Abstract

This article utilises up-to-date financial panel data, and investigates the capital structure of small and medium sized enterprises (SMEs) in the U.K. Different capital structure theories are reviewed in order to formulate testable propositions concerning the levels of debt in small businesses, and a number of regression models are developed to test the hypotheses.

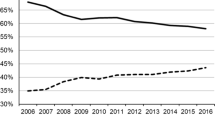

The results suggest that most of the determinants of capital structure presented by the theory of finance appear indeed to be relevant for the U.K. small business sector. Size, age, profitability, growth and future growth opportunities, operating risk, asset structure, stock turnover and net debtors all seem to have an effect on the level of both the short and long term debt in small firms. Furthermore, the paper provides evidence which suggest that the capital structure of small firms is time and industry dependent. The results indicate that time and industry specific effects influence the maturity structure of debt raised by SMEs. In general terms, average short term debt ratios in SMEs appear to be increasing during periods of economic recession and decrease as the economic conditions in the marketplace improve. On the other hand, average long term debt ratios exhibit a positive relationship with changes in economic growth.

Similar content being viewed by others

References

Ang, J., 1991, 'small Business Unqiueness & The Theory of Financial Management', Journal of Small Business Finance 1(1), 1–13.

Ang, J., 1992, 'On the Theory of Finance for Privately Held Firms', Journal of Small Business Finance 1(3), 185–203.

Ang, J., J. Chua and J. J. McConnell, 1980, The Administrative Cost of Corporate Bankruptcy, Purdue University.

Baltagi, B. H., 1995, Econometric Analysis of Panel Data, New York: Wiley.

Bank of England, 1998, Finance for Small Firms: A Fifth Report, Bank of England.

Barnea, A., R. H. Haugen and L. W. Senbet, 1981, 'An Equilibrium Analysis of Debt Financing Under Costly Tax Arbitrage and Agency Problems', Journal of Finance (June), 569–581.

Barton, S. L., N. C. Hill and S. Sundaram, 1989, 'An Empirical Test of Stakeholder Theory Predictions of Capital Structure', Financial Management (Spring), 36–44.

Bennet, M. and R. Donnelly, 1993, 'The Determinants of Capital Structure: Some U.K. Evidence', British Accounting Review 25, 43–59.

Bradley, M., G. Jarrel and E. H. Kim, 1984, 'On the Existence of an Optimal Capital Structure: Theory and Evidence', Journal of Finance 39(3), 857–880.

Cambridge Small Business Research Center (CSBRS), 1992, The State of British Enterprise, University of Cambridge.

Chittenden, F. and R. Bragg, 1997, 'Trade Credit, Cash-Flow and SMEs in the U.K., Germany and France', International Small Business Journal 16(1), 22–35.

Chittenden, F., G. Hall and P. Hutchinson, 1996a, 'small Firm Growth, Access to Capital Markets and Financial Structure: Review of Issues and an Empirical Investigation', Small Business Economics 8(1), 59–67.

Chittenden, F., P. Poutziouris and T. Watt, 1996b, Taxing Exapansion: A Model for Farier Taxes on Small and Medium-Sized Enterprises, London: National Westminster Bank.

Chittenden, F., P. Poutziouris, N. Michaelas and T. Watt, 1998, The March 1998 Budget and Small Business Taxation, London: National Westminster Bank.

DeAngelo, H. and R. Masulis, 1980, 'Optimal Capital Structure Under Corporate and Personal Taxation', Journal of Financial Economics 8, 3–29.

Department of Trade and Industry, 1995, Small Firms in Britain, DTI, London: HMSO.

Ferri, M. G. and W. H. Jones, 1979, 'Determinants of Financial Structure: A New Methodological Approach', Journal of Finance 34(3), 631–644.

Hsiao, C., 1986, Analysis of Panel Data, Cambridge University Press.

Hughes, A., 1997, 'Finance for SMEs: A U.K. Perspective', Small Business Economics 9, 151–166.

Jensen, M. and W. Meckling, 1976, 'Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure', Journal of Financial Economics 3, 305–360.

