Abstract

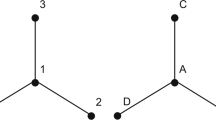

The discontinuous tax treatment of sales at borders creates incentives for individuals to cross-border shop. This paper addresses whether it is optimal for a state composed of multiple regions to levy differentiated commodity tax rates across the regions. In a model where states maximize social welfare, a state’s optimal commodity tax system is almost always geographically differentiated. The optimal pattern of geographic differentiation critically depends on fundamental parameters as well as whether the state has a preference for high or low taxes. Under the assumption that utility is linear in consumption and that the elasticity of cross-border shopping is less than unity in absolute value, high-tax states will find it optimal to set a tax rate that is lower in the border region than in the periphery region and low-tax states will find it optimal to set a tax rate that is higher in the border region than in the periphery region. Optimizing high-tax states will set a higher tax rate in the border region if the social welfare measure is sufficiently redistributive. With welfare maximization, it is possible for taxes to be higher in the region near the state border—an outcome that cannot arise when the government cares only about total tax revenue.

Similar content being viewed by others

Notes

The word “optimal” in this paper will always refer to what is “optimal from the prospective of a state planner” rather than what is “globally optimal” unless specifically noted otherwise.

The law providing for this provision is Act 180 of the Regular Session of the 87th General Assembly.

The regions could be two equally sized jurisdictions. The word “region” need not imply a non-governing entity. As an alternative, the two regions can be viewed as two towns—with one town being the preferred tax region—as in the case of Arkansas.

The transportation cost is independent of distance. Each consumer lives an identical amount of distance from the nearest region or state border.

The sales tax in the United States is levied de facto according to the origin principle. The use tax is notoriously under-enforced. Because the use tax is often evaded, taxes are implicitly paid based on the location of purchase rather than the destination of the sale.

When the public good is provided at the state level, this means that the size of the tax base in one region is independent of the level of public good provision that the region receives.

An alternative way to proceed would be to maintain welfare maximization, start from a symmetric equilibrium where all tax rates are identical and then shock the public good preferences in one state. With only one tax rate, these results are extremely complex.

Note I need to add one more derivative to Eq. (4) to solve this problem. This derivative can be obtained by totally differentiating Region B’s individual budget constraint.

The intuition for this can be seen in an example. If the MCF is 1.5 in Region A but is 1.1 in Region B, then raising an additional dollar of revenue in Region B is less costly than raising an additional dollar in Region A. Raising additional revenue from Region B is welfare enhancing for the state even though it is not a Pareto improvement for Region B.

The equations are arranged so that it is always the second additive term on its side of the equality.

In the language of Mintz and Tulkens (1986) these are “public consumption effects.”

Mintz and Tulkens (1986) refer to this as a “private consumption effect.”

Both sides of the equation in the text are positive because \(U_{C}^{A}\geq U_{C}^{B}\). The right side illustrates the revenue change through the tax base effect. The left side illustrates the social planner’s concern for equality. The derivation of this equation is in the Appendix.

In this model, the only decision is over where to shop. Thus, commodity taxation in a closed economy will amount to a head tax. In an open economy with a high-tax neighbor, commodity taxation imposes no other distortions. Of course, this would not necessarily hold if other distortions existed in the economy, such as an endogenous labor-leisure choice.

When interpreting this result, it is important to remember that all agents in each region are identical and located the same distance from borders. The interpretation of the results would change if the population of the region were distributed heterogeneously with respect to distance to borders.

It is worth recognizing that there are significant administrative difficulties of implementing border-zones under a VAT. For example, it raises the question of how inter-region purchases of intermediate goods are treated. Although similar issues arise with sales and excise taxes, such concerns are not as significant.

References

Dahlby, B., & Wilson, L. S. (1994). Fiscal capacity, tax effort, and optimal equalization grants. Canadian Journal of Economics, 27, 657–672.

Davis, L. (2011). The effects of preferential vat rates near international borders: evidence from Mexico. National Tax Journal, 64(1), 85–104.

Fox, W. F. (1986). Tax structure and the location of economic activity along state borders. National Tax Journal, 39(4), 387–401.

Harding, M., Leibtag, E., & Lovenheim, M. (forthcoming). The heterogeneous geographic and socioeconomic incidence of cigarette taxes: evidence from Nielsen Homescan data. American Economic Journal: Economic Policy.

Haufler, A. (1996). Tax coordination with different preferences for public goods: conflict or harmony of interest. International Tax and Public Finance, 3(1), 5–28.

Janeba, E., & Peters, W. (1999). Tax evasion, tax competition and the gains from nondiscrimination: the case of interest taxation in Europe. The Economic Journal, 109(452), 93–101.

Kanbur, R., & Keen, M. (1993). Jeux Sans Frontières: tax competition and tax coordination when countries differ in size. American Economic Review, 83(4), 877–892.

