Abstract

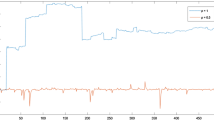

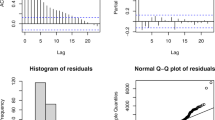

This paper discusses the problem of estimation for two classes of nonlinear models, namely random coefficient autoregressive (RCA) and autoregressive conditional heteroskedasticity (ARCH) models. For the RCA model, first assuming that the nuisance parameters are known we construct an estimator for parameters of interest based on Godambe's asymptotically optimal estimating function. Then, using the conditional least squares (CLS) estimator given by Tjøstheim (1986, Stochastic Process. Appl., 21, 251–273) and classical moment estimators for the nuisance parameters, we propose an estimated version of this estimator. These results are extended to the case of vector parameter. Next, we turn to discuss the problem of estimating the ARCH model with unknown parameter vector. We construct an estimator for parameters of interest based on Godambe's optimal estimator allowing that a part of the estimator depends on unknown parameters. Then, substituting the CLS estimators for the unknown parameters, the estimated version is proposed. Comparisons between the CLS and estimated optimal estimator of the RCA model and between the CLS and estimated version of the ARCH model are given via simulation studies.

Similar content being viewed by others

References

Billingsley, P. (1961). The Lindeberg-Lévy theorem for martingales, Proc. Amer. Math. Soc., 12, 788-792.

Bollerslev, T., Chou, R. Y. and Kroner, K. F. (1992). ARCH modeling in finance: A review of the theory and empirical evidence, J. Econometrics, 52, 5-59.

Engle, R. F. (1982). Autoregressive conditional heteroskedasticity with estimates of the variance of U. K. inflation, Econometrica, 50, 987-1007.

Feigin, P. D. and Tweedie, R. L. (1985). Random coefficient autoregressive processes: A Markov chain analysis of stationarity and finiteness of moments, J. Time Ser. Anal., 6, 1-14.

Godambe, V. P. (1960). An optimum property of regular maximum likelihood equation, Ann. Math. Statist., 31, 1208-11.

Godambe, V. P. (1985). The foundations of finite sample estimation in stochastic processes, Biometrika, 72, 419-28.

Gouriéroux, C. (1997). ARCH Models and Financial Applications, Springer, New York.

Hafner, C. M. (1998). Nonlinear Time Series Analysis with Applications to Foreign Exchange Rate Volatility, Physica, Heidelberg.

Hansen, L. P. (1982). Large sample properties of generalised method of moments estimators, Econometrica, 50, 1029-1054.

Heyde, C. C. (1997). Quasi-likelihood and Its Application: A General Approach to Optimal Parameter Estimation, Springer, New York.

Hwang, S. Y. and Basawa, I. V. (1998). Parameter estimation for generalised random coefficient autoregressive processes, J. Statist. Plann. Inference, 68, 323-337.

Klimko, L. A. and Nelson, P. I. (1978). On conditional least squares estimation for stochastic processes, Ann. Statist., 6, 629-642.

Newey, W. K. and McFadden, D. L. (1994). Large sample estimation and hypothesis testing, Handbook of Econometrics, Vol. 4 (eds. R. F. Engle and D. L. McFadden), 2111-2245, Elsevier, New York.

Nicholls, D. F. and Quinn, B. G. (1982). Random Coefficient Autoregressive Models: An Introduction, Lecture Notes in Statist., Vol. 11, Springer, New York.

Pötscher, B. M. and Prucha, I. R. (1997). Dynamic Nonlinear Econometric Models: Asymptotic Theory, Springer, Berlin.

Shephard, N. (1996). Statistical aspects of ARCH and stochastic volatility, (eds. D. R. Cox, D. V. Hinkley and O. E. Barndorff-Nielson), Time Series Models in Econometrics, Finance and Other Fields, 1-55, Chapman & Hall, London.

Thavaneswaran, A. and Abraham, B. (1988). Estimation for nonlinear time series models using estimating equations, J. Time Ser. Anal., 13, 99-108.

Tjøstheim, D. (1986). Estimation in nonlinear time series models, Stochastic. Process Appl., 21, 251-273.

Tong, H. (1990). Nonlinear Time Series: A Dynamical System Approach, Oxford University Press, Oxford.

Wooldridge, J. M. (1994). Estimating and inference for dependent processes, Handbook of Econometrics, Vol. 4 (eds. R. F. Engle and D. L. McFadden), 2639-2738, Elsevier, New York.

Author information

Authors and Affiliations

About this article

Cite this article

Chandra, S.A., Taniguchi, M. Estimating Functions for Nonlinear Time Series Models. Annals of the Institute of Statistical Mathematics 53, 125–141 (2001). https://doi.org/10.1023/A:1017924722711

Issue Date:

DOI: https://doi.org/10.1023/A:1017924722711