Abstract

A system dynamics modeling approach was used to analyze the impact of economical mechanisms on CO2 emissions from the Latvian district heating system that is not covered by the European Union (EU) Emission Trading System (non-ETS). Three policy instruments were included in the system dynamic model: carbon tax, subsidies for solar technologies, and funding for energy-efficient building renovations with the aim to decrease energy consumption. Eight development scenarios were examined, taking into account different policy mixes for the transition of the heat network to the low-temperature regime. The heat tariff was used as the main indicator to determine the pace and structure of the technology change. The existing natural gas technologies and three renewable energy technologies (biomass combustion equipment, heat pump, and solar collectors with accumulation) were included in the model. Modeling results show substantial CO2 reduction potential; however, the results are highly dependent on the applied financial instruments. It is recommended to apply a policy mix, including all the proposed policy instruments—carbon tax, subsidies for solar technologies, and funding for energy-efficient renovation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In 2015, world leaders concluded an agreement to keep the average global temperature increase well below the 2 °C preindustrial levels, with the aim to limit the increase to 1.5 °C. According to the Paris Agreement, all parties have committed to making individual voluntary pledges to contribute to the global goal. The Paris Agreement came into force on November 4, 2016. The EU is one of the biggest greenhouse gas (GHG) emitters; however, the situation differs in the 28 member states [1]. The initial commitment of the EU is to reduce GHG emissions at least 40% (from 1990 levels) by 2030. The EU energy climate policy is considered to be a good example to follow [2, 3].

The EU has a comprehensive GHG reduction strategy [4]. The EU emission trading system (ETS) is the key tool for reducing greenhouse gas emissions from large-scale facilities of the power production and industrial sectors, as well as the aviation sector. The ETS covers about 45% of the EU’s GHG emissions. Non-ETS sectors account for some 55% of total EU emissions. These include housing, non-ETS energy, agriculture, waste, and transport (excluding aviation). EU countries have taken on binding annual targets to 2020 to cut emissions in these sectors (as compared to 2005) according to the Effort Sharing Decision [5] and draft binding targets for 2030. It is thought that with early action, the EU can get comparative advantages with other countries that start the implementation process later [6]. Modeling results show that the influence of reaching EU 2030 (as well as 2050) targets may be limited regarding GDP and positive employment levels [7]. A new investigation shows that the influence of anthropogenic GHG emissions may be significantly greater than previously estimated [8]. If these results are confirmed, an additional urgent global action might be necessary. Bioenergy will pay a substantial role in reaching EU climate—energy targets [9, 10].

The Latvian non-ETS sector is large compared to other EU countries—79.3% of total emissions (2014) [11]. That means—more action should be made at the national level. The new draft regulation [12] requires a reduction of up to 6% from 2005 levels until 2030. According to the current estimates [13], non-ETS emissions will increase by 7%. System dynamics modeling results show that under the existing policy regime, GHG emissions may by 2030 increase by 19% above the 2005 level [14]. Modeling with linear programming optimization MARKAL, Latvia’s model predicts that taking into account national economic development forecasts comprising the existing GHG emission reduction policies and measures, emissions in 2030 may increase significantly (up to 26.5%) compared to 2005 [15]. Investigations [14,15,16,17] show that in the agricultural sector, it may be difficult or impossible to reduce non-ETS emissions below the 2005 level. It may mean that those emissions will rather increase, which means that other sectors will need to achieve more substantial reductions.

According to [18], the key focus on non-ETS emissions reduction should be placed on: (1) improving energy efficiency (for production, transmission, and end-use); (2) reducing the peak load in the electricity distribution system; (3) increasing the use of biomass and biogas co-generation systems as well as biogas in the transport sector; (4) increasing the use of renewable energy in district and individual heating; and (5) a wider use of other renewable sources, including wind energy.

Different modeling approaches may be used for calculating the impact of climate mitigation measures and for a broader approach—green economy models including econometrics—measuring the relation between two or more variables, running statistical analysis of historical data and finding the correlation between specific selected variables, optimization—generating a statement of the best way to accomplish goals, and system dynamics—tools that provide information on what would happen, where a policy is implemented at a specific point in time and within a specific context [19].

District heating (DH) is one of the non-ETS emission sources. It plays a significant role in countries, where it is widely used [20]. The fourth generation district heating (4GDH) is a new paradigm of DH system moving to zero-emission level [20].

