Abstract

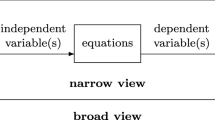

The teaching of computational economics to graduate students has mostly been in a single course with a focus on algorithms and computer code. The shortcoming with this approach is that it neglects one of the most important aspects of computational economics—namely model development skills. These skills are the ability to conceptualize the science, engineering and economics of a problem and to convert that understanding first to a mathematical model and then to a computational representation in a software system. Thus we recommend that a two course sequence in computational economics be created for graduate students with the first course focusing on model development skills and the second course on algorithms and the speed and accuracy of computer codes. We believe that a model development course is most helpful to graduate students when it introduces the students to a wide variety of computational models created by past generations and ask them to first make small modification in order to better understand the models, the mathematics and the software. This in turn is followed by encouraging them to make more substantial modifications of the students’ own choosing so as to move the models in directions that permit the students to address current economic problems. We think that the key element of this process is it’s enhancement of the creative abilities of our students.

Similar content being viewed by others

References

Adda J., Cooper R. (2003). Dynamics economics: Quantitative methods and applications. Cambridge, Massachusetts, MIT Press

Brown, M., Dammert, A., Meeraus, A., & Stoutjesdijk, A. J. (1983). World investment analysis: The case of aluminum. World bank staff working papers, World Bank, Washington, D.C.

Choksi A.M., Meeraus A., Stoutjesdijk A.J. (1980). The planning of investment programs in the fertilizer industry. Baltimore, The Johns Hopkins University Press

Corbae D. (1993). Relaxing the cash-in-advance constraint at a fixed cost: Are simple trigger-target portfolio rules optimal?. Journal of Economic Dynamics and Control 17: 51–64

Date C.J. (1977). An introduction to database systems (2nd ed). Reading, Massachusetts, Addison-Wesley

Dixon, P. B., Parmenter, B. R., Sutton, J., & Vincent, D. P. (1982). ORANI, a multisectoral model of the australian economy. Amsterdam, the Netherlands: North Holland.

Dorfman R., Samuelson P., Solow R. (1958). Linear programming and economic analysis. New York, McGraw-Hill Book Company

Duraiappah A.K. (2003). Computational models in the economics of environment and development, advances in computational economics. Dordrecht, the Netherlands, Kluwer Academic Publishers

Epstein J.M., Axtell R. (1996). Growing artificial societies: Social science from the bottom up. Cambridge, Massachusetts, MIT Press

Hall R.E., Taylor J.B. (1997). Macroeconomics (5th ed). New York New York, W.W. Norton and Company

Judd K.L. (1998). Numerical methods in economics. Cambridge, Massachussets, MIT Press

Judd, K. L., & Tesfatsion, L. (2006). Agent-based computational economics, Vol. 2 of Handbook of computational economics. Amsterdam, the Netherlands: North-Holland Publishers (Elsevier).

Kendrick D.A., Meeraus A., Alatorre J. (1984). The planning of investment activities in the steel industry. Baltimore, MD, The Johns Hopkins University Press

Kendrick D.A., MercadoP.R., Amman H.M. (2006). Computational economics. Princeton, New Jersey, Princeton Universit Press

Kim S.R. (2004). Uncertainty, political preferences, and stabilization: Stochastic control using dynamic CGE models. Computational Economics 24: 97–116

Klein L.R. (1947). The Keynesian revolution. London United Kingdom, Macmillan Company

Koopmans, T. C. (1947). Optimum utilization of the transportation system. In: Proceedings of the International Statistical Conferences, 1947, Washington, D.C. (vol. 5) (Vol. 5 reprinted as Supplemental to Econometrica, Vol. 17, 1949).

Krusell P., Smith A.A. (1998). Income and wealth heterogeneity in the macroeconomy. Journal of Political Economy 106: 867–896

Lin, K. P. (2001). Computational econometrics: GAUSS programming for econometricians and financial analysts, ETEXT Publishing, available at http://www.etext.net.

Markowitz H. (1952). Portfolio selection. Journal of Finance 7: 77–91

McKibbin W.J., Wilcoxen P.J. (2002). Climate change policy after Kyoto: Blueprint for a realistic approach. Washington, D.C, Brookings Institution

Mennes L.B.M., Stoutjesdijk A.J. (1985). Multicountry investment analysis. Baltimore, Maryland, Johns Hopkins University Press

Mercado P.R., Kendrick D.A., Amman H.M. (1998). Teaching macroeconomics with GAMS. Computational Economics 12: 125–149

Miranda M.J., Fackler P.L. (2002). Applied computational economics and finance. Cambridge, Massachussets, MIT Press

Nordhaus W.D. (1992). An optimal transition path for controlling greenhouse gases. Science 258: 1315–1319

Ramsey F.O. (1928). A mathematical theory of saving. Economic Journal 38: 543–559

Sargent T.J. (1993). Bounded rationality in macroeconomics. Oxford United Kingdom, Clarendon Press

Thompson G.L., Thore S. (1992). Computational economics. South San Francisco, California, Scientific Press

Tinbergen J. (1950). The dynamics of business cycles: A study in economic fluctuations. Chicago Illinois, University of Chicago Press

Varian H.R. (1996). Computational economics and finance: Modelling and analysis with mathematica. Santa Clara CA, Springer-Verlag Publishers

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kendrick, D.A. Teaching Computational Economics to Graduate Students. Comput Econ 30, 381–391 (2007). https://doi.org/10.1007/s10614-007-9099-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-007-9099-x