Abstract

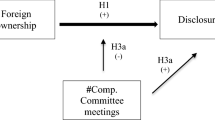

This study assesses changes in the executive compensation policy of 94 commercial banks following the SEC's expanded compensation disclosure rules and revisions in the Internal Revenue Code regarding deductibility of compensation expense. During the period from 1989–1997, commercial banks experience a significant decline in the number of insiders serving in executive compensation committees. Following compensation reform, banks seem to substitute non-cash for cash compensation, and exhibit a somewhat stronger pay-for-performance relationship. Further, board structures are statistically indistinguishable among banks that were acquired compared to surviving banks, and between banks and a sample of electric utilities. Taken together, our analysis suggests that compensation reform, rather than deregulation or corporate control, led commercial banks to change their governance structures and provides limited evidence that such changes enhanced the incentive effects of compensation contracts.

Similar content being viewed by others

References

Adams, R. and H. Mehran, “Board Structure and Banking Firm Performance. ” Working paper, Federal Reserve Bank of New York, 2002.

Alchian, A. and H. Demsetz, “Production, Information Costs, and Economic Organization. ” American Economic Review 62, 777–795 (1972).

Anderson, R. and J. Bizjak, “An Empirical Examination of the Role of the CEO and the Compensation Committee in Structuring Executive Pay. ” Working paper, American University and Portland State University, 2000.

Barro, J. and R. Barro, “Pay, Performance, and Turnover of Bank CEOs. ” Journal of Labor Economics 8, 448–481 (1990).

Baysinger B. and H. Butler, “Corporate Governance and the Board of Directors: Performance Effects of Changes in Board Composition. ” Journal of Law, Economics and Organization 1, 101–124 (1985).

Berger, A., R. Demsetz and P. Strahan, “The Consolidation of the Financial Services Industry: Causes, Consequences, and Implications for the Future. ” Journal of Banking & Finance 23, 135–194 (1999).

Brickley, J., L. Coles and R. Terry, “Outside Directors and the Adoption of Poison Pills. ” Journal of Financial Economics 34, 371–390 (1994).

Brickley, J. and C. James, “The Takeover Market, Corporate Board Composition, and Ownership Structure: The Case of Banking. ” Journal of Law and Economics 30, 161–180 (1987).

Byrd, J. and A. Hickman, “Do Outside Directors Monitor Managers? Evidence from Tender Offer Bids. ” Journal of Financial Economics 32, 195–221 (1992).

Cotter, J., A. Shivdasani and M. Zenner, “Do Independent Directors Enhance Target Shareholder Wealth During Tender Offers?” Journal of Financial Economics 43, 195–218 (1997).

Crawford, A., J. Ezzell, and J. Miles, “Bank CEO Pay-Performance Relations and the Effects of Deregulation. ” Journal of Business 68, 231–256 (1995).

Eisenburg, T., S. Sundgren and M. Wells, “Larger Board Size and Decreasing Firm Value in Small Firms. ” Journal of Financial Economics 48, 35–54 (1998).

Gilson, S., “Bankruptcy, Boards, Banks, and Blockholders: Evidence on Changes on Corporate Ownership and Control when Firms Default. ” Journal of Financial Economics 27, 355–387 (1990).

Hermalin, B. and M. Weisbach, “The Determinants of Board Composition. ” RAND Journal of Economics 19, 589–606 (1988).

Hermalin, M. and M. Weisbach, “The Effects of Board Composition and Director Incentives on Firm Performance. ” Financial Management 20, 101–112 (1991).

Holderness, C., R. Kroszner and D. Sheehan, “Were the Good Old Days that Good? Changes in Managerial Stock Ownership Since the Great Depression. ” Journal of Finance 54, 435–470 (1999).

Houston, J. and C. James, “CEO Compensation and Bank Risk—Is Compensation in Banking Structured to Promote Risk Taking?” Journal of Monetary Economics 36, 405–431 (1995).