Jordan, J., J. Lowe and P. Taylor, 1998, 'strategy and Financial Policy in U.K. Small Firms', Journal of Business Finance and Accounting 25(1), 1–27.

Keasey, K. and R. Watson, 1987, 'Non-Financial Symptoms and the Prediction of Small Company Failure: A Test of Argenti's Hypothesis', Journal of Business Finance & Accounting 14.

Kester, W. C., 1986, 'Capital and Ownership Structure: A Comparison of United States and Japanese Manufacturing Corporations', Financial Management (Spring), 5–16.

Leland, H. and D. Pyle, 1977, 'Information Asymmetries, Financial Structure, & Financial Intermediation', Journal of Finance (May), 371–388.

Lowe, J., G. E. Tibbits and J. McKenna, 1991, 'small Firm Growth & Failure: Public Policy Issues and Practical Problems', in Renfrew, K. M. and R. C. McCosker (eds.), The Growing Small Business, Proceedings of Fifth National Small Business Conference, pp. 175–190.

Marsh, P., 1982, 'The Choice Between Equity and Debt: An Empirical Study', Journal of Finance 37(1), 121–143.

McConnell, J. J. and R. R. Pettit, 1984, 'Application of the Modern Theory of Finance to Small Business Firms', in P. M. Horvitz and R. R. Pettit (eds.), Small Business Finance, Edition 1, Greenwich, Connecticut: JAI Press.

Modigliani, F. and M. Miller, 1958, 'The Cost of Capital, Corporate Finance, and the Theory of Investment', American Economic Review 48(3), 291–297.

Myers, S. C., 1984, 'The Capital Structure Puzzle', Journal of Finance 34, 575–592.

Myers, S. C., 1977, 'Determinants of Corporate Borrowing', Journal of Financial Economics 5, 147–175.

Petersen, M. A. and R. G. Rajan, 1994, 'The Benefits of Lending Relationships: Evidence from Small Business Data', The Journal of Finance 49(1), 3–37.

Pettit, R. and R. Singer, 1985, 'small Business Finance: A Research Agenda', Financial Management (Autumn), 47–60.

Pinches, G. E. and K. A. Mingo, 1973, 'A Multivariate Analysis of Industrial Bond Ratings', Journal of Finance 28 (March).

Ray, G. H. and P. J. Hutchinson, 1993, The Financing and Financial Control of Small Enterprise Development, Aldershot: Gower.

Reid, G. C., 1996, 'Financial Structure and the Growing Small Firm: Theoretical Underpinning and Current Evidence', Small Business Economics 8(1), 1–7.

Remmers, L., A. Stonehill, R. Wright and T. Beekhuisen, 1974, 'Industry and Size As Debt Ratio Determinants in Manufacturing Internationally', Financial Management (Summer), 24–32.

Ross, G. C., 1977, 'The Determination of Financial Structure: The Incentive Signalling Approach', Bell Journal of Economics & Management Science (Spring), 23–40.

Stiglitz, J. E. and A. Weiss, 1981, 'Credit Rationing in Markets with Imperfect Information', American Economic Review 71(3), 393–410.

Storey, D., R. Watson and P. Wynarczyk, 1988, 'Fast Growth Small Businesses: A Study of 40 Small Firms in North East England', Research Paper No. 67, London Department of Employment.

Titman, S. and R. Wessels, 1988, 'The Determinants of Capital Structure Choice', Journal of Finance 43(1), 1–19.

Van der Wijst, N. and R. Thurik, 1993, 'Determinants of Small Firm Debt Ratios: An Analysis of Retail Panel Data', Small Business Economics 5, 55–65.

Warner, J. B., 1977, 'Bankruptcy Costs: Some Evidence', Journal of Finance 32, 337–348.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Michaelas, N., Chittenden, F. & Poutziouris, P. Financial Policy and Capital Structure Choice in U.K. SMEs: Empirical Evidence from Company Panel Data. Small Business Economics 12, 113–130 (1999). https://doi.org/10.1023/A:1008010724051

Issue Date:

DOI: https://doi.org/10.1023/A:1008010724051