In sum, the main aim of this investigation is to evaluate how different mechanisms of CO2 emissions influence non-ETS DH system development with the goal of moving towards the zero-emission level and achieving 4GDH system. Using the system dynamic (SD) model, policy instruments are integrated to determine their correlation to each other with a view to identifying the most efficient way of moving towards a 4GDH system. Different scenarios are formed to identify the most efficient combinations of policy instruments.

Background information on case study

The non-ETS DH system in Latvia

The DH system is historically well-developed in Latvia; some 67% of the population is connected to the DH system [21]. The structure of DH consumption has not changed significantly in recent years. Space heating consumes 65–70%, and hot water preparation 30–35% of the total thermal energy used. 71.1% of the total final consumption of district heating was directed to households; 25.6% for services; 2.2% for industry and construction, and 1.1% for agriculture (2013) [22]. Historically, the vast majority of DH operators are non-ETS sector participants (see Table 1) [23].

Only 20 Latvian operators are taking part in the 2013–2020 stage of the ETS. This means that the operators of the non-ETS DH systems will have reduced their emissions, and ideally, they should conform to the principles of the fourth generation of the DH system. The total thermal energy produced in 2013 was 6.65 TWh, 1.79 TWh of this was produced by heat only boiler (HOB) technology [24].

Two fuels dominate in the Latvian DH system: natural gas and biomass. The share of thermal energy produced from biomass has begun to increase only in last few years (see Fig. 1) [24].

Heat production share at DH system in Latvia [24]

Systems operate within the second and third generation temperature regimes, respectively, 110/70 or 90/60 (supply/return). Heat production 1.79 TWh per year by proportion 30/70% (biomass/natural gas) was used as the initial data for modeling.

Energy consumption in buildings

The main consumers for the DH non-ETS sector are apartment buildings. Pursuant to the Latvian regulation on building energy performance, the Ministry of Economics updates certification space heating energy consumption in apartment buildings yearly. According to this information, space heating consumption in 2016 is 152.04 kWh/m2 per year. This represents a decrease from 157.67 kWh/m2 in 2014. There is a limited success in renovating older apartment buildings because of legal problems and a shortage of resources [25].

Since the amount of energy produced in non-ETS DH systems is directly related to energy consumption in buildings, it was assumed in this study that the rate of change of energy produced will be the same as the rate of change of energy consumption in apartment buildings.

The rate of change of energy consumption for heating apartment buildings was calculated based on the existing energy consumption in apartment buildings and the expected investments in building renovation.

It was assumed that apartment buildings will be renovated only if co-funding for renovation is received, considering that there were no new renovation projects after the middle of 2015 when EU co-funding became unavailable.

The available co-funding for apartment building renovation for the new EU funds programming period is 156.3 million EUR. On average, co-funding makes up 43% of total building renovation costs. This means that the total investment for apartment building renovation can be assumed to be 363.5 million EUR. This investment must be spent by 2022, which means a yearly investment of 60.6 million EUR. The average cost of building renovation (according to the results of previous EU funding period) is 120 EUR/m2. This means that 505 thousand m2 of apartment buildings can be renovated each year. In total, there are 61 million m2 of households in Latvia [25]. It was assumed that after building renovation, the average space heating consumption will be 70 kWh/m2, which is the level of heat consumption in those apartment buildings in Latvia that have already been renovated. It was assumed that after 2022 when EU co-funding for apartment building renovation ends, energy consumption will decrease at the same rate as during the period 2017–2022, assuming that other economical mechanisms promoting renovation will be introduced.

The goal of the long-term energy strategy of Latvia is to reduce specific heat consumption to 100 kWh/m2 per year by 2030 [26]. In this scenario, it is assumed that sufficient amount of economical mechanisms for reaching this goal will have been introduced.

CO2 tax policy and other economical instruments in Latvia

Latvia has applied a carbon tax for non-ETS emissions in the energy sector; the tax is relatively small, 2.85 EUR/t in 2014, 3.5 EUR/t 2015–2016, and 4.50 EUR/t beginning in 2017. One of the arguments is that tax should not differ significantly from the carbon price in the EU ETS system. Still, the Latvian non-ETS tax rate is one of the lowest in comparison with other countries, including many EU countries [27]. There is an assumption that the price of carbon in the form of tax or ETS system should be at least 20 EUR/t [28, 29]. The authors of [29] even discuss options about simultaneously applying a carbon tax and an ETS system. According to [27], a realistic carbon tax of around 60 USD/t (55 EUR/t) may be set.