Hubbard, R. and D. Palia, “Executive Pay and Performance: Evidence from the U.S. Banking Industry. ” Journal of Financial Economics 39, 105–130 (1995).

Jensen, M. and K. Murphy, “Performance Pay and Top Management Incentives. ” Journal of Political Economy 98, 225–264 (1990).

Kole, S., “The Complexity of Compensation Contracts. ” Journal of Financial Economics 43, 79–104 (1997).

Kole, S. and K. Lehn, “Deregulation and the Adaptation of Governance Structures: The Case of the U.S. Airline Industry. ” Journal of Financial Economics 52, 79–117 (1999).

Mayers, D., A. Shivdasani and C. Smith, “Board Composition and Corporate Control: Evidence from the Insurance Industry. ” Journal of Business 70, 33–62 (1997).

Mitchell, M. and H. Mulherin, “The Impact of Industry Shocks on Takeover and Restructuring Activity. ” Journal of Financial Economics 41, 193–229 (1996).

Murphy, K., “Corporate Performance and Managerial Remuneration: An Empirical Analysis. ” Journal of Accounting and Economics 7, 11–42 (1985).

Murphy, K., “Executive Compensation. ” Forthcoming in Orley Ashenfelter and David Card (Eds.), Handbook of Labor Economics, vol. 3, North Holland, 1999.

Newman, H. and H. Moses, “Does the Composition of the Compensation Committee Influence CEO Compensation Practices?” Financial Management 28, 41–53 (1999).

Perry, T. and M. Zenner, “Pay for Performance? Government Regulation and the Structure of Compensation Contracts. ” Working paper, Arizona State University and University of North Carolina, 1999.

Prowse, S., “Corporate Control in Commercial Banks. ” Journal of Financial Research 20, 509–527 (1997).

Schrantz, M., “Takeovers Improve Firm Performance: Evidence from the Banking Industry. ” Journal of Political Economy 101, 299–326 (1993).

Shivdasani, A. and D. Yermack, “CEO Involvement in the Selection of New Board Members: An Empirical Analysis. ” Journal of Finance 54, 1829–1854 (1999).

Smith, C. and R. Watts, “Incentive and Tax Effects of Executive Compensation Plans. ” Australian Journal of Management 7, 139–157 (1982).

Subrahmanyam, V., N. Rangan and S. Rosenstein, “The Role of Outside Directors in Bank Acquisitions. ” Financial Management 26, 23–36 (1997).

The Cadbury Report, Report of the Committee on the Financial Aspects of Corporate Governance, Gee Publishing, United Kingdom, 1992.

U.S. Securities and Exchange Commission (SEC), Executive Compensation Disclosure, Release 33–6940 (June 23, 1992a).

U.S. Securities and Exchange Commission (SEC), Executive Compensation Disclosure, Release 33–6962 (October 16, 1992b).

Vafeas, N., “Board Meeting Frequency and Firm Performance. ” Journal of Financial Economics 53, 113–142 (1999).

Vafeas, N. and Z. Afxentiou, “The Association Between the SEC's 1992 Compensation Disclosure Rule and Executive Compensation Policy Changes. ” Journal of Accounting and Public Policy 17, 27–54 (1998).

Yermack, D., “Higher Market Valuation of Companies with a Small Board of Directors. ” Journal of Financial Economics 40, 185–211 (1996).

Wartzman, R., “The Clinton Budget: Tax Plan Gives Shareholders a Voice in How Companies Pay Top Executives. ” The Wall Street Journal, A4, (April 9 1993).

Whidbee, D., “Board Composition and Control of Shareholder Voting Rights in the Banking Industry. ” Financial Management 26, 27–41 (1997).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Vafeas, N., Waegelein, J.F. & Papamichael, M. The Response of Commercial Banks to Compensation Reform. Review of Quantitative Finance and Accounting 20, 335–354 (2003). https://doi.org/10.1023/A:1024020300363

Issue Date:

DOI: https://doi.org/10.1023/A:1024020300363