Abstract

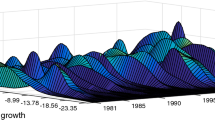

The present paper provides a comprehensive and consolidated analysis of the business cycle synchronicity between European regions and EU-14. Our study is conducted in three levels. First, we analyse regional business cycle synchronization with the EU-14 benchmark cycle, using real GDP in 200 NUTS II regions for a period of 30 years (1980–2009), detrended by Hodrick–Prescott filter. Secondly, we employ a VAR type methodology as a measurement devise to examine the dynamic relationship of the regional business cycles. Our main interest is to study the dynamics of business cycles as well as the pattern of the transmission mechanism to regions with different level of development. Finally, we empirically extend the research on identifying factors which might drive regional business cycle synchronization. In particular, we analyse the role of trade integration-cum- the sectoral patterns of specialisation as determinants of regional growth cycle correlations with the EU-14. Moreover, we draw attention to regional productivity as another possible determinant of business cycle synchronisation associated with the pattern of the spatial distribution of economic activities across regions. Panel three-stage least-squares estimation is implemented for the simultaneous equations between determinants and regional business cycles synchronisation.

Similar content being viewed by others

Notes

Luxembourg was discarded from the sample because of lack of data.

See Canova and F Ciccarelli (2013) the main features of the mentioned models and how they compare to the PVAR models.

To perform the analysis we used the STATA pvar routine written by Inessa Love (see Love and Zicchino 2006).

Our identification scheme is based on a lower triangular Cholesky decomposition with the above indicated ordering. Hence, a variable coming earlier in the ordering affects the next ones both contemporaneously and with a lag, while a variable coming later has merely lagged effects on the preceding ones. This implies that structural shocks of national and EU14 affect regional cycles but not vise-versa. Reversing the order was also tested but results were approximately the same (not shown in our paper). To complete the interpretation of our findings, we also expose the matrix with variance decompositions, which describe the percent of one variable explained by innovations accumulated over time in another variable.

The panel is balanced.

Pedroni Residual Cointegration Test, Johansen Fisher Panel Cointegration Test, and Kao Residual Cointegration Test were employed to test for cointegration in our panel sample, the existence of the cointegration relationship was no supported, the results are not presented here for economy of space.

References

Acemoglu D, Ventura J (2001) The world income distribution. Q J Econ 117(2):659–694

Amiti M (1998) Inter-industry trade in manufactures: Does country size matter? J Int Econ 44(2):231–255

Anselin L (2010) Thirty years of spatial econometrics. Pap Reg Sci 89:3–25

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econ 68(1):29–52

Arrow K (1962) Economic welfare and the allocation of resources for invention. In: Nelson R (ed) The rate and direction of inventive activity. Princeton University Press, Princeton, pp 609–626

Artis MJ, Zhang W (1997) International business cycles and the ERM. Int J Financ Econ 2(1):1–16

Artis MJ, Zhang W (1999) Further evidence on the international business cycle and the ERM: Is there a European business cycle? Oxf Econ Pap 51:120–132

Artis M, Galvao AB, Marcellino M (2003) The transmission mechanism in a changing world. CEPR discussion paper 4014. CEPR, London

Artis M, Marcellino M, Proietti T (2004) Characterising the business cycles for accession countries. Discussion paper 4457. CEPR, London

Banbura M, Giannone D, Reichlin L (2010) Large scale Bayesian VARs. J Appl Econ 25:71–92

Barrios S, de Lucio J (2003) Economic integration and regional business cycles: evidence from the Iberian Regions. Oxford Bull Econ Stat 65:497–515

Barrios S, Lucio J (2003) Economic integration and regional business cycles. Oxford Bull Econ Stat 65(4):497–515

Baxter M, King Robert G (1999) Measuring business cycles: approximate band-pass filters for economic time series. Rev Econ Stat 81(4):575–593

Baxter M, Kouparitsas M (2004) Determinants of business cycle comovement: a robust analysis. NBER working paper 10725

Beine M, Candelon B, Sekkat K (2003) EMU membership and business cycle phases in Europe: Markov-switching VAR analysis. J Econ Integr 18:214–242

Belke A, Heine J (2006) Specialisation patterns and the synchronicity of regional employment cycles in Europe. Int Econ Econ Policy 3(2):91–104

Benčik M (2011) Business cycle synchronisation between the V4 Countries and the Euro Area. NBS working paper 1/2012, Bratislava, Slovakia