The proceeds from the ETS auctions, according to the Latvian legislation, should be used for GHG mitigation measures and for adapting to climate change.

Methodology

Overview of developed system dynamics model

CO2 tax policy and other economic instruments were integrated into the non-ETS system dynamics model made in previous research [30]. Then, the dynamics of the DH system development towards the fourth generation system were investigated. The aim of the system dynamics model is to analyze how complex systems change over time. To do so, the elements within the system as well as their mutual relationships have to be identified [31]. The SD theory is based on the three main concepts that should be taken into account when developing a new model, to acquire correct and reliable results [32]:

-

stocks, flows and feedback loops;

-

precisely defined boundaries of the system;

-

causal relationships, not correlations.

In the previous research of the authors [30], a conceptual framework of the non-ETS DH model (Fig. 2) was developed using the five main steps of SD—problem formulation, creating a dynamic hypothesis, model formulation and simulation, model testing, and scenario simulation.

Within this research, various scenarios for CO2 reduction using different methods were examined: CO2 tax, subsidies for renewable energy technologies and grants for conservation measures in buildings. These measures were applied separately as well as in different combinations. In this research, economic indicators in the context of the reduced CO2 emissions, which describes the sustainability of the scenarios, were also examined.

The reduction of CO2 emissions (E, tCO2 per year), achieved by switching from fossil fuel technologies to renewable energy technologies in heat production, was calculated using the following formula:

The 4GDH model was developed with the program “Powersim Studio 8”. The model used in this research is an extended version of the authors’ previous research [30]. The previous model was built to predict how the future DH system will look. Four different technologies were chosen for this purpose and they form the main stocks of the model—natural gas boilers and biomass boilers which are already used in DH system as well as solar collectors with seasonal storage and heat pumps, which are taken as plausible future technologies [30]. The initial share of installed capacity of natural gas combustion technology in SD model is 70% and the share of biomass combustion technology—30%. A share of the different resource technologies depends on the capacity changes. Incoming investment flows and outgoing depreciation flows determine the installed capacity stocks [33]. In general, the stock level at a particular time (t) is determined by differential equation [32]:

Technologies compete with each other. Economically most profitable technologies are installed in the following years.

To determine which of these technologies will develop in the future and how the DH system will look, heat tariffs of all four technologies are compared. Heat tariffs are taken as the main driving force when making decisions about which of the four technologies to install after the old ones have reached the end of their technical lifetime. Tariffs are compared at the time when decisions about the change of technologies should be made. The heat tariff calculation methodology based on the heat calculation methodology developed by the Public Utility Commission of Latvia [34]. Methodology determines the procedures by which suppliers are calculated following the tariff-regulated thermal energy supply services: the production, distribution, and sale. The single-part tariff is applied by research and calculated so, as to cover both the fixed cost as well as the variable cost:

Each part of the tariff is constituted by the values of fixed costs (FC) and variable costs (VC):

The distribution of the fixed and variable costs is maintained also for the transmission and sales tariff; however, different from Eq. (4), costs are divided not by the total produced amount of heat, but by the amount of heat transmitted to the consumers.

Variable costs concern the cost of fuel and the cost of the production process required electricity as well as natural resources tax, income tax, and others. Fixed costs include maintenance and operating costs, which account both labor and administration salaries, as well as repair and other additional expenses. One of the most important fixed costs is investments and the related loan repayments. The main input data for modeling are collected in Table 2.

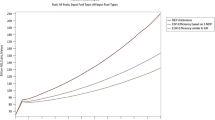

In addition, the efficiency of all provided technologies will be gradually increased until 2030. This will increase the efficiency of biomass boilers from 0.8 to 0.95 [38]. Owing to the efficiency increase of the condenser economizer, the COP of the heat pump may be increased from 3.5 to 4.5, the efficiency of solar collectors—from 0.45 to 0.55, and the efficiency of gas boilers—from 0.92 to 0.97 [38]. The initial price of natural gas was 32 EUR/MWh, which is based on the average price in the year 2016 and the initial price of biomass was 12 EUR/MWh.

Creation of dynamic hypotheses

The causal loop diagram consists from one reinforcing (R) and one balancing (B) loop. The reinforcing loop describes a situation in which renewable technologies replace fossil, or in this case, natural gas technologies, and by so doing, attempt to decrease network temperature and increase the efficiency of the whole system. This contributes to even further development of renewable technologies. The balancing loop tries to prevent renewable technologies from being implemented thus slowing down the transition. The heat tariff is the element that determines whether the reinforcing or the balancing loop will be the stronger; it actually determines which way the DH system will develop—towards fossil technologies or towards 4GDH system.

