Abstract

Research and development (R&D) partnerships are formed to share the risks and benefits of R&D. At the macro level, they result in a globe-spanning network that can be a valuable source of international knowledge spillovers. This network is the subject of a considerable body of literature. Often-made claims are that R&D collaboration is an important activity in a competitive environment, but that the importance of international partnerships has declined over time. Furthermore, it is claimed that collaborations are disproportionally concentrated within the developed economies. However, this literature fails to account for variations in the sizes of underlying firm populations between countries and over time. We argue that these population sizes create an opportunity structure of available collaboration partners for firms, and that ignoring variations in this structure potentially leads to erroneous conclusions about the structure and dynamics of the R&D network. To address this problem, we study the structure and dynamics of the global R&D network on an international and cross-industry scale using longitudinal data for 1989–2002. We integrate data on public firms and their R&D partnerships and confront earlier findings with our data and a set of methods, which enables us to correct for the structure and dynamics in the firm population. While our study confirms previous findings concerning the worldwide trend in collaborative activity, it also shows that results on individual countries need correction. In particular, the importance of R&D collaboration for US companies is overestimated, while their openness towards foreign partners is underestimated.

Similar content being viewed by others

1 Introduction

Networks of inter-firm research and development (R&D) partnerships have recently attracted great attention from researchers and policy makers. A central objective of the Seventh Framework Programme of the European Commission, for example, is the development of a pan-European knowledge network between the leading research centers on the continent. To give another example, in order to reduce international trade disparities, the Trade and Development Board of the 2000 United Nations Conference in Geneva has promoted the formation of a collaboration network connecting small and medium-sized firms from the least-developed countries with large transnationals (UNCTAD, 2000).

A major motivation behind policy initiatives like these is the belief that inter-firm networks can play an important role in international technological development and economic growth (Freeman and Hagedoorn 1994; Vonortas and Safioleas 1997). Two sources of network effects have been identified in the business and economics literature. First, there are the beneficial effects from the collaborative partnerships themselves. As compared to in-house projects, collaborative R&D avoids the duplication of research investments and enables the exploitation of nationally distinct stocks of know-how. Theoretical models suggest that inter-firm collaboration on R&D has positive effects on the overall amount of research conducted as well as is associated with efficiency gains. This seems to hold even if the collaborating firms also collude in the subsequent production and marketing of their products. The positive effects are to be expected especially in the industries, in which the within-alliance knowledge spillovers are large i.e., the results of the research conducted by one firm in an alliance can be utilized rather easily by other firms in that partnership (d’Aspremont and Jacquemin 1988). The aforementioned beneficial effect of R&D collaboration have been also supported based on empirical data (Kogut 1988; Hagedoorn et al. 2000), despite the fact that the effects of R&D spillovers and associated returns on investment are very hard to measure on the macro level (Griliches 1992).

Second, it has been argued that inter-firm networks can provide benefits that go beyond the effects of the relationships they consist of. At the heart of this idea are some studies suggesting that the network itself is a locus of knowledge production (Freeman 1991; Powell et al. 1996; Verspagen and Duysters 2004). These studies point to various mechanisms through which the network facilitates information production and diffusion: first, know-how can be transmitted along chains of partnerships in the network from firm to firm. Second, information that “leaks” out of a company’s R&D projects may be assimilated by the firms that are connected to it. Finally, firms can use the network to gather timely information about technological novelties and trends (Ahuja 2000). An implication of the aforementioned network effects is that a few international partnerships in the global R&D network might be sufficient to link distinct knowledge pools in different parts of the world. Moreover, they point to the capability of the network as an effective device for the transfer of technological know-how to the lesser developed countries (see Arvanitis and Vonortas 2000, and the five papers in the Journal of Technology Transfer 2000 spring collection).

However, the presence of network effects also raises some important questions about the structure of the global network of R&D partnerships. Is the network sufficiently connected to enable international know-how diffusion? Is there sufficient overlap between national or regional clusters in the network? Moreover, are collaborative activities sufficiently equally dispersed around the globe? In this paper, we contribute to these questions by empirically investigating the macro-level properties of the inter-firm R&D network on a global scale and over the extensive time period from 1989 to 2002. When compared to prior work on these questions, the distinctive feature of our study is that we isolate an important, but so far omitted, factor to explain the structure of the inter-firm network, namely the structure of the global firm population. To the best of our knowledge, all previous studies have formed their own view on the network based on an observation of the distribution of inter-firm R&D partnerships around the globe. We argue that disregarding the distribution of firms over country and its changes over time will logically lead to a distorted picture of the network. The reason is that many properties of the worldwide distribution of partnerships, such as the geographical concentration of partnerships or the fraction of international alliances, are influenced by the sizes of the national firm populations.

For example, Freeman and Hagedoorn (1994) have found that the largest share of the worldwide number of R&D partnerships is between firms from the stronger economies in North America, Western Europe, and East Asia. This finding has led to a rather pessimistic outlook for the future of the technological gap between developed and less developed countries. We argue, however, that it is natural to find more partnerships within the developed countries, because these countries also host the largest share of the worldwide number of firms. Similarly, it has been found that US companies form a lot of domestic partnerships when compared to other countries (Hagedoorn 2002). This pattern has been explained by the favorable antitrust treatment of R&D joint ventures in the United States. However, given the size of the US economy, we would expect a large share of domestic partnerships, simply because the number of available domestic partners is much larger in the United States than any where else.

One could argue that these considerations alone do not make our exercise indispensable, because the firm population is just one explanatory variable of the network structure, amongst many others. Yet, as compared to other variables, the structure of the firm population is unique because it produces a “natural” inequality in the network based on logical opportunities for partnerships. In order to distinguish the effect of opportunities from other determinants of the network structure, we apply measures of density, centralization, and integration taken from the social network literature that correct for the different sizes of the national firm populations.Footnote 1

Our analysis reveals two sets of results. On the one hand, it confirms the robustness of some of the previous empirical findings. First, in line with Hagedoorn (2002), we find an unclear time trend in the total number of R&D partnerships over the 1990s. Second, we reconfirm the trend towards the formation of segregated national clusters in the global alliance network, as firms show a steadily declining interest in international partnerships (Duysters and Hagedoorn 1996). On the other hand, our analysis provides some novel insights: first of all, the network is less concentrated than suggested by previous research. The dominance of US firms in the network is to a large extent explained by the pure size of the US economy. Japanese firms are comparably active collaborators when controlling for the smaller number of firms based in Japan. Second, we find that the inter-firm R&D alliance network is extremely sparse. Comparing the number of partnerships to the number of firms, our findings suggest that the typical firm is involved in a partnership about every thirty-five years. Moreover, the group of companies that is involved in a considerable number of alliances represents only a small fraction of the numbers of companies worldwide. Hence, an important contribution from our analysis is a rather different view on the global R&D partnership network than the one put forward in previous research. The sparseness of the network raises some serious doubts about the general importance of collaborative R&D for the firms themselves, but also about the role of the network as a spurring force behind a globalizing economy.

