Abstract

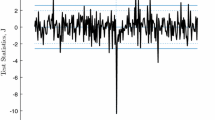

Investors in financial markets bet their dollars on whether amerger will raise or lower prices. Below, we apply an event-probability methodology to the proposed merger between Staples and Office Depot, which was challenged by the FTC and eventually withdrawn. In addition to a time-series regression,we also look at the effect of the merger in specific event windows. We find highlysignificant returns to the only rival firm in the relevant market. We estimate theprice effect of the merger and find it highly consistent with independent estimates.

Similar content being viewed by others

References

Bollerslev, Tim (1995) ‘Generalized Autoregressive Conditional Heteroscedasticity’, in Robert F. Engle, ed., ARCH: Selected Readings. Advanced Texts in Econometrics. Oxford and New York: Oxford University Press.

Brown, Stephen J., and Jerold B. Warner (1984) ‘Using Daily Stock Returns: The Case of Event Studies’, Journal of Financial Economics, 4, 3–31.

Cox, Alan J., and Jonathan Portes (1998) ‘Mergers in Regulated Industries: The Uses and Abuses of Event Studies’, Journal of Regulatory Economics, 14, 281–304.

Dalkir, Serdar, and Frederick R. Warren-Boulton (1998) ‘Prices, Market Definition, and the Effects of Merger: Staples-Office Depot (1997)’ in John E. Kwoka, Jr., and Lawrence J. White, eds., The Antitrust Revolution: Economics, Competition, and Policy, 3rd edn. Oxford: Oxford University Press.

Federal Trade Commission v. Staples, Inc., Transcript of Trial (1997).

MacKinlay, A. Craig (1997) ‘Event Studies in Economics and Finance’ Journal of Economic Literature, XXXV: 13–39.

McGuckin, Robert H., Frederick R. Warren-Boulton, and Peter Waldstein (1988) ‘Analysis of Mergers Using Stock Market Returns’ Economic Analysis Group Discussion Paper, EAG 88-1.

McGuckin, Robert H., Frederick R. Warren-Boulton, and Peter Waldstein (1992) ‘The Use of Stock Market Returns in Antitrust Analysis of Mergers’ Review of Industrial Organization, 7, 1–11.

Simpson, John D., and Daniel Hosken (1998) ‘Are Retailing Mergers Anticompetitive? An Event Study Analysis’ FTC Working Papers (No. 216).

Werden, Gregory J., and Michael A. Williams (1988) The Role of Stock Market Studies in Formulating Antitrust Policy Toward Horizontal Mergers, mimeo.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Warren-Boulton, F.R., Dalkir, S. Staples and Office Depot: An Event-Probability Case Study. Review of Industrial Organization 19, 467–479 (2001). https://doi.org/10.1023/A:1012548125974

Issue Date:

DOI: https://doi.org/10.1023/A:1012548125974