The main dynamic hypothesis is that non-ETS DH systems will be the first ones from this sector to shift to the fourth generation system, which is characterized by its high renewable energy share, low-temperature networks, and low specific heat consumption at end users.

To strengthen the reinforcing loop, even more, subsidies for solar collectors with seasonal storage at the amount of 25% were integrated into the model. Subsidies should help to reduce the necessary investment for solar collectors and thus promote solar’s faster introduction into the system by replacing existing technical solutions. The availability of solar subsidies depends on renewable energy policy and available funding. Additional complications are caused by the fact that use of solar technologies in Latvia is in its early stages, which leads to additional costs (inconvenience cost) (see Fig. 3).

The reduction of heat consumption at the end users reduces the total energy required. It is associated with different processes in society including: approved standards and regulations, legislative requirements about energy efficiency, and available funding to perform conservation measures.

To weaken the balancing loop, a CO2 tax for fossil fuels was implemented in the model. A CO2 tax is already applied in several EU countries (see “CO2 tax policy and other economical instruments in Latvia”).

Scenarios showing the impact of economical mechanisms on CO2 emissions from non-ETS district heating in Latvia

Various policy instruments are used in different scenarios to analyze the behavior of non-ETS DH systems during the transition to the 4GDH (Table 3).

The first two scenarios developed in this article are related only to energy-efficiency measures in buildings, taking into account the change in energy consumption. Scenario 1 is based on the available funding for apartment building renovation; while the high energy-efficiency scenario 2 is based on reaching heat consumption of 100 kWh/m2 per year in 2030 (for government goal, see “Energy consumption in buildings”). The consumption of produced heat for non-ETS DH systems gradually decreases from 1.75 to 1.64 TWh per year in scenario 1 and from 1.75 to 1.15 TWh per year in scenario 2 (see Fig. 4).

In scenarios 3–8, a CO2 tax for fossil fuel is introduced. The CO2 tax is increased gradually from 4.5 EUR/tCO2 (2016) to 20.0 EUR/tCO2 (2030) in scenarios 3, 5, and 7. A more rigorous policy is applied in scenarios 4, 6, and 8, where the CO2 tax is gradually increased from 4.5 EUR/tCO2 (2016) to 55.0 EUR/tCO2 (2030).

Subsidies for investment in solar collectors with accumulation technologies are applied in scenarios 7 and 8.

Results

Comparison of short- and long-term perspectives of non-ETS CO2 emission mitigation in DH system development

A comparison of CO2 emission decrease for all eight scenarios described in this article for both the short-term (2020) and long-term perspectives (2030) is shown in Fig. 5.

The level of CO2 emissions in Fig. 5 is shown in relation with the current state of DH systems (2016). In the short term, the emission reduction fluctuates from 11.6 to 35.0% in every scenario. A CO2 emission reduction to 11.6% (1 Sc) is expected in the worst-case scenario, which is if the country continues with its existing residential sector energy-efficiency policy, and if funding, which is the main driving force of this process, is not increased. However, if the funding is increased and other economic incentives implemented including, for example, the promotion of Energy service companies (ESCO), to achieve the government’s energy-efficiency goal for 2030 (2 Sc), then it is possible to reach a 20% reduction in the short term. The difference between 1 Sc and 2 Sc is only 8.4% in the short term, but in the long term, it doubles and reaches 15.6%. The financial support necessary for implementing the residential sector housing renovation processes is 60.6 million EUR per year in the case of 1 Sc. By 2030, the total costs will be 848 million EUR. From the standpoint of energy efficiency, the more sustainable 2 Sc goal will cost 363.6 million EUR per year, and by 2030, the total costs are estimated to be up to 4643 million EUR (5.48 times more than 1 Sc).

