Abstract

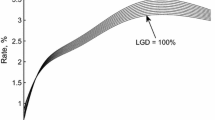

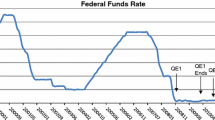

In the aftermath of the 2007–2009 financial crisis, a variety of spreads have developed between quantities that had been essentially the same until then, notably LIBOR–OIS spreads, LIBOR–OIS swap spreads, and basis swap spreads. By the end of 2011, with the sovereign credit crisis, these spreads were again significant. In this paper we study the valuation of LIBOR interest rate derivatives in a multiple-curve setup, which accounts for the spreads between a risk-free discount curve and LIBOR curves. Towards this end we resort to a defaultable HJM methodology, in which these spreads are explained by an implied default intensity of the LIBOR contributing banks, possibly in conjunction with an additional liquidity factor. Markovian short rate specifications are given in the form of an extended CIR and a Lévy Hull–White model for a risk-free short rate and a LIBOR short spread. The use of Lévy drivers leads to the more parsimonious specification. Numerical values of the FRA spreads and the basis swap spreads computed with the latter largely cover the ranges of values observed even at the peak of the 2007–2009 crisis.

Similar content being viewed by others

References

Barndorff-Nielsen O.E., Shephard N. : Modelling by Lévy processes for financial econometrics. In: Barndorff-Nielsen, O.E., Mikosch, T., Resnick, S. (eds) Lévy Processes: Theory and Applications, pp. 283–318. Birkhäuser, Basel (2001)

Bianchetti, M.: Two curves, one price. Risk Mag., August 74–80 (2010)

Bielecki T.R., Rutkowski M.: Rutkowski: Multiple ratings model of defaultable term structure. Math. Finance 10, 125–139 (2000)

Bielecki T.R., Rutkowski M.: Credit Risk: Modeling, Valuation and Hedging. Springer, New York (2002)

Carr P., Geman H., Madan D., Yor M.: The fine structure of asset returns: An empirical investigation. J. Busi. 75, 305–332 (2002)

Chiarella C., Kwon O.K.: Classes of interest rate models under the HJM framework. Asia Pacific Financ Mark 8(1), 1–22 (2001)

Chiarella, C., Maina, S.C., Nikitopoulos, C.S.: Markovian defaultable HJM term structure models with unspanned stochastic volatility. Research Paper Series 283, Quantitative Finance Research Centre, University of Technology, Sydney (2010)

Cont R., Tankov P.: Financial Modelling with Jump Processes. Chapman and Hall/CRC Press, London (2003)

Crépey, S.: Bilateral counterparty risk under funding constraints - part II: CVA. Forthcoming in Mathematical Finance (2011)

Eberlein E., Glau K., Papapantoleon A.: Analysis of Fourier transform valuation formulas and applications. Appl. Math. Finance 17(3), 211–240 (2010)

Eberlein E., Jacod J., Raible S.: Lévy term structure models: no-arbitrage and completeness. Finance Stochas. 9, 67–88 (2005)

Eberlein E., Kluge W.: Exact pricing formulae for caps and swaptions in a Lévy term structure model. J. Comput. Finance 9(2), 99–125 (2006)

Eberlein E., Kluge W.: Valuation of floating range notes in Lévy term structure models. Math. Finance 16, 237–254 (2006)

Eberlein E., Koval N.: A cross-currency Lévy market model. Quant. Finance 6(6), 465–480 (2006)

Eberlein E., Özkan F.: The defaultable Lévy term structure: ratings and restructuring. Math. Finance 13, 277–300 (2003)

Eberlein E., Raible S.: Term structure models driven by general Lévy processes. Math. Finance 9, 31–53 (1999)

Filipović, D., Trolle, A.B.: The term structure of interbank risk. SSRN eLibrary. http://papers.ssrn.com/so13/papers.cfm?abstract_id=1923696 (2011)

Fujii M., Shimada Y., Takahashi A.: A market model of interest rates with dynamic basis spreads in the presence of collateral and multiple currencies. Wilmott Mag. 54, 61–73 (2011)

Fujii M., Shimada Y., Takahashi A.: A note on construction of multiple swap curves with and without collateral. FSA Res. Rev. 6, 139–157 (2010)

Grbac, Z.: Credit Risk in Lévy Libor Modeling: Rating Based Approach. Ph.D. thesis, University of Freiburg, Baden-Württemberg (2010)

Heath D., Jarrow R., Morton A.: Bond pricing and the term structure of interest rates: a new methodology for contingent claims valuation. Econometrica 60, 77–105 (1992)

Henrard M.: The irony in the derivatives discounting. Wilmott Mag. 2, 92–98 (2007)

Henrard M.: The irony in the derivatives discounting part II: the crisis. Wilmott J. 2, 301–316 (2010)

Jacod J., Shiryaev A.N.: Limit Theorems for Stochastic Processes. 2nd edn. Springer, New York (2003)

Kenyon, C.: Short-rate pricing after the liquidity and credit shocks: including the basis. SSRN eLibrary. http://papers.ssrn.com/so13/papers.cfm?abstract_1i=1558429 (2010)

Kijima M., Tanaka K., Wong T.: A multi-quality model of interest rates. Quant. Finance 9(2), 133–145 (2009)

Kluge, W.: Time-Inhomogeneous Lévy Processes in Interest Rate and Credit Risk Models. Ph.D. thesis, University of Freiburg, Baden-Württemberg (2005)

Kyprianou A.E.: Introductory Lectures on Fluctuations of Lévy Processes with Applications. Springer, New York (2006)

Mercurio, F.: Interest rates and the credit crunch: new formulas and market models. Bloomberg Portfolio Research Paper No. 2010-01-FRONTIERS (2010)

Mercurio, F.: A LIBOR market model with a stochastic basis. Risk Mag., December 84–89 (2010)

Michaud F.-L., Upper C.: What drives interbank rates? Evidence from the Libor panel. BIS Quart. Rev. 3, 47–58 (2008)

Moreni, N., Pallavicini, A.: Parsimonious HJM modelling for multiple yield-curve dynamics. Preprint, arXiv:1011.0828v1 (2010)

Morini, M.: Solving the puzzle in the interest rate market. SSRN eLibrary. http://papers.ssrn.com/so13/apapers.cfm?abstract_id=1506046 (2009)

Musiela M., Rutkowski M.: Martingale Methods in Financial Modelling. (2nd ed.). Springer, New York (2005)

Papapantoleon, A.: Applications of Semimartingales and Lévy Processes in Finance: Duality and Valuation. Ph.D. thesis, University of Freiburg, Baden-Württemberg (2007)

Raible, S.: Lévy processes in finance: theory, numerics, and empirical facts. Ph.D. thesis, University of Freiburg, Baden-Württemberg (2000)

Sato K.-I.: Lévy Processes and Infinitely Divisible Distributions. Cambridge University Press, Cambridge (1999)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Crépey, S., Grbac, Z. & Nguyen, HN. A multiple-curve HJM model of interbank risk. Math Finan Econ 6, 155–190 (2012). https://doi.org/10.1007/s11579-012-0083-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11579-012-0083-4