The remainder of this paper is organized as follows. Section 2 reviews the findings from prior studies on the global network of R&D partnerships and summarizes the interpretation, as put forward by these studies, concerning the causal factors underlying the structure of this network. Section 3 presents the methodology used in the current study and Sect. 4 introduces the data. Our findings are presented in Sect. 5. In each of these sections, we also briefly present the previously used methods, data, and findings for comparison. The discussion of our results and a summary of the implications from our study are delegated to Sect. 6.

2 Literature review

In the past two decades, a considerable number of studies have been published that investigate the structure of the global network of R&D partnerships (Freeman and Hagedoorn 1994; Duysters and Hagedoorn 1996; Hagedoorn 1996, 2002; Moskalev and Swensen 2007; Rosenkopf and Schilling 2007). At the same time, there was an even larger number of publications on the network structures in particular industries or regions (e.g., Duysters and Vanhaverbeke 1996; M’Chirgui 2007; Nishimura and Okamuro 2011). A commonality of most of these studies is that they attribute regional patterns and temporal changes in the network structure to differences across countries in terms of their social, political, or technological conditions and the development of these conditions over time. Freeman and Hagedoorn (1994) and Hagedoorn (2002), for example, point to the rapid growth of the information technology sector in the 1960s and the rise of the biotech sector in the 1970s as two important factors for the rise of worldwide collaborative activities. On the political side, supranational efforts towards an integration of the world economy, such as the European Common Market or the Uruguay Round, have provided firms with new opportunities for international partnerships (UNCTAD 2000b; Desai et al. 2004). However, in the light of the ambitions of these studies, a general limitation is that they investigate trends and patterns in the distribution of inter-firm R&D partnerships, but omit the structure of the underlying international firm population.

Two often studied figures are the level and the time trend in the number of newly formed R&D partnerships per year. Related studies are motivated by the widely accepted hypothesis that due to shortened product life cycles and the increased uncertainty of R&D projects, collaborative research has become more important during the second half of the past century. Since the mid-1980s, R&D collaboration is supposed to constitute a key factor in the innovation strategies of firms (Harrigan 1988; Mytelka 1991; Nooteboom 1999; Huang and Yu 2011). The hypothesis has been confirmed by several studies indicating that the number of newly formed R&D partnerships has significantly increased during the 70s up to the mid 1980s (OECD 1992; Hagedoorn 1996, 2002). For the period 1990–1998, which is also the period studied in this paper, Hagedoorn and van Kranenburg (2003) have not found any continuation of this trend, but rather a cyclical pattern in the number of new partnerships. Gomes-Casseres (1988) argues that such an “alliance cycle” can be explained by bandwagon effects. In order to succeed in the competition for scarce resources and to maintain a legitimate position in the market, a company is expected to adopt the best practices from other, successful firms. Yet, what is a best practice at certain times might be out of fashion at other times. Other research links the alliance cycle to the parallel wave of mergers and acquisitions in the 1990s (Hagedoorn 1996; Desai et al. 2004) or changes in national regulations regarding inter-firm collaboration (Link et al. 2005). In this study, we reinvestigate these hypotheses for the period 1989–2002. Our ambition is to isolate an alternative explanation for the previous observations, namely the significant increase in the worldwide numbers of firms during the 1970s and 1980s and some fluctuations in the global firm population during the 1990s:

Research question 1 (Network density)

How dense is the global network of inter-firm R&D partnerships during the period 1989–2002?

Research question 2 (Network density over time)

Has the density of the global network of inter-firm R&D partnerships increased, fluctuated or decreased during the period 1989–2002?

Another commonly studied dimension of the network is the extent to which collaborative activities are regionally and nationally concentrated (Freeman and Hagedoorn 1994; Hagedoorn 2002; Moskalev and Swensen 2007). The underlying motivation is the hope that firms from all countries can, and also do, take advantage from collaborative R&D. By looking at the country affiliation of the participating companies, Freeman and Hagedoorn (1994) have found that the vast majority of all R&D partnerships are formed between firms from the stronger economies in North America, Western Europe, and East Asia. The authors conclude that the less developed countries lack the necessary technological and organizational capabilities for the complex task of R&D partnering. Hagedoorn (2002) and Moskalev and Swensen (2007) have found that in particular US firms are involved in many of the recorded R&D partnerships, reflecting the overall dominance of the US economy in major high-tech industries such as the information technology sectors and pharmaceutical biotechnology. However, it is not clear to what extent the findings of these studies reflect differences in the sizes of the national firm populations. Thus, we reinvestigate the question:

Research question 3 (Network centralization)

Are there national or regional differences in the proclivity of firms to form R&D partnerships during the period 1989–2002?

A third, frequently studied feature is the extent of internationalization in the global R&D network (Duysters and Hagedoorn 1996; Narula and Hagedoorn 1999; Hagedoorn 2002). International research collaborations are important, because they facilitate the combination of distinct national knowledge resources and can be an effective means of transferring know-how to the least developed parts of the world (UNCTAD 2000a; Ernst and Kim 2002). In the literature, there are two opposing hypotheses concerning the trend towards international R&D partnerships over time. The still ongoing supranational efforts towards a liberalization of foreign ownership, as well as the progressing international division of labor, have split formerly integrated production processes into separate pieces scattered around the world. This suggests, on the one hand, that international collaboration has become more important over time (Duysters and Hagedoorn 1996; Narula 1996). According to an alternative view, international partnerships are mainly perceived as a vehicle to circumvent barriers to foreign ownership (Contractor 1990; Desai et al. 2004). However, because the liberalization efforts have rendered the necessity of shared ownership obsolete, firms replaced alliances by direct investments abroad. Hence, rather than increasing the importance of international partnerships, the authors expect the opposite effect.

According to Hagedoorn (2002), the share of international partnerships in the total number of newly formed partnerships has been steadily declining over the period 1980–1998. Moreover, the decline is strongest in the United States. Knoke et al. (2002) have made a similar observation for the R&D network in the information technology sector and for Japanese firms in particular, which have significantly reduced their international partnerships during the 1990s. These findings suggest that international alliances have been replaced by cross-border mergers and foreign direct investments. Hagedoorn (2002) proposes an alternative explanation in the discussion section of his article, which is closely related to the argument developed in this study. He argues that the share of international R&D partnerships has declined in the United States, not so much because of changes in the international environment, but rather as a result of domestic developments. The 1980s and 1990s have witnessed a strong growth in the US biotech and information technology industries, aligned with the start-up of many new businesses. Hence, it is not so much a tendency to avoid foreign alliance partners, but rather the availability of interesting local partners that explains the diminishing importance of international collaboration. In this study, we reinvestigate the worldwide trend in the attitude toward international partnerships, where we rigorously exclude changes in the availability of interesting domestic alliance partners as an alternative factor to explain the declining share of international R&D partnerships:

Research question 4 (Network integration over time)

Has the global network of R&D partnerships become more or less integrated during the period 1989–2002?