Bergman M (2005) How synchronized are European buisness cycles? In: Jonung L (ed) Proceedings of the 2004 first annual DG ECFIN research conference on “Buisness Cycles and Growth in Europe”, European Economy 227

Bordo MD, Helbling T (2003) Have national business cycles become more synchronized? NBER working paper 10130

Boschan C, Ebanks WW (1978) The phase-average trend: a new way of measuring growth. In: 1978 Proceedings of the business and economic statistics section, American Statistical Association, Washington, DC

Calderon C, Chong A, Stein E (2007) Trade intensity and business cycle synchronization: are developing countries any different? J Int Econ 71(1):2–21

Camacho M, Perez-Quiros G, Saiz L (2006) Do european business cycles look like one? Computing in economics and finance 2006, no 175, Society for Computational Economics

Canova, F Ciccarelli M (2013) Panel vector autoregressive models: a survey. European Central Bank, working paper series, no 1507

Cantwell JA (1991) The international agglomeration of R&D. In: C-Casson M (ed) Global research strategy and international competitive-ness. Blackwell, Oxford

Cardarelli R, Kose MA (2004) economic integration, business cycle, and productivity in North America. International Monetary Fund WP/04/138

Christiano L, Fitzgerald TJ (2003) The band-pass filter. Int Econ Rev 44(2):435–465

Clark TE, van Wincoop E (2001) Borders and business cycles. J Int Econ 55:59–85

De Haan J, Inklaar RC, Jong-A-Pin RM (2008) Will business cycles in the Euro area converge? A critical survey of empirical research. J Econ Surv 22:234–273

Dees S, Di Mauro F, Pesaran H, Smith V (2007) Exploring the international linkages of the Euro area: a global VAR analysis. J Appl Econ 22:1–38

Doyle B, Faust J (2002) An investigation of co-movements among the growth rates of the G-7 countries. Federal Reserve Bulletin, October, Federal Reserve Board

Eurostat (2012) Statistics database. http://eurostat.ec.europa.eu

Evenett S, Keller W (2002) On the theories explaining the success of the gravity equation. J Polit Econ 110:281–316

Fatás A (1997) EMU: countries or regions? Lessons from the EMS experience. Eur Econ Rev 41(3–5):743–751

Favero C (2001) Applied macroeconometrics. Oxford University Press, Oxford

Filis G, Floros C, Leon C, Beneki C (2010) Are EU and Bulgarian business cycles synchronized? J Money Invest Bank 14:36–45

Frankel JA, Rose AK (1998) The endogeneity of the optimum currency area criteria. Econ J 108:1009–1025

Gruben WC, Koo J, Millis E (2002) How much does international trade affect business cycle synchronization? Federal Reserve Bank of Dallas. Working paper 0203

Harding D, Pagan A (2001) Extracting, using and analysing cyclical information, MPRA Paper 15. University Library of Munich, Germany

Harding D, Pagan AR (2002) Dissecting the cycle: a methodological investigation. J Monet Econ 49(2):365–381

Hirschman A (1958) The strategy of economic development. Yale University Press, New Haven

Hodrick RJ, Prescott EC (1997) Postwar US business cycles: an empirical investigation. J Money Credit Bank 29:1–16

Im K, Pesaran H, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econ 115(1):53–74

Imbs J, (2001) Co-fluctuations. Discussion paper, CEPR 2267

Imbs J (2004a) Trade, finance, specialization and synchronization. Rev Econ Stat 86:723–734

Imbs J (2004b) The real effects of financial integration, CEPR Discussion Papers 4335. London Bussiness School

Imbs J, Wacziarg R (2003) Stages of diversification. Am Econ Rev 93(1):63–86

Inklaar R, Jong-A-Pin R, de Haan J (2005) Trade and business cycle synchronization in OECD countries, a re-examination. CESifo working paper 1546

Jacobs J (1969) The economy of cities. Vintage, New York

Jacobs J (1984) Cities and the wealth of nations: principals of economic life. Vintage, New York

Jagrič T (2002) Measuring business cycles—a dynamic perspective. Prikazi in analize X/1 (September 2002), Ljubljana, Banka Slovenije

Christodoulakis N, Dimelis SP, Kollintzas T (1995) Comparisons of business cycles in the EC: idiosyncrasies and regularities. Economica 62:1–27

Koopman S J, Azevedo JV (2003) Measuring synchronization and convergence of business cycles. Tinbergen Institute discussion paper 2003-052/4