The implementation of a CO2 tax and its gradual increase (from 4.5 to 20 EUR/tCO2) reduces emissions an additional 5% (1 Sc compared to 3 Sc) in the short term and 9.9% in the long term. In addition, it will increase Government revenues by 28.3 million EUR (3 Sc) to 2030 which 50% more than in 1 Sc. Where a more rigorous CO2 policy is applied, the emissions will be reduced by 7% (1 Sc compared to 4 Sc) in the short term and 14% in the long term when the CO2 tax is increased from 4.5 to 55 EUR/tCO2. 48.9 million EUR will be collected in the country’s budget by 2030 (4 Sc). We can conclude that a more stringent CO2 tax policy gives an additional 4.1% emission reduction (3 Sc compared to 4 Sc in the long term). A similar result (a 3.8% emission reduction) is achieved if we apply this CO2 tax policy to the advanced energy-efficiency scenarios for apartment buildings (5 Sc compared to 6 Sc in the long term). Using this CO2 tax policy augmented with subsidies for solar technologies (7 Sc compared to 8 Sc), the result is similar—4% additional emission reduction. Subsidies for solar technology installations result in the largest additional emission reductions. A subsidy policy together with a moderate CO2 tax (4.5–20 EUR/tCO2) results in a decrease in emissions by 11.4% in the short term and by 18.9% in the long term. (2 Sc compared to 7 Sc). Where subsidies are added to the more stringent CO2 tax policy (from 4.5 to 55 EUR/tCO2), emissions are reduced by 15% in the short term and by 22.9% in long term (2 Sc compared to 8 Sc). The required total amount of subsidies is 185.4 million EUR until 2030 in 7 Sc and 195.3 million EUR in 8 Sc.

Heat production technologies shares: a comparison of short- and long-term perspectives for non-ETS DH system

Figure 6 shows the distribution of technical solutions in the short term (2020). The share of natural gas-fired technologies will decrease from 10% (1 Sc) to 24.6% (8 Sc) (70% share at the start of modeling). The share of biomass-fired equipment increases from 9.9% (1 Sc) to 23.9% (8 Sc) (30% share at the start of modeling).

Unfortunately, the use of solar collectors with accumulation technologies does not exceed 1% in all scenarios in the short term (2020). The share of solar collectors and heat pump productions is negligible and not included in Fig. 6. Solar collectors, as well as heat pump usage, are not processes that can evolve without the application of additional financial aid [30].

A better situation for solar technologies can be achieved by 2030 (Fig. 7). However, even taking into account technology developments without the subsidies, we cannot increase the use of solar collectors by more than 10% (1, 2, 3, 4, 5, and 6 Sc). The share of solar collector production increase in scenarios 7 and 8 in the long term (2030) is based on the reductions dynamics of solar technology cost. The heat tariff of the solar technology remains competitive from the 2023 year. On the other hand, in all other scenarios (1, 2, 3, 4, 5, and 6 Sc), it happens only in 2027–2028, which does not allow installed solar technologies to compete with biomass combustion technology. However, thanks to the additional subsidies, which speeds up the tariff reduction, solar technology installation increases significantly in scenarios 7 and 8 (Fig. 6). The rate of solar collectors with accumulation technologies usage can increase to about 50% if subsidies of 25% above the amounts invested are included. A substantial reduction in the use of natural gas technologies can be achieved. A reduction of 31.1% (1 Sc) in the use of natural gas technologies is projected. Usage could fall to 14.5% (8 Sc) from 70% at the start of modeling. In scenarios 1–6, the main alternative for natural gas-fired technologies is biomass-fired technologies. Only by adding the subsidies for solar technology, we can increase its usage to 43.8–49.4% at the same time reducing the usage of natural gas technologies from 18.8 to 14.5%. This will also have to effect of not allowing biomass-fired technologies to become the dominant technology. Biomass-fired technology will have an important role in Latvia’s future 4GDH system, but we should take into account that we can produce different products with higher added value from biomass rather than burning it in DH systems [39]. Still, biomass has an important role in stabilizing daily and seasonal fluctuations that happen with solar energy sources. It will also make DH systems more flexible. This means that scenarios 7 and 8 are optimal to encourage technology diversification.

Conclusions

-

1.

According to the Paris Agreement, all EU countries have committed to making individual voluntary pledges to reduce GHG emissions. The article has investigated different means for reducing CO2 emissions, from further development of non-ETS DH systems, to developing 4GDH systems that move towards zero emission levels: increasing CO2 tax, the energy-efficiency measures by heat consumers’ side, and solar technology subsidies. This paper provides eight different scenarios that combine these three mechanisms. The first two scenarios examine the reduction in CO2 emissions due to energy-efficiency measures by renovating in buildings. The consumption of produced heat for non-ETS DH systems gradually decreases from 1.75 to 1.64 TWh per year in scenario 1 and from 1.75 to 1.15 TWh per year in scenario 2. Implementation of both scenarios requires large capital investments. The investment for scenario 2, which is more sustainable, is estimated up to 4643 million euro (5.48 times more than 1 Sc). Energy-efficiency measures implementation by consumers’ side allows reducing CO2 emissions by 62% (2 Sc).