The observation of a declining share of international partnerships has led authors, like Freeman and Hagedoorn (1994), Narula and Hagedoorn (1999), and Hagedoorn (2002), to the question about regional differences in internationalization. The concern of the authors is that US and Japanese firms tend to segregate themselves from the rest of the global network, thereby reducing potential knowledge spillovers from these important economies. Furthermore, considering the overall low level of collaborative activity in the least-developed countries, the study of regional differences in the propensity with which firms form international partnerships is important, because such an analysis indicates whether the firms from the least-developed countries are at least connected to partners from the stronger economies.

Narula and Hagedoorn (1999) and Hagedoorn (2002) have investigated the differences in internationalization between the developed economies, and Freeman and Hagedoorn (1994) have examined the link between these economies and the least-developed countries. Their findings confirm a low propensity in choosing foreign alliance partners for US firms, but not for Japanese firms. Moreover, they show that almost all R&D partnerships involving firms from the least-developed countries have a partner from one of the stronger economies on board. In this study, we reinvestigate these issues where we additionally control for regional differences in the availability of domestic partners:

Research question 5 (Regional differences in network integration)

Are there national or regional differences in the propensity with which firms form R&D partnerships with foreign partners?

In the following sections, we provide a more rigorous test of the contentions of the previous literature by using a novel set of measures and novel data for our analysis. We complement data on inter-firm R&D partnerships from the period 1989–2002 by data on the numbers of firms per country during the same period and examine the resulting data structure using methods from the social network literature. By doing this, we are able to isolate an important, but so far omitted, factor to explain patterns and trends in worldwide collaborative activities, namely the structure of the global firm population.

Before we proceed, let us remark that our study also breaks with the conventions of another strand in the literature that provides a “true” social network analysis of the global R&D network. Unlike several other recent studies on this topic (e.g., Verspagen and Duysters 2004; Gay and Dousset 2005), we do not aim for a complete characterization of all the properties of the network, such as the measurement of component sizes or the lengths of the paths between any two firms. Instead we focus on those measures of the network structure that are most sensitive to the omission of taking the size and the structure of the underlying actor population into account.

3 Research methodology

In this section, we present our measures of network density, centralization, and integration and compare them with the measures that have previously been used to examine the structure of the global inter-firm R&D network. In order to investigate the overall importance of collaborative R&D and its trends (Research Questions 1 and 2), previous studies have counted the numbers of newly formed R&D partnerships per year (e.g., Hagedoorn 1996, 2002). However, this measure can lead to a misleading conclusion, as we will demonstrate with the following example. Suppose we find that in a given year the number of newly formed partnerships has increased when compared to the previous year. There are two alternative interpretations for this observation:

-

1.

The number of partnerships per firm has increased, which means that firms have been more actively creating them. Following this interpretation, we would have to conclude that R&D collaboration has become more important for firms over the two years.

-

2.

Firms have been equally active in creating partnerships in the two years, but the number of firms has increased. According to this interpretation, there would be no reason to conclude that the importance of R&D collaboration has increased.

This suggests that a proper measure of the importance of collaborative R&D has to be corrected for the number of active firms in a given year. Such a measure is the average degree. Formally, let η t i denote the degree of a firm i in the set of worldwide active firms N t, and let n t denote the number of active firms in year t. The degree measures the number of alliance participations of the firm in a given year. The average degree is defined as:

To address the question about the centralization of collaborative activities in certain countries or regions (Research Question 3), Freeman and Hagedoorn (1994) and Moskalev and Swensen (2007) have calculated and compared the number of partnerships per country and region, respectively. Similar to the shortcoming of the previous measure of network density, the number of partnerships per country is not an appropriate measure for a comparison of national differences in propensities or barriers to collaboration, because it does not take into account the fact that larger countries are expected to have more partnerships. Therefore, we use the national average degree as a measure of country-specific propensities and constraints to collaboration. Formally, let us denote the set of firms in country k and year t by N t k . The national average degree is defined as:

In the same manner, regional average degrees can be defined on the level of world regions by letting N t k denote the set of firms in region k.

Finally, in order to trace patterns and trends in the affinity towards foreign alliance partners (Research Questions 4 and 5), Freeman and Hagedoorn (1994) and Hagedoorn (2002) have calculated the shares of international alliances in the total number of newly formed partnerships. As already outlined in the work by Blau (1977) and more recently by Currarini et al. (2009), a problem with this measure is that it conceals differences in the opportunities for international partnerships stemming from differences in the numbers of available alliance partners. To illustrate this argument, say we observe that the firms from a certain country form relatively more domestic as compared to international partnerships. There might be two possible explanations:

-

1.

The firms from this country have, for whatever reason, a preference for domestic partnerships; or

-

2.

There are, as compared to the rest of the world, a lot of firms in this country and therefore a lot of opportunities for domestic partnerships. This will lead to relatively many partnerships within this country even if firms would randomly create partnerships, disregarding whether partners are domestic or not.

While the researcher might be interested in the first effect, ignoring the second will lead likely to a wrong conclusion about the role of preferences. In order to isolate the preference-based tendency to form domestic partnerships, we calculate for each country a variant of the inbreeding homophily measure introduced by Coleman (1958). Formally, denote the share of domestic partnerships in the number of newly formed partnerships in country k and year t by s t k . We define the inbreeding homophily index of country k as:Footnote 2

In order to study the global trends in network integration, we trace the development of the average of the national homophily measures. Moreover, for the comparison of homophily across world regions, let the term s t k measure the share of intra-regional partnerships in region k and let the fraction n t k /n t be the number of firms in the region relative to the worldwide total.

The inbreeding homophily measure has several desirable properties. Because firms from larger countries have more opportunities to source out interesting domestic partners, the measure is declining in the relative size of a country, n t k /n t. The index value is zero, if the observed share of domestic partnerships equals the relative country size, s t k = n t k /n t. In this case, the firms from the particular country are defined to exhibit no preference towards, or against, domestic partners. The observed share of domestic partnerships is then merely due to opportunities. In contrast, there is a maximal tendency to form domestic partnerships in a country if s t k = 1. Finally, if the share of domestic partnerships is smaller than the relative country size, s t k < n t k /n t, a country is said to be heterophile.Footnote 3

4 Data

In the following, we present a detailed description of the data sources that we utilize in our study and outline our sample selection procedure.

Our first data source is the Thomson Financial SDC Platinum database on inter-firm strategic alliances and joint ventures. The database is one of the two available datasets on inter-firm R&D partnerships with a comprehensive coverage of the whole spectrum of industries, a large number of countries, and an extensive time period.Footnote 4 For every recorded inter-firm relation, the database reports the date of completion, the names of the alliance participants as well as their countries of origin. Moreover, the database contains information on the partnership purpose, the mode of governance (contract versus ownership), the participants’ industry affiliations, and their public status. As compared to other data sources on this topic, the major limitation within the Thomson data lies in the fact that the information is collected from announcements in press releases, journal articles, and comparable public sources. Thus, the appearance of a partnership in the database depends on the self-interest of firms and news services to publicize the announcement of a joint venture. However, despite the potential reporting biases aligned with this collection procedure, the study by Schilling (2009) shows that the Thomson database provides a consistent picture with alternative datasets in terms of the sectoral composition, the alliance activity over time, and the geographical origin of the alliance participants.