Keen, M. (2001). Preferential regimes can make tax competition less harmful. National Tax Journal, 54(4), 757–762.

Kessing, S. (2008). Discriminatory indirect taxation in international tax competition. 2008 CESifo Conference Paper.

Lovenheim, M. F. (2008). How far to the border? The extent and impact of cross-border casual cigarette smuggling. National Tax Journal, 61(1), 7–33.

Merriman, D. (2010). The micro-geography of tax avoidance: evidence from littered cigarette packs in Chicago. American Economic Journal: Economic Policy, 2(2), 61–84.

Mintz, J., & Tulkens, H. (1986). Commodity tax competition between member states of a federation: equilibrium and efficiency. Journal of Public Economics, 29(2), 132–172.

Nielsen, S. B. (2001). A simple model of commodity taxation and cross-border shopping. Scandinavian Journal of Economics, 103(4), 599–623.

Nielsen, S. B. (2010). Reduced border-zone commodity tax? Working Paper.

Slemrod, J. (2007). Cheating ourselves: the economics of tax evasion. The Journal of Economic Perspectives, 21(1), 25–48.

Slemrod, J., & Yitzhaki, S. (1996). The cost of taxation and the marginal efficiency cost of funds. IMF Staff Papers, 43(1), 172–198.

Slemrod, J., & Yitzhaki, S. (2001). Integrating expenditure and tax decisions: the marginal cost of funds and the marginal benefit of projects. National Tax Journal, 54(2), 189–202.

Tosun, M. S., & Skidmore, M. L. (2007). Cross-border shopping and the sales tax: an examination of food purchases in West Virginia. B.E. Journal of Economic Analysis and Policy, 7(1), 1–18.

Trandel, G. (1994). Interstate commodity tax differentials and the distribution of residents. Journal of Public Economics, 53(3), 435–457.

Walsh, M., & Jones, J. (1988). More evidence on the border tax effect: the case of West Virginia, 1979–1984. National Tax Journal, 41(2), 261–265.

Acknowledgements

I am especially grateful to my dissertation committee chair Joel Slemrod along with the members of my committee—David Albouy, Robert Franzese and James Hines. I also wish to thank Paul Courant, Lucas Davis, Charles de Bartolomé, Dhammika Dharmapala, Reid Dorsey-Palmateer, Marcel Gérard (discussant), Michael Gideon, Makoto Hasegawa, Ravi Kanbur, Sebastian Kessing, Michael Lovenheim (discussant), Byron Lutz (discussant), Søren Bo Nielsen, Ben Niu, Stephen Salant, Nathan Seegert, Jeff Smith, Caroline Weber, and David Wildasin for helpful suggestions and discussions. Suggestions from conference participants at the 2011 International Institute of Public Finance Annual Congress, the 2011 Association of Public Economic Theory Conference and the Michigan Tax Invitational contributed to the paper. Two anonymous referees and the editor, Ruud de Mooij, improved the paper. Any remaining errors are my own.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 7.1 Derivation of MCF terms

The algebraic derivation of Eq. (7) is below. The derivations of all the other marginal cost of fund equations follow a similar process.

Recall that for this case, t A >t B and the state is a low-tax state. The government then maximizes \(U^{A}(c^{A}, t_{A}c_{A}^{A}+t_{B}c_{B}^{A}+t_{B}c^{B}+t_{B}c_{B}^{N})+U^{B}(c^{B}, t_{A}c_{A}^{A}+t_{B}c_{B}^{A}+t_{B}c^{B}+t_{B}c_{B}^{N})\). Differentiating with respect to t A and t B yields

Using Eqs. (4) and (5) simplifies:

Rearranging terms gives

The two equations are set equal to each other in order to obtain Eq. (7).

1.2 7.2 Proof of Proposition 1

Proof

Equation (7) or (10) must hold at an optimum. Taking the limit as t A →t B implies that the first order conditions are continuous when a state changes from sub-case 1 to sub-case 2. Start from a point where all jurisdictions in State H have equal tax rates (t A =t B =t). Because the tax rates are equal, \(c_{j}^{i}=0\) for all i≠j. This immediately implies that \(c^{A}=c^{B}=c_{A}^{A}=c_{B}^{B}=c\) and that the marginal utilities of consumption are equal. Residents of State N cross-border shop such that \(c_{B}^{N}>0\). Using these simplifications, Eq. (7) implies \(\mathit{MCF}_{A}(t_{A}=t_{B})-\mathit{MCF}_{B}(t_{A}=t_{B})=\frac{\frac{c}{1+t}}{(\frac{c}{1+t})}-\frac{\frac{c}{1+t}}{(\frac{c}{1+t}-\frac{t}{S_{N}''}+c_{B}^{N})}\). A little algebra will show that this expression is equal to zero if \(c_{B}^{N}=\frac{t}{S_{N}''}\), implying equal tax rates. The tax system will be differentiated if MCF A (t A =t B )≠MCF B (t A =t B ). Using (7) and the above substitutions, MCF A (t A =t B )−MCF B (t A =t B )<0 if \(c_{B}^{N}<\frac{t}{S_{N}''}\). MCF A <MCF B implies the government must lower the tax rate in Region B relative to Region A to equalize the marginal cost of funds. Therefore, \(c_{B}^{N}<\frac{t}{S_{N}''}\) guarantees that t A >t B is welfare improving. Similarly, it can be shown that MCF A >MCF B if \(c_{B}^{N}>\frac{t}{S_{N}''}\), which implies t A <t B is optimal. □