-

2.

Moreover, increasing of CO2 tax is added to energy-efficiency measures by renovating in buildings. Increased CO2 tax can be implemented in two ways: gradually from 4.5 EUR/tCO2 (2016) to 20.0 EUR/tCO2 (2030) and from 4.5 EUR/tCO2 (2016) to 55.0 EUR/tCO2 (2030). This paper provides four scenarios, which combine these two mechanisms with to energy-efficiency measures by renovating in buildings. A more rigorous CO2 policy allows collecting 48.9 million euro in the country’s budget by 2030 (4 Sc). Unfortunately, it does not cover the necessary investment for solar technology which is up to 136 million euro. The emissions will be reduced by 55.5% (1 Sc compared to 4 Sc) in the long term (2030) when the CO2 tax is increased from 4.5 to 55 EUR/tCO2.

-

3.

In addition, 25% subsidies for investment for solar collectors with accumulation technology were included in scenario 7 and scenario 8. The CO2 emission reduces at 76% for scenario 7 and at 80% for scenario 8. In that case, scenarios 7 and 8 are the most sustainable, because they achieve the highest emission reduction from natural gas and the highest share of solar collectors while keeping the share of biomass combustion technologies at a sustainable 30–40% level. It can be concluded that for achieving emission reductions in the non-ETS sector as well as energy-efficiency goals and taking into account biodiversity goals, Government should as much as possible apply a policy mix that includes taxation, solar technology subsidies, and promotion of energy efficiency in buildings.

Abbreviations

- \(T_{i}\) :

-

Tariff of thermal energy for the respective technology i, €/MWh

- \({\text{FC}}_{\text{R}}\) :

-

Fixed costs for the production, tariff, €/year

- \(T_{{{\text{tr}}i}}\) :

-

Distribution tariff, €/MWh

- \(T_{{{\text{prod}}i}}\) :

-

Production tariff for the respective technology i, €/MWh

- \({\text{VC}}_{\text{R}}\) :

-

Variable costs of the production tariff, €/year

- \(T_{3i}\) :

-

Sales tariff, €/MWh

- \(Q_{{{\text{prod}}i}}\) :

-

Produced amount of heat for the respective technology i, MWh/year

- i :

-

Type of selected technology

- \({\text{Stock}}_{t}\) :

-

The stock level at time t

- \({\text{Flow}}_{{(t,t - {\text{d}}t)}}\) :

-

The flow rate influencing the stock during the time period from (t − dt) to t

- \({\text{Stock}}_{{(t - {\text{d}}t)}}\) :

-

The stock level at the time (t − dt), the initial stock

- dt :

-

The time interval over which the equation spans

- \(E_{\text{CO2}}\) :

-

CO2 emission factor, tCO2/MWh

- Q :

-

Amount of heat produced, MWh per years

- η :

-

Efficiency coefficient

- GHG:

-

Greenhouse gas

- EU:

-

The European Union

- ETS:

-

The emissions trading system

- non-ETS:

-

Not covered by Emission Trading System

- GDP:

-

Gross domestic product

- DH:

-

District heating

- 4GDH:

-

Fourth generation district heating

- SD:

-

System dynamic

- HOB:

-

Heat only boiler

- M€:

-

Million euro

- COP:

-

Coefficient of performance

- R:

-

Reinforcing

- B:

-

Balancing

- 1 Sc:

-

Scenario 1

- 2 Sc:

-

Scenario 2

- 3 Sc:

-

Scenario 3

- 4 Sc:

-

Scenario 4

- 5 Sc:

-

Scenario 5

- 6 Sc:

-

Scenario 6

- 7 Sc:

-

Scenario 7

- 8 Sc:

-

Scenario 8

References

Su, M., Pauleit, S., Yin, X., Zheng, Y., Chen, S., Xu, C.: Greenhouse gas emission accounting for EU member states from 1991 to 2012. Appl. Energy (2016). doi:10.1016/j.apenergy.2016.02.074