Our second data source complements the alliance data by providing information on the numbers of firms per country and year. The numbers are retrieved from the World Development Indicators (WDI), which is part of the annual reports of the World Bank and records the numbers of domestic companies listed on the national stock markets. As compared to alternative company databases, the advantage of the WDI data lies in the fact that it covers a large set of countries and an extensive period of time including the late 1980s and the 1990s, where the number of newly formed R&D partnerships reached its peak.Footnote 5 A major drawback is that the WDI data does not provide a complete picture of the total number of firms in a country, because it does not contain any information on private enterprises. Furthermore, the reported numbers might not even be representative for the national firm populations, because the proportion of firms that go public may vary from country to country. These issues can render the interpretation of our findings and in particular a comparison of the network structures between countries difficult. However, given the lack of an alternative dataset with the necessary comprehensive geographical and temporal scope that we need for our study, the WDI data is the best dataset that is currently available for our purposes. In fact, the lack of representativeness is a generic problem of all company databases. The Worldscope company profile data, for example, only records publicly held companies as well. While the United Nations UNIDO database also contains information on private business establishments, the data is sensitive to the precise definition of a business establishment that varies from country to country. Another problem of this data is that the propensity to open business establishments is country-specific. To illustrate this point, according to the UNIDO database, the numbers of registered business establishments in Italy and Poland are comparable to the ones of the United States, because many Italians and Poles work on a freelance basis.Footnote 6

Another potential problem of the WDI data is that it does not contain a split of the numbers of public companies by industries. This can be problematic, because for an accurate picture of the network density, for example, one would want to filter out those companies from the network, where ex-ante considerations exclude the possibility of R&D partnerships. One might consider the financial service industry. Since the typical bank does not even have an R&D budget, it is unlikely that it will ever be involved in a research project or be considered as an alliance partner. However, as is outlined below, we apply a broad definition of an R&D partnership in this study, which also includes agreements involving a mere licensing of technologies, and, as is shown in Table 1, even the financial sector is involved in quite a lot of these agreements.

In order to obtain a complete picture of all R&D partnerships formed by the public companies in the WDI dataset, we confine our analysis to a subset of the available data. First, we restrict ourselves to the period 1989–2002 which is the same period studied in most previous alliance network studies of the same international and cross-sectoral scope. Second, we select the largest possible number of countries from the WDI data, for which the database provides complete information on the numbers of public companies during the whole sample period. Our selection results in a set of 52 countries situated in different parts of the world. The countries within our sample comprise 27 nations classified by the Worldbank as high-income economies, 19 classified as middle-income economies, and 6 classified as low-income countries. Based on the previous sample of countries and years, we focus only on those alliances and joint ventures from the Thomson SDC data, where at least one publicly held company is involved that has its headquarter in one of the 52 countries. However, the other venture partners might well be based outside the sample countries and might also be privately held firms or governmental institutions. Hence, our selection of inter-firm relations corresponds to the set of all publicly reported alliances and joint ventures that were formed by the public companies in our sample.

A virtue of this selection procedure is that it partially alleviates the potential reporting bias inherent in the Thomson data that we have already addressed above. Because the activities of public companies are of interest to financial investors and the general public, their partnerships are also likely to appear more consistently in the business news than the alliances between only private firms. As a partial indication for this conjecture, the fact is that in 80% of the R&D partnerships recorded in the Thomson SDC data at least one of the participants is a public company. This suggests that our selection produces a rather complete picture of all the partnerships that have been formed by the firms in our sample.

Finally, we select only those partnerships, where one of the major purposes is “research and development” as indicated by the alliance activity description in the Thomson SDC data. In line with the broad definition of R&D partnerships that has been used in previous studies (Hagedoorn and Schakenraad 1992; Hagedoorn et al. 2000; Link et al. 2002), our selection includes equity-based research joint ventures as well as the more loose forms of contract-based R&D agreements. Moreover, in terms of the partnership purpose, the definition comprises all agreements in which the creation of new technology through R&D or other innovative efforts are central, which also includes technology transfer and licensing agreements. As a result, we keep the information on 8,150 R&D partnerships between 3,555 alliance participants out of a total number of 31,671 public companies. The industry affiliations of the alliance participants are presented in Table 1.

5 Results

5.1 Network density

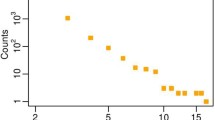

Here, we investigate the time-average density of the networks of newly formed R&D partnerships that are generated from our data. This will serve as our answer to Research Question 1. Moreover, we examine the change of network density during the period 1989–2002 to address Research Question 2. In order to exclude the effects from the overall size and the dynamics of the worldwide firm population, we examine the average degree and the development of this measure over time. However, we also present the total number of new partnership, which has been used as a network density measure in previous studies, for comparison. Figure 1 summarizes our findings.

The figure shows the time lines for the average degree and the number of newly formed alliances using an index representation. Both measures indicate the same picture of a phase of expansion of collaborative activities, peaking in the mid 1990s, followed by a significant contraction. Until 1994, the number of new partnerships rose sharply to a level ten times greater than in 1989, but declined thereafter to a level comparable to the original. Similarly, the average degree was more than eight times greater in 1994 than in 1989. Hence, the findings from both measures contradict the hypothesis that firms made increased use of collaborative research during the 1990s. Instead, they support Hagedoorn and van Kranenburg’s (2003) observations of an alliance cycle.

Moreover, our analysis provides some interesting insights into the time-average density of the global R&D network. As suggested by the absolute values for the average degree presented in the table below the graph in Fig. 1, the typical public company in our data is only involved in a very small number of partnerships. In fact, averaged over the period 1989–2002, the number of new partnerships per company and year amounts to just 0.028 suggesting that the typical firm signs a collaborative R&D agreement about every 35 years. In light of the findings of the literature on joint venture termination, according to which the average lifespan of a joint venture amounts to no more than 7 years (Kogut 1989; Park and Russo 1996), we are left to conclude that most firms in our data were not involved in any ongoing R&D partnership at all during the 1990s.

Because these findings seems to contradict the observations from previous studies, let us briefly discuss their relationship here. Earlier studies have reported some very actively collaborating firms in the high-tech sectors, in particular in the information technology and the biotech industries (Hagedoorn and Schakenraad 1992; Duysters and Vanhaverbeke 1996; Gay and Dousset 2005). How can the low average degree be reconciled with these observations? To investigate the issue, we have taken a closer look at the distribution of newly formed partnerships across the firms in our dataset. We only report the main findings from this investigation here. The analysis has shown that all R&D partnerships in our sample are concentrated around a small fraction of the public companies in our dataset. In fact, in a typical year, a share of only 1% of the total number of firms announced any collaborative agreement at all. Some of these firms, notably a handful of well-known players from the IT-industry, have been involved in a considerable number of partnerships every year. Hence, a way to reconcile our observation with the findings from the previous literature is to recognize that the global network of R&D partnerships is very concentrated: while the vast amount of collaborative activity is due to a small number of firms from the high-tech sectors, there is a large, but previously overlooked, amount of firms that are not even involved in a single partnership.