Krugman P (1991a) Increasing returns and economic geography. J Polit Econ 99:484–499

Krugman PR (1991b) Geography and trade. MIT Press, Cambridge

Krugman P (1993) Lessons of Massachusetts for EMU. In: Torres F, Giavazzi F (eds) Adjustment and growth in the European monetary union. Cambridge University Press, Cambridge, pp 241–269

Krugman P (1999) Balance sheets, the transfer problem, and financial crises. Int Tax Pub Financ 6(4):459–472

Leon C (2007) The European and the Greek business cycles: Are they synchronized? MRPA paper 1312, November

Long J, Plosser C (1983) Real business cycles. J Polit Econ 91(1):39–69

Love I, Zicchino L (2006) Financial development and dynamic investment behavior: evidence from Panel VAR. Q Rev Econ Financ 46(2):190–210

Lucas R (1977) Understanding business cycles, stabilization of the domestic and international economy. Carnegie-Rochester Conference Series on Public Policy

Marattin L, Salotti S (2010) The Euro-dividend: public debt and interest rates in the Monetary Union. Working papers 695, Dipartimento Scienze Economiche, Universita di Bologna

Marcet A, Ravn M (2001) The HP-filter in cross-country comparisons. Economics working papers 588, Department of Economics and Business, Universitat Pompeu Fabra

Marelli E (2006) Specialisation and convergence of European regions. Eur J Comp Econ 4(2):149–178

Marshall A (1920) Principles of economics: an introductory volume. Macmillan, London, UK

Massmann M, Mitchell J (2004) Reconsidering the evidence: are Eurozone business cycles converging? J Bus Cycle Meas Anal 1(3):275–308

Montoya A, de Haan J (2008) Regional business cycles synchronization in Europe? IEEP 5(1–2):123–137

Myrdal G (1957) Economic development and underdevelopment regions. Hutchinson, UK

Otto G, Voss G, Willard L (2001) Understanding OECD output correlations. Reserve Bank of Australia research discussion paper. 2001-5

Perocco M, Dallerba S, Hewings G (2007) Structural convergence of the national economies of Europe. In: Geenhuizen M, Reggiani A, Rietveld P (eds) Policy analysis of transport. Ashgate, UK

Pesaran H, Schuerman T, Wiener S (2004) Modelling regional interdependencies using a global error-correcting macroeconomic model. J Bus Econ Stat 22:129–162

Petrakos G, Fotopoulos G, Kallioras D (2005) Peripherality and integration: industrial growth and decline in the Greek Regions. University of Thessaly discussion paper series 11(15):281–302

Puga D (1998) The rise and fall of regional inequalities. Discussion paper 314, CEP, London School of Economics and CEPR Centre For Economic Performance, November 1996

Ravn M, Uhlig H (1997) On adjusting the HP-filter for the frequency of observations. Rev Econ Stat 84(2):371–376

Rodríguez-Pose A, Fratesi U (2006) Regional business cycles and the emergence of sheltered economies in the southern periphery of Europe. Bruges European economic research papers, BEER paper 7, November 2006

Romer P (1986) Increasing returns and long run growth. J Polit Econ 94:1002–1037

Siedschlag I, Tondl G (2011) Regional output growth synchronisation with the Euro Area. Empirica 38(2):203–221

Sims C, Stock J, Watson M (1990) Inference in linear time series models with some unit roots. Econometrica 58(1):113–144

Stock JH, Watson MW (1989) New indices of coincident and leading indicators. In: Blanchard O, Fisher S (eds) NBER macroeconomic annual, 4

Stock J, Watson M (2003) Understanding changes in international business cycle dynamics. J Eur Econ Assoc 3:968–1006

Tondl G, Traistaru I (2006) Regional growth cycle synchronisation with the EURO area. Working paper 173. The Economic and Social Research Institute, Dublin, Ireland

Traistaru I (2004) Transmission channels of business cycles synchronisation in an enlarged EMU. Working paper B04-18. Center for European Integration Studies, ZEI, University Bonn

Venables A (1996) Equilibrium locations of vertically linked industries. Int Econ Rev 37:341–359

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Anagnostou, A., Panteladis, I. & Tsiapa, M. Disentangling different patterns of business cycle synchronicity in the EU regions. Empirica 42, 615–641 (2015). https://doi.org/10.1007/s10663-014-9268-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-014-9268-9