Calvin, K., Edmonds, J., Bakken, B., Wise, M., Kim, S., Luckow, P., Patel, P., Graabak, I.: EU 20-20-20 energy policy as a model for global climate mitigation. Climate Policy (2014). doi:10.1080/14693062.2013.879794

de las Heras, B.P.: Beyond Kyoto: the EU’s contribution to a more sustainable world economy. Eur. Law J. (2013). doi:10.1111/eulj.12041

da Graça Carvalho, M.: EU energy and climate change strategy. Energy (2012). doi:10.1016/j.energy.2012.01.012

Decision No. 406/2009/EC: http://eur-lex.europa.eu/legal-content/EN/TXT/?uri=uriserv:OJ.L_.2009.140.01.0136.01.ENG. Accessed 6 Feb 2017

Karkatsoulis, P., Capros, P., Fragkos, P., Paroussos, L., Tsani, S.: First-mover advantages of the European Union’s climate change mitigation strategy. Int. J. Energy Res. (2016). doi:10.1002/er.3487

Fragkos, P., Tasios, N., Paroussos, L., Capros, P., Tsani, S.: Energy system impacts and policy implications of the European intended nationally determined contribution and low-carbon pathway to 2050. Energy Policy (2017). doi:10.1016/j.enpol.2016.10.023

Friedrich, T., Timmermann, A., Tigchelaar, M., Timm, O.E., Ganopolski, A.: Nonlinear climate sensitivity and its implications for future greenhouse warming. Sci. Adv. 2, e1501923 (2016)

Proskurina, S., Sikkema, R., Heinimö, J., Vakkilainen, E.: Five years left—how are the EU member states contributing to the 20% target for EU’s renewable energy consumption; the role of woody biomass. Biomass Bioenerg. (2016). doi:10.1016/j.biombioe.2016.09.016

Röder, M., Thornley, P.: Bioenergy as climate change mitigation option within a 2 °C target—uncertainties and temporal challenges of bioenergy systems. Energy Sustain. Soc. (2016). doi:10.1186/s13705-016-0070-3

Latvia’s National Inventory Report. Submission under UNFCCC and the Kyoto protocol. 1990—2014 http://www.meteo.lv/fs/CKFinderJava/userfiles/files/Vide/Klimats/Zin_starpt_org/LV_NIR_2016_UNFCCC_KP_Final.pdf. Accessed 15 Nov 2016

COM (2016) 482 final 2016/0231 (COD) https://ec.europa.eu/transparency/regdoc/rep/1/2016/EN/1-2016-482-EN-F1-1.PDF. Accessed 1 Nov 2016

SWD (2016) 82 final COMMISSION STAFF WORKING DOCUMENT Country Report Latvia 2016 http://ec.europa.eu/europe2020/pdf/csr2016/cr2016_latvia_en.pdf. Accessed 15 Oct 2016

Blumberga, A., Timma, L., Lauka, D., Dace, E., Barisa, A., Blumberga, D.: Achieving sustainability in non-ETS sectors using system dynamics modelling practice. Chem. Eng. (2015). doi:10.3303/CET1545146

Klavs, G., Kudrenickis, I., Rekis, J.: Development of Latvia greenhouse gas reduction policy: modelling and analysis. In: International Multidisciplinary Scientific GeoConference Surveying Geology and Mining Ecology Management, SGEM, vol. 1. no. 4, pp 921–932 (2015)

Dace, E., Muizniece, I., Blumberga, A., Kaczala, F.: Searching for solutions to mitigate greenhouse gas emissions by agricultural policy decisions —application of system dynamics modeling for the case of Latvia. Sci. Total Environ. (2015). doi:10.1016/j.scitotenv.2015.04.088

Pilvere, I., Lenerts, A.: Agricultural GHG emission and mitigation measures in Latvia. Eng. Rural Dev. 14, 571–576 (2015)

Blumberga, D., Cimdiņa, G., Timma, L., Blumberga, A., Rošā, M.: Green energy strategy 2050 for Latvia: a pathway towards a low carbon society. Chem. Eng. Trans. (2014). doi:10.3303/CET14392521507

UNEP Green Economy Using models for green economy policymaking. http://www.un-page.org/files/public/content-page/unep_models_ge_for_web.pdf. Accessed 1 Nov 2016

Lund, H., Werner, S., Wiltshire, R., Svendsen, S., Thorsen, J.E., Hvelplund, F., Mathiesen, B.: 4th generation district heating (4GDH) smart thermal grids into future sustainable energy systems. Energy 2014(68), 1–11 (2014)

