Abstract

Although the mathematics of interest is very precise, the practice of charging computing and disclosing interest or cost of credit is full of variations and therefore often questionable on ethical grounds. The purpose of this paper is to examine some of the prevalent practices which are incorrect, illogical, unfair or deceptive. Both utilitarian and formalist schools of ethical theory would find these practices to be inappropriate. The paper will specifically look at unfair practices in the areas of estimation of intrayear rates, use of 360 days in a year, the "rule of 78th", interest rate ('APR') advertising, and computation of unpaid balance by credit card issuers to figure interest costs.

The current practices are not in the best interest of the average consumer. There is, therefore, an urgent need for new legislation, change in regulatory code and disclosure requirement for eliminating these unethical practices. The author recommends that the Truth in Lending Code of the Federal Reserve should require the disclosure of the effective APR if the periodic rate is determined by dividing the 'APR' by the number of payment period in a year; the use of 360 days in a year methods and the "Rule of 78ths" should be immediately discontinued; Deceptive advertising, which tend to understate the true cost of credit or hides hidden costs and fees should be outlawed; interest should be payable with the same frequency as the frequency of compounding and credit card holders should be provided with a comparative example of various methods of balance computation.

Similar content being viewed by others

References

Bhandari, S.: 1991, 'Compounding/Discounting of intrayear Cash Flows: Principles, Pedagogy and Practices', Financial Practice and Education (Spring), 87–89.

Brady, F. N.: 1990, Ethical Managing: Rules and Results (MacMillian Publishing, New York).

DeGeorge, R. T.: 1990, Business Ethics (MacMillian Publishing Co, New York).

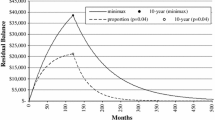

Loffman, L. and S. C. Presant: 1984, 'Interest Accruals Under the Rule of 78s: A Postmortem', Real Estate Review (Fall), 44–49.

Pae, P.: 1992, 'Watching for 'Traps' on Lower Card Rates', The Wall Street Journal (Feb. 21).

Rohner, R. J. (ed.): 1984, The Law of Truth in Lending (Gorham & Lamont, Warren, Boston).

Rushing, P. J.: 1991, 'How Many Days Are in a Year?', ORER Letter (Fall), 16 (University of Illinois).

'The Rule of 78th', Federal Reserve Bank of Philadelphia, 1988.

'Truth in Lending', Code of Federal Regulation, Washington DC, U.S. Government Printing Office, Title 12, Section 226.

Walsh, M. W.: 1984, 'Banks' Policies on Figuring and Advertising Deposit Interest Make Picking Rates Hard', The Wall Street Journal (October 8), 29.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Bhandari, S.B. Some Ethical Issues in Computation and Disclosure of Interest Rate and Cost of Credit. Journal of Business Ethics 16, 531–535 (1997). https://doi.org/10.1023/A:1017993704216

Issue Date:

DOI: https://doi.org/10.1023/A:1017993704216