5.2 Regional concentration of the network

In the previous subsection, we have seen that a small group of firms is responsible for a large fraction of the newly formed partnerships in the worldwide R&D network. Here, we investigate whether the concentration of collaborative activity is also reflected on the level of countries and world regions (Research Question 3). Considering the important role that the network might have for the economic growth in the less developed parts of the world, the hope is that companies from all countries are equally involved in it.

Several authors have found that the majority of firms participating in R&D agreements are based in the world’s strongest economic regions, the Anglo-Saxon countries, Western Europe, and East Asia (Freeman and Hagedoorn 1994; Duysters and Hagedoorn 1996; Moskalev and Swensen 2007). Our findings summarized in Table 2 confirm this pattern, regardless of whether we look at the worldwide distribution of partnerships, as the previously used concentration measure, or the regional average degree. 99% of all the companies that participated in an R&D partnership between 1989 and 2002 were based in the Anglo-Saxon countries, Western Europe, or East Asia. Also, the average degree of Western European firms, as the least active of these regions, was still more than ten times larger than the average degree in the developing countries.

However, our analysis of the average degree provides a rather different picture regarding the distribution of collaborative activities between the world’s strongest economies. Using the MERIT-CATI data, Narula and Hagedoorn (1999) and Hagedoorn (2002) find that most R&D partnerships formed during the 1990s involve an Anglo-Saxon company. In particular, firms from the US played a dominant role in both the Anglo-Saxon part of the network as well as in the global alliance network as a whole. As Table 2 shows, this pattern is also reflected in our data. 73% of all newly formed R&D partnerships involved an Anglo-Saxon company. Moreover, US companies were, with a share of 63% of all newly formed partnerships, responsible for many of the collaborative activities during the 1990s.

Yet, even though the distribution of partnerships might suggest otherwise, the typical US firm is not a much more active collaborator than any other firm from the Anglo-Saxon countries, Western Europe, or East Asia. Consider, for example, the case of Japan. Comparing the numbers in columns one and three of Table 2 for Japan and the United States, it becomes clear that Japanese firms are much closer to US firms in terms of their collaborative activity, when comparing average degrees instead of numbers of partnerships. With an average degree of 0.059 in the United States and 0.048 in Japan, the typical US firm formed only 20% more partnerships than the typical Japanese firm. This suggests that only a minor part of the huge difference in the numbers of partnerships between the two countries is explained by differences in the propensities to collaboration. Instead, the most important factor seems to be that Japan has only a relatively small firm population as compared to the much larger number of firms in the United States.

Repeating the same exercise for the United States and any other country from the world’s strongest economic regions, one can see that much of the apparent dominance of US companies in the global alliance network is explained by the sheer size of the US economy.

5.3 International integration in the network

We now turn to our examination of Research Questions 4 and 5 concerning the extent to which the global network connects firms from different countries and regions. A highly integrated alliance network would be desirable, because such a network could facilitate the diffusion of know-how and technologies around the globe (Pearce 1989; Ernst and Kim 2002). In their studies, Duysters and Hagedoorn (1996) and Hagedoorn (2002) have come to a rather pessimistic conclusion about the worldwide trends in the integration of the network. Even though they have found that the share of international alliances in the total of newly formed partnerships was, with a share of about 60%, on a rather high level during the 1980s and 1990s, they have also observed a steadily declining trend. Hence, the network seems to fall apart into more nationally segregated clusters, because firms increasingly chose domestic instead of foreign alliance partners. However, as we argue in this paper, the share of international alliances might conceal the “true” openness towards foreign alliance partners, because the measure contains the combined effects of preferences and opportunities for selecting international partnerships.

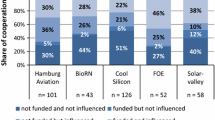

A measure that is corrected for opportunities is the homophily index (3). Figure 2 plots the worldwide average homophily during the period 1989–2002 and indicates its trend for the United States, the strong economies as well as the developing countries in our data. As can be seen from the development of the worldwide average, there was a slight but noticeable trend towards the formation of homophile clusters in the network. In fact, our findings suggest that the network was quite international in 1989, with an average homophily that did not reflect any preference towards or against international partnerships. However, the upwards trend shows that international alliances became less popular over time, with a worldwide average homophily of 0.26 at the end of the year 2002. Hence, Duysters and Hagedoorn’s (1996) and Hagedoorn’s (2002) pessimistic view on the worldwide trends in international collaboration seems to be robust with respect to controlling for the opportunities for finding foreign and domestic alliance partners.

In the following, we investigate national and regional differences in homophily. Narula and Hagedoorn (1999) and Hagedoorn (2002) have observed major differences in homophily between the countries from the regions North America, East Asia, and Western Europe. While foreign alliance partners are rather welcome in most of these countries, US companies tend to form a segregated national cluster. In another study, Freeman and Hagedoorn (1994) have found that almost all R&D partnerships in the developing countries also involved a partner from one of the stronger economies. Our results, which are summarized in Table 3, confirm the finding for the developing countries, but shed new light on the homophily among US firms. The first two columns of the table show the share of domestic partnerships, as the previously used homophily measure, as well as the homophily index (3), respectively. Since these measures are hardly comparable, the third column presents a hypothetical share of domestic partnership, s * k , that is based on the homophily index from column two. Because the measure s * k is corrected for the sizes of the national firm populations and, therefore, for the opportunities of domestic partnerships, it reflects the share of domestic alliances that is purely due to preference-based homophily.Footnote 7

All three measures in Table 3 present the same picture that the public companies from the developing countries, despite their overall low level of collaborative activity, show a strong preference for partnerships with firms from the stronger economies. In particular, the index value of −0.24 clearly indicates a heterophily in this region. Concerning the homophily in the United States, the share of 0.59 of domestic partnerships in the first column supports the observation by Hagedoorn (2002) that US firms, unlike firms from most other nations, tended to form quite a lot of domestic partnerships during the 1990s. However, the homophily measures in columns two and three show that, next to a preference-based homophily, at least part of the explanation lies in the fact that US firms had so many opportunities for domestic partnerships. Even though the United States was by far the most homophile nation with an index value of 0.47, a comparison between the first and the third column suggests that a considerable fraction of 0.11 of the share of domestic partnerships in column one is merely due to opportunities. An explanation is that the US economy, with its strong position in many high-tech industries, offers many more valuable alliance partners than any other nation. Also, the latest trends in our data put the importance of international alliances for US firms in a rather optimistic light (see Fig. 2). Although US companies tended to prefer domestic partners throughout most of the 1990s, the homophily index indicates a slight turnaround in the year 2000, when US firms became more open towards foreign alliance partners. Hence, even though our analysis confirms the findings of previous studies that US firms tended to form a segregated national cluster, we also find that the size of the US economy conceals the country’s true level of internationalization to a certain degree.