1.3 7.3 Proof of Corollary 1

Proof

The term of interest in the marginal revenue equation is \(-\frac{t_{B}}{S_{N}''}+c_{B}^{N}\). This can be rewritten as \(t_{B}\frac{\partial c_{B}^{N}}{\partial t_{B}}\frac{c_{B}^{N}}{c_{B}^{N}}+c_{B}^{N}=(1-\epsilon)c_{B}^{N}\), where ϵ is the elasticity of \(c_{B}^{N}\) with respect to t B and ϵ is positive. □

1.4 7.4 Proof of Proposition 2

Proof

Equation (13) or (16) must holds at an optimum. Taking the limit as t A →t B implies that the first order conditions are continuous when a state changes regimes from sub-case 1 to sub-case 2. Start from a point where all jurisdictions in State H have equal tax rates (t A =t B =t). Because the tax rates are equal, \(c_{j}^{i}=0\) for j≠i when j is a region in State H. Some consumption from Region B is purchased across the state border so that \(c_{N}^{B}>0\). This implies that c A≤c B, \(c_{A}^{A}\geq c_{B}^{B}\) and \(U_{C}^{A}\geq U_{C}^{B}\). Substituting into Eq. (13), t A =t B is optimal if \(\mathit{MCF}_{A}(t_{A}=t_{B})-\mathit{MCF}_{B}(t_{A}=t_{B})=U_{C}^{A}-\frac{U_{C}^{B}\frac{c_{B}^{B}}{1+t}}{(\frac{c_{B}^{B}}{1+t}-\frac{t}{S_{B}''})}=0\). The tax system will be differentiated if MCF A (t A =t B )≠MCF B (t A =t B ). MCF A (t A =t B )−MCF B (t A =t B )<0 if \(U_{C}^{A}(\frac{c_{B}^{B}}{1+t}-\frac{t}{S_{B}''})<U_{C}^{B}\frac{c_{B}^{B}}{1+t}\) and the government must lower the tax rate in Region B relative to Region A to equalize the marginal cost of funds. Similarly, it can be shown that \(U_{C}^{A}(\frac{c_{B}^{B}}{1+t}-\frac{t}{S_{B}''})>U_{C}^{B}\frac{c_{B}^{B}}{1+t}\) implies t A <t B . □

1.5 7.5 Derivation of Eq. (19)

To derive this equation, I start with the equality of the marginal cost of funds in a high-tax state, given by Eqs. (13) and (16):

To proceed, I need to compare these expressions when taxes in this state are equal, but still less than taxes in the neighboring state (where \(t_{A}\rightarrow t=t_{B}<\bar{t}\)). The limit for both equations are the same. Without loss of generality, work with the second equation. There can be no within-state cross-border shopping when t A =t B implying that \(c_{A}^{B}=0\). Because \(c^{B}=c_{A}^{B}+c_{A}^{A}+c_{A}^{N}=c_{A}^{A}+c_{A}^{N}\) and \(c^{A}=c_{A}^{B}+c_{A}^{A}=c_{A}^{A}\), it is easy to see that the ability of consumers in B to arbitrage and cross the state border implies that in the limit c B≥c A and therefore, \(U_{C}^{B}\leq U_{C}^{A}\). Substituting into the above equation and letting tax rates converge to t A =t B =t, yields

which reduces to

and simplifying further implies

which then yields the equation in the text:

1.6 7.6 Proof of Corollary 2

Proof

If marginal utility is constant, then \(U_{C}^{A}=U_{C}^{B}\) because the utility functions are identical. To have t A ≤t B , then MCF A (t A =t B )≥MCF B (t A =t B ) implies \(1\geq\frac{\frac{c_{B}^{B}}{1+t}}{(\frac{c_{B}^{B}}{1+t}-\frac{t}{S_{B}''})}\). But this requires \(-\frac{t}{S_{B}''}\geq0\), which is never true. However, MCF A (t A =t B )<MCF B (t A =t B ) is always true because \(-\frac{t}{S_{B}''}<0\). This immediately implies t A >t B is optimal. □

Rights and permissions

About this article

Cite this article

Agrawal, D.R. Games within borders: are geographically differentiated taxes optimal?. Int Tax Public Finance 19, 574–597 (2012). https://doi.org/10.1007/s10797-012-9235-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-012-9235-y