Ziemele, J., Pakere, I., Blumberga, D.: The future competitiveness of the non-emissions trading scheme district heating systems in the Baltic States. Appl. Energy (2016). doi:10.1016/j.apenergy.2015.05.043

Ministry of Economics of Latvia: https://www.em.gov.lv/lv/nozares_politika/energoefektivitate_un_siltumapgade/siltumapgade/. Accessed 10 Nov 2016

Central Statistical Burea of Latvia: Statistical Yearbook of Latvia, p. 487. Central Statistical Bureau of Latvia, Riga (2016)

Central Statistical Bureau of Latvia. 2010. http://www.csb.gov.lv/. Accessed 1 Nov 2016

Miezis, M., Zvaigznitis, K., Stancioff, N., Soeftestad, L.: Climate change and buildings energy efficiency—the key role of residents. Environ. Clim. Technol. (2016). doi:10.1515/rtuect-2016-0004

Informative Report Long-Term Energy Strategy of Latvia 2030—Competitive Energy For The Society http://vvc.gov.lv/image/catalog/dokumenti/Informative_Report_Long-Term_Energy_Strategy_of_Latvia_2030.doc. Accessed 12 Feb 2017

World Bank; Ecofys; Vivid Economics: State and trends of carbon pricing 2016. Washington, DC (2016) License: CC BY 3.0 IGO. http://hdl.handle.net/10986/25160. Accessed 8 Feb 2017

Rocchi, P., Serrano, M., Roca, J.: The reform of the European energy tax directive: exploring potential economic impacts in the EU27. Energy Policy (2014). doi:10.1016/j.enpol.2014.09.022

Brink, C., Vollebergh, H.R.J., van der Werf, E.: Carbon pricing in the EU: evaluation of different EU ETS reform options. Energy Policy (2016). doi:10.1016/j.enpol.2016.07.023

Ziemele, J., Gravelsins, A., Blumberga, A., Vigants, G., Blumberga, D.: System dynamics model analysis of pathway to 4th generation district heating in Latvia. Energy (2016). doi:10.1016/j.energy.2015.11.073

Albin, S.: Building a System Dynamics Model Part 1: Conceptualization. Massachusetts Institute of Technology, Cambridge (1997). https://ocw.mit.edu/courses/sloan-school-of-management/15-988-system-dynamics-self-study-fall-1998-spring-1999/readings/building.pdf. Accessed 10 July 2017

Blumberga, A., Blumberga, D., Bazbauers, G., Davidsen, P., Moxnes, E., Dzene, I., et al.: System Dynamics for Environmental Engineering Students. Riga Technical University, Riga, Massachusetts (2011)

Blumberga, D., Blumberga, A., Barisa, A., Rosa, M., Lauka, D.: Modelling the Latvian market to evaluate its environmental long-term performance. Appl. Energy 162, 1593–1600 (2016)

Methodology for Calculation of Heat Supply Tariff. 2010. http://likumi.lv/doc.php?id=208283. Accessed 1 Feb

Historical Natural Gas Tariffs. 2015. http://www.lg.lv/?id=139&lang=lat. Accessed 1 Feb

Danish Energy Agency: Technology data for energy plants—generation of electricity and district heating, energy storage and energy carrier generation and conversion. Technical Report. Danish Energy Agency and Energinet (2012)

Chau, J., Sowlati, T., Sokhansanj, S., Preto, F., Melin, S., Bi, X.: Techno-economic analysis of wood biomass boilers for the greenhouse industry. Appl. Energy 86, 364–371 (2009)

Ziemele, J., Gravelsins, A., Blumberga, A., Blumberga, D.: The effect of energy efficiency improvements on the development of 4th generation district heating. Energy Proc. 95, 522–527 (2016)

Mathiesen, B., Lund, H., Connolly, D.: Limiting biomass consumption for heating in 100% renewable energy systems. Energy 48(2012), 160–168 (2012)

Acknowledgements

The work has been supported by the National Research Program “Energy efficient and low-carbon solutions for a secure, sustainable and climate variability reducing energy supply (LATENERGI)”. We would also like to show our gratitude to the Baccalaureate student Ms. Amalija Svarckopfa from the Institute of Energy Systems and Environment for her help during the development of this article.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Ziemele, J., Cilinskis, E., Zogla, G. et al. Impact of economical mechanisms on CO2 emissions from non-ETS district heating in Latvia using system dynamic approach. Int J Energy Environ Eng 9, 111–121 (2018). https://doi.org/10.1007/s40095-017-0241-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40095-017-0241-9