6 Summary and discussion

In this paper, we shed new light on the structure and dynamics of the global network of inter-firm R&D partnerships over a period of fourteen years, from 1989 to 2002. While we have focussed on a reinvestigation of previously addressed research questions, the novelty of our study is that it relates patterns and changes in the network structure to geographical and temporal differences in the numbers of firms per country and region. In order to set up this relationship, we complement data on strategic alliances and joint ventures by data on the number of publicly held companies around the globe. Moreover, we apply measures from the social network literature that allow us to control for patterns in the worldwide firm population. These steps are necessary, because the patterns produce a natural inequality in the network which is, unlike other political or technological barriers and stimuli to collaboration, merely based on the logical opportunities for partnerships.

Even though our data provides an incomplete picture of the global inter-firm R&D network during the studied period, because (1) the Thomson SDC data does not contain all the R&D partnerships formed during 1989–2002 and (2) we focus on the collaborative activities of publicly held companies from a sample of countries, our analysis is still able to reproduce many of the previously found empirical regularities. The most important among these are the “alliance cycle” of the 1990s (Hagedoorn 2002; Hagedoorn and van Kranenburg 2003), the concentration of collaborative activity in the developed economies (Freeman and Hagedoorn 1994), and the trend towards a formation of segregated national clusters (Duysters and Hagedoorn 1996; Hagedoorn 2002). This suggests that many of the major macro-level patterns of the network are retained in our data. However, our analysis also reveals a series of novel insights:

-

1.

The global inter-firm R&D network was very sparse during the period 1989–2002. An extrapolation of our findings on the network density suggests that the typical public company initiates a collaborative agreement once every 35 years. Moreover, the share of companies that actually announced an alliance amounted to no more than 1% of the worldwide number of public companies during the period under study.

-

2.

The previously found dominant role of US firms and their centrality in the global R&D network was amplified to a significant extent by the size of the US economy. The average US firm was not a much more active collaborator than any other firm from the Anglo-Saxon countries, Western Europe or East Asia. What made US firms so visible in the network is their sheer number.

-

3.

The size of the US economy concealed the importance of international R&D partnerships for US firms to some extent. A significant share of the large number of partnerships within the United States can be explained by the fact that, as compared to other nations, there were so many US firms and, therefore, many opportunities for domestic alliances.

Particularly the first observation implies a rather different picture of the international R&D network than the ones proposed by previous research on this topic. Despite the fact that our data does not evince all collaborative R&D activities in the period 1989–2002, our finding of an extremely low number of newly formed partnerships raises some serious questions about the conclusions of at least two streams in the literature. First, there is the often made claim that R&D joint ventures were widely used strategies in the fierce competitive environment of the 1980s and the 1990s (Harrigan 1988; Mytelka 1991; Nooteboom 1999). Our findings certainly cast some doubt about this assertion. Instead, they rather support a view which portrays R&D collaboration as some kind of “elite sports” which is exercised by the world’s largest firms from the high-tech industries, whereas the vast majority of firms are never engaged in any collaborative activity at all.

Second, our findings have some important implications for the literature investigating the role of inter-firm alliance networks for knowledge diffusion (Ahuja 2000; Furtado and de Freitas 2000; Schilling and Phelps 2007; Nishimura and Okamuro 2011). With an average of just 0.028 newly formed R&D partnerships per firm each year, the typical firm in our dataset hardly formed any collaborative agreement at all during the fourteen years studied. Thus, even if prior research is correct and knowledge spills along chains of alliances in a network, the worldwide inter-firm network might be simply too sparse to assimilate these spillovers. This grim view on the network is reinforced by our finding that the 1990s witnessed a worldwide trend towards the formation of more segregated national clusters in the network, which further inhibits the important international knowledge flows.

Finally, even though our data are a little bit outdated our findings might give some direction for the improvement of current policy programs to foster R&D collaboration. A common ambition of the policies in the United States and in Europe is to improve the international competitiveness of domestic high-tech industries through more efficient production and diffusion of technical know-how (Caloghirou et al. 2002). Concerning the more laissez-faire oriented approach followed in the United States, which basically consists of a set of relaxed anti-trust regulations for R&D joint ventures, our findings suggest the need for programmatic change. The pronounced core-periphery structure in the international R&D network of the 1990s suggests that a fundamental impediment to the expansion of the network lies in the peripheral firms’ failure to overcome some threshold level of collaborative activity before they initiate privately-financed partnerships on their own. As argued and shown convincingly in a large number of business and economics studies, the problem seems to lie in the presence of scale economies in the formation of R&D partnerships which require a minimum scale of production, prior alliance experience, and complementary in-house projects in order to pay off (Powell et al. 1996; Morrison Paul and Siegel 1999; Westbrock 2011). Hence, active policy support for small and medium-sized firms seems indispensable (see also Tassey (2010) in this journal on a more proactive US policy reform). And even though the United States has proved to be a successful breeding ground for many of the top collaborators in the global R&D network the large number of isolated firms in our dataset shows that the room for improvement is large, both in the United States and in Europe.

Concerning the more proactive policy initiatives in the European Union, our finding of a core-periphery structure in combination with scale economies begs for a bundling of activities on the problems of small and medium-sized firms. If the Framework Programmes should ever want to trigger more follow-up, privately-financed partnerships by the smaller program participants as criticized in the recent Europe (2005) report on FP6, funding of several complementary projects of the same applicant and throughout several successive program rounds seem a proper directive. At least in the near future, the policy focus should lie on the formation and gradual expansion of a world-class cluster of firms in the European arena, even if this comes at the cost of temporal disparities across regions or the omission of knowledge spillovers across the member states.

To put these rather pessimistic views into perspective, let us point out that the collaborative agreements investigated in this paper are not by far the only possible channel for inter-firm knowledge spillovers. In fact, a problem in our alliance dataset, the Thomson SDC Platinum data, is that it only contains information on publicly announced strategic alliances and joint ventures. Even though we select a firm population, where we expect that the Thomson SDC data provides a rather complete picture of the R&D partnerships of these firms, there might still be many more unrecorded agreements. As a first possible extension to our study, one could therefore try to link the different available data sources on alliances and joint ventures, most notably the data from MERIT-CATI, CORE, NCRA-RJV, Steps to RJVs, Recombinant Capital, and Bioscan, to obtain a more complete picture of the global inter-firm network. Schilling’s (2009) comparison of the different databases suggests that this could be a worthwhile step, since their overlap is very low.

