Abstract

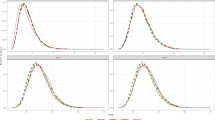

Two tests for multivariate conditional heteroscedastic models are proposed. One is based on the cross-correlations of standardized squared residuals and the other is a score (Lagrange multiplier) test. The cross-correlations test can be used to detect the presence of multivariate conditional heteroscedasticity whereas the other test can be used for diagnostic checking. Simulation studies on the size and power of the test statistics are reported. The application of the tests is illustrated by an example using the S & P 500 and Sydney All Ordinary Indexes.

Similar content being viewed by others

References

Bera, A. K. and Bilias, Y. (2001). Rao's score, Neyman's C(α) and Silvey's LM tests: An essay on historical developments and some new results, J. Statist. Plann. Inference, 97, 9–44.

Bera, A. K. and Higgins, M. L. (1993). ARCH models: Properties, estimation and testing, Journal of Economic Surveys, 7, 305–362.

Bera, A. K., Higgins, M. L. and Lee, S. (1992). Interaction between autocorrelation and conditional heteroskedasticity: A random coefficients approach, J. Bus. Econom. Statist., 10, 133–142.

Bera, A. K., Higgins, M. L. and Lee, S. (1996). Random coefficient formulation of conditional heteroscedasticity and augmented ARCH models, Sankhyā Ser. B, 58, 199–220.

Billingsley, P. (1961). The Lindeberg-Levy theorem for martingales, Proc. Amer. Math. Soc., 12, 788–792.

Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity, J. Econometrics, 31, 307–327.

Bollerslev, T., Chou, R. Y., and Kroner, K. F. (1992). ARCH modeling in finance, J. Econometrics, 52, 5–59.

Bollerslev, T., Engle, R. F. and Nelson, D. (1994). ARCH models, Handbook of Econometrics Vol. IV, (eds. R. F. Engle and D. J. McFadden), 2959–3038, Elsevier, Amsterdam.

Box, G. E. P. and Jenkins, G. M. (1970). Time Series Analysis: Forecasting and Control, Holden-Day, San Francisco, California.

Box, G. E. P. and Pierce, D. A. (1970). Distribution of the residual autocorrelations in autoregressive integrated moving average time series models, J. Amer. Statist. Assoc., 65, 1509–1526.

Cheung, Y. W. and Ng, L. K. (1996). A causality in variance test and its applications to financial market prices, J. Econometrics, 72, 33–48.

Chu, C. S. J. (1995). Detecting parameter shift in GARCH models, Econometric Rev., 14, 241–266.

Conlisk, J. (1974). Stability in a random coefficient model, Internet Econom. Rev., XV, 529–533.

Ding, Z., Granger, C. W. J. and Engle, R. F. (1993). A long memory property of stock market returns and a new model, Journal of Empirical Finance, 1, 83–106.

Engle, R. F. (1982). Autoregressive conditional heterocedasticity with estimates of variance of United Kingdom inflations, Econometrica, 50, 987–1007.

Engle, R. F. (1983). Estimates of the variance of US inflation based upon ARCH model, Journal of Money, Credit and Banking, 15, 286–301.

Engle, R. F. and Kroner, K. F. (1995). Multivariate simultaneous generalized ARCH, Econom. Theory, 11, 122–150.

Engle, R. F. and Ng, V. K. (1993). Measuring and testing the impact of news on volatilitiy, Journal of Finance, 48, 1749–1777.

Fiorentini, G., Calzolari, G. and Panattoni, L. (1996). Analytic derivatives and the computation of GARCH estimates, Journal of Applied Econometrics, 11, 397–417.

Granger, C. W. J. and Andersen, A. P. (1978). An Introduction to Bilinear Time Series Models, Vandenhoeck and Ruprecht, Gottingen.

Haggan, V. and Ozaki, T. (1981). Modelling non-linear vibrations using an amplitude-dependent autoregressive time series model, Biometrika, 68, 189–196.

Hall, P. and Heyde, C. C. (1980). Martingale Limit Theory and Its Application, Academic Press, New York.

Harvey, A. C. (1990). The Econometric Analysis of Time Series, 2nd ed., Philip Allan, New York.

He, C. and Teräsvirta, T. (1999). Properties of moments of a family of GARCH models, J. Econometrics, 92, 173–192.

Hentschel, L. (1995). All in the family: Nesting symmetric and asymmetric GARCH models, Journal of Financial Economics, 39, 71–104.

Higgins, M. L. and Bera, A. K. (1992). A class of nonlinear ARCH models, Internat. Econom. Rev., 33, 137–158.

Li, W. K. and Mak, T. K. (1994). On the squared residual autocorrelations in non-linear time series with conditional heteroskedasticity, J. Time Ser. Anal., 15, 627–636.

Lundbergh, S. and Teräsvirta, T. (1998). Evaluating GARCH models, Working Paper Series in Economics and Finance, No. 292, Stockholm School of Economics.

Luukkonen, R., Saikkonen, P. and Teräsvirta, T. (1988). Testing linearity in univariate time series models, Scan. J. Statist., 15, 161–175.

Magnus, J. R. (1988). Linear Structures, Oxford University Press, New York.

Mak, T. K. (1993). Solving nonlinear estimation equations, J. Roy. Statist. Soc. Ser. B, 55, 945–955.

McLeod, A. I. (1979). Distribution of the residual cross-correlations in univariate ARMA time series models, J. Amer. Statist. Assoc., 74(368), 849–855.

McLeod, A. I. and Li, W. K. (1983). Diagnostic checking ARMA time series models using squared-residual autocorrelation, J. Time Ser. Anal., 4, 269–273.

Nicholls, D. F. and Quinn, B. G. (1982). Random Coefficient Autoregressive Models: An Introduction, Springer, New York.

Rogers, G. S. (1980). Matrix Derivatives, Marcel Dekker, New York.

Taylor, S. J. (1986). Modelling Financial Time Series, Wiley, New York.

Tong, H. (1980). A view of nonlinear time series model building, Proc. International Time Series Meeting, Nottingham (ed. O. D. Anderson), North Holland, Amsterdam.

Tong, H. (1990). Non-linear Time Series, A Dynamical System Approach, Oxford University Press, New York.

Tsay, R. S. (1987). Conditional heteroscedastic time series models, J. Amer. Statist. Assoc., 82, 590–604.

Wong, H. and Li, W. K. (1996). Distribution of the cross-correlations of squared residuals in ARIMA models, Canad. J. Statist., 24(4), 489–502.

Wong, H. and Li, W. K. (1997). On a multivariate conditional heteroscedastic model, Biometrika, 84, 111–123.

Author information

Authors and Affiliations

About this article

Cite this article

Wong, H., Li, W.K. Detecting and Diagnostic Checking Multivariate Conditional Heteroscedastic Time Series Models. Annals of the Institute of Statistical Mathematics 54, 45–59 (2002). https://doi.org/10.1023/A:1016161620735

Issue Date:

DOI: https://doi.org/10.1023/A:1016161620735