysis of insurance markets with adverse selection’, Games and Economic Behavior 40 (2): 153–184.

Asheim, G. B. and Nilssen, T. (1996) ‘Non-discriminating renegotiation in a competitive insurance market’, European Economic Review 40 (9): 1717–1736.

Attar, A., Mariotti, T. and Salanié, F. (2014) ‘Non-exclusive competition under adverse selection’, Theoretical Economics 9 (1): 1–40.

Bisin, A. and Gottardi, P. (2006) ‘Efficient competitive equilibria with adverse selection’, Journal of Political Economy 114 (3): 485–516.

Cohen, A. and Siegelman, P. (2010) ‘Testing for adverse selection in insurance markets’, Journal of Risk and Insurance 77 (1): 39–84.

Crocker, K. J. and Snow, A. (1985) ‘The efficiency of competitive equilibria in insurance markets with asymmetric information’, Journal of Public Economics 26 (2): 207–219.

Dasgupta, P. and Maskin, E. (1986) ‘The existence of equilibrium in discontinuous economic games, ii: Applications’, The Review of Economic Studies 53 (1): 27–41.

Dosis, A. (2014) On modelling efficient competition in markets with adverse selection, mimeo.

Dubey, P. and Geanakoplos, J. (2002) ‘Competitive pooling: Rothschild–Stiglitz reconsidered’, Quarterly Journal of Economics 117 (4): 1529–1570.

Einav, L., Finkelstein, A. and Levin, J. (2010) ‘Beyond testing: Empirical models of insurance markets’, Annual Review of Economics 2: 311–336.

Engers, M. and Fernandez, L. (1987) ‘Market equilibrium with hidden knowledge and self-selection’, Econometrica 55 (2): 425–439.

Faynzilberg, P. S. (2006) Credible forward commitments and risk-sharing equilibria, mimeo.

Guerrieri, V., Shimer, R. and Wright, R. (2010) ‘Adverse selection in competitive search equilibrium’, Econometrica 78 (6): 1823–1862.

Hellwig, M. (1987) ‘Some recent developments in the theory of competition in markets with adverse selection’, European Economic Review 31 (1–2): 319–325.

Hellwig, M. F. (1988) ‘A note on the specification of interfirm communication in insurance markets with adverse selection’, Journal of Economic Theory 46 (1): 154–163.

Hendren, N. (2013) ‘Private information and insurance rejections’, Econometrica 81 (5): 1713–1762.

Hendren, N. (2014) ‘Unraveling versus unraveling: A memo on competitive equilibriums and trade in insurance markets’, The Geneva Risk and Insurance Review 39 (2): 176–183.

Inderst, R. and Wambach, A. (2001) ‘Competitive insurance markets under adverse selection and capacity constraints’, European Economic Review 45 (10): 1981–1992.

Jaynes, G. D. (1978) ‘Equilibria in monopolistically competitive insurance markets’, Journal of Economic Theory 19 (2): 394–422.

Lacker, J. M. and Weinberg, J. A. (1999) ‘Coalition-proof allocations in adverse-selection economies’, The Geneva Papers on Risk and Insurance—Issues and Practice 24 (1): 5–17.

Maskin, E. and Tirole, J. (1992) ‘The principal-agent relationship with an informed principal, ii: Common values’, Econometrica 60 (1): 1–42.

Mimra, W. and Wambach, A. (2010) Endogenous capital in the Rothschild–Stiglitz model, mimeo.

Mimra, W. and Wambach, A. (2011) A game-theoretic foundation for the Wilson equilibrium in competitive insurance markets with adverse selection, CESifo working paper no. 3412.

Miyazaki, H. (1977) ‘The rat race and internal labor markets’, The Bell Journal of Economics 8 (2): 394–418.

Netzer, N. and Scheuer, F. (2014) ‘A game theoretic foundation of competitive equilibria with adverse selection’, International Economic Review 55 (2): 399–422.

Picard, P. (2010) Participating insurance contracts and the Rothschild–Stiglitz equilibrium puzzle, mimeo.

Picard, P. (2014) ‘Participating insurance contracts and the Rothschild–Stiglitz equilibrium puzzle’, The Geneva Risk and Insurance Review 39 (2).

Riley, J. G. (1979) ‘Informational equilibrium’, Econometrica 47 (2): 331–359.

Rosenthal, R. W. and Weiss, A. (1984) ‘Mixed-strategy equilibrium in a market with asymmetric information’, The Review of Economic Studies 51 (2): 333–342.

Rothschild, M. and Stiglitz, J. (1976) ‘Equilibrium in competitive insurance markets: An essay on the economics of imperfect information’, The Quarterly Journal of Economics 90 (4): 629–649.

Rothschild, M. and Stiglitz, J. (1997) ‘Competition and insurance twenty years later’, The Geneva Papers on Risk and Insurance—Issues and Practice 22 (2): 73–79.

Smart, M. (2000) ‘Competitive insurance markets with two unobservables’, International Economic Review 41 (1): 153–169.

Snow, A. (2009) ‘On the possibility of profitable self-selection contracts in competitive insurance markets’, Journal of Risk and Insurance 76 (2): 249–259.

Spence, M. (1973) ‘Job market signaling’, The Quarterly Journal of Economics 87 (3): 355–374.

Spence, M. (1978) ‘Product differentiation and performance in insurance markets’, Journal of Public Economics 10 (3): 427–447.

Villeneuve, B. (2003) ‘Concurrence et antiselection multidimensionnelle en assurance’, Annales d’Economie et de Statistique 69: 119–142.

von Siemens, F. and Kosfeld, M. (2014) ‘Team production in competitive labor markets with adverse selection’, European Economic Review 68: 181–198.

Wambach, A. (2000) ‘Introducing heterogeneity in the Rothschild–Stiglitz model’, The Journal of Risk and Insurance 67 (4): 579–591.

Wilson, C. (1977) ‘A model of insurance markets with incomplete information’, Journal of Economic Theory 16 (2): 167–207.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Mimra, W., Wambach, A. New Developments in the Theory of Adverse Selection in Competitive Insurance. Geneva Risk Insur Rev 39, 136–152 (2014). https://doi.org/10.1057/grir.2014.11

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/grir.2014.11