Furthermore, there might be spillover channels other than the collaborative agreements between the firms. In fact, many of our observations are consistent with the perspective proposed in Desai et al. (2004). The authors argue that, due to the political initiatives in the 1980s and 1990s towards a liberalization of foreign ownership, firms have replaced international joint ventures by cross-border mergers and foreign direct investments as their preferred mode of foreign market access. Hence, our finding of a trend towards more segregation in the global alliance network could be nothing else than the reflection of this process of substitution. At the same time, there would be no reason for concern about the erosion of international spillovers. As another possible extension to our work, we therefore propose to investigate the network between firms also taking into account other inter-firm relations such as mergers and acquisitions. A recent study in this spirit is M’Chirgui (2007).

Finally, in a preliminary analysis of the more detailed characteristics of the network studied in this paper, we have found that the network connects almost all of the actively collaborating firms in a giant component. This suggests that even though the know-how produced in one of the partnerships reported in our dataset does not reach all the firms around the globe, it might at least diffuse to the other active collaborators. Hence, as another valuable extension to our work, we suggest to do a complete social network analysis of the global R&D network which also contains characterizations of the network components, the clustering, and the path lengths. Such an analysis might uncover the mechanisms through which knowledge is currently diffused in the network.

Notes

In particular, our measure of network density builds on the average degree of a group of individuals in a network, whereas to measure network integration we make use of a homophily index, which captures the tendency of individuals to associate and bond with similar others in a network (Lazarsfeld and Merton 1954; Coleman 1958).

The measure (3) is a variant of Coleman’s original measure, because Coleman (1958) defines the term s t k in terms of degrees in a network and not in terms of partnerships, as we do here. The reason for this deviation from the original definition is that we intend to apply a homophily measure that is closely related to Hagedoorn’s (2002) measure of internationalization, apart from the fact that ours allows to isolate the effects from alliance opportunities. In fact, the term s t k in the nominator of (3) corresponds to an uncorrected measure of homophily, which is directly related to Hagedoorn’s share of international alliances, i t k , by s t k = 1 − i t k .

In an earlier version of this paper, we used Freeman’s segregation index (Freeman 1978), which has a stronger theoretical foundation and is more prominent in the social network literature. To assess the level of segregation in a network, the index compares the observed proportion of cross-class ties, i.e. ties that link nodes belonging to different groups, with an expected proportion in a random network of the same average degree. The problem of this measure is that it is originally designed for networks of two, equally active groups but it is not well-suited for networks with many groups and significant differences in the average degrees across these groups. Hence, even though we found a similar deviation from the earlier results in Freeman and Hagedoorn (1994) and Hagedoorn (2002) in our calculations of network segregation using the Freeman index, the deviation was much more extreme than the one reported in Sect. 5 below. Because we suspected that these results were to some extent driven by the significant differences in the average degrees across world regions, we decided to report our findings from the inbreeding homophily measure of Coleman (1958), which is more robust with regard to variations in the activity levels across groups.

For more information on the Thomson SDC database, consult http://www.thomson.com/content/financial/brand_overviews/SDC_Platinum. Some other datasets on inter-firm partnerships that have previously been used in the literature are the CATI, CORE, NCRA-RJV, Steps to RJVs, Recombinant Capital, and Bioscan datasets. The only alternative dataset with the same broad scope is the CATI databank collected at the MERIT institute at the University of Maastricht.

For more information on the World Development Indicators, see http://web.worldbank.org/WBSITE/EXTERNAL/DATASTATISTICS/0,,contentMDK:21298138pagePK:64133150piPK:64133175theSitePK:239419,00.html. Some alternative data sources we considered were the Worldscope company profile database as well as the United Nations UNIDO data.

A viable alternative for our study might be to relate the numbers of R&D partnerships to the total R&D expenditures in a given industry sector and/or country. The advantage would be that the R&D expenditures also control for sectoral or national differences in firm sizes. The OECD STAN Industrial Structure database provides this figure for all OECD countries. However, a complete picture of all sectoral R&D expenditures in these countries covers currently only a very short time period.

In particular, we rewrite the homophily index (3) as s * k = (1 − n k /n)H k + n k /n and assume the numbers of firms to be identical across countries or regions. Hence, n k /n = 1/52 for the country-level hypothetical shares and n k /n = 1/4 for the regional-level hypothetical shares. Finally, we calculate s * k for a certain country or region by substituting the term H k from column two in the table into the formula. Note that in the benchmark case of zero homophily we expect the share of intra-regional and domestic partnerships to amount to 0.25 and 0.02, respectively.

References

Ahuja, G. (2000). Collaboration networks, structural holes, and innovation: A longitudinal study. Administrative Science Quarterly, 45(3), 425–455.

Arvanitis, R., & Vonortas, N. S. (2000). Technology transfer and learning through strategic technical alliances—International experiences: Introduction to the symposium. The Journal of Technology Transfer, 25, 9–12.

Blau, P. M. (1977). Inequality and heterogeneity: A primitive theory of social structure. New York: Free Press.

Caloghirou, Y., Vonortas, N. S., & Ioannides, S. (2002). Science and technology policies towards research joint ventures. Science and Public Policy, 29(2), 82–94.

Coleman, J. (1958). Relational analysis: The study of social organizations with survey methods. Human Organization, 17, 28–36.

Contractor, F. (1990). Ownership patterns of U.S. joint ventures abroad and the liberalization of foreign government regulations in the 1980s: Evidence from the benchmark surveys. Journal of International Business Studies, 21, 55–73.

Currarini, S., Jackson, M. O., & Pin, P. (2009). An economic model of friendship: Homophily, minorities and segregation. Econometrica, 77(4), 1003–1045.

d’Aspremont, C., & Jacquemin, A. (1988). Cooperative and noncooperative R&D in duopoly with spillovers. The American Economic Review, 78, 1133–1137.

Desai, M. A., Foley, C. F., Jr., & Hines, J. R. (2004). The costs of shared ownership: Evidence from international joint ventures. Journal of Financial Economics, 73, 323–374.

Duysters, G., & Hagedoorn, J. (1996). Internationalization of corporate technology trough strategic partnering: An empirical investigation. Research Policy, 25, 1–12.

Duysters, G., & Vanhaverbeke, W. (1996). Strategic interactions in dram and risc technology: A network approach. Scandinavian Journal of Management, 12(4), 437–461.

Ernst, D., & Kim, L. (2002). Global production networks, knowledge diffusion, and local capability formation. Research Policy, 31, 1417–1429.

Europe, R. (2005). ERAnets: Evaluation of networks of collaboration between participants in ist research and their evolution to collaborations in the european research area (ERA). final report. http://ec.europa.eu/dgs/information_society/evaluation/data/pdf/studies/s2003_01/2005_eranets_final.pdf.

Freeman, L. C. (1978). Segregation in social networks. Sociological Methods & Research, 6(4), 411–429.

Freeman, C. (1991). Networks of innovators: A synthesis of research issues. Research Policy, 20, 499–514.

Freeman, C., & Hagedoorn, J. (1994). Catching up or falling behind: Patterns in international interfirm technology partnering. World Development, 22(5), 771–780.

Furtado, A. T., & de Freitas, A. G. (2000). The catch-up strategy of Petrobrás through cooperative r&d. The Journal of Technology Transfer, 25(1), 23–36.

Gay, B., & Dousset, B. (2005). Innovation and network structural dynamics: Study of the alliance network of a major sector of the biotechnology industry. Research Policy, 34, 1457–1475.

Gomes-Casseres, B. (1988). Joint venture cycles: The evolution of ownership strategies of U.S. MNEs: 1945–1975. In: Contractor, F., Lorange, P. (eds) Cooperative strategies in international business. Lexington, MA: Lexington Books, pp. 111–128.

Griliches, Z. (1992). The search for R&D spillovers. The Scandinavian Journal of Economics, 94, 29–47.

Hagedoorn, J. (1996). Trends and patterns in strategic technology partnering since the early seventies. Review of Industrial Organization, 11, 601–616.

Hagedoorn, J. (2002). Inter-firm R&D partnerships: An overview of major trends and patterns since 1960. Research Policy, 31, 477–492.

Hagedoorn, J., & Schakenraad, J. (1992). Leading companies and networks of strategic alliances in information technologies. Research Policy, 21, 163–190.

Hagedoorn, J., & van Kranenburg, H. (2003). Growth patterns in R&D partnerships: An exploratory statistical study. International Journal of Industrial Organization, 21, 517–531.

Hagedoorn, J., Link, A. N., & Vonortas, N. S. (2000). Research partnerships. Research Policy, 29, 567–586.

Harrigan, K. R. (1988). Joint ventures and competitive strategy. Strategic Management Journal, 9(2), 141–158.

Huang, K. F., & Yu, C. M. (2011). The effect of competitive and non-competitive R&D collaboration on firm innovation. The Journal of Technology Transfer, 36, 383–403.

Knoke, D., Yang, S., & Granados, F. J. (2002). Dynamics of strategic alliance networks in the global information sector, 1989–2000. Conference paper presented at 18th EGOS colloquium “The dynamics of networks”, Barcelona, July 4–6. http://www.soc.umn.edu/~knoke/pages/Knoke_Yang_Granados_Dynamics_of_Strategic_Alliance_Networks.pdf.

Kogut, B. (1988). Joint ventures: Theoretical and empirical perspectives. Strategic Management Journal, 41, 319–332.

Kogut, B. (1989). The stability of joint ventures: Reciprocity and competitive rivalry. The Journal of Industrial Economics, 38(2), 183–198.

Lazarsfeld, P. F., & Merton, R. K. (1954). Friendship as a social process: A substantive and methodological analysis. In: Berger, M., Abel, T., Page, C. H. (eds.), Freedom and control in modern society. New York: Van Nostrand, Chap.~2, pp. 18–66.

Link, A. N., Paton, D., & Siegel, D. S. (2002). An analysis of policy initiatives to promote strategic research partnerships. Research Policy, 31, 1459–1466.

Link, A. N., Paton, D., & Siegel, D. S. (2005). An econometric analysis of trends in research joint venture activity. Managerial and Decision Economics, 26, 149–158.

M’Chirgui, Z. (2007). The smart card firms’ network positions: A social network analysis. European Managenemt Journal, 25(1), 36–49.

Morrison Paul, C. J., & Siegel, D. S. (1999). Scale economies and industry agglomeration externalities: A dynamic cost function approach. The American Economic Review, 89(1), 272–290.

Moskalev, S. A., & Swensen, R. B. (2007). Joint ventures around the globe from 1990-2000: Forms, types, industries, countries, and ownership patterns. Review of Financial Economics, 16, 29–67.

Mytelka, L. (1991). Strategic partnerships and the world economy. London: Pinter.

Narula, R. (1996). Multinational investment and economic structure. London: Routledge.

Narula, R., & Hagedoorn, J. (1999). Innovation through strategic alliances: Moving towards international partnerships and contractual agreements. Technovation, 19, 283–294.

Nishimura, J., & Okamuro, H. (2011). R&D productivity and the organization of cluster policy: An empirical evaluation of the Industrial Cluster Project in Japan. The Journal of Technology Transfer, 36, 117–144.

Nooteboom, B. (1999). Inter-firm alliances—Analysis and design. London: Routledge.

OECD (1992). Technology and the economy. Organisation for Economic Cooperation and Development, Paris.

Park, S. H., & Russo, M. V. (1996). When competition eclipses cooperation: An event history analysis of joint venture failures. Management Science, 42(6), 875–890.

Pearce, R. (1989). The internationalization of R&D by multi-national enterprises. London: Macmillan.

Powell, W. W., Koput, K. W., & Smith-Doerr, L. (1996). Interorganizational collaboration and the locus of innovation: Networks of learning in biotechnology.Administrative Science Quarterly, 41(1), 116–145.

Rosenkopf, L., & Schilling, M. A. (2007). Comparing alliance network structures across industries: Observations and explanations. Strategic Entrepreneurship Journal, 1, 191–209.

Schilling, M. A. (2009). Understanding the alliance data. Strategic Management Journal, 30, 233–260.

Schilling, M. A., & Phelps, C. (2007). Interfirm collaboration networks: The impact of large-scale network structure on firm innovation. Management Science, 53(7), 1113–1127.

Tassey, G. (2010). Rationales and mechanisms for revitalizing us manufacturing R&D strategies. The Journal of Technology Transfer, 35, 283–333.

UNCTAD. (2000a). Enhancing the competitiveness of SMEs through linkages. United Nations conference on trade and development secretatiat, Geneva.

UNCTAD. (2000b). World investment report 2000: Cross-border mergers and acquisitions and development. United Nations conference on trade and development secretatiat, Geneva.

Verspagen, B., & Duysters, G. (2004). The small worlds of strategic technology alliances. Technovation, 24, 563–571.

Vonortas, N. S., & Safioleas, S. P. (1997). Strategic alliances in information technology and developing country firms: Recent evidence. World Development, 25(5), 657–680.

Westbrock, B. (2011). Natural concentration in industrial research collaboration. RAND Journal of Economics, 41(2), 351–371.

Acknowledgments

The authors would like to thank the editor of JTT and an anonymous reviewer for helpful suggestions. Additionally, thanks are extended to Vincent Buskens, Stephanie Rosenkrantz, Utz Weitzel, Werner Raub, and Marco van der Leij for comments on draft versions of this article. The research presented benefited from the financial support from Utrecht University High Potentials 2004 grant for the project Dynamics of Cooperation, Networks, and Institutions (http://www.dyconi.nl).

Open Access

This article is distributed under the terms of the Creative Commons Attribution Noncommercial License which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This is an open access article distributed under the terms of the Creative Commons Attribution Noncommercial License (https://creativecommons.org/licenses/by-nc/2.0), which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

About this article

Cite this article

Bojanowski, M., Corten, R. & Westbrock, B. The structure and dynamics of the global network of inter-firm R&D partnerships 1989–2002. J Technol Transf 37, 967–987 (2012). https://doi.org/10.1007/s10961-011-9234-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-011-9234-7